ESG — the European fund selector view

While there is clear evidence to suggest that Environmental, Social, and Governance's (ESG) popularity is rising among European fund selectors, there is less consensus between fund selectors, clients, and asset managers on a clear definition of what exactly ESG is (and what it isn’t).

While there is clear evidence to suggest that Environmental, Social, and Governance's (ESG) popularity is rising among European fund selectors, there is less consensus between fund selectors, clients, and asset managers on a clear definition of what exactly ESG is (and what it isn’t).

This is a problem. Fund selectors feel that the current system forces them to put in a lot of work to identify the precise type of ESG product that they are looking for: Some are even going so far as to build their own proprietary databases to monitor ESG funds.

Selectors are hopeful that new Sustainable Finance Disclosure Regulations (SFDR) will help to clarify terminology, facilitate easier comparisons of funds, and generally push the industry towards more responsible practices. SFDR already looks set to have a massive impact, with indications that some firms are beginning to only consider SFDR funds for their portfolios.

“Firms who do not transition to Socially Responsible Investment (SRI) may see their sales volume decrease. Typically, under the Sustainable Finance Disclosure Regulation, there will be fewer opportunities for asset managers who do not have a large concentration of so-called ‘Article 9’ funds (funds targeting sustainable investments).” — Fund Selector View, France

“We see that providers from outside Europe have a problem meeting the demands of the market in the field of ESG. For example, as regards SFDR Articles 8 and 9, I see that the American providers, especially, find it harder to meet our wishes there.”— Fund Selector View, Netherlands Discretionary Portfolio Management

That is not to suggest that all clients are in the same boat when it comes to ESG: Some are much more committed than others, and there remains plenty of scepticism about ESG, even from those who have bought into the concept. Nor are fund selectors immune from critical commentators sowing the seeds of doubt.

So how can asset managers deal with this? Transparency must be placed above all else, and at every stage of the sales journey: Before sale, at point of sale, and in the ongoing reporting.

It will become critical for managers touting credible ESG offerings to provide clear and frank information to investors regarding the nature of any ESG products an asset manager is promoting, including giving an honest opinion on what any ESG product likely will or won’t achieve.

Not every ESG fund will save the world, and if investors are being misled regarding the exact nature of the ESG products they think they are paying for, the industry risks building a house of cards.

“ESG will be the biggest driver in the fund industry. I will continue to fall back on the providers I know, as they gained the corresponding expertise in this sector. I hope ESG will not be misused as a marketing instrument, i.e., falling victim to greenwashing. I am after the authentic implementation of ESG criteria or building dedicated teams for this sector, as well as steering organisations in this direction.” — Fund Selector View, Germany

“I see a lot of new ESG products but in my opinion a lot of providers are merely engaged in greenwashing.” — Fund Selector View, United Kingdom

“ESG will continue to drive change. Providers need to stop greenwashing because in doing so they treat their clients like idiots. So many funds have been recently re-labelled and marketed as "sustainable” but nothing has changed in the fund's philosophy or structure nor in the fund holdings. One problem for me is that we are selling ESG and sustainable labelled funds to retail clients to meet client demand for those types of products, but we as investment managers cannot really tell the difference between those two labels. It is almost as if the industry is trying to create another mis-selling scandal. What is required from providers, at the very least, is a campaign to educate both the advisors and retail investors regarding the language and definitions used within that space.” — Fund Selector View, UK

A balanced view

The selector views included here are intended to provide a balanced view. Fund selectors are much more positive than negative when it comes to ESG, albeit with several prominent areas of concern. Ultimately, the consensus is that selectors see current ESG offerings as a good early step on a journey and they are rewarding fund managers they perceive to be building strong and credible businesses with robust flows.

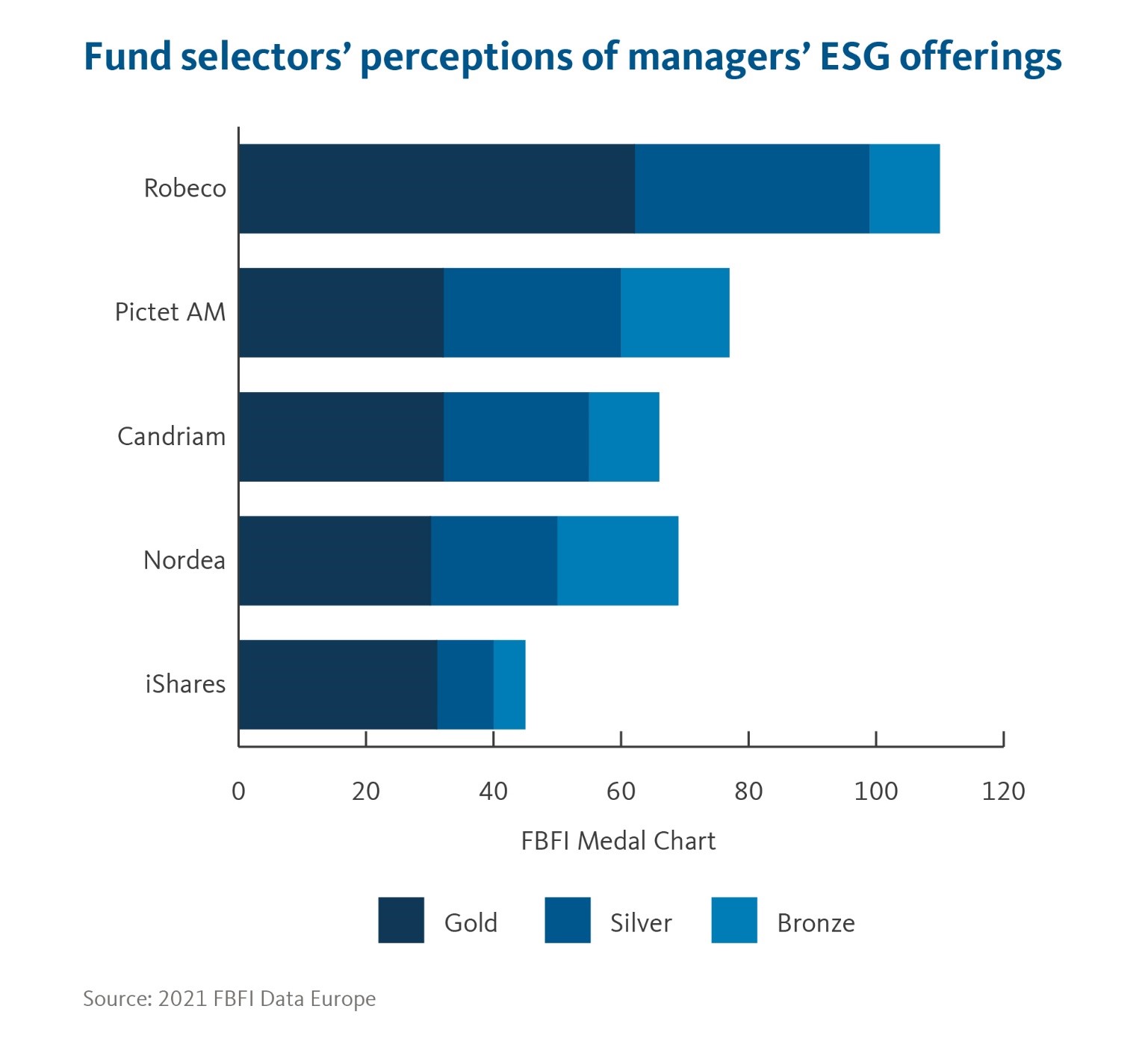

Right now, Robeco is perceived as having the best ESG product range. However, plenty of groups are rising up the rankings and yet more are investing huge resources in bolstering their ESG ranges, with a view towards improving client perception. With SFDR still in its early phases, this ranking table looks set to undergo plenty of flux. Fund managers need to keep a very close eye on their own rank, what their leading competitors are doing, and how the demands of their client base are evolving.