Cutting-edge fintech innovations &

impactful connections for accelerated growth

1000+ decision-makers. 600+ from banks and investors. 1000s of meetings. 35+ demos. 100+ speakers.

Sponsorship packages now open for 2025!

Sponsorship opportunities are open for 2025! Start conversations early and reserve the best spots! Contact the team at sponsor@finovate.com or +44 (0) 20 7017 5593 to reserve the best spots.

FinovateEurope 2024

Take a look back at the 2024 event highlights...

Europe's leading fintech conference by and for the executives transforming financial services

Your time is valuable. Finovate is carefully curated, fast-paced, and gets right to the point. See the top 6 reasons to attend.

The only major fintech event with half the attendees from financial institutions

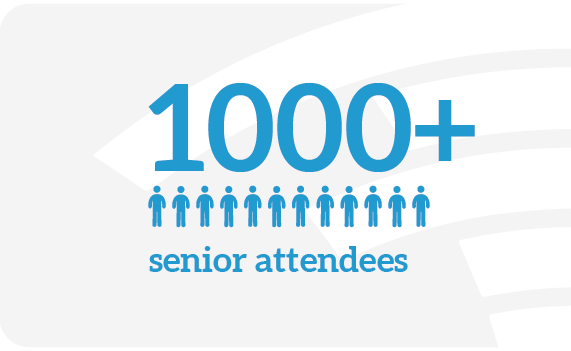

Join a global audience of 1000+ senior attendees with 600+ from banks and financial institutions. 2024 attendees included HSBC, Barclays, Lloyds Banking Group, Citi, Bank of America, JP Morgan Asset Management, BNP Paribas, Commerzbank & more.

Meet with the innovators leading the fintech revolution, senior decision-makers from financial institutions and top investors from VC firms looking for their next opportunity. 700+ attendees are C-level and heads/directors/VPs.

A quality of decision-makers you simply won't find anywhere else.

Grow your network with senior bankers, investors and fintech innovators

Business thrives on connections, which is why networking is at the heart of the event.

Elevate your profile through the app: send messages, book meetings and explore demo and sponsor technologies. Build your brand and create opportunities to meet new people.

Grow your network face-to-face through breakfast meetups, executive briefings, lunches and evening drinks receptions. Meet the innovators behind the hottest new technologies during demo intermissions.

Geo-diverse cutting-edge fintech

7 minute demos of the most innovative tech in the market now, ready to plug in and give you the edge to compete. Short, punchy, and informative.

90% of selected startups are walking onto the Finovate stage for the first time. In 2024 we had representatives from Austria, Belgium, England, Finland, France, Germany, Hungary, Iceland, Israel, Lithuania, Serbia, Spain, Sweden, Switzerland, Taiwan, and the USA.

Insights from industry titans

Leave no stone unturned. Explore every aspect of digital transformation in financial services with an unparalleled range of perspectives.

Hear from the key industry players on fast-tracking innovation and driving the adoption of new technologies in order to enhance customer experience and drive revenue growth.

Speakers in 2024 included leaders from BBVA, Societe Generale, ABN AMRO, Citibank, Deutsche Bank, ING, NatWest, SEB, Lloyds, JP Morgan, Revolut., Raisin, Stripe, Klarna, OakNorth and many more!

The best fintech event to hear from industry leaders. The 2024 line up included...

Finovate underlines commitment to diversity with 50% female and 50% male speaker lineup!

DEI at FinovateEurope 2024

Take a look at how are we challenging the industry...

An audience like no other...

0+

senior attendees

0+

from banks and other financial institutions

0+

attendees are C-level/heads of/directors/VPs

0+

top financial institutions represented

0+

start-ups

0+

VCs/investors

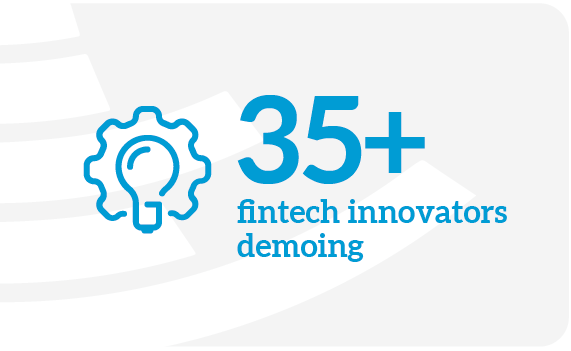

Demos on the main stage

Cut to the chase. 35+ product demos of new and improved financial services technology.

These are actual demos, not just pitches, with tech for all financial services players: Commercial, retail & investment banks, fintechs & techs, insurance providers, merchants & retailers, regulators and more.

Sponsor the fintech conference with the most senior audience profile

We provide a unique platform to connect with 1000+ senior fintech decision-makers. Tell us your business goals. We'll help you achieve them.

Get the Latest Event Updates

Finovate's digital community

Keep up with the latest in fintech from our global network of experts all year round

Finovate Blog

Daily analysis and insight from our resident analysts.

Come back each day for new articles, or sign up to the weekly newsletter delivering the insights directly to your inbox.

Finovate on Streamly

Throughout the year we publish exclusive video content focusing on business critical trends and new innovative technologies.

Featuring some of the key influencers in the industry, find the insight you need to stay ahead with our video content on Streamly.

Finovate Podcast

The Finovate Podcast, hosted by Greg Palmer, carries the expert conversation and ideas forward from the stage.

Get caught up on all 200+ episodes with fintech pioneers.

Fintech Training

Face-to-face, digital and bespoke in-company courses

Lead media partner: Fintech Futures

The premier publishing platform for the worldwide fintech community – providing daily news, analysis and expert commentary. Comprehensive, accessible and free.

CERTIFIED BY THE CPD CERTIFICATION SERVICE

FinovateEurope is CPD certified event. Continuing Professional Credits will be provided in accordance with the National Association of State Boards of Accountancy (NASBA). All credits will be provided following the conclusion of the conference. Attendees can request a CPD certificate after attending the event.

For further information on CPD accreditation please visit: www.cpduk.co.uk.