How top active managers can add value in non-U.S. equity markets

I’ve long believed that the debate over whether one should choose an active or passive approach to investment management is ultimately misguided. Investors can benefit greatly by combining both approaches in the same portfolio; the two can be complementary, if employed selectively and with an awareness of the potential performance differences among active and passive strategies. That awareness is critical, as historical results have shown that the ability of top active managers to consistently outperform over passive approaches has been more prevalent in certain investment categories than in others. One particularly notable category is non-U.S. equities, where active managers have an abundance of opportunities to not only stand out from the crowd, but add long-term value.

How skilled non-U.S. equity managers can outperform

While globalization has gone a long way to level the playing field internationally in terms of market access and information, the investment landscape in many markets remains distinctly different and more challenging than it does in the United States.

Here’s a look at a few of the ways that skilled non-U.S. equity managers can turn these challenges into opportunities to add value:

Access to information

In the U.S. market, legions of Wall Street analysts parse seemingly every piece of company news, especially when it comes to the largest stocks. In some non-U.S. markets, detailed financial metrics may not be readily available for all publicly traded companies, and data and news on non-U.S. companies tend to draw less attention than information in the heavily researched U.S. market. As a result, analysts’ forecasts of future earnings results have been far less accurate for non-U.S. stocks than for U.S. equities, creating opportunities for non-U.S. active managers. For example, over the five-year period ended 30 September 2016, the median error in forecasts that analysts made nine months prior to the release of actual earnings results was 15.4% for companies in the MSCI Emerging Markets Index and 12.1% for firms in another common international benchmark, the MSCI EAFE Index. For companies in the S&P 500 Index, a U.S. benchmark, the median error was just 6.0%.1

The value of research

Often, portfolio managers and the analysts supporting them unearth non-U.S. equity opportunities through boots-on-the-ground research, traveling the globe to assess economic conditions and interviewing corporate management teams to better evaluate individual stocks.

Market inefficiency

Skilled managers may be able to find opportunities in the market dislocations that can be caused by liquidity disruptions and obstacles to market access that can make some non-U.S. markets less efficient than the U.S. market.

Alongside traditional active management, the growth of strategic beta in recent years has opened new avenues to potentially beat equity benchmarks in non-U.S. and U.S. markets alike. These strategies use custom-designed indexes weighted in favor of certain equity characteristics, such as value, momentum, or size, and offer an alternative to traditional passive approaches for generating inexpensive, diversified equity exposure.

Strong potential for outperformance by active managers in non-U.S. equities

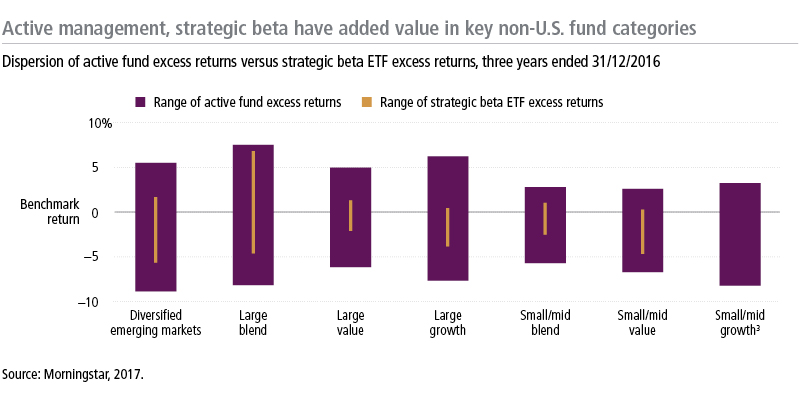

To assess how active approaches and strategic beta have fared in non-U.S. markets, we examined the performance of these strategies against common benchmarks across seven Morningstar non-U.S. equity categories for the three-year period ended 31 December 2016. For actively managed funds, we found substantial numbers of strategies that outperformed, based on annualized total returns net of fees, across all seven non-U.S. categories: diversified emerging markets, large blend, large growth, large value, small/mid blend, small/mid growth, and small/mid value. In the largest category, diversified emerging markets, 82 of 170 actively managed strategies outperformed, or 48%; in the second-largest group, large blend, 54 out of 127 strategies outperformed, or 43%.2 The large number of out-performers suggests that investors have plenty of top talent to choose from in the big categories that tend to draw the most investment dollars.

As for strategic beta, the top strategic beta ETF outperformed its group’s common benchmark across each of the six categories where there were strategic beta offerings with records of three years or longer. The category with the most benchmark-beating strategic beta ETFs was large blend, with 12 of 31 outperforming.3

A wealth of top non-U.S. strategies to choose from

These findings support the notion that active managers of non-U.S. strategies have a broad range of tools to generate alpha, or returns that skew positively relative to a benchmark. Moreover, the sizable number of benchmark-beating non-U.S. strategies suggests that selective investors can choose among a large pool of funds that have generated strong relative performance in the recent past, through either traditional active management or strategic beta. Identifying the strategies that have the greatest potential to continue performing strongly requires additional due diligence and robust oversight, but investors could be rewarded for those efforts.

Leo M. Zerilli is Chief Investment Officer at John Hancock Investments and will be taking part in the panel discussion, The rise of sub-advisory mandates, taking palace at FundForum International, taking place in Berlin 12-14 June. Find out more about the world's leading asset management event.

1 Thomson Reuters I/B/E/S Estimates, as of 30/09/2016.

2 Many funds use different benchmarks than the MSCI non-U.S. equity indexes that were used in this study as common benchmarks for funds within their respective categories.

3 One of the seven non-U.S. equity categories, small/mid growth, did not have a strategic beta ETF with a three-year record.

The universe of fund returns is compared against benchmarks in the following categories: diversified emerging markets (MSCI Emerging Markets Index), large blend (MSCI EAFE Index), large growth (MSCI EAFE Growth Index), large value (MSCI EAFE Value Index), small/mid blend (MSCI EAFE Small Cap Index), small/mid growth (MSCI EAFE Small Cap Growth Index), and small/mid value (MSCI EAFE Small Cap Value Index). The MSCI Emerging Markets Index tracks the performance of publicly traded large- and mid-cap emerging-market stocks. The MSCI Europe, Australasia, and Far East (EAFE) Index tracks the performance of publicly traded large- and mid-cap stocks of companies in those regions. The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Diversification does not guarantee a profit or eliminate the risk of a loss. Investing involves risks, including the potential loss of principal, which are detailed in a fund’s prospectus. There is no guarantee that a fund’s investment strategy will be successful.

John Hancock Worldwide Investors, PLC (company) has been authorized in Ireland as a UCITS fund pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulation 2011, as amended. Certain funds of the company have also been authorized for retail sale in Switzerland and the United Kingdom.

Shares of John Hancock Worldwide Investors, PLC are only available for certain non-U.S. persons in select transactions outside the United States or, in limited circumstances, otherwise in transactions that are exempt from the registration requirements of the U.S. Securities Act of 1933, as amended, and such other laws that may be applicable. Fund shares may only be sold in accordance with applicable law.

This material does not constitute or contain an offer, solicitation, recommendation, or investment advice with respect to the purchase of any security in any jurisdiction. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment. This and other important information is contained in the prospectus and other disclosure documents. Read these documents before investing. To obtain a prospectus for any John Hancock UCITS fund, visit us at jhworldwideinvestors.com. Prospective investors should also consult their professional advisors as to the suitability of any investment in light of their particular circumstances and applicable citizenship, residence, or domicile.

OF370343

UCITSFFBLOG 05/2017