Limited partners and private equity firms embrace ESG

ESG has grown beyond its socially conscious roots to become a core component of creating value in private equity.

Environmental, social, and corporate governance (ESG) standards are rising in importance. This is true for businesses worldwide, especially for limited partners (LPs). LPs see progress in ESG initiatives as delivering multiple benefits.

The days of seeing ESG efforts as just a check-the-box, risk-mitigation exercise are ending. More and more, LPs view ESG factors as additive to investment performance. Furthermore, a lack of strategy for thoughtfully managing ESG considerations can cause proposed deals to face obstacles—or cancellation.

Challenges remain. A measurement gap exists that is difficult to reconcile, though improvements are accelerating. For example, net-zero carbon until recently was a vague concept. Now, emissions footprints can be measured more accurately. Still, collecting quality, comparable ESG data across an investment portfolio is posing real challenges. Investors must navigate numerous methodologies, frameworks, and approaches to translate ESG policies into concrete, data-driven processes and actions.

Given market dynamics, what do LPs really think? To find out, the Institutional Limited Partners Association (ILPA), in partnership with Bain & Company, surveyed more than 100 LP organizations. Their responses, along with some follow-up interviews, provide valuable insights into recent ESG developments and concerns among LPs.

ESG influence passes the tipping point

From the joint survey results, the big picture is clear: ESG is now a mainstream consideration. In terms of awareness and mobilization, an increasing percentage of LPs now factor ESG issues into investment decisions and consider how they will affect private equity (PE) investments.

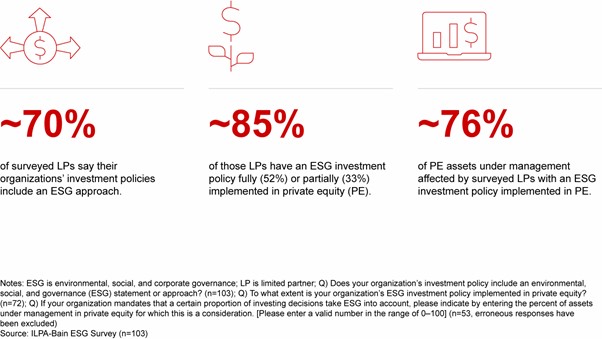

More than two-thirds of respondents stated that ESG considerations play a part in organizational PE investment policies. Of those LPs, around 85% include at least some ESG initiatives, with more than half having fully implemented ESG-specific policies, and 33% having partially implemented such policies. Overall, these policies affect about 76% of surveyed PE assets under management (see Figure 1).

As one respondent noted, policies can help demonstrate the level of ESG commitment. Another respondent noted that an early focus on “awareness, education, foundational policies, and processes” can accelerate a “shift to the next frontier on accountability, impact, and systemic issues.”

The LPs we spoke with indicated that many of these ESG policies reflect growing global concerns about climate change and the value of diversity, equity, and inclusion (DEI) initiatives. One respondent noted a desire “to see evidence [that general partners (GPs)] are making climate change a board-level issue” and exhibit “systematic engagement with companies on climate risk management.”

However, progress on ESG implementation varies geographically. Of the LPs surveyed, the highest rates of ESG integration exist outside North America. Only 62% of responding LPs with headquarters in North America reported having an ESG policy, while 83% with headquarters in Europe and 92% of respondents in all other regions of the world have taken this step.

The case for ESG integration: Risk mitigation versus value creation

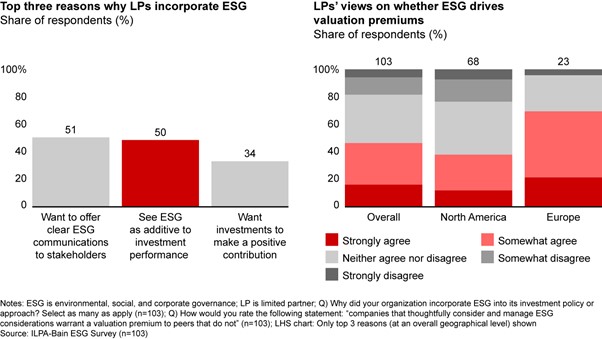

The top reasons LPs in our survey gave for incorporating ESG considerations into their investment policies or approach are that they view them as additive to investment performance and they want to offer clear ESG communications to stakeholders. One-third of respondents credited ESG incorporation as the result of a desire to choose investments that make a “positive contribution” (see Figure 2).

Although being “additive to investment performance” is a major reason to include ESG considerations across the investment life cycle, a wide gap exists between Europe and North America regarding the influence of ESG adoption. Of the LPs headquartered in Europe, 70% agreed or strongly agreed that ESG commitments influence valuation premiums. However, only 38% of LPs headquartered in the US held the same opinions.

The survey results spotlight the benefits of ESG incorporation—and the increasing risks of ignoring ESG considerations. Furthermore, we see an interesting pattern emerging in the primary reason for those risks.

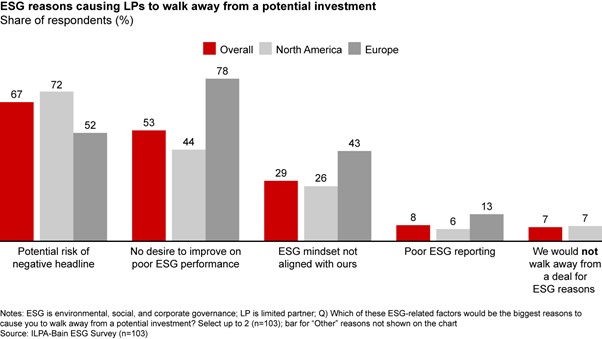

Only 7% of surveyed LPs—all North American firms—said they would not walk away from an investment because of ESG reasons. Analysis of the reasons for walking away revealed that North American LPs are more concerned with ESG risk mitigation, whereas European LPs focus on opportunities to drive or improve ESG performance.

Nearly three-quarters of North American respondents cited the potential for negative publicity as a reason to scrap an investment; only half of European LPs shared this worry. Conversely, 44% of North American LPs considered a lack of desire to improve on poor ESG performance to be a deal-breaker, compared with 78% of European LPs. And nearly twice as many European LPs (43% and 13%, respectively) as North American LPs (26% and 6%) were concerned with a misalignment between firms’ ESG mindset and their own or with poor ESG reporting (see Figure 3).

One respondent said LPs are becoming savvier about what makes ESG initiatives valuable, and they can tell “the difference between meaningful action and greenwashing.” Another recalled that the holistic incorporation of ESG standards by a firm’s leadership was the deciding factor in a tight competition between fund managers with similar performance records.

Click here to read the rest of the article on bain.com, which looks at how LPs are responding to monitoring and measurement challenges, and what the next steps are for them and GPs to capture value from ESG adoption.