Private equity: A bridge over troubled waters?

Private equity managers have produced strong returns through cycles and the outlook continues to look bright.

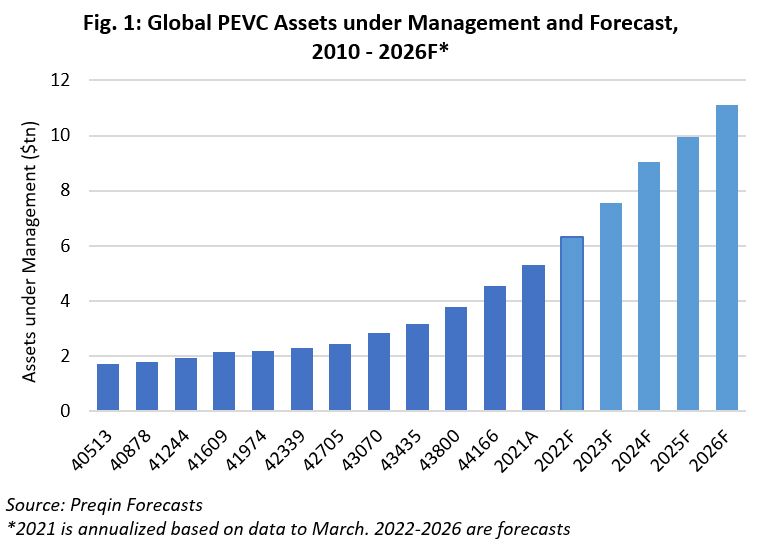

Growth across alternative assets has been phenomenal over the past 10 years, driven by the success of private equity funds in generating returns and raising capital. Assets under management (AUM) grew from $1.72tn at the end of 2010 to $4.56tn in 2020, with the compound annual growth rate (CAGR) accelerating from 6.0% over 2010-2015 to 14.9% over 2015-2020. Impressive as this growth rate has been, Preqin expects a further acceleration to 15.9% over the next five years, taking AUM to a forecasted $11.12tn at the end of 2026 (Fig. 1).

Preqin’s AUM Forecaster[1] was developed by our Research Insights and Data Science teams, using a deterministic backward-looking trend, based on moving averages, and combining Preqin’s historic dataset with macro data. However, any forecast can be knocked off beam by changing circumstances. So, given inflation not seen for decades, the ongoing impact of COVID, and a war in Europe, how will private equity fare over the next few years?

The impact of inflation on rates

In our 2022 Global Private Equity Report we examined the impact of inflation which, if sustained, could lead to higher interest rates and pose perhaps the biggest risk to our AUM forecasts. Inflation has gone higher and persisted longer than markets expected it would a year ago, as Russia’s invasion of Ukraine compounded the supply chain impact of COVID, and tight labor markets have raised wage pressures. However, longer-term expectations are for inflation to fall back to more manageable levels. The Cleveland Fed 10-year expected rate of inflation has ticked up from 1% in April 2020 but remains under 2% today. The expected real rate of interest has turned positive over that period, but the 10-year expectation remains below 0.5%.

Whilst most investors we speak to see these immediate pressures as being transitory, there are additional structural forces at work putting upward pressure on prices. The rebalancing of China’s economy, diversification of sources of supply, and the global transition towards net zero, will all make it more expensive to do business. On the other hand, population ageing in developed economies is leading to relatively lighter consumption and a build-up of domestic savings. Meanwhile, the adoption of new technologies across all industries, collectively known as digital transformation, have the potential for structural and permanent cost reductions for many goods and services.

Inflation hits portfolio companies in two main ways. First, rising costs put pressure on profitability. The extent to which this is a significant factor will depend on the extent to which companies can pass higher prices onto their customers and, given the general preference of most funds to back market leaders with strong positions over buying companies at low multiples, the industry as whole is likely to fare relatively well.

Second, financing costs may rise which may have a particular impact on larger, more leveraged buyouts that are more exposed to interest rate rises than public companies. The increased penetration of private debt into the LBO financing market may exacerbate this impact, given how floating rate facilities will pass on any rate rises. One concern is whether rising costs, and a more difficult trading environment, would lead to increased default rates. Last year Fitch Ratings reduced its forecast default rate for US LBOs for 2022 from 2.5% to 1.5%, a forecast it stuck with in March despite the Ukraine crisis.[2]

The virtuous cycle

The past decade of the growth of private equity has been fueled by a virtuous cycle, as low interest rates have pushed both public and private equity markets to new highs. In private equity this is evidenced by an increase in the value of unrealized investments, whose valuation multiples have moved in tandem with public markets, and in dry powder, fueled by inflows of capital into the asset class. Unrealized value has climbed from $1.29tn at the end of 2011 to an estimated $4.01tn as of December 2021.

Dry powder, the amount of capital available for investment by private equity, has climbed from $503bn at the end of 2011 to $1.32tn in 2021. It’s extremely unlikely that there will be anyone at Super Return who can remember a time when there wasn’t “too much money chasing too few deals”, given that the concern dates back until at least the 1980s. The ratio of dry powder to aggregate deal value, a yardstick to gauge whether funds raised can be deployed, was 1.7x at the end of 2011 and 1.6x as of September 2021, indicating that the issue of oversupply of capital is no more acute now than it was a decade ago. Nevertheless the high absolute level of dry powder will ensure that private equity managers will continue to compete for larger and larger deals – including public-to-private transactions.

The private equity industry is in an uncharted macro-economic environment. You would have to go back to the early 1990s to find an even remotely comparable period for inflation and interest rates, and the industry wasn’t the behemoth it is now. Funds raised during the 2000s boom eventually delivered surprisingly robust returns, while post-Global Financial Crisis vintages benefit from a contraction of supply and lower pricing.

COVID-19’s impact on markets was sharp but short. It’s impact on the private equity industry may last longer. GPs were able to step in and support portfolio companies through the uncertainty, at the same turning to Zoom and other technologies to provide much more frequent and detailed reports to LPs. The private equity industry and the companies it supports were responsive and resilient. We believe it will rise to the challenges that lie ahead.

The bottom line

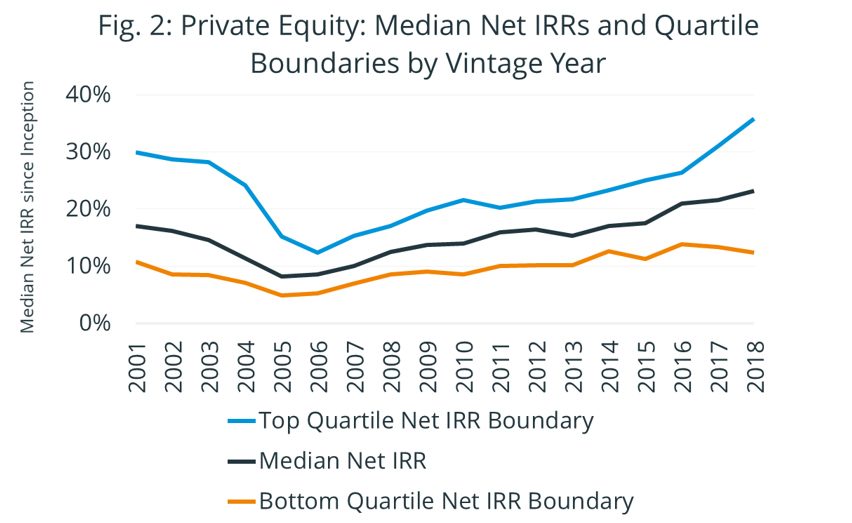

Which brings us to the trillion-dollar question: will private equity continue to perform? Since 2001 the median net IRR recorded by Preqin has dipped into single figures for only two vintages, 2005 and 2006, and since 2011 median net IRRs have exceeded 15% every year, while the boundary for top quartile funds has been over 20% (Fig. 2).

- [1] https://www.preqin.com/insights/research/reports/aum-forecaster-a-technical-overview

- [2] https://www.fitchratings.com/research/corporate-finance/fitch-us-leveraged-loan-default-insight-diamond-sports-dde-lifts-ttm-default-rate-to-0-6-default-forecasts-maintained-despite-ukraine-crisis-22-03-2022

Under the spotlight: Cameron Joyce

Cameron Joyce has 10 years of experience in the investment industry and is currently Deputy Head of Preqin’s Research Insights team, based in London. He previously worked on the international equity desk of one of the largest pension funds in Latin America where he managed a $5bn allocation to Emerging Market equities in Asia, where he has also worked. Cameron is also a CFA Charterholder and an Economics graduate from the University of Manchester.

Preqin is the Home of Alternatives, providing indispensable data, analytics, and insights to more than 170,000 alternative assets professionals around the globe. Our Insights+ platform highlights the latest trends, helping investors navigate an increasingly complex landscape. Insights+ subscribers can access our network of tens of thousands of GPs, LPs, and consultants who are ready to deliver critical insights from across the alternatives market.

For more insights from industry experts, be sure to join us at SuperReturn International >>