AI explainability and adoption challenges: Thoughts from the AI & ML Summit

Machine learning is the most talked about topic in quant finance, and it has been the buzzword for a few years now. But how widely is ML used in finance?

In 2019, we spoke to Michael Steliaros, Global Head of Quantitative Execution Services, Goldman Sachs, about this very topic. He concluded that machine learning changed traders' "advertising material a lot", but it hasn't really transformed anything else yet.

“It's still very much a research exercise” – Andrea Nardon, Former Head of Quant, Sarasin & Partners, told us this year.

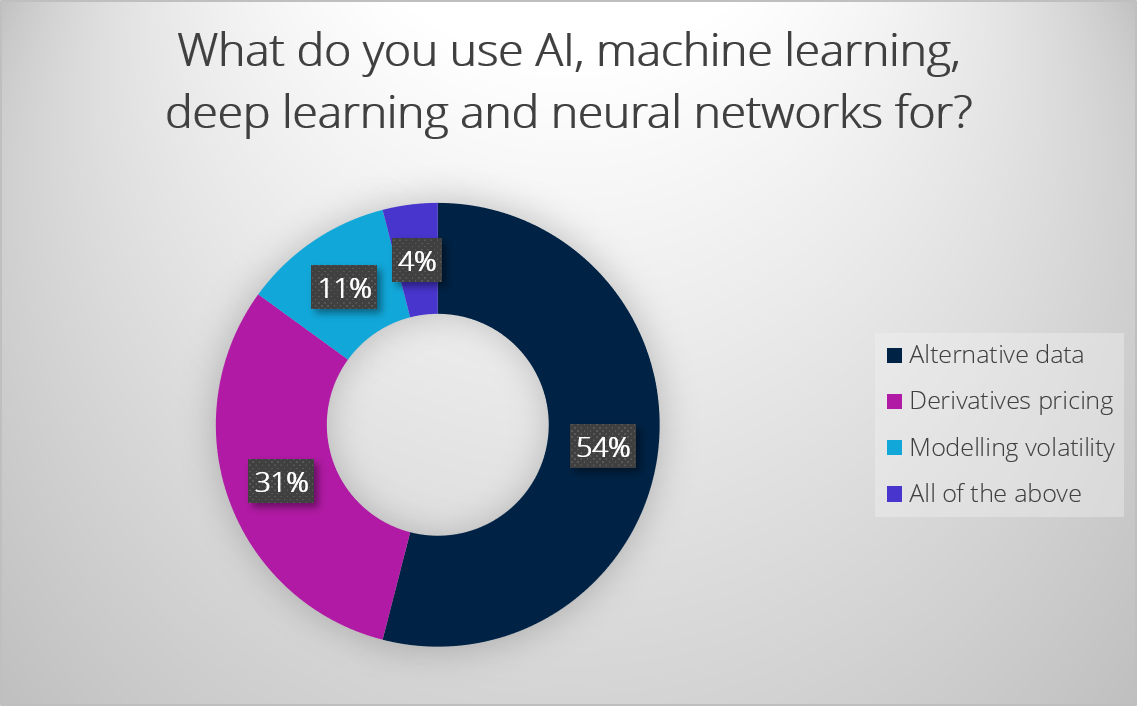

But that shouldn't diminish ML's impact on quant finance. In fact, those who tuned into day 1 of QuantMinds International heard a wide range of presentations detailing machine learning applications. The use cases ranged from market generation to alpha testing, and from portfolio construction to risk management.

Perhaps more importantly, the conversations around artificial intelligence and machine learning adoption challenges highlighted why ML, one year on, is still a research exercise. To understand these challenges, we will take advice from Sam Livingstone, Head of Data Science, Jupiter Asset Management, and start from the basics.

What is machine learning?

John Hull, Maple Financial Professor Of Derivatives & Risk Management, Joseph L. Rotman, School of Management at University Of Toronto, is often asked this question, especially in relation with statistics and data mining. The aim of statistics is to test a hypothesis using data that is collected, whereas in machine learning, the starting point is the data, and from that models trained on, patterns are searched for, and predictive tools are developed.

Types of ML include:

- Supervised learning (where numerical value is predicted)

- Unsupervised learning (where ML is used to find patterns in the data)

- Semi-supervised learning (where some data has labels, some data doesn't have labels)

- Reinforcement learning (where decision making is involved)

The tools within ML include:

- Clustering, for e.g. segmenting customers

- Linear/ logistic regression

- Decision trees/ random forests

- SVM (support vector machines)

- Neural networks

- Reinforcement learning

- NLP (natural language processing)

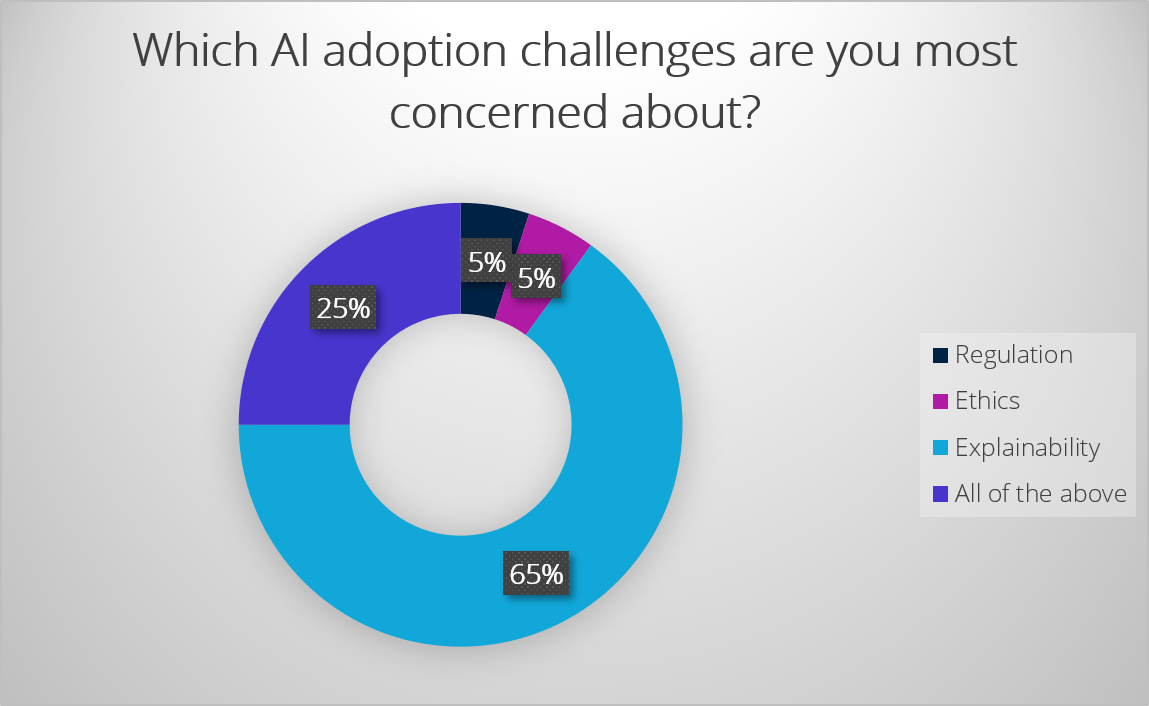

Many quants will know that these terminologies are difficult to explain and understand, which is where criticisms of AI/ML techniques come in, heightened by regulatory and ethical concerns.

Unboxing the black box: AI explainability

Incidents where artificial intelligence and machine learning fail are well-documented and many boil down to skewed data, bias – a word that is synonymous with sociopolitical and economical injustices. Daniel Mayenberger, Co-Author of the upcoming book "Reverse Stress Testing in Banking", notes that although AI in the fintech sector has made financial services available to many who previously had no access to them, the uglier, and perhaps more well-known, side of this innovation is giving many people reasons to distrust it.

One of the most (in)famous cases in this area is the COMPAS (Correctional Offender Management Profiling for Alternative Sanctions) algorithm which wrongly predicted which criminals might reoffend. More recently, the wider use of facial recognition received backlash, particularly after many misidentifications of minority demographics.

So how do we ensure that we end up with the right models and that the models work? Speaking from experience, Sam Livingstone, Head of Data Science, Jupiter Asset Management, found that engaging the end user in the model building process yields the best results. This process allows the end user to familiarise with the technology and help build a model that is fit for purpose.

However, many models in finance are overfitted, so "it's important to acknowledge that current approaches are limited", Darko Matovski, CEO, CausaLens, told us. Statisticians will know very well, that correlation is not causation, and over-reliance on correlation leaves models open to interpretations.

Interestingly though, researchers in the field of AI find that understanding how the model works is not actually that useful, Ioana Boier, Head of Quantitative Portfolio Solutions, Alphadyne Asset Management, said. For example, take two spaceships; you understand perfectly how spaceship A works and operates, but it has never entered the atmosphere. However, spaceship B has flown before, but you don't understand its internal mechanics. Would you choose to fly with spaceship A or B? Would it be wiser to regulate the outcome, not the process?

Machine learning is already becoming an increasingly important part of the role of the quant. It's clear, however, that the obstacles to adoption needs a more considered approach from the get-go. Perhaps it'll involve new tools and techniques. Perhaps it'll be an innovative approach which will make AI and ML more accessible to a broader number of people. Whatever it may be, watch this space, because change is inevitable.