With about a third of the biopharmaceutical industry’s 240 alliances with disclosed financial terms between January 2017 and June 2018 focused around cancer drug candidates or technologies to develop them, oncology continues to be an area where nearly every company is trying to get a leg up on the competition. Here we analyze the 80 oncology deals in that 18-month period, examining the trends in biopharma’s most important market and the key deals that illustrate their importance.

Cell therapy joining traditional modalities

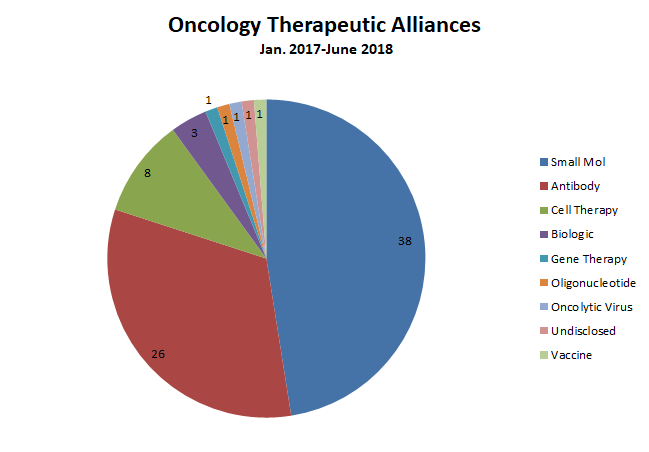

Though oncology is an area where cell and gene therapies and other novel therapeutic modalities are gaining a foothold, traditional modalities continue to dominate dealmaking in the space. Nearly half of all the oncology alliances in the dataset featured small-molecule therapeutic candidates; monoclonal antibodies (and a few mAb-like biologics) accounted for more than a third (figure 1). While biopharmaceutical buyers are dipping a toe into neoantigen cancer vaccines, oncolytic viruses, mRNA therapeutics and gene therapies, these novel approaches accounted for only slivers of dealmaking activity.

There were eight cell therapy alliances during the 18-month timeframe, however, underscoring (alongside blockbuster acquisitions like Celgene’s $9 billion Juno buyout and Gilead’s $11.9 billion takeover of Kite Pharma) big biopharma companies’ interest in technologies like chimeric antigen receptor T-cell (CAR-T) therapies. These deals featured an average $96 million in total upfront payments —roughly twice the average upfront value associated with antibody deals in the oncology space.

Leading the way was Janssen’s December 2017 alliance with Legend Biotech for worldwide co-development and co-commercialization rights to that biotech’s LCAR-B38M CAR-T treatment. Janssen paid $350 million upfront for the therapy, which targets B-cell maturation antigen (BCAM) and is under regulatory review in China for the treatment of multiple myeloma. Gilead added to Kite’s CAR-T technologies in a deal with gene editing pioneers Sangamo Bioscience worth $150 million upfront (that deal has the highest disclosed possible value, with more than $3 billion in potential milestone payments). Sangamo will use its technology platform to knock out or insert specific genes in the big biotech’s various cell therapies, including T-cells and natural killer cells.

Figure 1

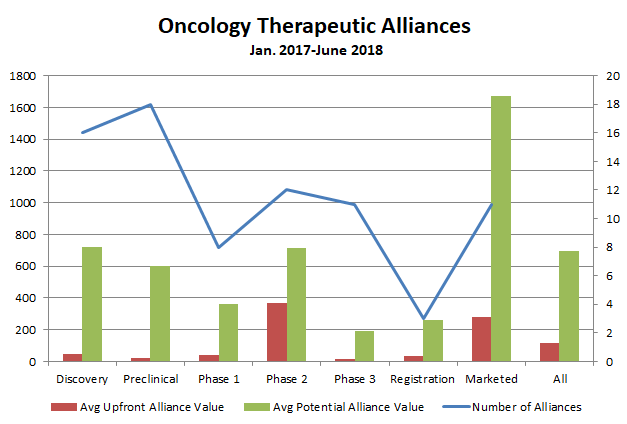

Oncology deals overall boasted the second-highest average upfront payment in the broader dataset, behind only cardiovascular alliances (of which there were only six). Breaking down the 80 oncology alliances by development phase shows that while deal volume was concentrated at the early end of the value chain (there were 16 and 18 deals for assets in discovery and preclinical stages, respectively), upfront value peaked in Phase 2 (figure 2).

The average upfront payment for a Phase 2 oncology asset during the 18-month timeframe was more than $365 million. That figure was driven by Bristol-Myers Squibb Co.’s broad February 2018 alliance with Nektar Therapeutics, a deal worth $1.85 billion upfront ($1 billion in cash and an $850 million equity investment). BMS and Nektar will co-develop and co-commercialize Nektar’s lead immuno-oncology asset NKTR-214 globally in combination with BMS’s Opdivo and Yervoy checkpoint inhibitors in 20 cancer indications. (Nektar will also be able to continue to develop NKTR-214, a CD122-biased agonist, in combination with its own pipeline assets or with third parties.)

Upfront and potential deal value in oncology alliances also spiked for marketed therapies, driven mostly by Merck & Co.’s alliance with fellow big pharma AstraZeneca around the latter’s marketed PARP inhibitor Lynparza and development-stage MEK inhibitor selumetinib. That deal featured a $1.6 billion upfront payment and enables each company to independently develop and commercialize the two assets with its own immuno-oncology medicines, and including milestone payments could be worth up to $8.5 billion to AZ.

Figure 2

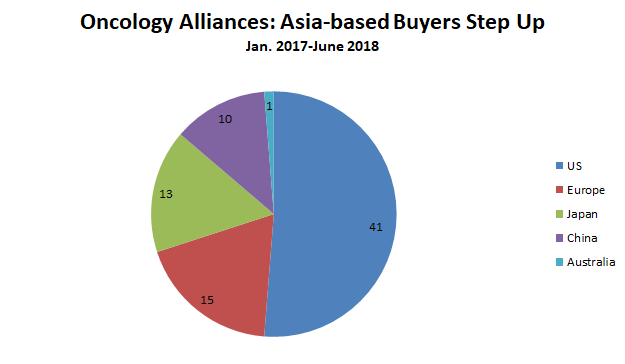

Like Merck and BMS, most oncology buyers were largely interested in global rights to the therapeutics they are licensing. Fifty-one of the 80 oncology alliances featured worldwide rights or options to license worldwide rights to certain therapeutic candidates. Among the 29 deals for regional rights, 11 alliances granted development and/or commercialization rights in China and five granted those rights in Japan.

Companies based in China or Japan were also on the buying end of 23 oncology alliances during the 18-month timeframe, compared with only 15 deals for companies based in Europe (figure 3). Japan’s Takeda Pharmaceutical Co. Ltd. was particularly active, with five oncology alliances (not to mention its $5.2 billion acquisition of cancer-focused Ariad Pharmaceuticals in January 2017). Takeda’s oncology-focused alliances included three option-based discovery deals (with Maverick Therapeutics, Molecular Templates, and Heidelberg Pharma) and two later-stage deals: rights in Japan and other geographies to Tesaro’s PARP inhibitor niraparib, and Japanese rights to Exelixis’ multi-kinase inhibitor cabozantinib.

Figure 3

Chris Morrison has covered the biopharmaceutical industry for 18 years as a writer and editor for several industry publications. He is a former editor of In Vivo: The Business and Medicine Report and "The Pink Sheet" where he focused on trends in biopharmaceutical finance, business development, and research and development. Chris contributes to a variety of publications, including In Vivo, Datamonitor, Nature Biotechnology, and Nature Reviews Drug Discovery. He holds a bachelor’s degree in neurobiology and behavior from Cornell University and a master’s in science journalism from New York University.

Chris Morrison has covered the biopharmaceutical industry for 18 years as a writer and editor for several industry publications. He is a former editor of In Vivo: The Business and Medicine Report and "The Pink Sheet" where he focused on trends in biopharmaceutical finance, business development, and research and development. Chris contributes to a variety of publications, including In Vivo, Datamonitor, Nature Biotechnology, and Nature Reviews Drug Discovery. He holds a bachelor’s degree in neurobiology and behavior from Cornell University and a master’s in science journalism from New York University.