BEPS Documentation Requirements: Where to Start

We asked one of our sponsors from TP Minds Asia 2016 to talk through their approach to BEPS documentation, a cornerstone of the new transfer pricing landscape. Here, Zara Ritchie and Nick Drizen from BDO Australia lay out the basics for MNEs:

BEPS is now a reality with groups having to tackle for the first time the implications of Actions 8 -10 on value creation and Action 13 on Transparency focusing on documentation and country by country reporting.

We have set out a practical step plan which can be used by your group to practically address BEPS over the coming year. This shows three key steps to get your group ready to address the new documentation requirements under BEPS.

Step 1: What are your documentation requirements under BEPS in the countries in which your group operates?

In principle each country around the globe should be operating under the OECD model of a:

- Master File

- Local File

- Country by Country Reporting

Per the OECD guidelines these requirements should apply to accounting periods beginning after 1 January 2016 where the group has a global turnover of more than 750 million Euros. However, it is up to each country to implement BEPS within their local legislation and there have been considerable differences in the way countries have implemented this globally.

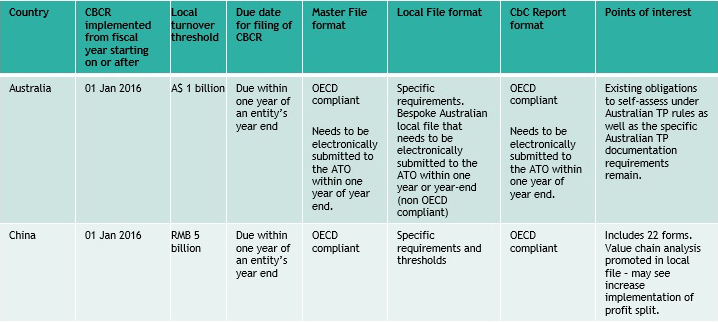

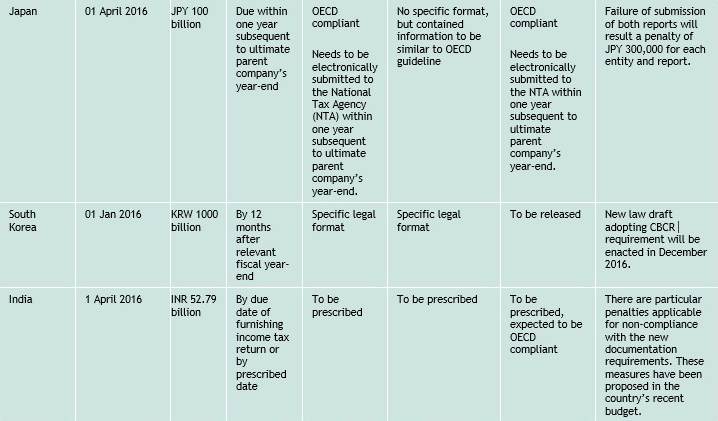

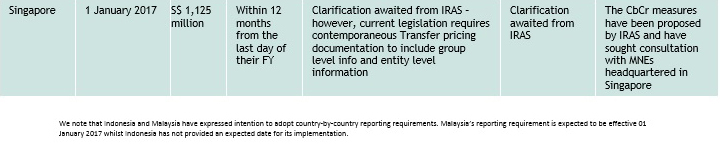

The table below provides details of the BEPS documentation requirements for selected Asian countries.

What are the key pitfalls to be aware of?

Different turnover limits for BEPS by each country: As can be seen above, there are different start dates for BEPS reporting (e.g. Japan). There are different turnover limits for the application of BEPS by country (which are not precisely the same in Euros equivalent). The country with the lowest turnover threshold and earliest start dates are likely to impact on when your group needs to address BEPS.

Non-compliance with OECD templates of documentation: Countries like Australia and China have specific Local File requirements that differ from OECD norms. These non OECD compliant countries will need to be treated as higher risk and require local advice. There may also be severe penalties for non-compliance with the BEPS requirements. Australia has the highest penalties of $450,000 AUD for non-compliance.

Step 2: BEPS dry run

Having established your global BEPS requirements, we recommend performing a dry run prior to 31 December 2016 (assuming your group has a calendar year end.)

This involves:

- Assessing whether your group has the capability to extract the correct data off ERP systems to produce CbC reports

- Considering whether a third party software solution tool should be used to gather the information, produce CbC tables and to analyse the ratios

- Having extracted the CbC data to perform bespoke ratio analysis, assess upfront key transfer pricing risks for your group.

- Raise any BEPS related risks at Board Level and make appropriate changes pre year end, if appropriate.

Each tax authority is likely to carry out their own bespoke ratio analysis to identify potential BEPS risks. Given the focus of BEPS on economic substance, the focus on the ratio analysis is likely to identify potential substance issues.

For example, the ATO in Australia has already indicated that they will look at the cost plus return of companies operating in low tax jurisdictions for marketing hubs (but this can equally apply to companies holding IP or taking financial risks. Where these companies have a cost plus return of higher than 100%, this will be treated as a higher audit risk. This approach may be adopted by other tax authorities to challenge profits arising in a low tax jurisdiction where there is a small number of local employees, costs and assets.

Identifying these risks upfront allows your group to:

- Raise key risks to the Board level so there are no surprises and that adequate provisions can be made

- Make appropriate structural changes to your group’s transfer pricing operating model

- Update your global transfer pricing documentation to address key transfer pricing risks.

Step 3: Completing your documentation for BEPS

Having risk assessed your group and made appropriate structural changes, the final step is documenting your arrangements post year end. We have set out some of the key changes you need to consider in updating your existing documentation for BEPS:

- Risk profile of different entities: The ratio analysis in Step 2 identifies your key BEPS risk areas. Where you have operations that are considered to be low risk, your transfer pricing documentation strategy could be to roll forward existing internal documentation or to get advisors to do a light touch on low risk countries. This approach may not work for all countries. You may have a company doing low risk operations in China from a transfer pricing perspective, but consider that China is a high risk country simply due to the more onerous documentation requirements.

For high risk companies which typically are entrepreneurial companies deriving profits in lower tax jurisdictions, we recommend a critical reappraisal of your group’s existing transfer pricing documentation in light of BEPS Actions 8 – 10.

- Substance based transfer pricing documentation: For higher risk countries, we recommend producing substance based documentation. This would involve a much higher degree of focus on the functional analysis than has traditionally been the case. This would include:

- Commercial rationale for the overseas operations (e.g. to get closer to the local market, to take advantage of specialist knowledge or low cost labour etc.)

- Key people employed by local operations including their experience, seniority in the group, pay package etc. together with an explanation of their suitability to manage the IP, risks or sales activity.

- A detailed decision tree matrix for the areas of the value chain that are managed by the company offshore. For example in a company managing IP:

- Who sets the strategy of developing and maintaining IP?

- Who sets the budgets?

- Who controls the decision of R&D projects?

- Who oversees the R&D operations on a day to day basis?

- Who can pull the plug on R&D projects?

- What evidence can be provided to show critical decisions are actually made offshore and attached to file or kept as a separate document, as appropriate?

- Board Minutes

- Emails

- Business plan

Zara Ritchie and Nick Drizen

https://www.bdo.com.au/en-au/home