Integrating transparency, accountability and ethical behavior into company culture can help organizations mitigate risk and keep ahead of regulatory change.

Compliance forms an integral part of virtually every organization’s operations. Depending on the organization’s ownership structure, industry and location, everything from its accounting to its human resources may be subject to a regulatory regime, industry association guidelines or internal codes of conduct.Organizations that operate in more than one jurisdiction will, of course, have to contend with different regimes in each place.

The significant legal, financial, and reputational damage that a violation can bring is reason enough for enterprises to stress compliance. Yet compliance is also critical, because poor compliance often signals the larger problem of poor business practices, which expose the organization to further risk. Ultimately, compliance is about more than fulfilling regulatory or other obligations: It involves establishing a culture of integrity that is centered on transparency, accountability and ethical behavior.

A culture of integrity yields benefits beyond those that come with scrupulous behavior. Government regulations, which can seem ubiquitous, are also often in flux. Any jurisdiction’s regulatory priorities can vary significantly over time, depending on the administration in power and other variables. An effort at regulatory reform at the national level may filter down unevenly to the local level or may cross industries. In addition, emerging industries often find that they are operating in regulatory gray areas. At those times, companies with strong cultures of integrity can stay ahead of regulatory change. Moreover, enterprises from more stringent jurisdictions will prefer to do business with companies where compliance is just considered the right thing to do.

The real test of the commitment to a culture of integrity is how it responds to questionable or prohibited behavior — particularly when the transgression involves a key employee or a member of management.

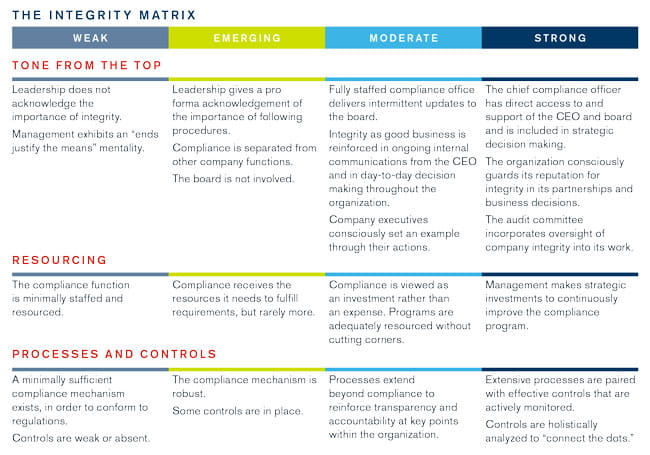

However, building a culture of integrity is a broader, more complex undertaking than simply ensuring that checklists and reporting mechanisms are in place. In our experience working with governments and corporations to help build, sustain and monitor such cultures, we have found that they rest on a foundation of six distinct elements:

- Tone From the Top An organization takes its direction from its leaders. A board that emphasizes compliance will likely be able to communicate that message much more powerfully than the head of compliance or internal audit.

- Resourcing A stated commitment to transparency and accountability must be backed up with the resources needed to build and maintain such a culture.

- Processes and Controls The right procedures provide a framework that ensures that decision making and actions are transparent and do not involve conflicts of interest. Controls allow the organization to identify and respond to exceptions and weaknesses that are more systemic.

- Education Everyone in the organization must understand what is expected. Executives and employees also need ongoing reinforcement and training so that they can apply their judgment in unexpected or ambiguous situations.

- Performance Goals and Incentives Ultimately, executives and employees act according to how they are incentivized. Board members and senior management must understand that unrealistic deadlines or budget constraints can constitute risks in their own right. Managers should set performance goals that can be achieved without compromising integrity, transparency, or compliance.

- Response and Remediation The real test of an organization’s commitment to a culture of integrity is how it responds to questionable or prohibited behavior. Particularly in cases where the transgression involves a key employee or a member of management, the temptation to rationalize or overlook the misdeed can be high.

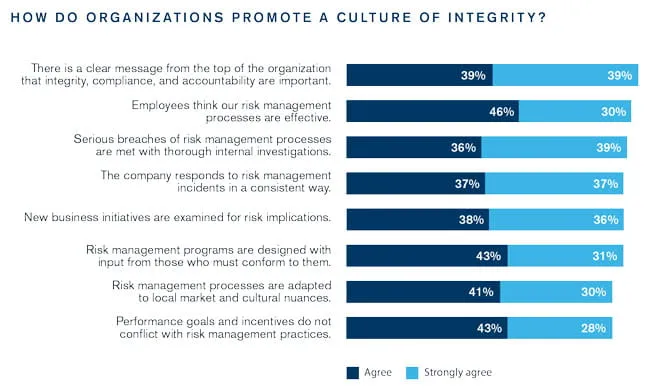

In the Kroll Global Fraud and Risk Report, we asked respondents about the extent to which they followed various best practices for instilling a culture of integrity (see Figure 16). Globally, each of the eight best practices is followed by roughly three-quarters of the organizations surveyed. However, while 35 percent say they have adopted all eight practices, one in four organizations say they have adopted half at most.

It is notable how few respondents strongly agree that their organization’s performance goals and incentives do not conflict with its risk management practices. While all of the practices listed are important, ensuring that performance goals and incentives can be met without compromising integrity is arguably the single most important step that organizations can take in building a culture of integrity.

While 35 percent of organizations say they have adopted all eight practices, one in four have adopted half at most.

For most organizations, building a culture of integrity is an ongoing task, with each element at a different level of strength at any given time. Organizations can use a matrix to assess the state of their culture of integrity and prioritize areas requiring further work (see table below).

|  |  | ||

| Amine Antari, Managing Director and Head of Middle East | Hiroki Katayama, Managing Director and Head of Japan | Recardeo Romero, Regional Managing Director, Latin America | ||

| Amine Antari is a managing director in Kroll's Business Intelligence and Investigations practice and Head of Middle East.Amine has 15 years of experience working with multinational companies, financial institutions, and consulting firms in the Middle East, North Africa and North America.He has particular expertise in investigations, with a strong knowledge of international regulatory requirements (e.g., UK Bribery Act, Foreign Corrupt Practices Act) as well as obligations with monitorship and debarments.

Over his career, Amine has assisted diverse financial institutions, governmental agencies, development organizations, and engineering companies with their fraud and corruption investigations, fraud and corruption risk assessments, and anti-money laundering initiatives. Prior to joining Kroll, Amine was Head of Compliance Investigations at SNC-Lavalin, a global infrastructure, engineering, and construction company. He joined the firm in 2011 to establish the Investigation department in its Montreal office, but spent his last two years with the firm in Abu Dhabi, with primary responsibility for investigating and mitigating risks related to bribery, corruption, and fraud. In this role, Amine led a number of cross-border investigations involving multi-lateral development banks as well as governmental and private sector entities in various countries in Africa, the Middle East, Asia, and Europe, as well as North and South America. Amine also played a central role in fraud risk assessments, anti-money laundering initiatives, internal controls design, and compliance consulting. Amine is an author and has also spoken at a number of global conferences. | Hiroki Katayama is a managing director and head of Japan for the Business Intelligence and Investigations practice of Kroll, a division of Duff & Phelps, based in the Tokyo office.He is responsible for managing a variety of risk consulting engagements, including complex compliance-related engagements in Japan and coordinating the delivery of such tasks globally for Japan-based clients.Hiroki’s areas of expertise include reviews of business processes and financial due diligence. His experience includes extensive consulting services in the areas of corporate governance related to the Sarbanes-Oxley Act, business due diligence for merger and acquisition deals, and reviews of internal control and remediation.

Prior to joining Kroll, Hiroki was an Associate Director at an international risk consultancy. He managed a broad range of complex initiatives with a specific focus on business due diligence and strategic organization reform. Previously, he was a senior manager at one of the Big Four accounting firms, where he led company-wide projects related to risk and management consulting, with a particular focus on valuation, due diligence, and internal control reviews of Japanese companies. Hiroki began his professional career at Dai-ichi Kangyo Bank (now Mizuho Bank), where he was extensively involved with compliance-related initiatives, including assessment of business requirements and systems related to regulation changes and guidance provided by the Japanese Ministry of Finance. | Recaredo Romero is Kroll’s regional managing director for Latin America. He has management responsibility for Kroll’s offices in Miami, São Paulo, Mexico D.F., Bogotá, Buenos Aires and St. George’s (Grenada).With more than 15 years of investigative and risk management experience, Recaredo assists clients to mitigate a wide range of fraud and corruption risks and to respond to compliance breaches and integrity incidents; he also provides extensive dispute advisory support. Recaredo has led diverse engagements advising clients on pre-transaction due diligence and compliance programs.In addition, he has managed and executed numerous cross-border investigations on commercial bribery, FCPA violations and corporate misconduct for local and international clients, often working closely with external legal counsel.

Recaredo joined Kroll from a leading risk consultancy where he served as practice leader of the Corporate Investigations Group. In this role, he oversaw all investigative work across the Andean region and led complex investigations for local and international clients. He also has significant expertise in political risk analysis and has consulted extensively to the public and private sector. Latin America media outlets regularly seek Recaredo’s perspectives on fraud, corruption and integrity issues. He has also served as a guest speaker on a number of topics for various investment and professional groups. |