Data has had a huge impact on the way the finance sector operates, but after all these years of AI developments and improvements on algorithms and machine learning, the industry can still do more to leverage data to its full potential. Pierce Crosby, Director of Business Development and Revenue Strategy at Stocktwits, looks forward as 2019 shapes up to be the year when automation and asset management practices transform.

Data has had a huge impact on the way the finance sector operates, but after all these years of AI developments and improvements on algorithms and machine learning, the industry can still do more to leverage data to its full potential. Pierce Crosby, Director of Business Development and Revenue Strategy at Stocktwits, looks forward as 2019 shapes up to be the year when automation and asset management practices transform.

In late 2018, quantitative hedge funds surpassed $1 trillion in assets under management, putting them squarely in the lead and putting the growth category roughly in the $3.5 trillion AUM hedge fund business.* At the end of 2018, Bridgewater Associates and Renaissance Technologies reported an outperformance of the next 20 managers combined. All said, the equation is increasingly simple for allocators; no longer can stock jockeys run the game, but rather those who rely on the input of machines and models to make decisions.

For fundamental managers, the allocation trend – and investment returns – have finally sounded the alarm to get into the business of ‘quant,’ or risk capital flight. As a result, companies developing the building blocks for funds looking into the systematic or quantitative business are flourishing. For a mid-size firm, what might have cost tens of millions in the late 2000s, now scales for less than $2M in overhead, removing the biggest barrier to entry.

At the forefront of this upfront cost automation, global third parties like Amazon and Alphabet have signaled that an “arms race” is underway. The aim is to reduce the cost in acquisition, cleaning, and storage of information. Meanwhile, startup vendors like Adaptive Management, Crux Informatics, Amass Insights, Socialgist, and Quandl (acquired), have already made significant headway into the space. While data engineering has always had a place inside quant firms, with no correlation with fund performance, its outsourcing can allow funds to refocus on data science and model development, making the firm more structurally competitive in the coming years.

Reduction in cost has allowed “quantimental” managers to flood the market, crowding what historically have been quant-only strategies, and pushing sophisticated managers to further focus on more cost-prohibitive markets. With barriers to entry falling, two frontiers remain and are the story to watch in 2019.

Artificial Intelligence (modeling, ML, and crowdsourcing)

Igor Tulchinsky’s new book The UnRules: Man, Machines and the Quest to Master Markets made the circuit last fall as the dominant philosophy in modern quantitative asset management. His thesis revolves around the need to automate the thinking process within investing, and in order to do that, you need lots (LOTS) of algorithms.

“Intuition is important when it predicts the future better than your models do. The more models you have and the better the models are, the less you need to rely on intuition. Today at WorldQuant, we have millions of alpha signals, so we don’t need to use intuition very much. That’s the goal.” – Igor Tulchinsky, CEO, WorldQuant

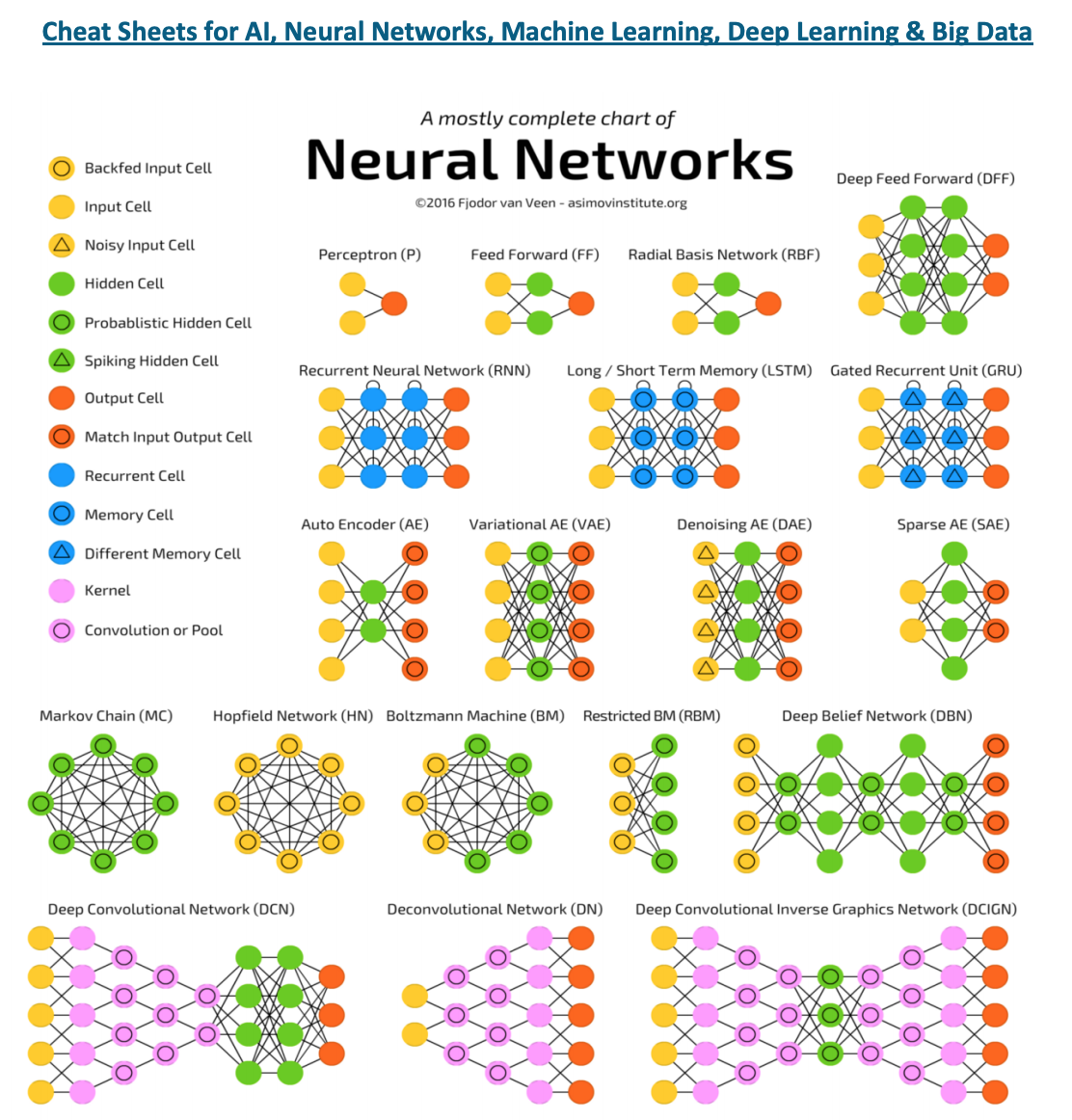

With the scaling of storage and compute (think S3 and GPUs), there is a bigger focus on building models and automating model building. This dovetails into the larger – and overused – categorisation of “Artificial Intelligence.”

Modelling remains the most proprietary element of quant workflows, causing quite a few legal scuffles between firms (1)(2)(3). Very few quant managers will outsource this process in the coming years, however, new out of the box solutions may very well start to offer access to some of these previously inaccessible strategies. Firms like Quantopian, QuantConnect and CloudQuant have also opened the floodgates to crowdsourcing model development.

Untapped Data Assets (exhaust, alt data, and startups)

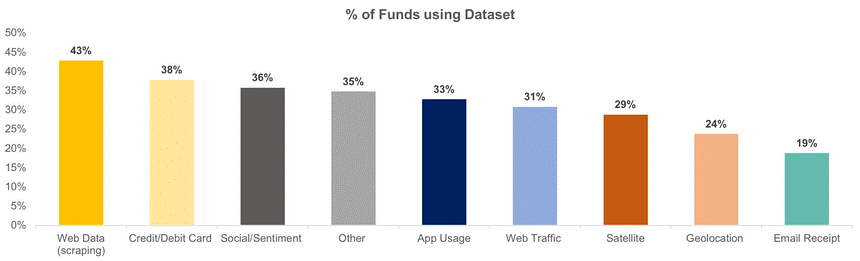

In 2015, a hedge fund event in Miami Beach, Florida was setup to discuss how “alternative data” could be used to augment existing investment processes. The attendees included about 25 asset management firms, 10 data companies, and a handful of venture capitalist and private equity firms. Just last month, the fifth annual event was held in Miami, boasting over 500 data companies and more than $760 billion in AUM present in attendance.

If that is not a signal, I don’t know what is.

Find out more about alternative data in our latest eMagazine. Download it now.

As the most essential component of the continued outperformance of leading quants, raw data assets remain the last frontier of asset management. From what was once a cottage business, a powerhouse industry of information is being formed.

As ‘startup managers’ are quickly realising, not all data is created equal. With both variable cost and variable outcomes, some firms pushing into the space have seen lackluster headway and shuttered strategies. But quants who have continually explored the space have separated their return profiles from more traditional factor-based strategies.

Trade publications now estimate more than 10,000 APIs to come online by 2020. Some of the larger “alt data” providers like 1010 Data, Orbital Insights, RavenPack, ReturnPath, Yipit, Thasos Group and FirstData now even face the questions of being labeled as “traditional data” as they become more ubiquitous across the industry.

With new data firms being born every day, and algorithms being reconfigured and scaled to run on top of these new information sources, this year looks to be the year when data takes center stage. And while alt data has historically been used for the equities and futures markets, there are large rumblings of the oncoming “quantification” of the bond market, and private equity business as well. Fingers crossed.

*In early 2016, quantitative hedge fund total AUM was reported to be around $560 billion within the broader hedge fund industry of $3.2 trillion in AUM according to Hedge Fund Research.

Pierce Crosby is a business leader, consultant, and advisor working in alternative data, financial technology and startups. He is the Director of Revenue Strategy at StockTwits, Inc. for more information on the above, or to share your opinion, reach out to him here.