Expert insights from QuantMinds Edge Alpha & Quant investing

On 6 June our very first QuantMinds Edge virtual event went live. This was part of our new Edge-series of virtual events, that delivers the latest topic and research within quantitative finance in only three hours. Watch it from the comfort of your home, from your office or during a quick break wherever you are in the world. Each session lasts between 5-30 minutes, offering large-scale research in bite-sized formats.

This session zoomed in on alpha & quant investing. We brought together some of the leading figures in quantitative finance to present their research within this field and share exclusive insights into this topic. Here some of the presentations that we enjoyed on the day:

The Correlation Matrix under general conditions: Robust inference and fully flexible stress testing and scenarios for financial portfolios

J.D Opdyke, Chief Analytics Officer, Sachs Capital Group Asset Management joined us on the day to present an invaluable part of his research. The session was a format of a chapter in a forthcoming book, “The Correlation Matrix Under General Conditions: Robust Inference and Fully Flexible Stress Testing and Scenarios for Financial Portfolios,” Elements in Quantitative Finance series, Cambridge University Press, eds. Ricardo Rebonato, PhD.

Read an exclusive summary of the research here.

Trading insight: Key elements of systematic trading strategies

Previous speaker at QuantMinds International, Zoltan Eisler, is a Senior Execution Strategist at Element Capital Management and held an intriguing session on the day about key elements of systematic trading. Above is a snippet of his presentation.

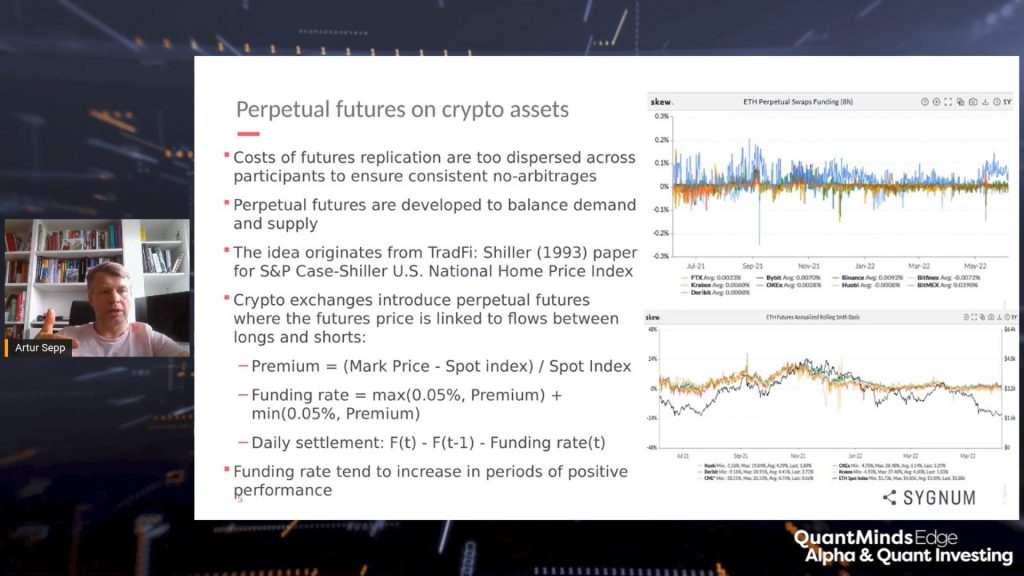

Derivatives on Crypto Assets in Decentralized Finance (DeFi) Space

Previous speaker at QuantMinds and contributor to our QuantMinds blog Artur Sepp is Head Systematic Solutions and Portfolio Construction at Sygnum Bank's Asset Management in Zurich, specializing in crypto assets and decentralized finance. His session at QuantMinds Edge covered derivatives on Crypto Assets in Decentralized Finance (DeFi) Space and touched upon:

• Liquid crypto derivatives in DeFi • Comparison with traditional finance: pricing by replication vs supply/demand equilibrium

• Examples: perpetual swaps and futures, vanilla and inverse options, perpetual power futures, forward-starting straddles

• Quantitative approach for arbitrage-free valuation and replication on crypto assets

Read more from Artur Sepp here.

Asset class focus: Exploring the latest quantitative development in Cryptocurrencies and digital assets

Jesus Rodriguez has previously spoken at QuantMinds conferences and is a technology expert, serial entrepreneur, angel investor, and internationallyQua recognized speaker and author. He gave a 30 minutes session in which he explored the latest quantitative developments in cryptocurrencies and digital assets.

Don’t miss any of our future QuantMinds Edge events. Buy our season pass and get access to all QuantMinds Edge events for the rest of 2022. Look no further than 9 august, where we our next virtual event will spend three hours investigating risk management and modelling.