Fatter tails and extreme currency market events

Brent Donnelly, of HSBC Foreign Exchange, will be speaking at Global Derivatives USA on the FX Volatility panel as they discuss the impact of large events and changes in the market. Here, he looks at the abnormal frequency of extreme currency market events since 2008.

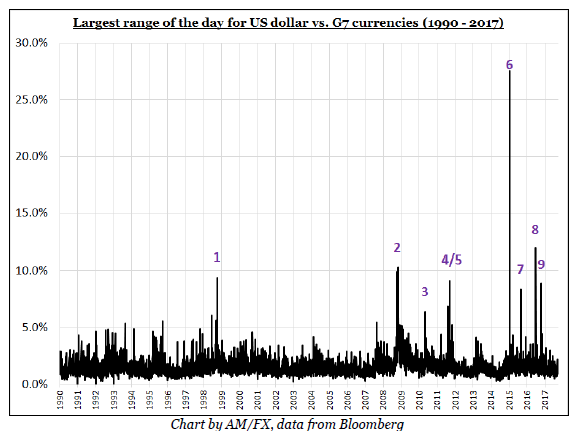

While it is well known that currency returns are not normally distributed, tail events in FX have been abnormally frequent in recent years. Take a look at the first chart which shows the largest range of the day for the US dollar vs. G7 currencies from 1990 until the end of September 2017:

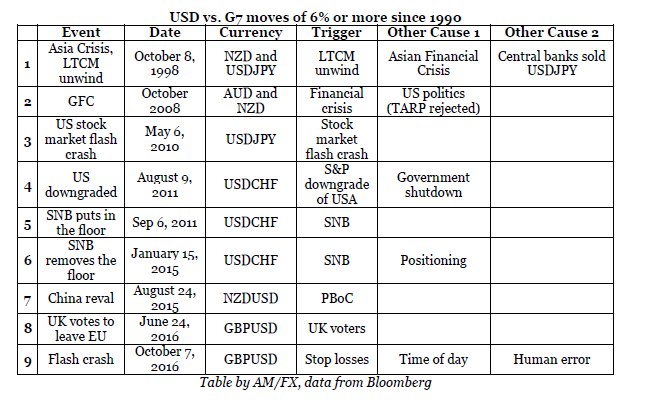

Certainly not anti-fragile! A daily range of 6% or more in the dollar was nearly unheard of before 2008; since then, we have seen eight different 6%+ ranges, including three events that produced daily ranges in excess of 10%. The challenge in diagnosing the multitude of tail events is that when we look at the triggers and causes of the events individually, it is hard to find common ground. The numbers on the chart correspond to the events listed in this table:

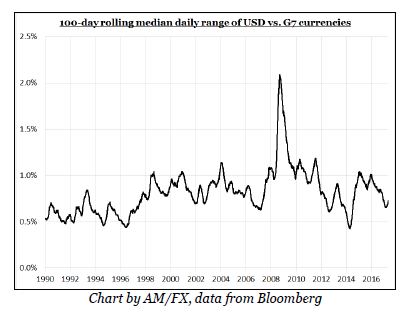

Fatter tails in FX have come while overall FX volatility has not changed as you can see here:

There is no meaningful difference in FX volatility before and after 2008. Furthermore, global currency market volumes continue to grow so there is no shortage of volume transacted.

Reading government reports on recent crash events in FX and other markets sheds very little extra light on causality as these reports generally cite a multitude of factors. For example, the BIS Markets Committee report on The sterling ‘flash event’ of 7 October 2016 says: “This analysis points to a confluence of factors catalyzing the move, rather than to a single clear driver…” While the Joint Staff Report: The US Treasury Market on October 15, 2014 says: “While no single cause is apparent in the data, the analysis thus far does point to a number of findings which, in aggregate, help explain the conditions that likely contributed to the volatility.”

In other words, when tail events happen, it is often hard to nail down a single cause.

As we try to explain the rising frequency of tail events in FX since 2008, it makes sense to start with what is different about FX markets now compared to pre-2008. There are five important differences:

1. The number of senior traders in FX has dropped substantially in the past decade. This is partially due to automation and also follows the disciplinary actions resulting from multiple investigations into currency trading from 2013-2015.

The BIS report on the GBP flash crash says: “The presence, outside the currency’s core time zone, of staff less experienced in trading sterling, with lower risk limits and risk appetite, and with less expertise in the suitability of particular algorithms for the prevailing market conditions, appears to have further amplified the movement.”

It is sensible to think that less-experienced traders are more likely to deal off market or trigger panic moves compared to senior dealers with experience in fast markets.

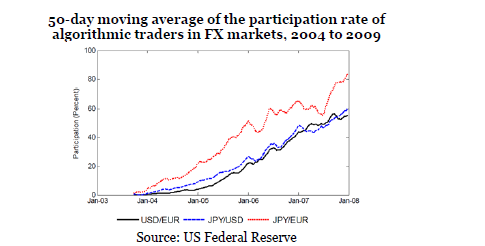

2. Electronic trading is now more than 60% of the FX market. Algorithmic volumes rose throughout the second half of the 2000s (see next chart). It is possible that we hit a tipping point in human vs. algorithmic participation right around 2008 and this has opened up cracks in the FX microstructure. Correlation does not always imply causation but there is plenty of evidence and logic to support a relationship here.

For example, many market-making algorithms are price makers in slow markets and price takers in fast markets. This can exacerbate feedback loops and generate negative convexity. Unlike market makers of yore, hedge funds and other non-bank electronic market makers are not obligated to maintain orderly markets. If things get crazy, VAR warnings sound and the algorithms reduce risk and turn off.

Also, the behavior of algorithms is not always perfect, adaptable or logical. Similar to inexperienced human traders, algorithms might accidentally exacerbate large moves and flash crashes as they fail to adapt to regime shifts and fast markets.

3. Order slicing / hiding has left fewer resting orders away from top of book. Pre-2007, most orders left on ECNs showed full size and trader interest. Now, most orders are sliced into the tiniest possible increment or show nothing to the market and wait only to aggress others’ liquidity. Many trading algorithms sense aggression or velocity in the market and pull back or cancel at the moment that liquidity is needed most. All this means fewer truly firm orders in the market.

4. Central bank pegs, bands, caps and floors lead to great stability at first but extreme instability later. Stability breeds instability. While the EURCHF market was placid when the SNB supported the 1.2000 level, it was abnormally volatile before and after. When currencies are pushed away from fair market value by central bank intervention, they have a strong compulsion to revert to equilibrium once policymaker intervention stops.

5. There are fewer strong hands on the buy side. The number of hedge funds approximately doubled from 2003 to 2007. Many of the new pod-based hedge funds operate with similar strategies and similar volatility and stop loss targets. Instead of buffering volatility by taking the other side of dramatic moves, volatility-targeting and momentum-chasing hedge funds are more likely to add to fat tails.

I believe these are the five main drivers of the recent rise in frequency of tail FX moves.

I am not arguing that we turn back the clock. Electronic markets are here to stay and are not a bad thing. However, in a world where many humans and algorithms are running similar strategies at higher and higher speeds, there are bound to be some accidents.

So first and foremost my suggestion with regard to the rise in frequency of FX tail events is this: Get used to it. Markets populated by algorithms and inexperienced traders will have a propensity towards fatter tails. This is a fact that FX practitioners need to accept. It has important implications for the future of FX risk management, option pricing and execution strategies.

While I believe that a greater frequency of FX tail events is somewhat inevitable going forward due to changes in market participation and microstructure, there are four steps participants can take to help reduce extreme moves in foreign exchange markets:

1. Proper controls need to be placed on all electronic trading systems to ensure off market, fat finger and extreme moves are not exacerbated by flawed code or failure of algorithms to adapt to extreme trading conditions.

Moving forward, electronic trading is very likely to cement or increase its gains over human trading and so it is crucial that algorithms do not contain errors and that they can adapt to unusual or extreme trading conditions. A senior human trader will always have the benefit of experience and (hopefully) common sense while an algorithm simply follows the code. That code needs to be accurate, compliant and adaptable to all market regimes.

Circuit breakers and submission of all FX trading algorithmic code to regulators are two solutions worthy of study though both would be very difficult to implement.

2. All bank entities trading in the interbank currency market need senior voice traders in all time zones to manage risk and supervise junior traders.

3. Hiding and slicing of orders should be discouraged whenever possible and institutions should build trading architecture that favors firm liquidity over contingent liquidity.

4. Central banks using currency pegs should not surprise markets unless they want multi-standard-deviation moves in their currencies. This reinforces the wisdom of the historical G7 and G20 stance on currencies which states that currencies should reflect fundamentals, and central banks should not target exchange rates. The G7 also say: “Excess volatility and disorderly movements in exchange rates have adverse implications for economic and financial stability” so there is good reason to avoid these fat tails.

The Czech central bank’s removal of the floor at 27.00 in EURCZK in April 2017 provides a useful example of how a currency floor can be removed without triggering catastrophic market dislocation.

Market microstructure is constantly evolving. Those who wish to survive must continually adapt. Market makers in spot and FX derivatives, traders on the buy side and end users of FX need to adapt their pricing and execution strategies to the current regime of increasingly electronic markets and fatter tails.

To download the article as a PDF with full references, click here.

Join the event that provides a complete update on derivatives trading, risk management and quant finance >>