Fund flows as country allocator

Tracking fund flows are extremely important in understanding where money is moving in the market, how fund managers are investing that money, and why they are shifting it based on geographical, political, or economic news. EPFR gives you access to over 135k traditional and alternative funds domiciled globally with a collective $51.5 trillion assets under management (AUM).

Fund Flows have been used extensively as a measure of investor sentiment. EPFR’s data has featured in previous research on market dynamics during good times and bad (collapse of 2008, financial shocks, estimating gross portfolio flows). Fund Flows as Country Allocator, by EPFR’s in-house quant team, builds on that research.

The paper, published in 2019, explains how daily fund flows predict country returns. It utilizes a dataset of portfolio capital flows and performance at the fund level, compiled by EPFR, that contains daily, weekly, and monthly flows from more than 16,000 equity funds and more than 8,000 bond funds.

Although EPFR covers all the major fund groups (equity, bond, alternative, etc.), this paper is based solely on data collected from equity funds. Within the group, the authors focus exclusively on funds with cross-border mandates.

The timeliness of EPFR’s data enabled our researchers to investigate the effects of shorter-term flow horizons. Daily frequency – as opposed to the weekly, quarterly, or annual frequencies often used in other research – opens windows into short-run dynamics.

EPFR combined this daily flow data with another dataset, monthly country allocations, to build a sentiment indicator for countries based on a measure they call flow percentage.

Armed with this measure, they proceeded to do three things:

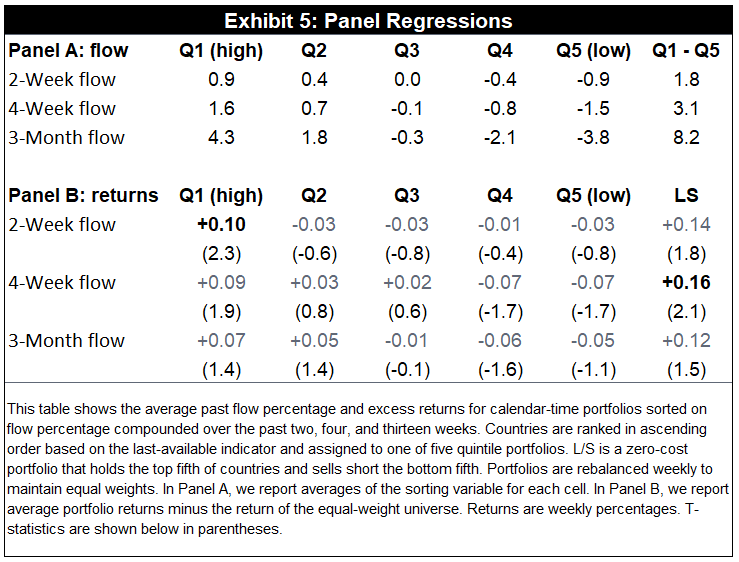

- Investigate weekly returns to 2-week, 4-week and 3-month flows, discovering that four-week flow can predict countries

- Show how four-week flow performs over the next 11 weeks

- Show flows add value even after adjusting for momentum and size

They found that countries that have attracted the highest indirect investment in terms of equity fund flows tend to outperform countries that have attracted the lowest indirect investment over the following month.

By compounding the daily flow percentages over a trailing flow horizon of 2, 4, or 13 weeks, the paper’s authors developed three predictors. All are based on the observation that high flows predict high subsequent stock returns.