Art

Growth of Branding in China

By: Vladimir Djurovic,

CEO at Labbrand

CEO at Labbrand

There are different ways to look at branding and it is

certain that I have a very different one.

certain that I have a very different one.

It is fascinating to imagine the journey of a brand that

starts with an idea from an entrepreneur. Personality, interests, and

environments bring to life ideas, leading to a project and the first version of

a brand, followed by ongoing cycles of brand innovations. Brands tend to be

perceived as intangible, but the whole process of branding is definitely

chemical, physical, and biological: even the slightest brand association is

supported in our brain by dozens of neuronal links and is constantly shaped and

reshaped by our experiences!

starts with an idea from an entrepreneur. Personality, interests, and

environments bring to life ideas, leading to a project and the first version of

a brand, followed by ongoing cycles of brand innovations. Brands tend to be

perceived as intangible, but the whole process of branding is definitely

chemical, physical, and biological: even the slightest brand association is

supported in our brain by dozens of neuronal links and is constantly shaped and

reshaped by our experiences!

With this physical dimension in mind, we can imagine how

brands are also moved by forces that are yet to be fully understood and

summarized into their own Principia. It is fascinating to consider how emotions

or memories can activate brand messages; to explore the role of design and

colors in forming brand perceptions; to imagine these thresholds that we jump

over when forming a preference for a brand or considering a purchase; to admire

the power of the alchemy that enables loyalty to sustain over time.

Digitalization is changing our interaction modalities and adding a

supplementary layer to the system. The forces that shape brands' perceptions

today are the result of highly complex underlying systems including everything

from neuroscience, biology, psychology, and semiotics up to microeconomics and

behavioral sciences: understanding how branding works is an infinite field for

study and amazement.

brands are also moved by forces that are yet to be fully understood and

summarized into their own Principia. It is fascinating to consider how emotions

or memories can activate brand messages; to explore the role of design and

colors in forming brand perceptions; to imagine these thresholds that we jump

over when forming a preference for a brand or considering a purchase; to admire

the power of the alchemy that enables loyalty to sustain over time.

Digitalization is changing our interaction modalities and adding a

supplementary layer to the system. The forces that shape brands' perceptions

today are the result of highly complex underlying systems including everything

from neuroscience, biology, psychology, and semiotics up to microeconomics and

behavioral sciences: understanding how branding works is an infinite field for

study and amazement.

It makes a great difference to us to know that branding is

much more tangible than many imagine, and that it is just a long journey

offered to us to undertake in order to better understand how it works. It also

makes us more responsible in our work, as we see branding first and foremost as

a deeply human activity. But we cannot operate at the chemical level for our

daily client request ' for that we need a more macroscopic view of branding. So

at Labbrand, we use some dimensions of brand equity: brand relevance, brand

differentiation, brand esteem, and brand knowledge are all used to describe how

well a brand functions at a certain point in time, how far it is has come since

its inception. It is a little like monitoring different dimensions of an object

(coordinates, temperature, weight), except that our brand dimensions are only

accessible through the effect on stakeholders to the brand'typically, but not

only, consumers'through their behaviors (Google searches, sales, etc.) or

responses to questionnaires.

much more tangible than many imagine, and that it is just a long journey

offered to us to undertake in order to better understand how it works. It also

makes us more responsible in our work, as we see branding first and foremost as

a deeply human activity. But we cannot operate at the chemical level for our

daily client request ' for that we need a more macroscopic view of branding. So

at Labbrand, we use some dimensions of brand equity: brand relevance, brand

differentiation, brand esteem, and brand knowledge are all used to describe how

well a brand functions at a certain point in time, how far it is has come since

its inception. It is a little like monitoring different dimensions of an object

(coordinates, temperature, weight), except that our brand dimensions are only

accessible through the effect on stakeholders to the brand'typically, but not

only, consumers'through their behaviors (Google searches, sales, etc.) or

responses to questionnaires.

Our ambition is to observe the phenomena of branding,

practice branding, and unveil the principles of branding. Here are a few

observations about the growth of branding in China gleaned over the past

years. This book, celebrating the 10 years of our company, is an

excellent occasion to compile and share our experience.

practice branding, and unveil the principles of branding. Here are a few

observations about the growth of branding in China gleaned over the past

years. This book, celebrating the 10 years of our company, is an

excellent occasion to compile and share our experience.

2005-2008

Pragmatic and mercantile stage with low innovation. Brand awareness and

brand esteem are determinant.

Pragmatic and mercantile stage with low innovation. Brand awareness and

brand esteem are determinant.

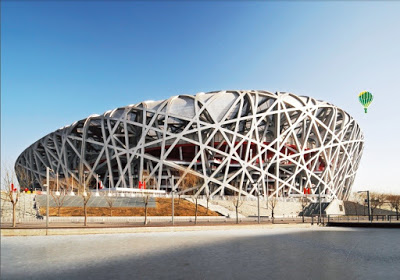

It is a period dominated by a form of classicism in

continuity with the previous decade: the context is a fast growing China

economy, with companies looking inland and to lower tiers as a reservoir for

growth. It is the epitome of fully optimistic, worry-free China, where the

brands function as identifiers without the need of building in-depth

associations. It is a thriving nation gearing towards the Olympics. It is all

about being fast, present, loud, and obvious, tapping into the trend of

mainstream adoption ' even for the luxury brands characterized by the golden

age of the monogram. The consumers are distracted by novelty; very few have

built enough experience in dealing with brands in order to sacrifice

exploration. There is no brand loyalty. What matters is the ability to

monopolize the space, be it retail or advertising. It is still a quite

traditional branding age with TVC and magazine ads holding a predominant role,

not yet driven by the digital revolution that is about to come.

continuity with the previous decade: the context is a fast growing China

economy, with companies looking inland and to lower tiers as a reservoir for

growth. It is the epitome of fully optimistic, worry-free China, where the

brands function as identifiers without the need of building in-depth

associations. It is a thriving nation gearing towards the Olympics. It is all

about being fast, present, loud, and obvious, tapping into the trend of

mainstream adoption ' even for the luxury brands characterized by the golden

age of the monogram. The consumers are distracted by novelty; very few have

built enough experience in dealing with brands in order to sacrifice

exploration. There is no brand loyalty. What matters is the ability to

monopolize the space, be it retail or advertising. It is still a quite

traditional branding age with TVC and magazine ads holding a predominant role,

not yet driven by the digital revolution that is about to come.

Foreign brands tend to be, at this time, only a name, often

not translated into Chinese and seldom appearing in written form. Most of the

CEOs, GMs, and brand and marketing managers even question the need for a local

identity. The 'foreignness' defines a very clear premium and niche space.

Further adaptation in terms of relevance (beyond the notion of making a brand

available and well known) and differentiation appears to be premature and

unnecessary. Big winners are the biggest brands that tend to already get

recognition. Most consumers want not only to experience, but also to display

what they are experiencing; they do this with a recognizable badge known by

all, not just their peers. This is a time when Chinese consumers are very

confident in the future. They are unwilling to project themselves into a

company's brand heritage. They are satisfied by floating on the surface of

branding, and do not gain pride in being discerning and driven to

individuality.

not translated into Chinese and seldom appearing in written form. Most of the

CEOs, GMs, and brand and marketing managers even question the need for a local

identity. The 'foreignness' defines a very clear premium and niche space.

Further adaptation in terms of relevance (beyond the notion of making a brand

available and well known) and differentiation appears to be premature and

unnecessary. Big winners are the biggest brands that tend to already get

recognition. Most consumers want not only to experience, but also to display

what they are experiencing; they do this with a recognizable badge known by

all, not just their peers. This is a time when Chinese consumers are very

confident in the future. They are unwilling to project themselves into a

company's brand heritage. They are satisfied by floating on the surface of

branding, and do not gain pride in being discerning and driven to

individuality.

We only see a few FMCG brands innovating for China:

functional biscuits by Danone and a slimming tea for women by Lipton.

functional biscuits by Danone and a slimming tea for women by Lipton.

Danone YouGuan, a functional biscuit with wheat, milk and

vitamins

vitamins

Lipton's XianYang tea claims to have beauty benefits.

Many Chinese brands are in the situation of being partly OEM

for other markets, partly consumer brands. They feel no pressure in their

consumer brand business that seems to be a nice asset, mostly handled through

wholesale to the gigantic China market place. We see the emergence of strong

FMCG brands like Wahaha, the strengthening of local automotive brands, the

growth of sport brands like Li-Ning that have the ambition to conquer the

world. These brands usually have very centralized decision-making capabilities

and immature bureaucratic formations. They are fast, and they benefit from the

local turf advantage, but they are neither process-oriented nor sustainable.

Some of them have original approaches to innovation, working with their value

chain partners to develop products and concept ideas (like Wahaha). It is one

of the early signs of the China-specific consumer goods innovation model.

for other markets, partly consumer brands. They feel no pressure in their

consumer brand business that seems to be a nice asset, mostly handled through

wholesale to the gigantic China market place. We see the emergence of strong

FMCG brands like Wahaha, the strengthening of local automotive brands, the

growth of sport brands like Li-Ning that have the ambition to conquer the

world. These brands usually have very centralized decision-making capabilities

and immature bureaucratic formations. They are fast, and they benefit from the

local turf advantage, but they are neither process-oriented nor sustainable.

Some of them have original approaches to innovation, working with their value

chain partners to develop products and concept ideas (like Wahaha). It is one

of the early signs of the China-specific consumer goods innovation model.

The first tier cities are evolving concurrently at a fast

pace: Beijing is moving rapidly ahead, propelled by the Olympics; Shanghai is

becoming a magnet for international media as they report on reviving the city's

past luster and making the most futuristic megalopolis of the 21st century;

Guangzhou and Shenzhen are raised to international recognition by the strong

manufacturing backbone of the Pearl delta regions. Shenzhen is a new city

attracting talents from all over China. All these cities are the crucible for a

new China lifestyle that blends influences from the West (American European)

and the East (Taiwan, Japan and Korea). Hollywood is in China via the DVD

stores, and Korean dramas are starting to fascinate China. It is the emergence

of successful bakery chains and coffee chains. Bread and coffee are becoming

part of the daily life of Shanghainese and to people in some parts of Beijing

and Guangzhou/ Shenzhen. It is the new signs of bourgeois life that replace or

complement the pajama street-walking and long nails of days gone by.

pace: Beijing is moving rapidly ahead, propelled by the Olympics; Shanghai is

becoming a magnet for international media as they report on reviving the city's

past luster and making the most futuristic megalopolis of the 21st century;

Guangzhou and Shenzhen are raised to international recognition by the strong

manufacturing backbone of the Pearl delta regions. Shenzhen is a new city

attracting talents from all over China. All these cities are the crucible for a

new China lifestyle that blends influences from the West (American European)

and the East (Taiwan, Japan and Korea). Hollywood is in China via the DVD

stores, and Korean dramas are starting to fascinate China. It is the emergence

of successful bakery chains and coffee chains. Bread and coffee are becoming

part of the daily life of Shanghainese and to people in some parts of Beijing

and Guangzhou/ Shenzhen. It is the new signs of bourgeois life that replace or

complement the pajama street-walking and long nails of days gone by.

We see urbanization, the rapid raise of real estate prices

across the country, avid demand for new construction. Construction and

manufacturing companies experience record growth. B2B and real estate companies

are sophisticating their offerings in what has become the biggest market in the

world. China starts to uncover needs for brand innovations in the least

expected place. At that time and still for a few years, the most un-happening

industry for brand innovation is the luxury industry in China.

across the country, avid demand for new construction. Construction and

manufacturing companies experience record growth. B2B and real estate companies

are sophisticating their offerings in what has become the biggest market in the

world. China starts to uncover needs for brand innovations in the least

expected place. At that time and still for a few years, the most un-happening

industry for brand innovation is the luxury industry in China.

2008-2012

Brands become more innovative on product level. More ambitions for Chinese

brands. Start of the strengthening of brands, but on new projects and

opportunities, not at the core.

Brands become more innovative on product level. More ambitions for Chinese

brands. Start of the strengthening of brands, but on new projects and

opportunities, not at the core.

This second period is a turning point in the Chinese

journey. China is no longer in the shadow, now benefiting from its status as a

growing superpower. The Olympic Games in Beijing put China on the global stage

and leave a lasting impression. The event has also created a platform for

branding, as the attention of an entire nation is centralized and focused

during the years surrounding the event. We see incredible branding campaigns

from Nike and Adidas carving out their brand territories in the Chinese market

as has seldom been done before (Maybe the 1984 Apple ad is the only comparable

event in the history of branding).

journey. China is no longer in the shadow, now benefiting from its status as a

growing superpower. The Olympic Games in Beijing put China on the global stage

and leave a lasting impression. The event has also created a platform for

branding, as the attention of an entire nation is centralized and focused

during the years surrounding the event. We see incredible branding campaigns

from Nike and Adidas carving out their brand territories in the Chinese market

as has seldom been done before (Maybe the 1984 Apple ad is the only comparable

event in the history of branding).

With the crisis hitting the developed economies, China has

become the hope of the world to sustain the growth of the global economy.

Chinese travelers, the Chinese domestic market, Chinese manufacturing

development, and China's need for primary resources are a solace amid dropping

demand in most other regions.

become the hope of the world to sustain the growth of the global economy.

Chinese travelers, the Chinese domestic market, Chinese manufacturing

development, and China's need for primary resources are a solace amid dropping

demand in most other regions.

The global crisis is the spark that has ignited the

evolution of branding in China. Now, the Chinese companies feel that their

destiny is no longer just to copy successful models, but to take the lead,

innovate, and push the boundaries. Internet brands are the first to capitalize

on this new mindset. Now, OEM are barely a reliable way to imagine sustainable

growth; instead, brands are pushing forward in the Chinese consumer market. At

first, things seem to be continuing as they were, but before long FMCG brands

start to meet a kind of invisible wall: they are no longer growing almost

automatically, and stocks are piling up. This triggers a stronger need for

developing brands that can sustain through relatively depressed times.

evolution of branding in China. Now, the Chinese companies feel that their

destiny is no longer just to copy successful models, but to take the lead,

innovate, and push the boundaries. Internet brands are the first to capitalize

on this new mindset. Now, OEM are barely a reliable way to imagine sustainable

growth; instead, brands are pushing forward in the Chinese consumer market. At

first, things seem to be continuing as they were, but before long FMCG brands

start to meet a kind of invisible wall: they are no longer growing almost

automatically, and stocks are piling up. This triggers a stronger need for

developing brands that can sustain through relatively depressed times.

Chinese companies start to become savvier in terms of

understanding the importance of the brand, resulting sometimes in epic fights

over trademark rights, like the battle over the trademark WangLaoJi.

understanding the importance of the brand, resulting sometimes in epic fights

over trademark rights, like the battle over the trademark WangLaoJi.

The WangLaoJi trademark dispute (Wikipedia)

caught national attention

caught national attention

With decades of opening up in different markets and several

years into the WTO, China is now becoming an increasingly competitive market in

almost every industry. We also see increasing demand for innovative product

concepts that will not only try to bring an existing concept to China, but also

adapt and transform it to make it more relevant, more different. This is often

happening at the product level more than at the brand level. We are looking for

innovation of the persona to create localized variants, but not yet a

revolution of the brand program for China. Some very emblematic projects for

Labbrand represent this trend'we work on developing product positioning through

flavors for industries including dairy, quick service restaurants, fruit juice,

and others. We also see a luxury brand Shang Xia created under Hermes Group

with what appears to be Chinese DNA, reviving Chinese traditional crafts into

finely designed fabrics, homeware and accessories. This is a very ambitious

move, very admirable and ahead of its time, as the Chinese consumer has yet to

revalorize their own craftsmanship tradition.

years into the WTO, China is now becoming an increasingly competitive market in

almost every industry. We also see increasing demand for innovative product

concepts that will not only try to bring an existing concept to China, but also

adapt and transform it to make it more relevant, more different. This is often

happening at the product level more than at the brand level. We are looking for

innovation of the persona to create localized variants, but not yet a

revolution of the brand program for China. Some very emblematic projects for

Labbrand represent this trend'we work on developing product positioning through

flavors for industries including dairy, quick service restaurants, fruit juice,

and others. We also see a luxury brand Shang Xia created under Hermes Group

with what appears to be Chinese DNA, reviving Chinese traditional crafts into

finely designed fabrics, homeware and accessories. This is a very ambitious

move, very admirable and ahead of its time, as the Chinese consumer has yet to

revalorize their own craftsmanship tradition.

SHANG XIA by Hermes

Source: http://www.11andcomanagement.com/wordpress/wp-content/uploads/2013/08/%E4%B8%8A%E4%B8%8B.jpg

Quality entertainment and culture makes it also relevant for

brands like Disney to foster a faster pace of development for their brands.

Marvel is a successful example of this with its multitude of branded

heroes. The digital space has become more and more innovative and starts

to play a much more important role than in most western economies, enabling the

development of more advanced services and creating higher expectations.

brands like Disney to foster a faster pace of development for their brands.

Marvel is a successful example of this with its multitude of branded

heroes. The digital space has become more and more innovative and starts

to play a much more important role than in most western economies, enabling the

development of more advanced services and creating higher expectations.

To summarize, this turning point put differentiation and

relevance of brands at the center again. It is no longer about fame and

mainstream, it is about making a difference, about surprising and delighting

the consumer. It is now a competitive era, but it is just the beginning of this

intensification.

relevance of brands at the center again. It is no longer about fame and

mainstream, it is about making a difference, about surprising and delighting

the consumer. It is now a competitive era, but it is just the beginning of this

intensification.

2012-2015

Strengthening of brand relevance and differentiation, first investments into

brand knowledge.

After the Olympics, Beijing continues to grow but somehow

closer to traditional Chinese values, leaving Shanghai almost alone to

represent the cosmopolitism that it once tried to contest. Shanghai, further

propelled by the World Expo in 2010, continues to be the favorite destination

for multinationals, and becomes the regional hub for many companies. Shanghai

is more permissive to foreign influences and we see a tremendous change in the

city in these years. Shanghai now has 256 Starbucks and counting ' the 3rd most

of any city in the world, and compared to just 137 in Beijing. And this is not

just about coffee and bread. You can now see literally hundreds of Olive Oil

brands in supermarkets. The selection is huge. Specialized large scale

supermarkets like Ol?? are mushrooming in the city with an incredibly wide range

of brands for any category of packaged food. Guangzhou and Shenzhen are close

behind and Chengdu has started to modernize deeply as an influential center for

the West. Shanghai is a fascinating place in which to project the future of

China: a place of experimentation, a place where all global trends

are crossing. It a place of harmonious coexistence of different trends, such as

increasing body efficiency through vitamins and improving wellbeing through

nature-inspired products. These intersections are mediated by a growing variety

of consumers. Gaps are becoming bigger and bigger between younger consumers and

mid aged ones. More profound segmentation is taking place.

closer to traditional Chinese values, leaving Shanghai almost alone to

represent the cosmopolitism that it once tried to contest. Shanghai, further

propelled by the World Expo in 2010, continues to be the favorite destination

for multinationals, and becomes the regional hub for many companies. Shanghai

is more permissive to foreign influences and we see a tremendous change in the

city in these years. Shanghai now has 256 Starbucks and counting ' the 3rd most

of any city in the world, and compared to just 137 in Beijing. And this is not

just about coffee and bread. You can now see literally hundreds of Olive Oil

brands in supermarkets. The selection is huge. Specialized large scale

supermarkets like Ol?? are mushrooming in the city with an incredibly wide range

of brands for any category of packaged food. Guangzhou and Shenzhen are close

behind and Chengdu has started to modernize deeply as an influential center for

the West. Shanghai is a fascinating place in which to project the future of

China: a place of experimentation, a place where all global trends

are crossing. It a place of harmonious coexistence of different trends, such as

increasing body efficiency through vitamins and improving wellbeing through

nature-inspired products. These intersections are mediated by a growing variety

of consumers. Gaps are becoming bigger and bigger between younger consumers and

mid aged ones. More profound segmentation is taking place.

At the same time, we witness the first global successes of

Chinese brands, with Chinese mobile brands rising to extreme success in India

and even worldwide (Huawei, ZTE, etc.). This is motivating for all Chinese

brands, even if a large majority of them just set out to be successful in their

domestic market. Global public relations, digital platforms, and social media

are now the type of activity that Chinese brands are engaging in consistently

and on a global scale. Chinese brands look for brand building help. It is part

of the China 5 year plan. There is no future in pure manufacturing; it is in

the state's best interest to develop strong brands that can maintain Chinese

economic growth. Added value and a brand mindset are the only way to go.

Chinese brands, with Chinese mobile brands rising to extreme success in India

and even worldwide (Huawei, ZTE, etc.). This is motivating for all Chinese

brands, even if a large majority of them just set out to be successful in their

domestic market. Global public relations, digital platforms, and social media

are now the type of activity that Chinese brands are engaging in consistently

and on a global scale. Chinese brands look for brand building help. It is part

of the China 5 year plan. There is no future in pure manufacturing; it is in

the state's best interest to develop strong brands that can maintain Chinese

economic growth. Added value and a brand mindset are the only way to go.

As companies strengthen their brands by making them more

relevant, a change is in the air: this time it is not a tactical move but a

clear ambition to set a lasting direction. At Labbrand, we see increasing

demand for brand positioning work for already established brands. The tactical

moves previously used for some innovative products are now being embraced by

the core product ranges and industrialized as central strategy. For the fashion

industry, we see that entire collections are using China trends, fitting

Chinese tastes.

relevant, a change is in the air: this time it is not a tactical move but a

clear ambition to set a lasting direction. At Labbrand, we see increasing

demand for brand positioning work for already established brands. The tactical

moves previously used for some innovative products are now being embraced by

the core product ranges and industrialized as central strategy. For the fashion

industry, we see that entire collections are using China trends, fitting

Chinese tastes.

At the same time, for foreign brands the situation has

totally changed. There is now an increasing number of affluent Chinese that can

buy imported products. Packaged food brands are increasingly ready to adapt

their products and translate their packaging rather than sticking on labels.

This change started just a few years back and we are currently in the middle of

it.

totally changed. There is now an increasing number of affluent Chinese that can

buy imported products. Packaged food brands are increasingly ready to adapt

their products and translate their packaging rather than sticking on labels.

This change started just a few years back and we are currently in the middle of

it.

For foreign luxury brands as well, there is a totally new

situation. Chinese consumers know they are important and are not only expecting

to be impressed by the 'foreignness' but also to be embraced.

situation. Chinese consumers know they are important and are not only expecting

to be impressed by the 'foreignness' but also to be embraced.

Digital space is dominated by local brands, but this last

period also bears witness to the success of a few international players

including LinkedIn who successfully develops in China under a name designed by

Labbrand called <a href="http://www.labbrand.com/work/linkedin" target="_blank"'' [l??ng y??ng]. Local digital

brands like Tencent are credibly innovating for the world, and the fast-growing

WeChat is set to become an indispensable tool for operating within the mobile

sphere.

period also bears witness to the success of a few international players

including LinkedIn who successfully develops in China under a name designed by

Labbrand called <a href="http://www.labbrand.com/work/linkedin" target="_blank"'' [l??ng y??ng]. Local digital

brands like Tencent are credibly innovating for the world, and the fast-growing

WeChat is set to become an indispensable tool for operating within the mobile

sphere.

THE JOURNEY IS STARTED

Looking at this journey, it seems the pace is just getting

faster and faster. We won't be surprised to witness an acceleration in the

transformation of the brands that surround us, with new brands developing in

almost all categories. We feel we have been privileged to be at the forefront

of this evolution and to have emerged in China in tandem with branding itself.

. We are excited to start the next decade and to continue to write this story.

faster and faster. We won't be surprised to witness an acceleration in the

transformation of the brands that surround us, with new brands developing in

almost all categories. We feel we have been privileged to be at the forefront

of this evolution and to have emerged in China in tandem with branding itself.

. We are excited to start the next decade and to continue to write this story.