How to survive in the world of trade credit marketplaces

Technological advances in recent years and the availability of ever-more connected services have given rise to new forms of customer engagement, and the trade finance space is not immune to the changes. In the past five years, a number of platforms have been launched to disrupt the way trade finance and credit insurance have been conducted for hundreds of years. Some auction individual deals or whole portfolios to a selection of lenders; others offer supply chain finance to SMEs; others still are using blockchain to offer end-to-end receivables insurance. From a general fintech sector have emerged subcategories: insurtech, regtech, tradetech.

Source: Tradetech 40 (Trade Finance Global, January 2019)

As these dedicated platforms and marketplaces refine their products, digital businesses from seemingly unrelated sectors are finding avenues into the trade finance space, too. E-commerce giants like Alibaba and Amazon are now extending trade loans to their sellers, leveraging data collected over the past decade to make credit decisions. Even accounting software providers are branching out to extend proprietary loans or work as marketplaces - think Quickbooks Capital.

How much of a threat do these platforms really present to the traditional trade credit market? Looking beyond the hype isn't easy, but the growth rate of these disrupters is a good indication: Quickbooks Capital, for example, lent US$140mn to small business customers in its first year of operation. This may not seem like much compared to the portfolio of an HSBC or Bank of America, but it's a rather impressive start, leading QuickBooks' parent company Intuit to increase its maximum loan amount from US$35,000 to US$100,000.

Cover Genius, which underwrites transactions for e-commerce customers directly on their platforms, also exhibits impressive growth: between its launch in 2014 and 2017, its revenue increased by a whopping 2,606%.

Overall, PwC estimates that up to 28% of banking and payments business is at risk of being lost to fintechs; 22% in the case of insurance, asset management and wealth management. In its Financial Services Technology: 2020 and Beyond report, the consultancy invites bank executives to imagine competing against a truly global, multi-service, low-cost, digital bank, with customers accessing their accounts through their mobile phones, paying with a tap on their wearables, sweeping savings to an AI-enabled exchange-traded fund (ETF) portfolio and paying no fees for cross-border payments.

"Imagine if you faced a competitor bank like this, with a low and nimble footprint, prototyping new services quickly, managing regulatory compliance transparently, using an AI system to limit fraud losses, and hedging currency risk using cryptocurrencies. This competitor does not exist today. But in the next few years, it is a very real possibility. Now what?" asks the report.

Banking on partnerships

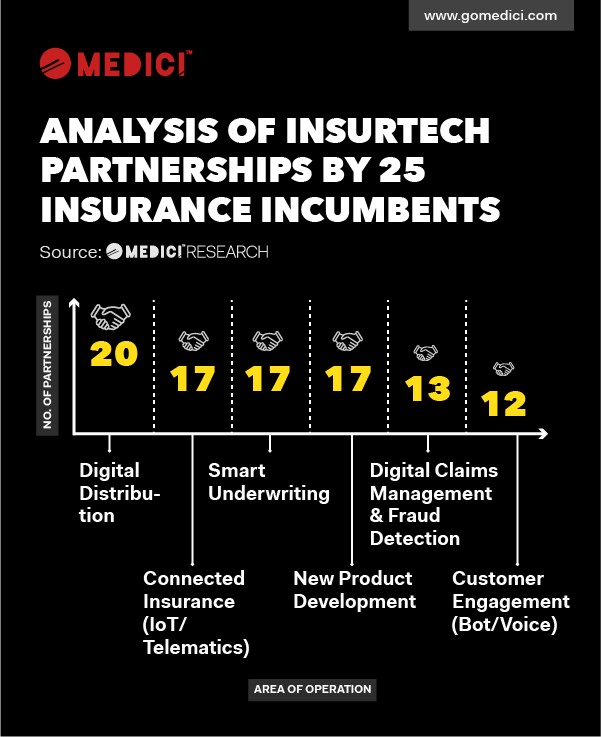

It is clear that banks and trade credit insurers cannot just stand by while digital competitors eat away at their market share - and most don't intend to. In 2018, Medici looked at a total of 95 partnerships established by 25 incumbents with several insurtech startups, and pointed out some interesting initiatives. AXA, for example, teamed up with Alibaba and Ant Financial Services in 2016 to jointly explore opportunities to distribute AXA’s insurance products and services through Alibaba’s ecommerce ecosystem - an interesting approach to self-disruption. However, nothing concrete has been announced since then.

More recently, Zurich entered into a collaboration agreement with European fintech Digital Insurance Group (DIG), whereby DIG will use its technology stack to help Zurich develop innovative mobile solutions that are continually optimized using deep customer data analytics. This type of partnership will surely help insurers improve the way they structure and deliver their services.

Source: Analysis of insurtech partnerships by 25 insurance incumbents (Medici Research)

On the banking side, most of the investment seems to be going into blockchain: the plethora of consortia launched in the past few years is proof of that. But while blockchain has the potential to seamlessly connect all the elements of a trade transaction, traditional players won't be able to reap its full benefits if they continue to follow an antiquated business model.

Leveraging smart data

What makes the strength of platforms and marketplaces is their ability to collect, process and use valuable data. QuickBooks Capital has over 15 years of information about its accountancy software customers to draw from and approve or deny credit, including past business history, use of QuickBooks Online, personal and business credit history, and current liabilities. As a result, it can offer loans to companies whose applications would have been declined in the traditional space: Intuit found 60% of QuickBooks Capital customers would likely not get a loan elsewhere, and 46% have never applied for a loan before.

There's no way around it: to compete, incumbents need to update their IT models, get rid of legacy systems, adopt artificial intelligence and build the technology capabilities to handle customer needs more intelligently. This, in turn, will help them open their systems up to more interconnectedness, as Internet of Things (IoT) technology becomes more prominent in trade. Auto and health insurers have already started integrating IoT into their business models, placing sensors in cars or even on toothbrushes to price their premiums. In trade credit insurance, underwriters could use data from sensors in warehouses or on ships to price cover.

This new wealth of data could even make the utopic idea of real-time underwriting a reality. In its 2013 white paper, Integrating the value of data in the underwriting process, IBM already predicted this: "The role of the underwriter is evolving to include the capability to leverage access to intellectual capital, mature data, and real time metrics. Tools that offer real-time price modeling, micro segmentation, exposure concentrations, reinsurance alternatives and predictive alerts will become standard. The sophisticated underwriter will learn how to channel this new 'guidance' not to avoid risk but to craft profitable solutions."

Integrating within the ecosystem

With the advent of e-commerce marketplaces, trade is quickly moving from one-on-one transactions to multi-vendor deals, and trade financiers and credit insurers will soon need to follow suit. Multi-vendor credit may seem like another utopia, but considering the pace of innovation displayed by marketplaces, it's an option incumbents cannot afford to dismiss.

To be ready for it - and for any other disruptive idea that comes up in the next couple of years - banks and insurers need to go beyond the stage of simply watching new developments from afar, and become an integral part of the 'new normal' trade ecosystem. This involves the aforementioned upgrades and partnerships, but also the attraction of the right talent pool: entrepreneurs, innovators and disrupters who may not wish to be hired under a traditional contract.

In order to survive in the world of marketplaces, trade credit players need to implement systemic change within their organization - and start now.

Hear Paul leading a panel at ExCred International to a lead an interactive expert discussion.