Tamlyn Rudolph, Head of Trading & Markets at Vega Protocol discusses how to innovate in decentralised financal markets, during QuantMinds International.

Satoshi Nakamoto’s distributed ledger protocol described how value could be transferred digitally as a scarce resource without risk of double spend or counterfeit. This launched Bitcoin, “a peer-to-peer electronic cash system” and the world’s first cryptocurrency.

Since 2008, more than 1500 digital “crypto-assets” have been created exploring alternative functionality and cryptographic approaches to Bitcoin. As the crypto financial ecosystem matures, use cases are widening beyond digital currencies, with numerous projects working on tokenising value inherent in open networks and protocols, as well as creating crypto-assets representing fiat currency, commodities, insurance, equities and debt instruments. Decentralised ledger technology is also being explored by a range of parties to improve operational efficiencies within traditional financial markets, for example streamlining settlement processes. However, these use cases are not typically designed to broadly decentralise the entire financial sector.

Vega are focussed on decentralising and opening up a core component of the financial sector; derivatives trading. We are creating a public and open protocol that will enable value exchange to be facilitated via a permissionless standalone network, in the vein of Bitcoin and Ethereum.

Beyond electronic cash: a blockchain for trading

Creating a sustainable and effective marketplace requires consideration of trading requirements as well as deep understanding of technical and financial risks.

Unlike the payments and transfers — the bulk of cryptocurrency transactions today — which tend to be fixed movements of assets and either succeed as described or fail if something is wrong, trading is the result of a continuous real time process of matching and price determination. Doing this effectively requires low latency and high throughput to ensure that all participants are included fairly in this process, something that’s unachievable with the performance characteristics of smart contract platforms like Ethereum.

Our lead scientist, George Danezis (Professor of Security and Privacy Engineering, UCL) and lead engineer, Dave Hrycyszyn have been collaborating for over two years on solutions to scaling Proof of Stake blockchains. Their research has led them to delve deeply into low-latency, high-throughput blockchain consensus algorithms including the technology underpinning Tendermint (and the Cosmos network) in addition to crafting several of their own solutions, including a bespoke network protocol for Vega which, at our latest test run, is already able to process 1000 transactions per second with < 1.2 seconds latency per market shard.

These early outcomes are faster than other decentralised exchange protocols, and our use of sharding within Vega means that new order books can add capacity rather than sharing a limited resource ever more thinly (like those built directly on Ethereum’s blockchain). We are designing a fair marketplace in which no participant can routinely gain advantage through malicious actions and market governance is decentralised.

Our technology focus is essential in creating an effective derivatives exchange that will be adopted not just for cryptocurrency derivatives, but for derivatives on all manner of other assets.

Decentralising the trade lifecycle

Vega’s protocol handles end to end trading including pre-trade, trade, post-trade and settlement functions for cash settled margined derivatives in a completely automated, safe, and decentralised way.

Unlike centralised marketplaces, Vega network code runs on nodes that are distributed across the globe. These nodes receive market orders via a trading terminal or API and form valid orders into blocks of transactions via Vega’s consensus algorithm. Confirmed blocks are then processed by the order matching engine (which also runs on each node) with trades executed in price/time priority. The consensus algorithm ensures that all nodes see the same sequence of orders, maintaining the integrity of the platform and ensuring transparency and auditability of trading outcomes.

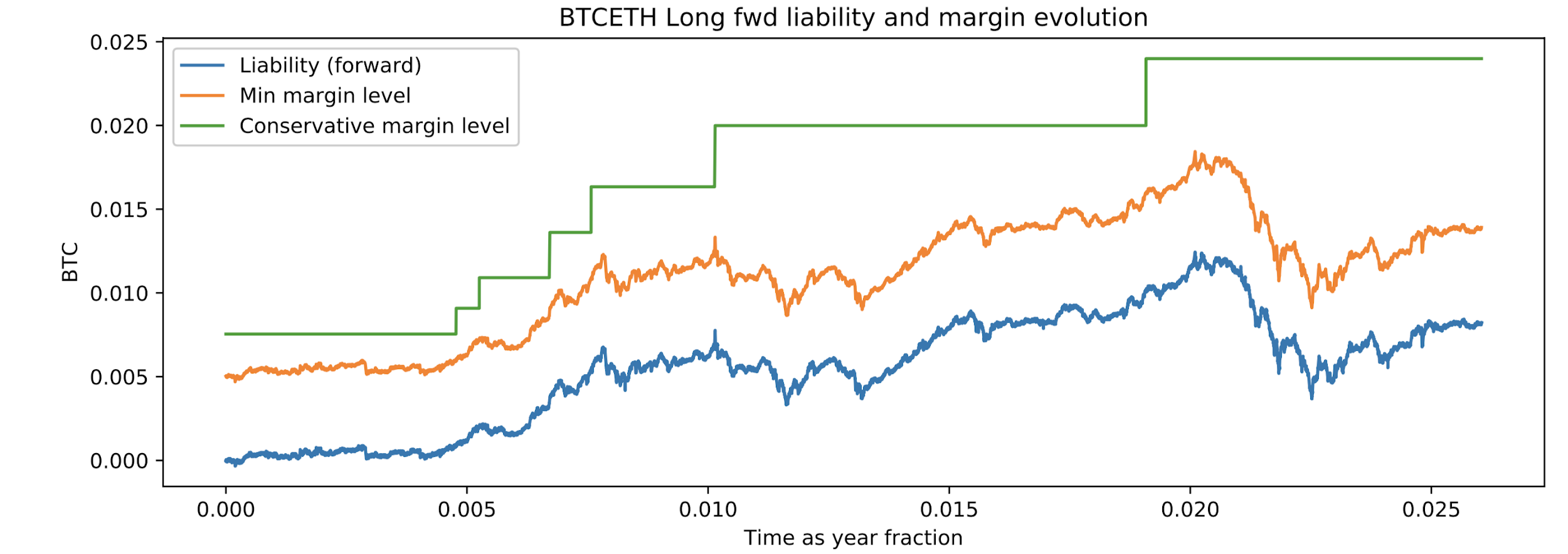

To ensure financial viability, traders’ margin requirements are calculated and required by the network for each new order permitted on the order book.

Importantly, since Vega requires only a cryptocurrency wallet (initially using Ethereum, with others to be added in future) and sufficient collateral deposited into the Vega smart contract to receive orders, there is no recourse by the network when a trader defaults on their position. In fact, there is no reputational consequences to a trader in the event of default, nor are they (or could they be) prevented utilising the network for other trading.

To address this default risk, the network nodes recalculate margin requirements continuously after each market price move. Much like the approach used by centralised exchanges undertaking daily margining, the network calculates the reasonable ‘worst case’ scenario for how much the price of a derivative contract could change in one discrete fixed time step. This time step for Vega is much smaller than a day, since recalculations happen alongside market moves. With annualised volatilities of crypto assets reaching > 1500% it becomes essential to do the margin calculations at as granular a time step as possible. In fact, we are likely to see as much volatility in an hour as a typical stock sees in a year. The margin requirement needs to exceed the current derivative value plus this time incremented ‘worst case’ scenario to protect the network.

Vega are focussed on decentralising and opening up a core component of the financial sector; derivatives trading. We are creating a public and open protocol that will enable value exchange to be facilitated via a permissionless standalone network, in the vein of Bitcoin and Ethereum.

When a trader does not meet the margin requirements (within a threshold), the network protects itself by closing out positions. This relies on sufficient available liquidity, and the risk of this is built into the margin calculations which consider order book depth.

Since these margin calculations are run on each node after every market price move, they must be fast and uniform across nodes. Therefore, where possible, analytic solutions are utilised, simulations seeded and in the interests of speed, used sparingly. This naturally poses challenges as Vega extends beyond crypto-currency futures and options (Aug 2018) into more complex derivative structures (2019). Our quantitative team, led by David Siska (PhD, lecturer Edinburgh University) is exploring innovative new approaches to risk calculations to achieve these goals, including utilising machine learning techniques such as neural networks.

Vega’s end-to-end protocol is wiring together custom blockchain technology, bespoke market design and risk management tools and strong liquidity and fee incentives (to be discussed in later blog posts). If you’re interested in learning more about our approach, please visit us at QuantMinds, Portugal May 2018, Coinscrum, London May 2018, https://vegaprotocol.io or send us an email to hi@vegaprotocol.io

Vega’s end-to-end protocol is wiring together custom blockchain technology, bespoke market design and risk management tools and strong liquidity and fee incentives (to be discussed in later blog posts). If you’re interested in learning more about our approach, please visit us at QuantMinds, Portugal May 2018, Coinscrum, London May 2018, https://vegaprotocol.io or send us an email to hi@vegaprotocol.io