Is strategic M&A finally catching on in private capital?

The numbers are up, but there’s nothing easy about combining firms in the alts industry. Consider an industry with more than 15,000 firms in which scale can be a clear advantage. Sounds like a fertile field for consolidation, right? Not if the industry happens to be private capital.

For much of the industry’s history, consolidation has largely been a nonstarter. Firms have tried over time to expand geographically or add an asset class through M&A. But very often, mergers have foundered on the many levels of integration complexity that arise when private partnerships try to combine.

There are certainly exceptions: Blackstone’s well-timed acquisition of credit firm GSO Capital Partners in 2008 is an example of a large deal that worked out well. But too often, cultures clash, compensation and carry issues prove insurmountable, or talent jumps ship. The difficulties are stubborn enough that most general partners (GPs) simply assume that consolidation makes perfect sense in every industry but their own.

For multiple reasons, however, that’s starting to change, especially for the growing number of public alternative asset managers. The race to expand assets under management (AUM) among ever-larger firms is putting pressure on GPs to find new ways to grow, encouraging more firms to give M&A a fresh look. It’s also true that smaller firms are facing higher hurdles to growth as fund-raising becomes more difficult. That is prompting many to consider hitching on to a larger platform.

The public-firm advantage

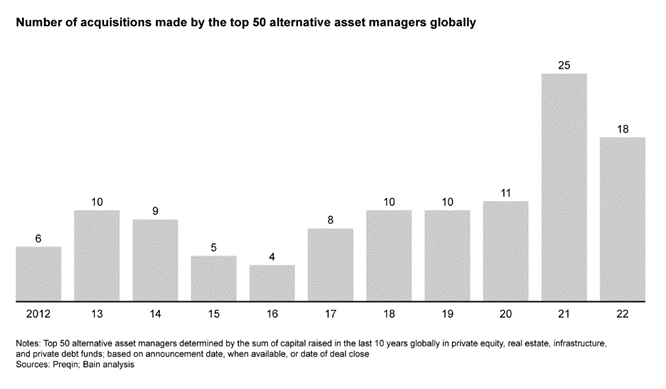

Among the top 50 alternative asset managers by AUM, the number of strategic acquisitions and strategic minority investments globally has accelerated in recent years, with a sharp spike in 2021 (see Figure 1). The numbers are still small: The top 50 firms have done a total of just 116 strategic deals since 2012, and more than half of that group (29 firms) haven’t done a deal at all. But the trend suggests that firms are increasingly looking for ways to make M&A work.

Figure 1

Strategic M&A in private capital has spiked in recent years

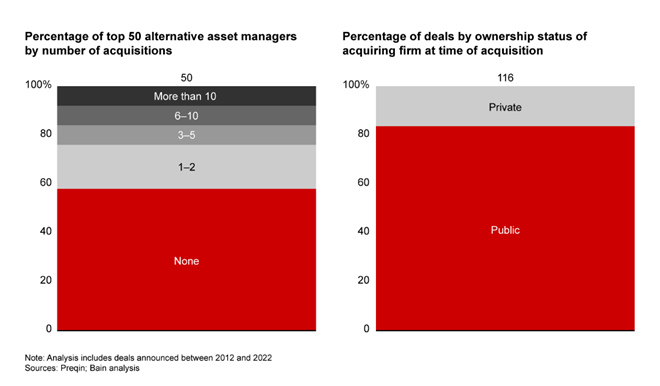

What’s clear is that strategic acquisitions and investments are significantly easier for firms that are publicly traded. Public alts managers have accounted for a full 84% of the deals done since 2012, largely because they have firepower in the form of balance sheets and liquid currency that private partnerships lack (see Figure 2). Private firms face the challenge of financing a merger out of the partners’ own pockets and sorting out the economics for the acquired firm. It’s also harder to access debt financing for private deals because private businesses are hard to value. All of this leads to fewer and smaller targets.

Figure 2

A minority of the top 50 alts managers have done a strategic M&A transaction since 2012, and most of those were public firms

Public firms not only find it easier to structure deals, but they are also under more pressure to do them. Public shareholders typically look for 15%-plus annual organic growth in fee-bearing AUM. That’s nudging public firms to think expansively about how to sustain that pace over time. Adding asset classes to a larger platform, geographic expansion, new customer channels, and strategic distribution are all means to that end. M&A can be an important way to accelerate those growth strategies.

These issues help explain why a firm like Sweden’s EQT had not done a strategic acquisition before it went public in 2019 but has done five since then. The firm has used M&A to expand its presence in Asia and build out adjacencies in real estate and healthcare venture investing. Referring to the firm’s biggest deal, the $7.5 billion acquisition of Baring Private Equity Asia, Christian Sinding, EQT’s CEO, told Forbes, “We realized for us to be able to build that scale organically in Asia would probably take another 10 years.”

He added that building scale is critical to winning in many of EQT’s new asset classes and will create the kind of global brand necessary to succeed in the private wealth channel, which accounts for half of all global assets under management but only 16% of alts portfolios. “Being public gives us a currency. It gives us a stronger balance sheet, so we can actually support these new initiatives,” Sinding said.

Read the rest of this article here on bain.com.