Human capital is at the core of value creation. Observing the dynamics of the workforce offers valuable insights for the investment community. Based on this idea, RavenPack has endeavored to create the most structured vantage point over job data for investors. In this article, we will be reviewing the key findings of our latest research which looks into how workforce intelligence can generate more alpha.

If we explore what makes human capital so valuable, we find that it comes down to collective knowledge and experience that drive productivity and innovation. In a McKinsey article from 2020, authors Marc Goedhart and Tim Koller pointed out that “value-creating companies create more jobs. The US and European companies that created the most shareholder value in the past 15 years have shown stronger employment growth.” This explains why hiring trends and patterns are strong indicators of a company's business growth, financial health and strategic direction. Another paper from 2019 by Elizabeth F. Gutierrez et al. noted that changes of an organization's number of job postings were positively correlated with future investment performance. This relationship was stronger when hiring was driven by growth rather than replacement.

A deeper look into job data would open ways to capture more momentum, and that’s what led us to look more closely into it. To be sure, job data has been a signal component for many alpha strategies. However, most were limited by the portion of job posts they could capture – often only job positions, company, posting dates, and location. This limitation stemmed from the nature of job postings: they are unstructured texts published by employers, written for human readers. Particularly the part which describes requirements, skills, benefits and responsibilities which is also one of the most insightful.

Historically, processing unstructured data has been the core business of RavenPack. So we found ourselves ideally positioned to unpack job postings with our world-class infrastructure, proven over 20 years of natural language processing of news, filings and other alternative data.

First, we needed an accurate dataset, so we partnered with LinkUp, the global leader in real-time job market data. LinkUp provides a 15 year archive of over 200 million jobs posted on the websites of more than 60,000 employers globally. Sourcing directly from companies ensures timeliness and unicity of job posts for a comprehensive daily snapshot of the job market.

Structuring insights required a targeted knowledge graph, so we built a proprietary taxonomy which identifies over 5,000 distinct occupations and more than 3,000 unique skills, benefits, qualifications, among other job requirements. By applying that taxonomy to LinkUp data, we created an accurate, point-in-time and fully searchable jobs archive. It covers 12 million companies, units, and subsidiaries, as well as links to all available financial identifiers.

Introducing RavenPack Job Analytics

In September, we launched RavenPack Job Analytics powered by LinkUp, an insightful, predictive and actionable workforce dataset. It uses state-of-the-art Natural Language Processing technology to analyze the entire body of each and every job posting.

For analysts and human capital specialists, this dataset opens the way to asking structured questions about the job market, from emerging skills to benefits like remote working, and to benchmark companies against competition. For investors, it means they can identify day-to-day changes in job market dynamics by sector, geography or company – for instance, which companies or sectors are growing faster or signaling a hiring freeze. Or discover whether Wall Street banks are now looking for crypto specialists and at what pace. The level of insight into labor markets is unparalleled with RavenPack Job Analytics.

Research backed: Information Ratio up to 1.7 from orthogonal alpha with RavenPack Job Analytics

Our latest research leverages the new RavenPack Job Analytics dataset to prove that workforce intelligence can be a new source of alpha.

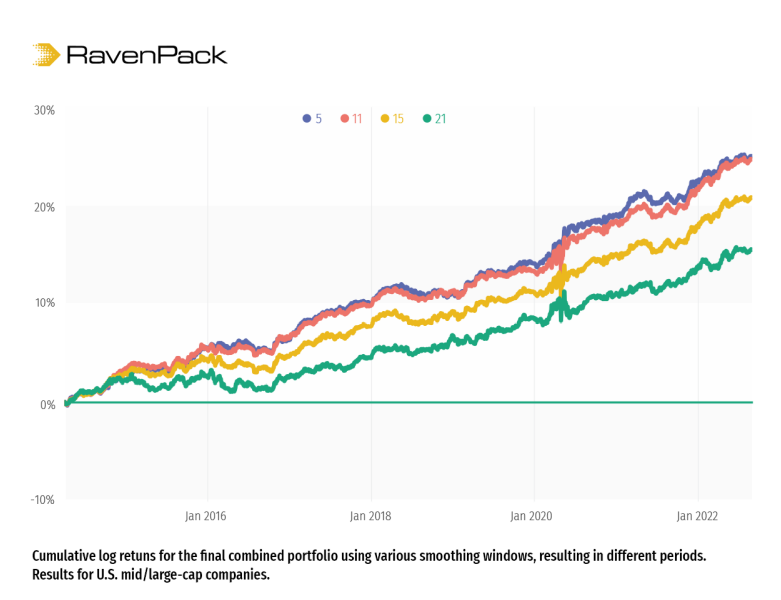

We discovered that monthly hiring growth is positively correlated with future stock performance. What's more, companies with higher hiring growth that also recruit in similar locations month on month, outperform the rest. A long/short sector-neutral portfolio delivers an Information Ratio of 1.1 and Annualized Returns of 2.9% with a weekly holding period.

We also looked at the monthly growth of the top demanded positions for each sector, we find that this strategy generates better performance than the overall growth strategy. The resulting portfolio achieves an Information Ratio of 1.4 and Annualized Returns of 3.0% with a weekly holding period.

We also found out that job descriptions are a source of orthogonal alpha. Companies with a stable distribution of soft skills outperform others, leading to a strategy with an Information Ratio of 0.9 and Annualized Returns of 2.0% with a monthly holding period.

Finally, we show that a combined strategy delivers robust performance over different trading horizons. With an effective holding period of two weeks, the strategy delivers an Information Ratio of 1.7 with Annualized Returns of 2.9%. The Information Ratio remains above 1.0 even with a monthly holding period.

The tip of the iceberg

Job Analytics allows us to explore hiring information from numerous, unprecedented angles — from sector trends and geographic segmentation, to emerging topics across public and private companies, on a day-by-day basis.

The results of our first research on job data speak only of a small fraction of what this new dataset can point us towards. This motivates our team of data scientists to dive more into sectors, skills types or employment policies to discover additional alpha-generating insights

Want to know more? Watch our exclusive interview with Peter Hafez, Chief Data Scientist at RavenPack, here:

Peter Hafez is Chief Data Scientist at RavenPack, who was an associate partner at QuantMinds International 2022.