Capital markets technology appears to be in the constant midst of profound transformation. As a result, financial professionals spanning the c-suite, front and middle offices face significant challenges. For sure, in today’s competitive environment, the need to improve performance and more rapidly react to changing market forces is becoming increasingly essential.

So, as markets become faster and more dynamic, risk decision making is moving towards real time. As a result, the demand for real-time decision-support technology and information is greater than ever. How is this being accomplished? What tools are being used? The answers are rooted in the growing popularity and use of quantitative technology, or “QuantTech,” which is comprised of comprehensive development platforms, rich data management capabilities and streaming real-time analytics for creating, testing and deploying innovative solutions.

Celent research: QuantTech will prove its Mettle

Celent, a financial services research and consulting company, published a report in April 2020 titled Accelerating Business Analysis and Response Kinetics in an Uncertain World. The report examines how the coming convergence of QuantTech, data science, and its ecosystem of technologies that have emerged in recent years will change how business impact analysis and responses are planned and executed.

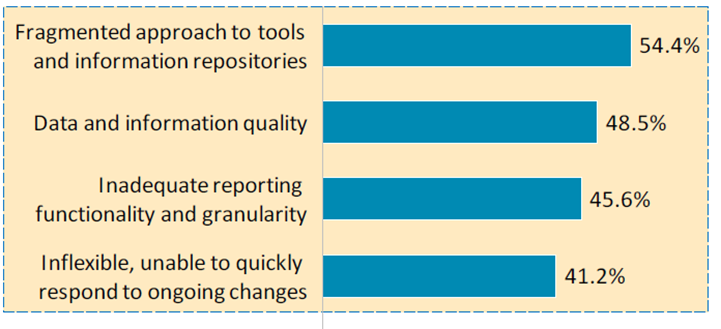

According to Celent’s analysis, it appears the time is ripe for next-generation QuantTech offerings to show their mettle and demonstrate their efficacy. Research determined that the following are the main challenges to existing risk platforms and data analysis/management:

Survey of financial institutions: What do you consider the biggest challenges with your existing risk systems and data?

Source: Celent

Celent emphasizes that “current generation data analytics, BI, and visualization tools were designed to generate reports for business-as-usual activities, and not necessarily for ad hoc, fast-moving collaborative endeavours,” which is exactly what is required for the present-day trading environment. As the report states, the coming convergence of QuantTech, data science, and its ecosystem of technologies that have emerged in recent years were made for times such as this.

The capital markets agree. Firms are looking to invest in development environments and platforms that address the challenges highlighted above and to gain multidimensional flexibility and experience new levels of productivity as they seek to build tailored solutions to address what are uniquely their own business needs and requirements. As the Celent report emphasizes, “firms must embrace and exploit the best of what emerging technologies can offer.”

So, the obvious question that arises is what does a next-generation enterprise quant platform look like? In my view, these are three core characteristics of such a platform:

- It is cloud based and features a Python development environment for building apps and one-off analyses, and which supports rapid time to market.

- Accommodates rich, out-of-the-box components that can be configured discretely or as part of a product suite, supporting a variety of mission-critical trading and risk management processes.

- Built-in data ingestion, processing and enrichment capabilities handling in-house as well as vendor data.

Enterprises are now running more strategic applications in the cloud, driven by many benefits, such as faster speed to market, scale, agility, and, in some cases, efficiencies in cost. A cloud-based architecture is a key enabler for rapidly and efficiently building and deploying new and different sets of applications and functionalities.

Cloud-Based architecture: Core to an enabling development environment

While the utilization of SaaS-delivered technology solutions varies widely across the industry, Celent Research suggests that in the next several years we will see a majority of vendor customers using some form of cloud innovation, whether they choose to focus on public, private or hybrid multi-cloud strategies.

As we look towards delivering a next-generation enterprise QuantTech platform for our clients, leveraging DevOps tools and cloud-native technologies are what we see as the keys to an enabling development environment.

While the utilization of SaaS-delivered technology solutions varies widely across the industry, Celent Research suggests that in the next several years we will see a majority of vendor customers using some form of cloud innovation, whether they choose to focus on public, private or hybrid multi-cloud strategies.

The bottom line

QuantTech is now enabling quantitative researchers, developers and traders with more powerful modeling tools and analytics for development, sandboxing ideas, and production—and it’s having a real impact in terms of increased flexibility, speed, and scalability.

As the saying goes, the rate of innovation is directly related to the rate of trying and testing new things. We couldn’t agree more. Our users need a sandboxing environment to create and test models at scale and get to production quickly, as well as to gain the flexibility to use off-the-shelf components to speed up development. This exists in an innovative, hybrid capital markets development environment that provides the components to build and configure applications that suit the end users’ specific trading and risk management needs.

Satyam Kancharla is Executive Vice President, Chief Product Officer, Client Solutions Group at Numerix.