Optimal portfolio strategy to control maximum cryptocurrency investment drawdowns

Have you been paying attention to your drawdowns? If you’re managing cryptocurrency hedge funds, monitoring your drawdown risk can make a big difference to your business’ survival. In this article, Patrick Tan, CEO of Novum Technologies, explains why cryptocurrency investment drawdowns have become so important and adapts traditional drawdown minimisation techniques to the nascent cryptocurrency market.

In the fund business, “drawdown” is a dirty word. The sort that ought only be repeated in hushed whispers and kept away from polite conversation. Yet it is also a critically important measure for investment management.

The common definition of drawdown of a portfolio is the percentage loss of current wealth (Wt) from a prior all-time high (Mt) and can be expressed as DDt = 1 - Wt / Mt.

Because media attention tends to focus purely on the profit potential from cryptocurrencies when they are rising, it is important, especially for cryptocurrency hedge funds geared for long term survivability, to consider the drawdown risks and manage those accordingly.

A portfolio’s downside risk of a prolonged drawdown matters not only to the investors’ financial wellbeing, but also to an investment manager’s business survival in the immediate term.

Which is why managing drawdown, especially for cryptocurrency hedge funds is so significant.

Cryptocurrency hedge funds post-2018

During the heady days of the cryptocurrency bull run of 2017 and early 2018, when Bitcoin hit US$20,000, many cryptocurrency hedge funds were just setting up shop and inundated with clients, in what can only be described as a bad case of FOMO (fear of missing out).

But given the massive drawdowns that many long-biased cryptocurrency hedge funds have experienced since then, it comes as no surprise that many either closed up or have had to return capital to their investors, with mere cents on the dollar to show for it.

As cryptocurrencies roared back to life this summer, managing these drawdowns and indeed managing long-biased cryptocurrency investment strategies is key to successfully navigating the risk-fraught waters of cryptocurrency markets.

And while early cryptocurrency hedge fund investors may have been quite content to accept lock-ins, given what had happened in 2018 to cryptocurrency prices, it is evident that moving forward, drawdowns need to be actively managed for investors to even re-consider cryptocurrencies as part of their investment portfolios.

To that end, there is little regard to whether a cryptocurrency investment strategy is valid in the long run, with high expected risk adjusted return, if cryptocurrency investment managers cannot adequately manage drawdowns in the short to medium term, they may not survive in the business at all.

Maximum drawdown in cryptocurrency hedge funds

Maximum drawdown challenges a client’s financial and psychological tolerance and according to Cheklov et al [1] a 50% drawdown is unlikely to be tolerated in an average account and an account may be closed if drawdown breaches 20% or has lasted two years.

Yet it is unclear whether the same standards apply to cryptocurrency hedge funds. Although most cryptocurrency hedge funds do not make public their returns except to existing or prospective clients, given that many were started up when cryptocurrencies were worth as much as 80% more than they are today, it is safe to assume that drawdowns for many of these funds have regularly exceeded Cheklov et al-suggested levels which would lead to client redemptions.

Yet that hasn’t been the case. While many cryptocurrency hedge funds have since shuttered, many others continue to function, despite massive drawdowns.

Perhaps this is a function of client education, manager communication and the knowledge that as volatile and unconstrained assets, the risks for cryptocurrency hedge funds are substantially greater than can be expected for hedge funds deploying capital in more traditional assets.

But it has been hardly the case that drawdowns in excess of 50% are peculiar to cryptocurrency markets alone.

Take for instance passive index investors. During the 2008-2009 financial crisis, maximum drawdowns of over 50% occurred for both the Dow Jones Industrial Average as well as the S&P 500 Index.

And according to Zhou and Zhu [2], a 50% drawdown has a 90% probability over a century even if the stock markets are simply modelled as a random walk.

What this suggests is that despite the perception of increased risk, cryptocurrency markets are perhaps only marginally more risky than financial markets, if at all.

As cryptocurrencies roared back to life this summer, managing these drawdowns and indeed managing long-biased cryptocurrency investment strategies is key to successfully navigating the risk-fraught waters of cryptocurrency markets.

And given the short history of cryptocurrency trading and the round-the-clock nature of trading, drawdowns for cryptocurrency hedge funds compare favorably with hedge funds that trade in purportedly “safe” assets.

If nothing else, an allocation in cryptocurrencies could provide an effective hedge against investment in other asset classes, especially given the uncorrelated nature of cryptocurrencies with other assets, because even diversification through passive asset allocation in traditional financial instruments was not effective to avoid large drawdowns.

During a market crisis, risky asset classes can exhibit a “contagion effect” with highly correlated losses across the board leading to large drawdowns. The concept of “safe havens” during broad financial crises has little bearing in such situations where all manner of assets are overcome by extreme pessimism in markets. Whether or not such “contagion effect” has any direct bearing on cryptocurrencies is less clear.

Born as a result of the financial crisis, Bitcoin and its brethren have yet to weather a major economic crisis and it remains to be seen whether they will be viewed as a “safe haven” asset, divorced from centralised control, or lumped into the same basket as a host of other risky assets which need to be dumped.

Markowitz’s modern portfolio theory and Mean Variance Optimisation methodology defined risk [3] as return standard deviation – a path-independent statistical attribute. But without an explicit mechanism to control maximum drawdown, many traditional balanced portfolios of 60% stocks and 40% bonds suffered a maximum drawdown loss of 30% or more during the 2008-2009 financial crisis.

Methods to minimise drawdown

Whilst various methods have been proposed to minimise drawdowns for the financial markets, none has been found to be particularly suited for cryptocurrencies, especially given the unpredictable nature of the nascent asset class.

Grossman and Zhou [4] pioneered the mathematical framework of portfolio optimisation under dynamic floor constraint to control maximum drawdown, extending the constant floor portfolio optimisation by Black and Perold [5].

Grossman and Zhou approached the problem with Expected Utility Theory and defined portfolio optimality as maximising long term growth rate in power law wealth utility function and assumed continuously rebalancing between a risk free asset and single risky asset which has random walk return dynamics.

In the cryptocurrency context, risk free assets exist in the provision of cryptocurrencies on cryptocurrency exchanges at an interest rate, paid out in the cryptocurrency being loaned out.

But for investors who are looking for returns denominated in fiat currencies such as the dollar, there is an immediate issue that such risk free rate of return is not entirely risk free as it masks the inherent volatility of the value of a cryptocurrency versus the dollar or other cryptocurrencies.

But vis-à-vis cryptocurrencies inter se, Grossman and Zhou’s model has some value towards managing drawdown for cryptocurrency trading aimed at increasing a client’s existing holdings of cryptocurrency.

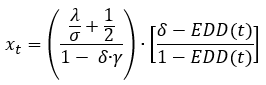

An Economic Drawdown (EDD) was defined by EDD(t) = 1 - Wt / EM(t), where an Economic Max (EM) since inception is calculated as ![]() The continuous Drawdown-Controlled Optimal Portfolio Strategy (DD-COPS) has the portfolio fraction allocated to a single risky asset as:

The continuous Drawdown-Controlled Optimal Portfolio Strategy (DD-COPS) has the portfolio fraction allocated to a single risky asset as:  where δ is the drawdown limit, (1 - γ) is the investor risk aversion and γ = (R - rf) / σ is the long term expected Sharpe ratio of the risky asset (R and σ are its long term expected return and volatility) and the rest of the portfolio is allocated to the risk free asset – in the case of cryptocurrencies, swapping back into fiat currencies.

where δ is the drawdown limit, (1 - γ) is the investor risk aversion and γ = (R - rf) / σ is the long term expected Sharpe ratio of the risky asset (R and σ are its long term expected return and volatility) and the rest of the portfolio is allocated to the risk free asset – in the case of cryptocurrencies, swapping back into fiat currencies.

But Economic Drawdown (EDD) in Grossman and Zhou’s model reflects an idealistic mental accounting from sophisticated investors – how much better off they would have been had they exited the risky asset completely at a retrospective perfect time in history, when a risk free rate compounded historical high was achieved.

Brought into the context of cryptocurrencies, it idealises a model where an investor would know that December 2018, was the perfect time at which to unload one’s holding of Bitcoin, close to the all-time high of US$20,000.

However, since not all investors invested or had memory since time zero (the inception of the portfolio), there are portfolio inception time differences among investors.

For instance, investors who had invested with Pantera Capital in 2013, at the fund’s inception would have seen outsize returns as compared with investors who invested with the fund in 2017.

The time windows one uses to monitor price movements can have a dramatic effect on the asset allocation into cryptocurrencies.

Then there are also liquidity constraints – not all investors can exit at a perfect time.

Some hedge funds have an initial 1-year lock-up and quarterly redemption window. Mutual fund minimum holding periods as well as redemption penalties are other examples of exit restrictions.

But for practical purposes, using a drawdown reference lower than Economic Max (EM) can improve performance as a forward-looking market timing mechanism and a proposal by Yang and Zhong [6] which manages drawdown might have applicability to cryptocurrency hedge funds.

Yang and Zhong propose an alternative to the anchored time window (since inception) for drawdown calculation, preferring instead a constant, rolling time window.

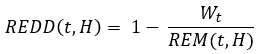

By defining a Rolling Economic Max (REM) at time t, looking back at portfolio wealth history for a rolling window of length H the duo propose this formula: ![]() From REM, Yang and Zhong consequently defined Rolling Economic Drawdown (REDD) as defined as:

From REM, Yang and Zhong consequently defined Rolling Economic Drawdown (REDD) as defined as:  Intuitively, a drawdown look-back period H somewhat shorter than or similar to the market decline cycle was what Yang and Zhong suggest is key to achieving optimality.

Intuitively, a drawdown look-back period H somewhat shorter than or similar to the market decline cycle was what Yang and Zhong suggest is key to achieving optimality.

In that sense, the pair propose that by substituting EDD with a lower REDD as in Grossman and Zhou’s formula, there is a higher risky asset allocation to improve portfolio return during a market rebound phase – which is precisely what had happened to Bitcoin and some other cryptocurrencies in the early part of this year.

Had Yang and Zhong’s formula been applied to the periods when Bitcoin was around US$3,500 in the early part of this year, they would have proven prescient in large part because of the rolling time window the duo had proposed.

Because of the inherent volatility of Bitcoin as well as other cryptocurrencies, the time windows one uses to monitor price movements can have a dramatic effect on the asset allocation into cryptocurrencies.

Yang and Zhong’s formula is decidedly more flexible and adaptable than any other proposed thus far, particularly for cryptocurrencies, because of their ability to meld investor risk profile characterisation with a rolling time window that has shorter look-back periods that are of greater relevance when applied to cryptocurrencies.

While it may be difficult to predict over longer periods of time, say months, for Bitcoin and other cryptocurrency price movements, over shorter periods, Yang and Zhong’s formula when applied to highly restrictive rolling time windows have provided an accuracy bordering on clairvoyance.

Because Yang and Zhong’s formula caters for low risk tolerance parameters, drawdown control target δ and risk aversion complement γ, a more risk-averse investor should have a lower drawdown loss tolerance which could be effectively applied even to cryptocurrency investments.

In the context of cryptocurrencies, one could adjust those figures to cater for the fact that investors who are looking into alternative asset classes such as cryptocurrencies are naturally less risk averse, yet at the same time, would not appreciate a complete drawdown of their investment.

But given that lower than average risk aversion, the rolling time window proposed by Yang and Zhong would have captured an increased portfolio allocation to Bitcoin and Litecoin in the early part of this year as the formula would have taken a higher risky asset allocation during what would ultimately be a market rebound phase.

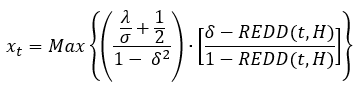

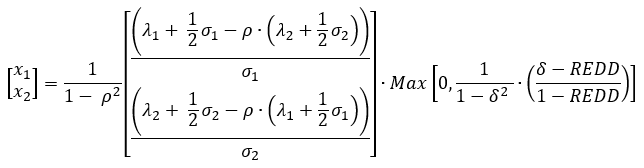

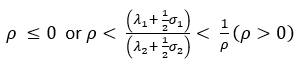

Adapting Yang and Zhong’s formula for cryptocurrencies, a Rolling Economic Drawdown – Controlled Optimal Portfolio Strategy (REDD-COPS), a dynamic allocation policy between risky assets and instead of a risk free asset, converting cryptocurrencies back to fiat currencies, such that the long term fiat-denominated wealth growth rate is maximised under a dynamic constraint REDD ≤ δ, the dynamic portfolio fraction allocated to any single cryptocurrency is:

And instead of the risk free asset which Yang and Zhong proposed, the remainder of the portfolio allocation is converted back into fiat currencies (xf) from cryptocurrencies:

xf = 1 - xt

In discrete trading, Yang and Zhong’s formula disallows shorting cryptocurrencies but has the portfolio all in fiat currency (preferably the dollar) for any out-of-control time when REDD ≤ δ.

Larger expected Sharpe ratio λ, lower volatility (typically absent in cryptocurrency trading) or a higher drawdown tolerance δ, leads to higher levels of investments in cryptocurrencies.

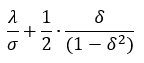

And maximum weighting in any specific cryptocurrency is:

when REDD = 0.

So, for two cryptocurrencies, using Yang and Zhong’s formula, dynamic asset allocation weights are:

The portion of the portfolio which would then need to be reconverted into fiat currencies is represented by:

xf = 1 - x1 - x2

with the return correlation efficient between two different cryptocurrencies impacting positions size in the dynamic asset allocation process.

When cryptocurrencies have positive Sharpe ratios (λ1,2 > 0), no shorting in any cryptocurrency, whether using derivatives or by selling back into fiat currencies, needs

Although the traditional asset allocation process benefits from the ability to estimate asset class returns, standard deviations and input parameters to the portfolio optimisation process, similar data is scarce when it comes to cryptocurrencies.

Instead, outside of the rolling time window suggested by Yang and Zhong, these input parameters must be taken from historical data that falls within far more constrained periods, to get fixed input parameters for the best possible cryptocurrency allocation outcome during the historical sampling period.

The dramatic cryptocurrency crash of 2018 and subsequent revival in 2019 (albeit not yet to previous levels) provides the opportunity to demonstrate that the continuous drawdown controlled optimal portfolio theory of Grossman and Zhou has limited applicability to cryptocurrency portfolios.

Instead, Yang and Zhong’s REDD-COPS model which depends on a shorter portfolio history, is far more suited for cryptocurrencies by looking back only at a constant rolling time window.

In what is essentially one-step momentum trading at discrete time intervals, REDD-COPS avoids a cascading performance drag due to the long memory of anchored drawdowns, especially over sharp V-shape cryptocurrency market cycles, which happen relatively frequently over short periods of time in cryptocurrency markets.

Cryptocurrency hedge funds are a relatively new invention, but that doesn’t mean that asset allocation ought to be static and unreactive.

Intuitively, REDD-COPS can time the cryptocurrency markets well when the cryptocurrency market drawdown cycle, as was experienced in 2018, is somewhat longer than (or at least matches) the rolling time window defining REDD.

Right before a cryptocurrency recovery from low, a lower Economic Max in the shorter time window results in a larger allocation in cryptocurrencies to boost subsequent returns.

Take for instance long-biased cryptocurrency funds set up in 2017 and 2018. Had they exited their cryptocurrency positions into fiat currency using REDD-COPS towards the second half of 2018 and remained in fiat currencies until early 2019 when they would have re-allocated back into cryptocurrencies, many would not be at the drawdown levels they are currently at.

Because REDD-COPS allows for variable time windows, it is flexible enough to factor in the volatility inherent in cryptocurrency markets as well as cater for the speed of market impact in the speculative cycles in cryptocurrencies.

And because transaction costs are negligible in cryptocurrency trading, using stablecoins such as USDT or USDC allow for constant rebalancing that trade in and out of cryptocurrencies before making a final exit into fiat currencies.

Cryptocurrency hedge funds are a relatively new invention, but that doesn’t mean that asset allocation ought to be static and unreactive.

In the early days of cryptocurrency hedge funds, many were long-biased and because of the different entry points for investors as well as the volatility of cryptocurrencies, investors were not afforded the full benefits of investments in cryptocurrencies while still bearing the brunt of much of the downside.

Asset allocation management and active rebalancing can provide a means to make the most of portfolio performance. As an active asset allocation framework, REDD-COPS provides three practical methodologies for portfolio management that can be applied to cryptocurrencies:

- Rolling Economic Drawdown (REDD) for portfolio control loss – this would help cryptocurrency funds to cut losses by converting back into fiat currencies and wait for new buying opportunities to re-allocate back.

- Risk aversion defined as the dynamic floor of maximum loss tolerance – depending on the mandate of the cryptocurrency fund and the risk appetite of investors, a dynamic floor can cater for maximum drawdown that is not completely subject to cryptocurrency market forces.

- Dynamic asset allocation implemented through the inverse of asset class volatility estimation – allocation to specific cryptocurrencies must be as dynamic as the digital assets are volatile and responsive enough to cater for the myriad externalities that are a regular feature of cryptocurrency trading.

Besides managing cryptocurrency investment portfolios, REDD-COPS is also flexible enough to design target risk cryptocurrency funds, cryptocurrency ETFs and target-date cryptocurrency funds.

With active trading mechanisms derived solely from risk statistics and risk targets, Yang and Zhong’s REDD-COPS provides a viable tool for cryptocurrency funds to utilise risk-based investment management, driven by active risk control, rather than performance chasing. Over the long term, such cryptocurrency portfolios will outperform.

Join Patrick at QuantMinds Americas and learn more about the most pressing issues in quant finance.

References

[1] Chekhlov, A., Uryasev S., and M. Zabarankin (2005), “Drawdown Measure in Portfolio Optimization”, International Journal of Theoretical and Applied Finance, Vol. 8, No. 1, pp. 13-58.

[2] Zhou, G. F and Zhu, Y. Z., (2010) “Why is the Recent Financial Crisis a “Once-In-A-Century” Event?” Financial Analysts Journal, Vol. 66, No. 1, 2010.

[3] Markowitz, H. M. (1952), “Portfolio Selection”, Journal of Finance, Vol. 7 (1952) 1, 77-91.

[4] Grossman, Sanford and Zhou, Zhongquan (1993), “Optimal Investment Strategies for Controlling Draw-downs”, Mathematical Finance Vol. 3 (3), pp. 241-276.

[5] F. Black and A.F. Perold (1992), "Theory of constant proportion portfolio insurance", Journal of Economic Dynamics and Control, 1992, Vol. 16, issue 3-4, pp. 403-426

[6] https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2053854

About Patrick Tan

Patrick has close to 20 years of experience in both the legal and business spheres and speaks regularly at cryptocurrency and blockchain events. Patrick holds a Bachelor of Laws (2nd Class Honors Upper Division) degree from the National University of Singapore and specialized in initial coin offerings (ICO) and blockchain technology law at one of Singapore’s leading blockchain and ICO law firms.

Patrick has close to 20 years of experience in both the legal and business spheres and speaks regularly at cryptocurrency and blockchain events. Patrick holds a Bachelor of Laws (2nd Class Honors Upper Division) degree from the National University of Singapore and specialized in initial coin offerings (ICO) and blockchain technology law at one of Singapore’s leading blockchain and ICO law firms.