Preparing for a LIBOR-less world: What are quants’ greatest challenges?

It has been a busy time of late for quantitative analysts and model validation teams within banks. Not only are they faced with the day-to-day necessities of supporting traders through ongoing model development, remediation, monitoring and validation but they need to weather the additional wave of model-based work presented by the ongoing demands of transitioning away from LIBOR. Our recent session at QuantMinds In Focus looked deeper into some of these challenges and how they are being addressed.

It has been a busy time of late for quantitative analysts and model validation teams within banks. Not only are they faced with the day-to-day necessities of supporting traders through ongoing model development, remediation, monitoring and validation but they need to weather the additional wave of model-based work presented by the ongoing demands of transitioning away from LIBOR. Our recent session at QuantMinds In Focus looked deeper into some of these challenges and how they are being addressed.

With regulatory deadlines looming on the active transition of legacy trades, in addition to new non-linear convention switches, time is being spent to support both the front and back book. ISDA provided prescriptive details on how the LIBOR fallback would behave for a suite of common LIBOR-linked non linear payoffs providing clarity to model developers on how the fallback logic could be coded. The initial priority has been to ensure that all cash flows and valuations linked to the fallback for a product are correct. This is no small task. Our poll determined the implementation of fallbacks as being the most resource intensive task that model owners/developers are currently battling. The complexity of the change is very much product dependent, but the sheer volume of updates necessary to ensure a correctly functioning pricing framework at the cessation date, is certainly keeping quantitative analysts occupied.

ISDA’s ‘one-size-fits-all’ approach to the fallback ensures that all products (subject to the relevant ISDA definitions/protocol) will function in a LIBOR-less world. However, the fallback instrument can look very different to an equivalent standardised RFR trade. The questions to ask are: “Do these fallback trades make sense in the new RFR world?”; “Would they still serve their initial intention?” This presents an opportunity to effectively cater to the needs of banking clients. Active outreach is necessary to answer these questions and quant analysts are having to be reactive to these discussions to ensure any alternatives are feasible and subsequently developed.

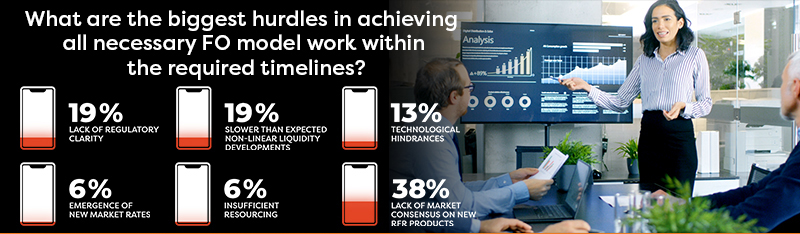

As quantitative analysts face the challenge of updating libraries to accommodate new RFR payoffs in the exotic and hybrid space, they are immediately hampered by the lack of consensus on product conventions. Scepticism remains as to whether all conventions will be revealed prior to this year end, even in light of regulatory messages to halt the trading of new LIBOR-linked issuance. Second-guessing conventions can lead to throwaway development work and lead to added complications when leveraging consensus pricing like Markit Totem. Front office teams looking to test their pricing code for new RFR products require close cooperation with IPV to ensure discrepancies in pricing are driven by genuine model differences and not trade conventions or any development bugs. According to our poll, the lack of transparency in RFR conventions was cited as the number one challenge to front office quants achieving their model deadlines on time.

Until recently, the future of products linked to ICE LIBOR swap rates also remained uncertain. Recent work from both the Non-Linear Derivatives Task Force of the Working Group for Sterling RFR and an ARRC subcommittee has produced detailed formulas that could form a fallback-like replacement for the GBP/USD ICE LIBOR swap rate respectively upon LIBOR cessation. In order to provide a map between conventions of RFR and LIBOR swaps the formula is rather complex, and quantitative analysts should perform testing work to ensure that the substitution of this formula in their pricing libraries does not cause any surprises. ISDA are currently working on drafting amendments into the relevant swap-rate option language and settlement provisions, such that legacy CMS and cash-settled swaption trades can continue operating in situ. The production release of the ICE SONIA swap rate and the healthy SONIA swap market liquidity help to suggest this language will be available for GBP before USD however work is still required to ensure that LIBOR-linked swaptions settle effectively given the knock-on impacts of CCPs halting the clearing of LIBOR swaps on the ability to publish the ICE LIBOR swap rate.

In conclusion, the demands on quantitative analysts over the next six months will be many, varied and urgent. Not only are models required for new RFR products but additional work is needed to ensure the correct operation of LIBOR trades adhering to ISDA fallbacks, not forgetting any trades referencing the ICE LIBOR swap rate fallback. At the same time, the downstream impacts including front office system alignment with supporting teams and enterprise-wide RFR base curve adoption represent significant challenges to manage. Quantitative analysts will need a clear and early view of these challenges so as to prepare solutions with what time is left before the end of the year.