Most quantitative funds are the new source of dumb money that can be exploited for profit in a time when the supply of uninformed and unskilled retail traders has diminished. The operational constraints of such funds make them easy targets. Here Michael Harris, quant systematic and discretionary trader and best selling author explores.

Trading is a zero-sum game. Although some believe this is not so, they do that at their own peril. If a trader does not understand that profits must come from losses of other market participants, then conditions for failure are already in place. However, convincing anyone who resists comprehending this fact is not the aim of this article.

In the 1980s and 1990s, when trading was very popular, professional traders and other skilled market participants were able to make significant profits due to a supply of dumb money. Unskilled and uninformed retail traders using untested methods such as chart patterns were the main source of profits for CTAs, market makers, skilled professional traders and other well-informed market participants. After the dot com bust and during the bear market that followed, most of the unskilled traders withdrew from the market and some of them became passive investors. It is not a surprise then why returns of CTAs and other skilled market participants have remained low since: there is not enough supply of dumb money around.

Given the above introduction to market realities, it has become much more difficult for traders to generate alpha in the last 10 years at least. By the way, passive investors have realized large returns in the stock markets thanks to relentless interventions by central banks but this party will be over soon. In addition, those passive investors run the high risk that at some point in time central banks will be tempted to take profits and finance their local government social policies, which I believe is the main intention from investing in trending stock markets. Actually, central bank selling may cause the next bear market and not geopolitical events.

The bad news is then that there is not much retail dumb money around. The good news is that there are many new quantitative funds. Although the people that operate these funds are smart and have math and programming skills, they have no market experience although they think they do because they believe trading markets is equivalent to deploying an algo after reading a few books on the subject. Most find out this is not so too late and at the uncle point.

Limitations of quantitative hedge funds

There are some limitations of quantitative hedge funds that can be exploited by skilled professional traders:

1. High capacity trading algos - Funds expect money inflows and therefore their strategies should accommodate that. This imposes constraints on the type of strategies they can use. In order to increase capacity, a large universe of instruments must be traded and this is usually available in the equity markets now that liquidity in futures markets is much lower. The S&P 500 constituents are an example of what constitutes a suitable universe. Trading a large universe of securities reduces return variance but also expected returns by enforcing a weak model due to bias-variance trade-off. In a nutshell, high capacity constraints usually lead to weak models and lower returns at high trading friction.

Professional traders can take advantage of this limitation by concentrating on trading index ETFs with relatively faster models. Price action in these ETFs affects underline price action due to rebalancing. The end result is that the hedge funds end up trading individual stocks at worse prices. Another more advanced way of profiting from the capacity limitation is by employing very fast algorithms. HFT traders already do that but medium to low frequency traders can benefit if the lag is small.

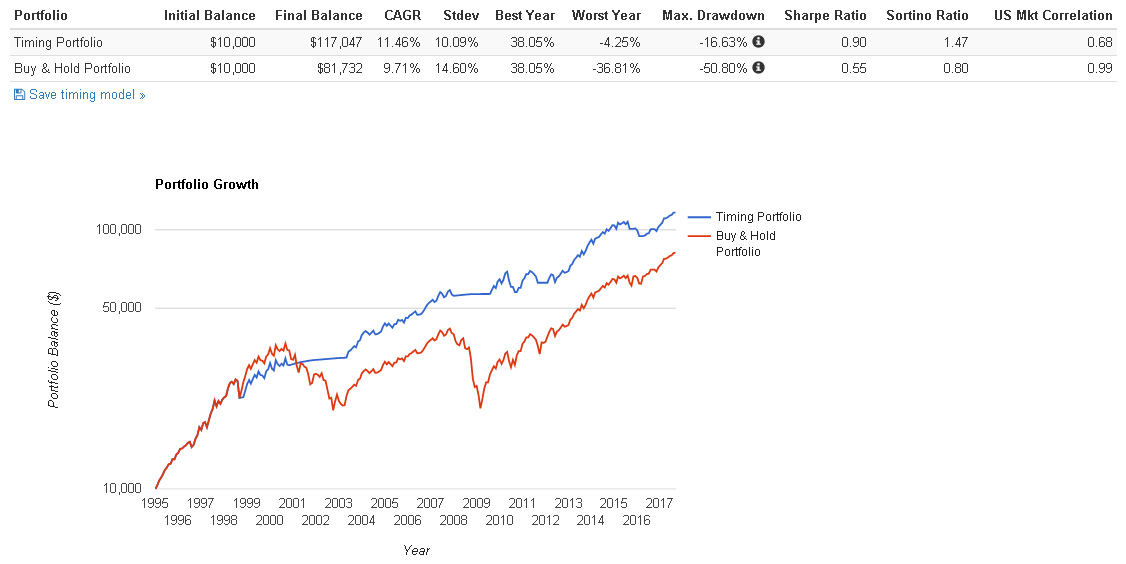

2. Low beta limitation - Most quantitative hedge funds require performance with low correlation to market. This translates to a beta as close to 0 as possible. However, this rules out a large class of highly profitable models on a risk-adjusted basis. For example, the 1–12 month moving average momentum rule in SPY since inception has a Sharpe ratio of 0.90 as compared to 0.55 for buy and hold but beta is 0.48, much above desired threshold.

Professional traders can use similar models that although they have higher beta, they nevertheless have the effect of lowering the profit potential of hedge funds that demand lower beta.

The above model was presented as an example but it is highly possible that its future performance will be adversely affected also by the lack of dumb money and central bank support. This is called a “pedestrian”strategy and it is only an example.

3. Relying on academic researcher advice - Relying on academic researchers is probably the worst thing a hedge fund can do. There is a huge difference in the frame of mind between academic researchers and professional skilled traders with skin-in-the-game.

I recently saw a presentation of an academic researcher to hedge funds regarding use of machine learning. It was obvious to me that although the researcher is a smart individual with advanced math skills, he used weird terminology for the purpose of creating hype and making an impression.

Data-mining bias and p-hacking are a problem but academic research solutions are ambiguous and ignore the fact that over-fitted models can work well for even decades and realize significant wealth before p-hacking is evident in hindsight. In trading, knowing when market conditions are changing is much more important than estimating data-mining bias. Actually, an over-fitted model may be a good solution as long as market conditions remain the same. I have examples in my paper Limitations of Quantitative Claims About Trading Strategy Evaluation. I receive emails from people telling me how this paper has changed their whole view about strategy development and the markets. And needless to say: I do not expect any praise from academic researchers as their objectives are different.

4. Many quantitative funds are doomed - Why do I list this as a limitation? In my opinion it is because anyone who believes there is easy money to be made with algos will eventually lose. Trading is much more than algos as anyone with skin-in -the-game knows. There are numerous factors that can affect performance. Keeping everything under the radar is a hard job and requires either a large group of highly disciplined employees and task sharing (Principles of Ray Dalio and Bridgewater) or keeping the operation small in size — a one man show focusing on a few liquid markets. Factors, features, machine learning, algos, backtesting, data-mining bias, fancy platforms, etc., are possibly less than 5o% of the job. The other 50% is about execution, maintenance and dealing with the unexpected.

Summary

New quantitative funds have several limitations professional traders can exploit and profit. High capacity requirements, low beta constraints, relying on academic advice and thinking that algo trading is a panacea are some of them. Quantitative hedge funds are the new dumb money despite the fact that the people that operate them may be smart and highly educated. The zero-sum game is ruthless.

This article was originally published on Price Action Lab Blog - If you have any questions or comments, happy to connect on Twitter:@mikeharrisNY