Silver linings chartbook: New data on development applications and construction from UrbanToronto reveals reasons for optimism

While headlines about Toronto's real estate industry were (often justifiably) dominated by doom and gloom, data from UrbanToronto suggests some hope for the future of the industry.

UrbanToronto tracks major real estate development in the Greater Golden Horseshoe area, tracking new applications and construction starts for commercial, residential, institutional, and even public park projects from Niagara Falls to Barrie to Bowmanville, and everything in between. (A development is “major” if it is bigger than a detached home, which often requires a rezoning or Official Plan amendment or similar application.)

Clients get full access to up to 150 fields of data for each of the 6500+ projects we track, from the submission and approval dates for applications and building permits, to the number of units and gross floor area, to the construction status and the number of cranes, to the companies (including developers, architects, engineers, and suppliers) working on building the project to life.

No doubt about it: Developers proposed fewer projects and fewer units in 2025

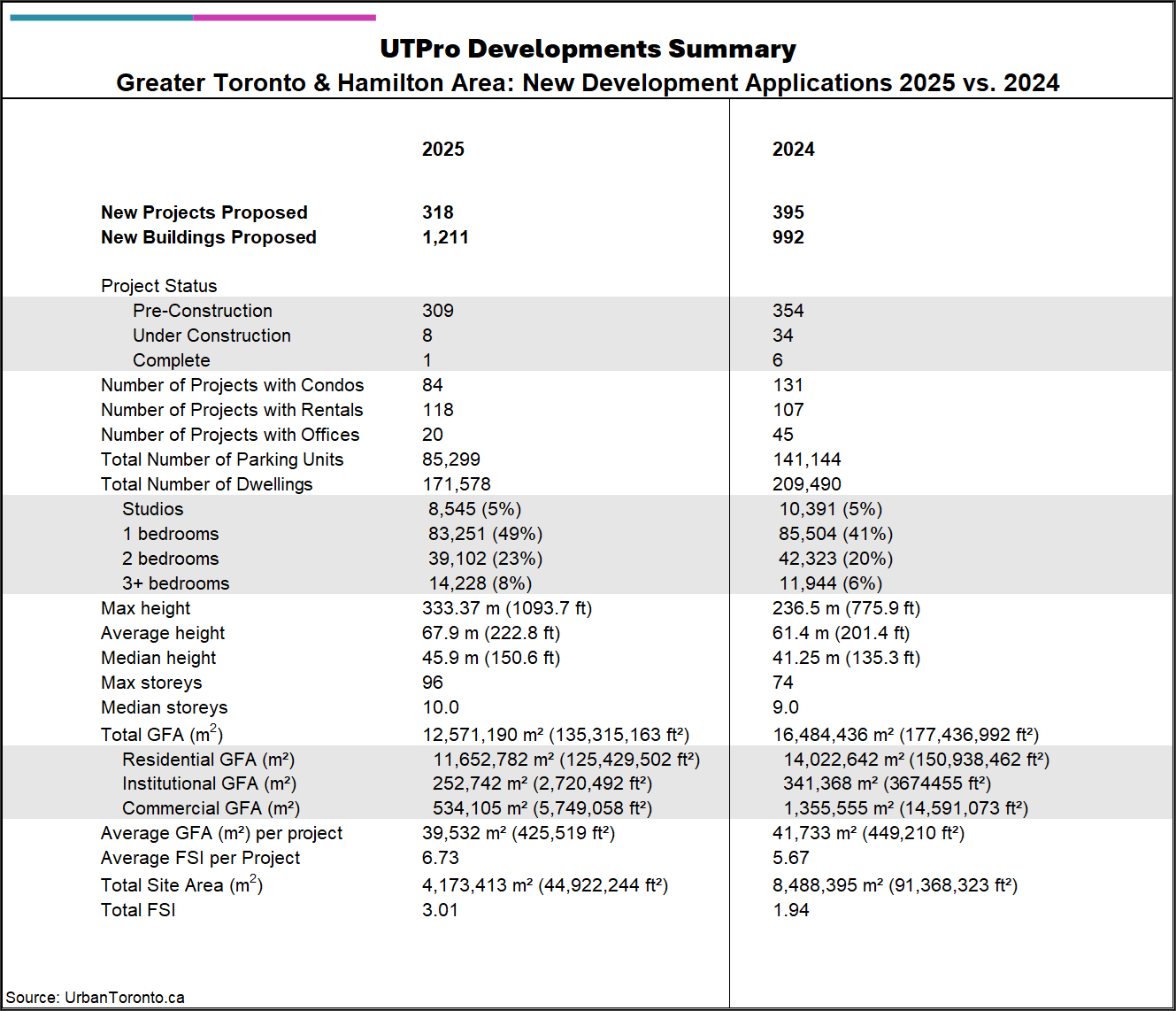

UrbanToronto’s UTPro data on year-end Developments Summary for the Greater Toronto and Hamilton Area shows a clear pullback in the volume of new proposals in 2025 compared with 2024. Developers put forward 318 new projects in 2025, down from 395 the year before, and the total number of dwellings proposed fell to 171,578 from 209,490. The pipeline also shifted toward earlier-stage files, with 309 of the 2025 proposals sitting in pre-construction compared to 354 in 2024, while only eight were under construction in 2025 versus 34 in 2024, and just one reached completion compared with six the year prior.

Figure: Comparison of development applications submitted in 2025 to 2024 in the Greater Golden Horseshoe. Data from UTPro.

New construction continued to increase, but for how long?

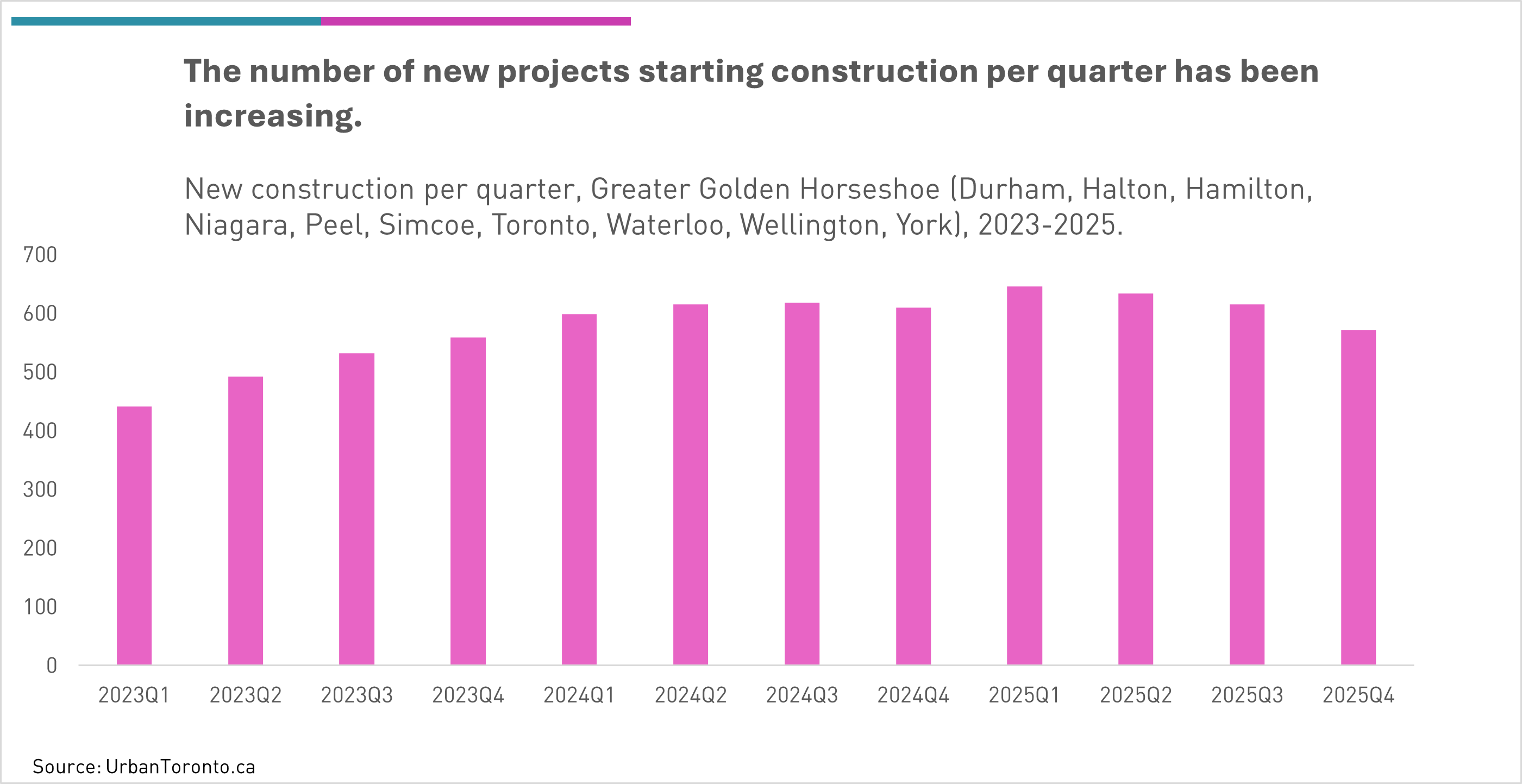

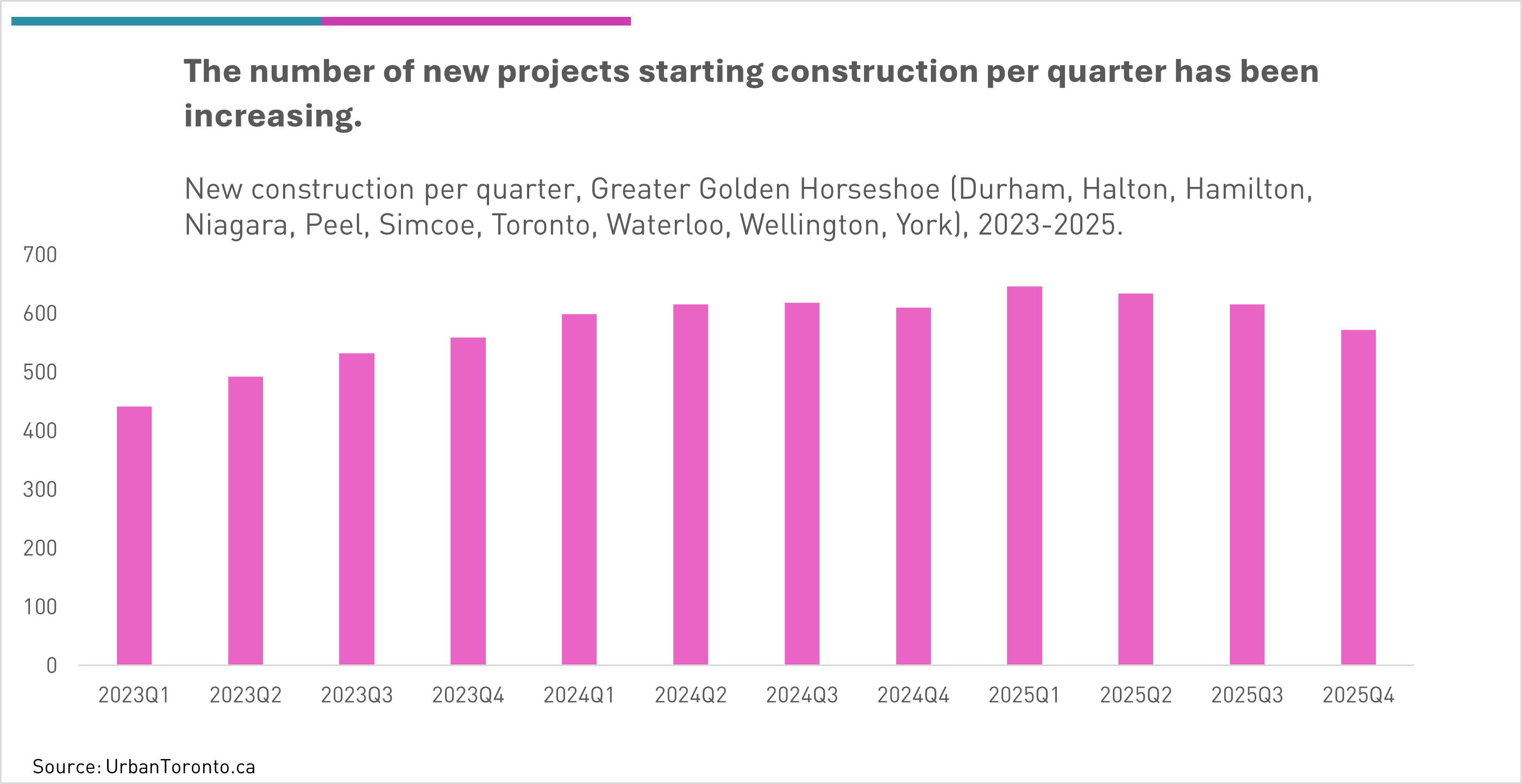

The quarterly construction-start chart for the Greater Golden Horseshoe shows that new construction kept trending upward into 2025, building on the momentum that began in 2023 and accelerated through 2024. Each quarter of 2024 sat meaningfully above the levels seen a year earlier, and 2025 opened even stronger, with the highest quarterly total arriving in the first quarter before easing modestly as the year progressed. The important point is that activity did not revert to 2023 levels; instead, it stayed in the higher range that emerged in 2024, suggesting that the region’s construction pipeline remained active even as broader market conditions continued to pressure feasibility and financing.

Figure: New construction beginning in each quarter for the Greater Golden Horseshoe. Data from UTPro.

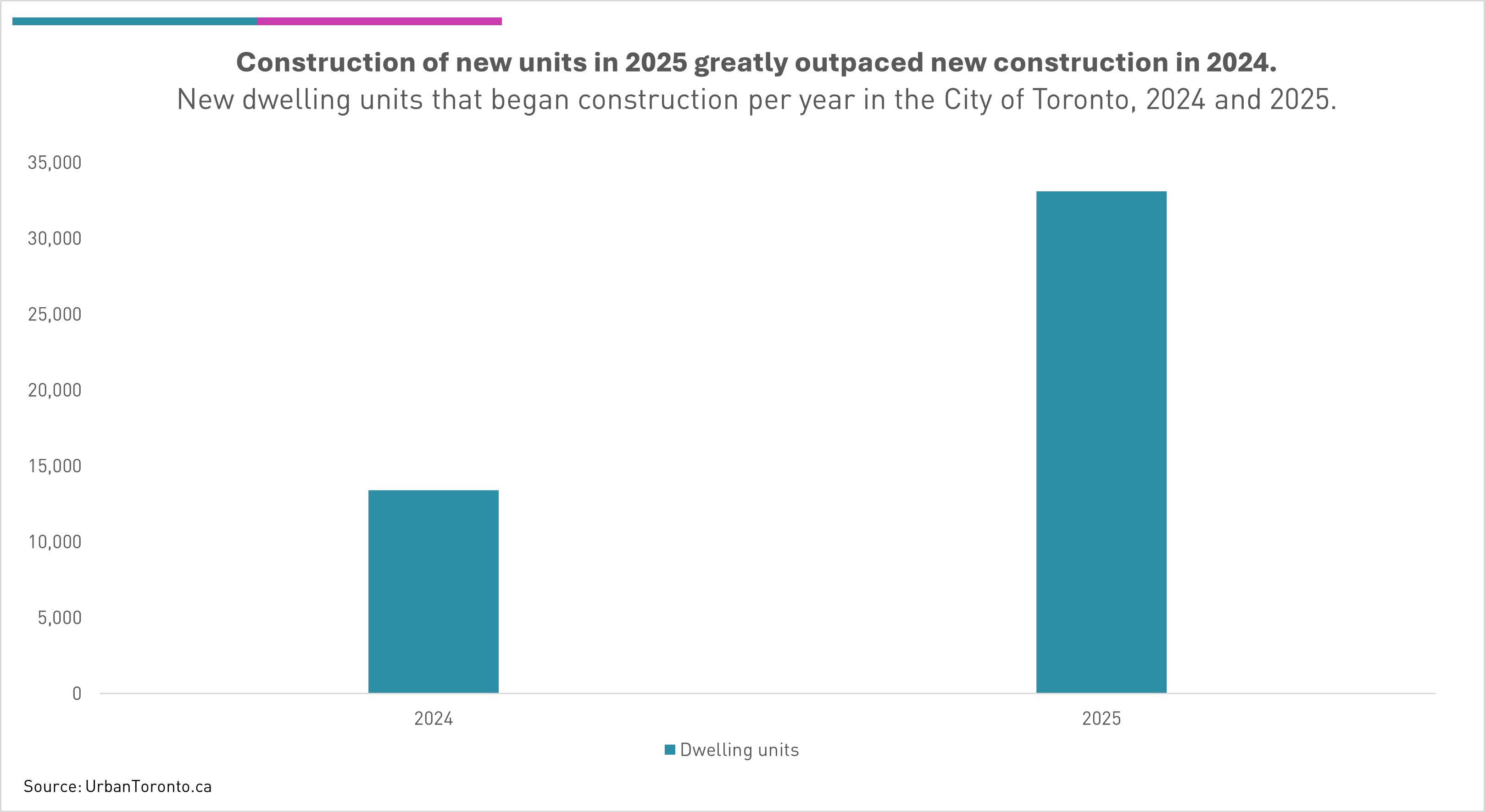

The year-over-year view reinforces that same conclusion, with 2025 clearly outpacing 2024 in overall construction starts rather than simply shifting activity between quarters. That apparent late-year cooling visible in 2025 Q4 may be a statistical artifact, as not all applications submitted in December were publicly available on January 1st.

Figure: Construction of new dwelling units in the City of Toronto, 2025 vs. 2024. Data from UTPro.

To answer that question, we need to break down the new applications and new construction numbers. There are some silver linings.

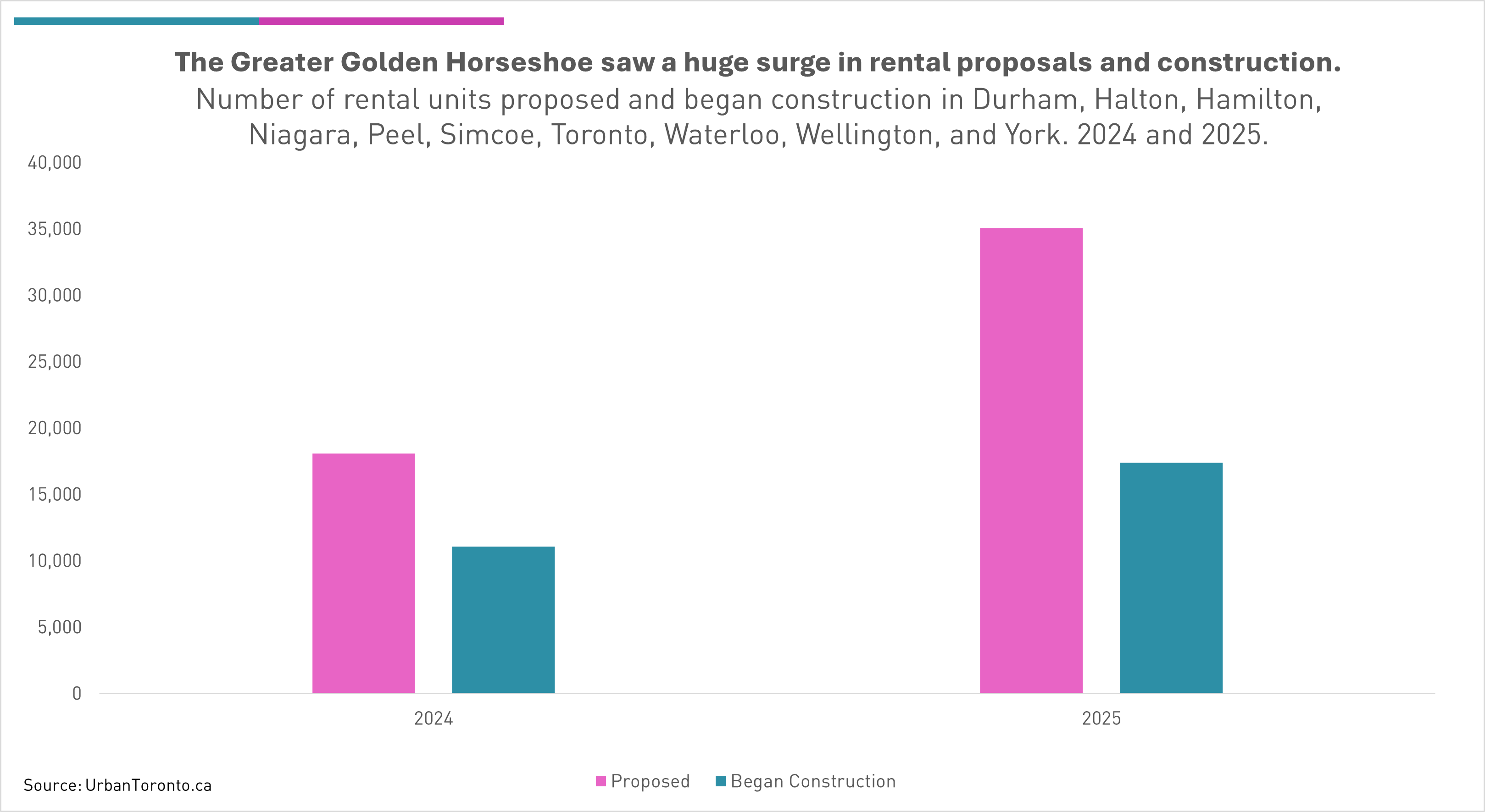

First silver lining: Developers loved rental in 2025

UTPro’s rental tracking across the Greater Golden Horseshoe makes one thing unmistakable: 2025 was a breakout year for purpose-built rental in the proposal pipeline. The number of rental units proposed nearly doubled year over year, jumping from roughly 18,000 in 2024 to about 35,000 in 2025 across Durham, Halton, Hamilton, Niagara, Peel, Simcoe, Toronto, Waterloo, Wellington, and York. That kind of increase is not a rounding error or a modest rebound; it is a clear signal that developers, investors, and landowners increasingly saw rental as the most viable path forward in a market where the economics of other housing forms have been under sustained pressure.

Figure: Comparison of applications for new rental units and construction of new rental units in the Greater Golden Horseshoe, 2025 vs. 2024. Data from UTPro.

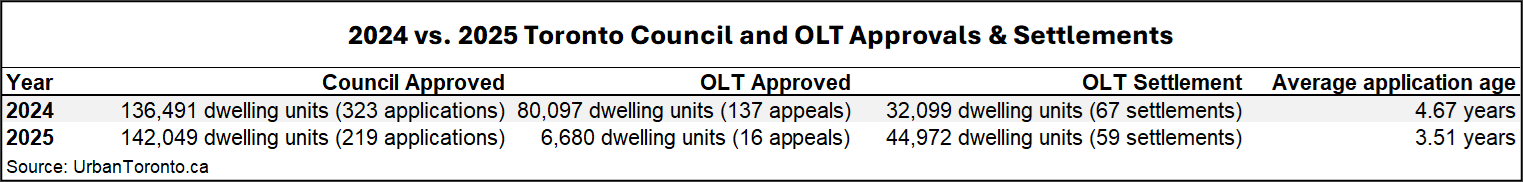

Second silver lining: Toronto City Council loved developers in 2025

When it came to getting units over the line, Toronto City Council was much more eager to approve in 2025 than it was in 2024. Council-approved units rose to 142,049 in 2025 from 136,491 in 2024, even though the number of applications approved dropped sharply from 323 to 219. In plain terms, fewer files accounted for more approved homes, which is exactly what it looks like when approvals are moving through more efficiently and the city is clearing larger proposals rather than grinding through a higher volume of smaller ones.

Figure: City Council and OLT approvals and settlements for applications to the City of Toronto, 2024 vs 2025. Data from UTPro.

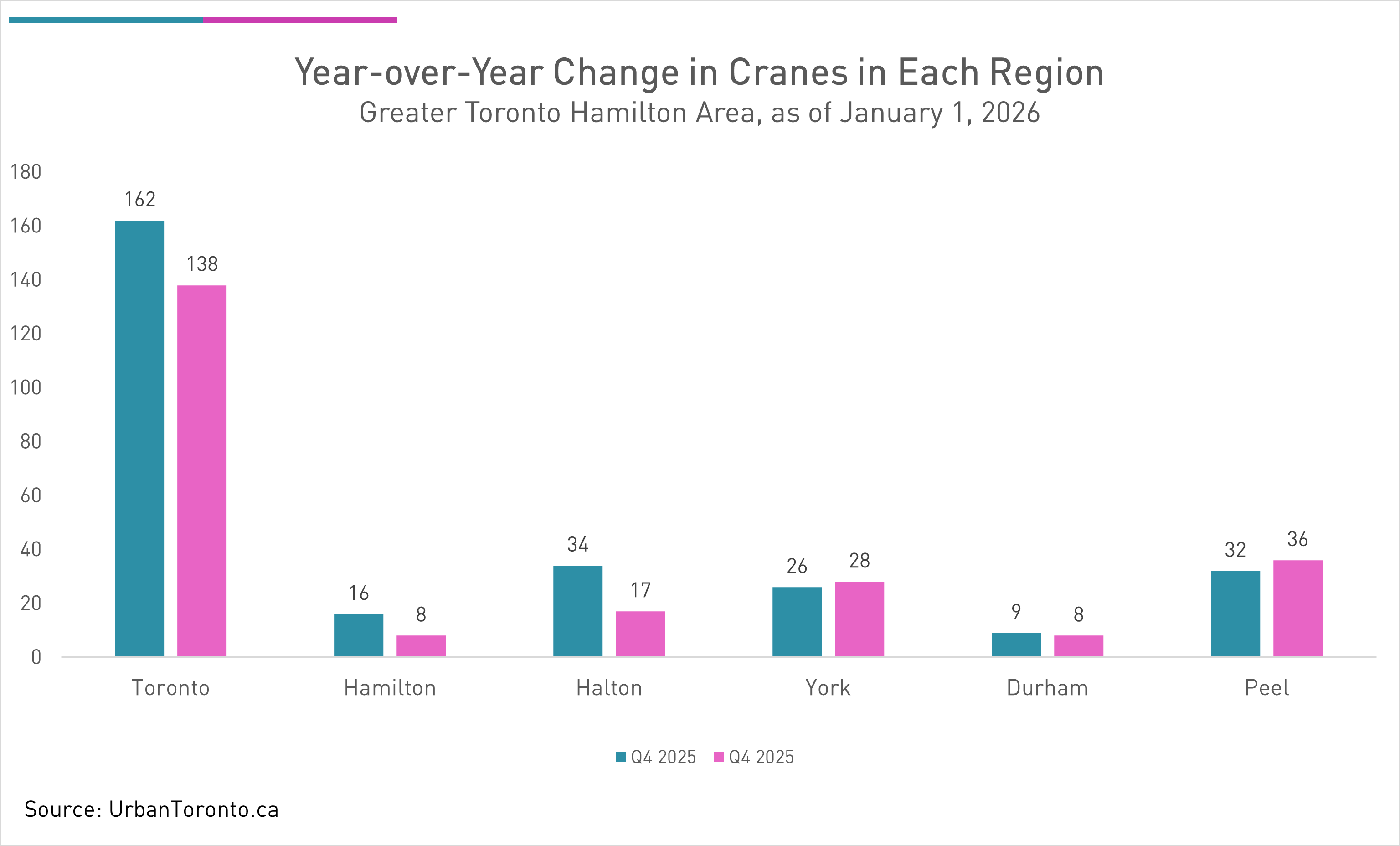

Third silver lining: Cranes show things are looking up in some places

The Toronto region's skylines are looking less dynamic again this year, as there are now fewer cranes on fewer projects for the second year in a row. As of January 1, 2026, there were 235 cranes atop buildings across the Greater Toronto and Hamilton Area (GTHA). This represents a drop of 44 cranes from our report covering the same period last year.

However, not all regions of the GTHA experienced a similar loss of cranes. While Toronto, Hamilton, and Halton all saw significant drops, York and Peel regions saw slight gains in cranes.

Figure: The changes in cranes in each region from the same time last year. Data from UTPro.

Conclusion: Green shoots or dead cat bounce?

Toronto's housing market has undoubtedly suffered from several major setbacks in recent years. One major policy (and attitude) shift has been at Toronto City Council, where there is clearly a new impetus to approve new projects faster than ever. This, combined with other changes to permitting smaller developments up to 6 storeys in the city's busiest areas, can dramatically reduce the costs and uncertainties in building housing.