Relative and absolute performance are of utmost concern for active managers and investors alike. However, many active managers struggle to outperform their benchmarks. Even successful managers can unknowingly expose their portfolios to factors that are consistently detracting from performance, and this detraction persists after identification. Mitigating the effects of these unintentional exposures significantly improves out-of-sample performance of otherwise successful strategies, and Brian Kozeliski, Lecturer, CQA Institute at Wilkes University, breaks down how.

“However beautiful the strategy, you should occasionally look at the results.” – Winston Churchill

Learning from one’s mistakes

Let me start with a simple premise. There are multiple components to any serious endeavor you choose to undertake, and you will not be equally proficient at each component. You might be excellent at some components and terrible at others. Experience will likely improve speed, efficiency and competency, but there is no guarantee. It is perfectly possible to be below average at doing something despite many years of experience. Reasons include never receiving the proper training and mentoring, not being aware of techniques that would allow you to make improvements, not having the time, tools and resources to identify areas of weakness, and, of course, not actually being interested in improvement.

In asset management, our job is to grow wealth, and we are typically expected to beat appropriate benchmarks and peers. Simplistically, we have two components to our jobs.

- Identify assets that will outperform.

- Construct a portfolio of these assets.

Surely it would be useful to evaluate our effectiveness at each of these components.

Performance evaluation

When attempting to evaluate ourselves or another manager we are typically given a performance attribution that shows excess returns relative to a benchmark. Consider the following example.

---

| Manager A | Manager B | Manager C | |

| 3-month excess return | 2.72% | 3.20% | -4.44% |

| 1-year excess return | 7.35% | -0.99% | -1.29% |

| 3-year excess return | 11.54% | 1.11% | -3.09% |

---

Assume these managers are very similar. They have the same benchmark, active risk, number of names, active sector weights, turnover, etc. Ask yourself these two questions.

- Which manager(s) are skilled at identifying assets that will outperform?

- Which manager(s) are skilled at constructing the portfolio?

These are what I call “endpoint specific” attributions and they tell you nothing. The best managers over ten years typically have a three-year period of underperformance within those ten years. We all know of managers whose three-year number instantly and dramatically improves after they are able to roll off a period of underperformance. We don’t know if these performance numbers are typical or unusual, and we don’t know where in the product or market cycle these numbers occurred.

Key point 1: You cannot effectively evaluate performance unless you know how consistent it is.

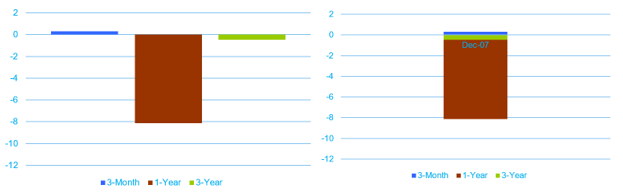

Let’s consider a manager who promotes having a momentum and value strategy with the following performance as of 12/31/2007.

---

| Excess return | Dec 2007 |

| 3-month | 0.32% |

| 1-year | -8.13% |

| 3-year | -0.45% |

---

If this is the only information we have, we conclude the manger isn’t skilled and move on. However, since one endpoint specific attribution is worthless, let’s look at all of them. This is easier in graphical form. Each of the following conveys the same performance in graphical form.

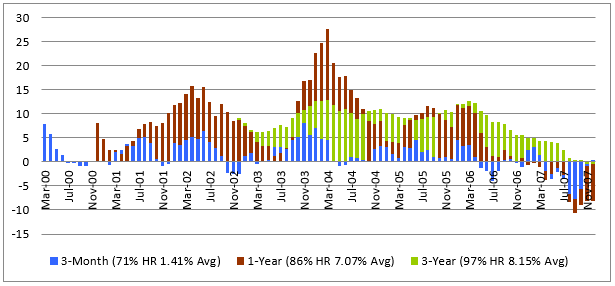

Notice the bars align with the performance numbers on the y-axis even when the bars are stacked. A stacked bar chart graph looking at all the endpoint specific attributions will look something like this.

The evaluation of this manager on December 2007 leads you to believe they are not that good. However, when you look at all the endpoint specific attributions, it is clear that this manager is consistently outperforming. I have more confidence in this manager’s long-term ability than I do in Manager A above. I would, of course, want to understand what is driving the underperformance at the end of this period.

Key point 2: You cannot effectively evaluate performance unless you know what is driving it.

This manager indicates they are adding value through their exposures to momentum and value. We can look at performance attributions like the one above for exposures to any factor, so let’s look at attributions for the momentum and value exposures for this manager.

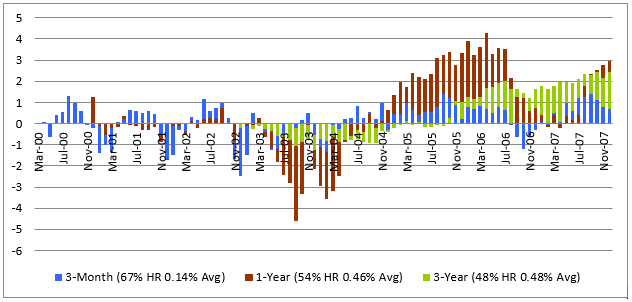

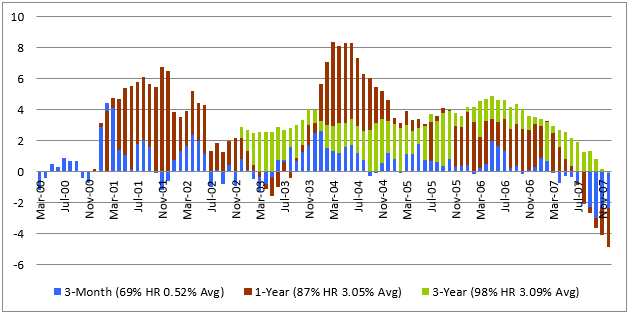

Momentum

Value

The exposure to momentum wasn’t doing much for the portfolio’s performance at the beginning of the period, but has since positively contributed to return. Value contributes positively to return for the majority of the time period. The manager is consistently providing what we are paying them for and they are consistently outperforming the benchmark. We have effectively answered question one. This manager is skilled at identifying assets that will outperform.

Unintended bets

We can use this same analysis to answer whether or not this manager is skilled at portfolio construction. The manager’s sole focus is on momentum and value exposures, and there are many portfolio construction constants including sector neutrality. We would not expect other factors to be contributing to the performance of the portfolio. However, this manager does, in fact, have exposures to other factors. Importantly, these exposures are in no way shape or form part of the manger’s investment mandate or part of the investment process. The manager is completely ignoring these factors, but is positioned as if that is not the case. The portfolio’s performance will be affected by them. Exposures to earnings quality, long-term momentum and profitability all stand out because these exposures consistently worsened the performance of this portfolio during this time period.

Just as consistency is critical for evaluating performance, it is critical for improving future performance. If you are consistently good at something, keep doing it. If you are consistently bad at something, stop doing it. If there is no consistency, it is difficult to act on the information. For this reason, we ignore unintentional factor exposures that have inconsistent effects on performance.

We have determined that overall performance of this portfolio is excellent. Momentum and value are positively contributing to performance as intended. Earnings quality, long-term momentum, and profitability are unintentionally detracting from performance. The manager has two choices.

- Continue the existing strategy as is.

- Continue the existing strategy but eliminate the unintentional exposures on earnings quality, long-term momentum and profitability.

Portfolio construction

This is really a portfolio construction problem. We want to know if making these changes, after identification, will improve the performance of the portfolio going forward.

If we continue the strategy as is, we continue to see outperformance going forward.

---

| Dec 2007 - Dec 2015 | |

| Portfolio return | 9.45% |

| Benchmark return | 6.65% |

| Excess return | 2.79% |

---

However, performance is even better if we also eliminate the unintentional exposures.

---

| Alternate strategy | Dec 2007 - Dec 2015 |

| Portfolio return | 11.54% |

| Benchmark return | 6.65% |

| Excess return | 4.54% |

---

I have performed this analysis many times on many different products. For managers good and bad the results are always conceptually the same even as the exposures differ. I find exposures that are consistently and positively contributing to performance. These are usually the factors the team knows about and is targeting. I find exposures that are consistently and negatively contributing to performance. These are usually the factors outside of the investment process and that the team is unaware of. I find that eliminating these exposures after identification improves future performance. I find that portfolio construction has a much larger impact on performance than managers realise. I find that developing strategic views on exposures outside of the investment process and incorporating them into the portfolio construction process on day one is ultimately the best strategy.

Determine what that something is that’s worsening your performance and stop doing that!