Africa now appears as the world’s next emerging economy and, thanks to a fast growing population and an improving business environment, is becoming increasingly attractive for investors and multinational companies. In parallel to this economic growth, the deployment of BEPS and the consecration of the mobilization and effective use of domestic resources as part of the United Nations sustainable development goals have made of transfer pricing (“TP”) a key issue for governments and businesses in Africa.

The TP environment is evolving at a very fast pace and is expected to continue on this trend with more and more countries implementing TP regulations, building specific expertise and generally developing their tax system. It is therefore essential for multinationals, whether already implemented in Africa or considering an investment in the region, to understand the specific features of TP in Africa and how they apply to their particular situation. This contribution proposes to address this question through an overview of the importance of TP for the African economies, the determining stakes of non TP rules and the sensitive question of sustainability.

1. The importance of TP to African economies

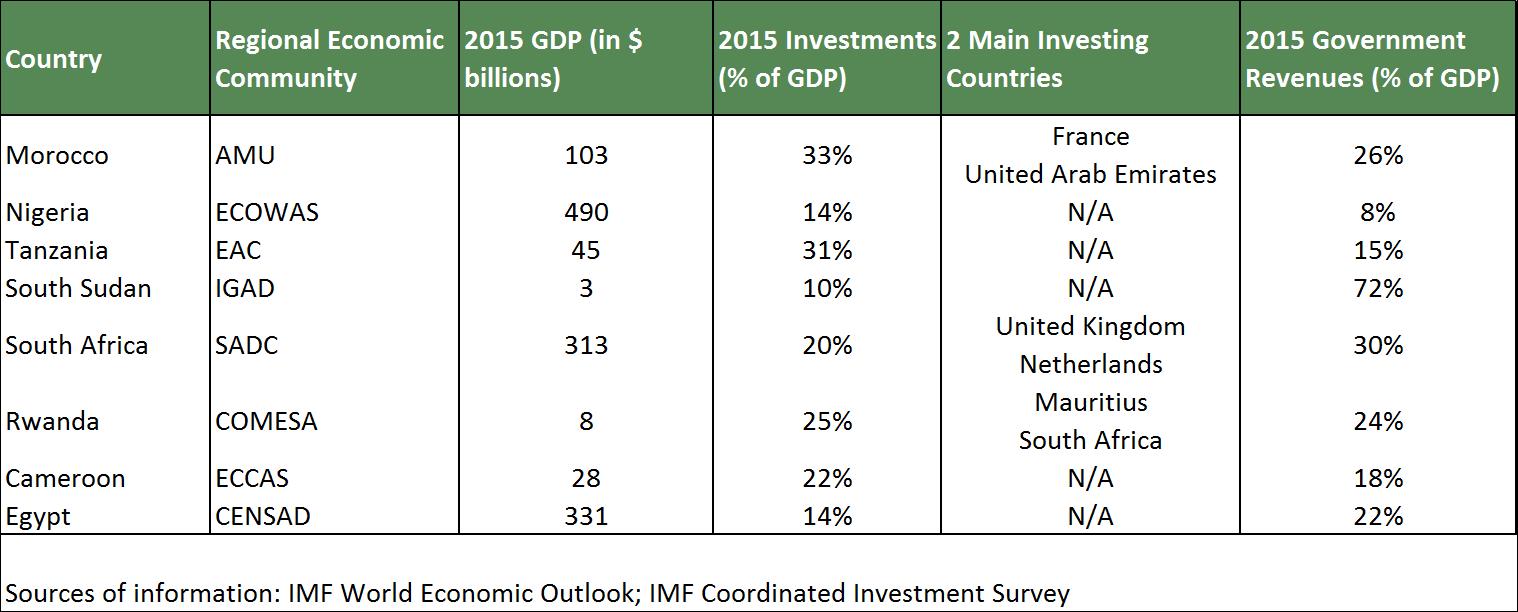

The African economies are characterised by a variety of situations and present significantly different levels of development, which impacts the context in which TP is being developed and applied. In order to illustrate this situation, several macro-economic criteria of countries located within different regional economic communities are presented below.

Table 1: macro-economic factors relevant to TP

These figures demonstrate that the level of development, estimated based on GDP, varies considerably across the continent, ranging from 3 to 490 $billions for the panel under review. Such variation extensively impacts the level of sophistication of the local tax authorities, TP practices and the importance of particular economic sectors.

On the other hand, the ratio of international investment to GDP appears more consistent and demonstrates the key role of multinational companies in the countries’ development. The origin of international investments illustrates that a wide range of countries have interests in Africa and relate to inbound flows into Africa as well as flows within Africa, creating a diversity of tax situations. Finally, looking at government revenues as a % of GDP establishes strong variation in terms of tax burden across countries, some of which like Cameroon or Tanzania having room to improve the amount of taxes recovered.

These indicators show that, despite significant variations in the development of local economies, multinational companies have a particular importance for the financing of most African public finances, which will continue to trigger significant focus on TP.

2. The diversity of the African TP landscape

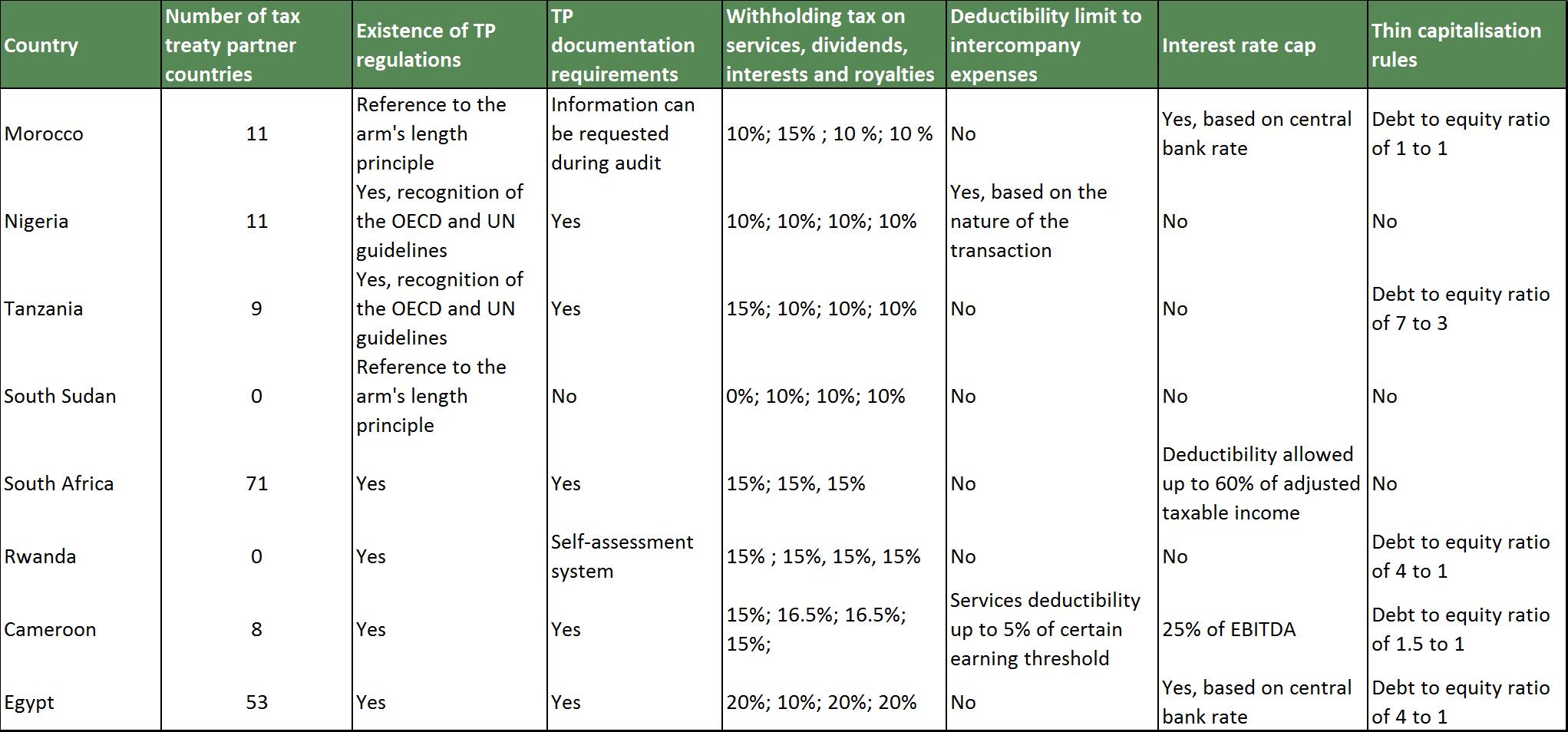

TP regulations in Africa are developing at a fast pace with more and more countries implementing formal transfer pricing regulations and documentation requirements. While these developments are generally consistent with international standards, African regulations are characterised by the importance of non TP rules. Tax treaty networks, withholding taxes, limits to tax deductibility of payment to affiliates and thin capitalisation rules have a decisive impact on the tax treatment of international transactions and need to be carefully considered for TP planning purposes.

Table 2: Summary of tax regulations relevant to TP

The footprint of tax treaty networks varies significantly from one jurisdiction to another, hence creating different risks level with regards to double taxation. Particular attention should be brought to withholding taxes, with all countries within the considered panel applying high rates to services, dividends, interests and royalties (from 10% to 20%).

In addition, several countries have implemented limits to the deductibility of intercompany expenses. Their definition in terms of structure and rate diverge considerably, ranging from a general deductibility threshold to a limit per type of transaction being calculated as percentage of sales or a percentage of EBITDA. Finally, interest expenses are increasingly subject to diverse thin capitalisation rules and interest rates cap rules such as debt to equity ratios, profitability based ratios and cap based on central bank rates.

It is therefore key for multinationals to analyse the impact of these rules on their transfer pricing structures based on their own facts and circumstances.

3. Transfer pricing sustainability

Increased scrutiny from tax authorities, investors, customers, employees and civil society at large has brought unprecedented attention on the TP structures of multinationals. Corporates are now expected not only to comply with formal tax regulation, but also pay their “fair-share” of taxes as part of their wider social responsibility.

Several multinational companies operating in Africa have come under wide scrutiny from tax authorities and public society, across different sectors including commodities, food or telecommunications. Their contribution to the public finances of the countries in which they operate has been publicly questioned, leading to erosion of their brand reputation and increased audit risks. Additionally, the consequences of TP challenges may significantly impact business operations, in particular those relying on licences or authorisations granted by governments.

Multinationals and heads of tax operating in Africa should monitor the risks and opportunities arising from the increased public attention to transfer pricing. The development of new TP compliance requirements, together with increased transparency and scrutiny from a wide range of stakeholders, make the operation of a sustainable TP model more complex and increasingly cross functional within a corporation.

4. Conclusion

The TP stakes in Africa are increasing and should continue in that direction in the coming years. Nevertheless, the disparity of countries’ economic situations coupled with the importance of non TP rules considerably complicates the operation of efficient TP structures. In this context, it is necessary for multinationals to fully assess their TP environment and implement sustainable practices so as to efficiently manage risks and seize opportunities.

After an education in law and business management, he has gained experience in a Big 4 consultancy in France and in-house within a large Swiss multinational company.