Technology adoption is on many industries’ agenda, but will regulations be able to keep up with the advances? It’s only right that regulators start adopting technology themselves, but which way will it be? Will they simply use technology to aid the regulatory processes or will they exercise their regulatory power on the algorithms themselves?

“[…] When I think about ingenuity, Einstein springs to mind. Where did his ingenious ideas come from? A blend of qualities, perhaps intuition, originality, brilliance […]” - Stephen Hawking[1]

In the discourse surrounding the impact of technology on social processes, regulation seems to be destined to follow two paths: either RegTech that is regulation through the use of technology, or algorithmic regulation.

RegTech

RegTech refers to the set of technological solutions that simplify and improve the regulatory process [2]. There are three stages that delimit the extent of RegTech. The first is led by financial institutions that sought to integrate technology into their internal processes and optimise their compliance systems. The second stage has focused on facilitating the process of adopting regulatory reforms after the 2007-2008 global financial crisis. The third stage projects a re-conceptualisation of the operation of the financial system and its regulation with the aim of building a better system [3]. As can be seen, the progress of RegTech has been closely linked to the dynamics of the system and of financial regulation [4].

For example, in the banking system, risk management often seeks a prediction of future events, so banks use quantitative analysis to predict their level of exposure to credit risk and market risk. This is precisely where the advent of new technologies can solve the limitations of the current system.

RegTech brings analytical forecasting elements, big data systems, and machine learning, which will help to overcome operational difficulties and, at the same time, integrate all areas related to banking consumer activity. Similar to FinTech [5], the RegTech adoption process will depend on the availability of banks, regulators, and technology developers to integrate and exchange information and experiences. Such an integration ought to include both new companies known as startups and incumbent institutions.

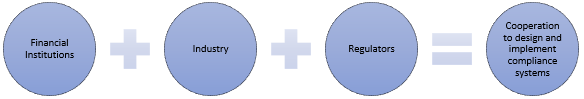

One of the areas where RegTech is most widely implemented is in compliance or compliance systems [6]. The design of RegTech systems seeks to improve the tools available to face challenges triggered by constant increase in regulation, development of individual liability regimes, and the over-expansion of compliance teams and the subsequent coordination issues. Indeed, one of the advantages of RegTech is the promotion of collaboration systems among the actors related to compliance, as follows:

In this context, the key challenge will be associated with

- the amount of information collected,

- the way in which that information will be shared,

- the ability to analyse the data, and

- the integration of that process with decision-making in the daily activities of the regulated and regulators.

Then, RegTech's role will be to provide the best technological scenario to achieve the integration of all these elements, and to facilitate the process of regulatory compliance [7].

Algorithmic regulation

Algorithmic regulation refers to the phenomenon according to which computational algorithms can be classified as mechanisms of control and social order [8]. Algorithmic regulation points to regulatory governance systems that use algorithmic decision-making. This means, decisions are informed and executed by means of knowledge generated through algorithms [9]. Algorithmic development and implementation occur, like with traditional regulation, in a fragmented regulatory space where the State and individuals interact [10]. For example, social networks use algorithms to decide what type of information to show their users, while traffic authorities can use their own algorithm to regulate the volume of traffic and avoid congestion [11]. Therefore, in addition to the use of knowledge generated by algorithms as a starting point for decision-making, in algorithmic regulation, there is the intention of managing risks or modifying behaviour.

In Karen Yeung's opinion the main characteristics of algorithmic regulation are:

- Algorithmic regulation emerges as a form of control that regulation theorists know as architectural or design-based techniques. In this sense, algorithmic regulation would only be an application of techniques already known.

- Algorithmic regulation seeks to coordinate the activity of individual and non-human agents, and to that extent, it becomes a novel form of social order. Thus, algorithmic regulation can come to reflect different types of pre-established political, normative, or ideological agreements and commitments.

- Considering the dominant position of tech giants, the development and improvement of algorithms will be led by them, rather than by government authorities. Although, we cannot ignore some efforts of state authorities to focus their intervention on information and data collection.

- Most criticisms of algorithm-based systems indicate that their implementation is reserved for industrialised and democratic societies. However, it is pivotal to understand that the adoption of algorithmic regulation is a double-edged sword. Thus, it is necessary to open the debate about the impact it can have in all types of societies, not just industrialised ones.

There are several trends built within the growing interest in explaining the phenomena associated with algorithmic regulation. One approach considers that algorithmic regulation is a complex technical-social system [12] that may have redistributive effects, positive social impact, reinforce social dynamics, and / or create interdependencies in the social group. In fact, algorithmic regulation provides an efficient mechanism to coordinate activities between different networks. However, not all the results achieved are predictable or anticipated by its designers.

Much of the considerations regarding algorithmic regulation take as a starting point ancient debates on the development of large-scale technological systems. However, algorithmic regulation brings some really novel features, such as machine learning [13], prediction of future behaviours, the possibility of continuous update of the algorithm, thus preventing it from becoming a deterministic tool, and the ability to feed the algorithm's information system in a decentralised manner [14].

References

- Stephen Hawking, Brief Answers to the Big Questions (John Murray Publishers, 2018) 199.

- Douglas W. Arner, Janos Barberis, y Ross P. Buckley, FinTech and RegTech in a Nutshell, and the Future in a Sandbox, 2017, The CFA Institute Research Foundation, p.p.299.

- Ibid.

- Shirish Netke, “RegTech and the Science of Regulation” en Janos Barberis, Douglas Arner y Ross Buckley, The RegTech Book: The Financial Technology, Handbook for Investors, Entrepreneurs and Visionaries in Regulation,2019, pp. loc. 2662.

- Ver Ligia Catherine Arias Barrera, Impacto del FinTech en al Regulación Financiera en Ingrid Ortiz (ed), Libro Colectivo Derecho de la Competencia y las TIC, 2020, Universidad Externado de Colombia, (En proceso de publicación).

- Zeeshan Rashid, “Technology-Enable Collaborative Compliance” en Janos Barberis, Douglas Arner y Ross Buckley, The RegTech Book: The Financial Technology, Handbook for Investors, Entrepreneurs and Visionaries in Regulation,2019, pp. loc.1213.

- Ibid. pp. loc.1324.

- Karen Yeung y Martin Lodge, Algorithmic Regulation,2019, Oxford University Press, pp. 4.

- Karen Yeung, “Algorithmic Regulation: A Critical Interrogation” (2018) Regulation and Governance Vol 12. 4, pp.505.

- S Zubboff, The Age of Surveillance Capitalism (Profile Books 2019).

- Karen Yeung y Martin Lodge, Algorithmic Regulation,ibid (n 43) 5.

- Fundado en la noción creada por Thomas Hughes en 1983. Thomas Hughes, Networks of power; Electrification in Western Society, 1880-1930 (Johns Hopkins University Press 1983).

- Es un método analítico que permite que un sistema, por sí mismo —sin intervención humana y en forma automatizada—, aprenda a descubrir patrones, tendencias y relaciones en los datos.

- Council of Europe, “A Study of the Implications of Advanced Digital Technologies (including AI systems) for the Concept of Responsibility within a Human Rights Framework” MSI-AUT (2018) 05 rev.