Why Europe’s asset-based finance deserves the spotlight

Private credit has established itself as a core allocation for institutional investors. Within that universe, corporate direct lending has been a driving force, offering scale and a track record of delivering attractive risk‑adjusted returns. However, as the asset class continues to mature, many investors are naturally looking at how to expand their existing private credit allocations, whilst also improving diversification. In this context, asset-based finance (ABF) is gaining deserved attention. Patrick Connors, Global Head of Private Credit, DWS, unpacks it all before the SuperReturn Private Credit Europe event.

Enter asset-based finance

Asset-based finance expands the opportunity set beyond corporate cash flow lending. Rather than relying on enterprise value and sponsor backing, ABF transactions typically focus on hard assets or pools of financial assets, such as consumer loans, auto finance, mortgages, and equipment leases – in both cases, those assets generate contractual cash flows largely uncorrelated to corporate credit.

Key features of asset-based finance

One of the distinguishing features of ABF is the strong structural defensiveness built into transactions. Asset purchases are typically executed through bankruptcy remote SPVs, ensuring that legal ownership of the receivables is fully separated from the originator’s balance sheet. This segregation helps to protect investors from the originator’s credit risk: if the seller becomes insolvent, the asset pool remains ringfenced and continues to generate cash flows for the benefit of the investor-owned vehicle.

Alongside this structural protection, ABF transactions emphasize operational continuity, given the critical role of servicing in maintaining cash flow performance. Transactions typically incorporate backup servicing arrangements to ensure collections continue should the primary servicer deteriorate or fail. Testing these arrangements is key to ensuring they work if needed in a downside.

In addition to structural and operational safeguards, private ABF transactions can incorporate bespoke credit enhancement and performance-based protections, designed to provide loss absorption capacity. These include overcollateralisation, purchase price discounts, excess spread trapping, and strict eligibility criteria. Furthermore, performance measures, such as delinquency and default rates on pools of receivables, can act as effective and timely triggers for additional protections, helping preserve value and limit tail risks for investors.

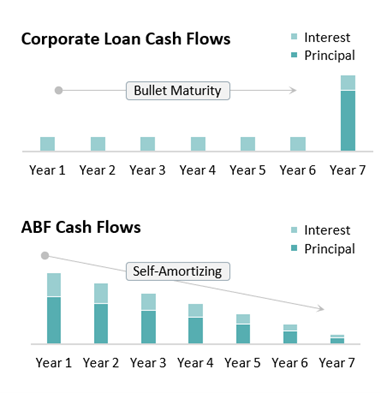

Finally, it’s worth highlighting that ABF transactions often comprise self-amortising underlying assets. As receivables are repaid over time, principal is returned gradually rather than concentrated at maturity. This natural amortisation reduces reliance on refinancing markets and shortens risk exposure as the pool ages.

Why asset-based Finance is gaining momentum

The growth of asset-based finance is closely linked to the continued retrenchment of banks from balance sheet-intensive lending. Regulatory frameworks such as Basel III and IV have increased the capital cost of holding many asset-backed exposures, even where the underlying credit quality remains strong.

As a result, banks are increasingly looking to:

- Reduce exposure to capital‑intensive lending

- Partner with private capital to fund asset origination

- Transfer risk while maintaining client relationships

At the same time, advances in technology and data analytics have enabled specialist non-bank lenders to originate, monitor and service granular asset pools more efficiently. Together, these forces are expanding the investable universe and creating a steady pipeline of opportunities for private capital.

Why Europe is particularly attractive

Firstly, regulatory pressure is felt acutely by European banks, where retrenchment continues to drive growth in non-bank lending activity, and there is little sign of easing.

Secondly, Europe’s fragmented nature and strong reliance on private markets create a diverse opportunity set across both countries and asset types. While this complexity raises the bar for managers, it also supports a premium for those with deep local expertise, broad origination networks, robust servicing oversight and strong structuring capabilities.

Finally, large parts of the ABF market are directly or indirectly anchored in retail credit, where fundamentals have historically been resilient. Household balance sheets are more conservative, and borrowers typically display a higher propensity to pay, in addition to broader social security systems and tighter regulatory standards.

Portfolio construction benefits

From an allocator’s perspective, the case for ABF is straightforward. It introduces:

- Diverse collateral types

- Different cash flow dynamics

- Lower reliance on sponsor behaviour and refinancing cycles

Overall, ABF can help broaden income sources, reduce concentration risk and enhance overall portfolio resilience, while remaining firmly within the private credit universe, which offers a meaningful pricing premium versus public fixed income markets.

Sidebar: Questions LPs Should Ask Before Allocating to European ABF

- Strategy definition and scope

ABF spans a wide spectrum from large, single asset financings (e.g., aviation, real estate–backed loans) to highly granular portfolios of smaller credits, such as consumer, mortgage, credit card or SME loans or receivables. LPs should understand exactly which part of the ABF universe a manager targets and how that strategy complements existing private credit exposures within their portfolio.

- Origination advantage and sourcing durability

A manager’s ability to source high-quality assets is central to performance. LPs should evaluate how proprietary the sourcing channels are and the concentration of any reliance on specific platforms or dealer networks.‑quality

- Jurisdictional and regulatory competence

Europe’s fragmented legal and regulatory landscape demands true local expertise. LPs should assess which jurisdictions the team can genuinely underwrite, including knowledge of enforcement regimes, consumer protection laws, licensing requirements, and the operational realities of cross-border structuring.

- Alignment, governance, and partner dynamics

ABF asset managers may utilise bank partnerships or platform relationships. LPs should understand who ultimately controls investment decisions, how economics and risk are shared, and how conflicts are managed.

Private Credit involves illiquid, long‑term investments with no guarantee of capital preservation or returns. Fund performance is exposed to macroeconomic, market and assumption risks, including interest rates, credit conditions and valuation uncertainty. Reliance on manager judgment, third‑party data and key personnel may impact investment outcomes. Structural risks include limited liquidity and leverage amplification.

In EMEA for Professional Clients (MiFID Directive 2014/65/EU Annex II) only. In Switzerland for Qualified Investors (Art. 10 Para. 3 of the Swiss Federal Collective Investment Schemes Act (CISA)).

DWS is the brand name of DWS Group GmbH & Co. KGaA and its subsidiaries under which they do business. The DWS legal entities offering products or services are specified in the relevant documentation. DWS, through DWS Group GmbH & Co. KGaA, its affiliated companies and its officers and employees (collectively “DWS”) are communicating this document in good faith and on the following basis.

This document is for information/discussion purposes only and does not constitute an offer, recommendation or solicitation to conclude a transaction and should not be treated as investment advice.

This document is intended to be a marketing communication, not an investment recommendation/ investment strategy or financial analysis. Accordingly, it may not comply with legal obligations requiring the impartiality of an investment recommendation/ investment strategy or financial analysis or prohibiting trading prior to the publication of such documents.

Any opinion expressed hereby reflects our current view and it is subject to change without prior notice.

This document contains forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. No representation or warranty is made by DWS as to the reasonableness or completeness of such forward looking statements. Past performance is no guarantee of future results.

The information contained in this document is obtained from sources believed to be reliable. DWS does not guarantee the accuracy, completeness or fairness of such information. All third-party data is copyrighted by and proprietary to the provider. DWS has no obligation to update, modify or amend this document or to otherwise notify the recipient in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Investments are subject to various risks. Detailed information on risks is contained in the relevant offering documents.

No liability for any error or omission is accepted by DWS. Opinions and estimates may be changed without notice and involve a number of assumptions which may not prove valid.

DWS does not give taxation or legal advice.

This document may not be reproduced or circulated without DWS’s written authority.

This document is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, including the United States, where such distribution, publication, availability or use would be contrary to law or regulation or which would subject DWS to any registration or licensing requirement within such jurisdiction not currently met within such jurisdiction. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions.

© 2026 DWS Investment GmbH. Issued in the UK by DWS Investments UK Limited which is authorised and regulated in the UK by the Financial Conduct Authority © 2026 DWS Investments UK Limited.

109121_1.0 February 2026