Why LPs are turning to Europe – and how GPs can respond

There’s a shift underway in global private equity allocation, and it’s moving firmly toward Europe.

According to Private Equity International data, Europe-focused funds accounted for 15% of global capital raised in H1 2025, up from 9% for all of 2024[1]. And as Bain notes[2], while the US private equity market remains the world’s largest, it's no longer the default destination. Some institutional investors – especially those in countries where US trade relations are strained – are rethinking their allocations. About a third of Canadian and European LPs say they expect their private equity exposure to lean more heavily toward Europe in the years ahead.

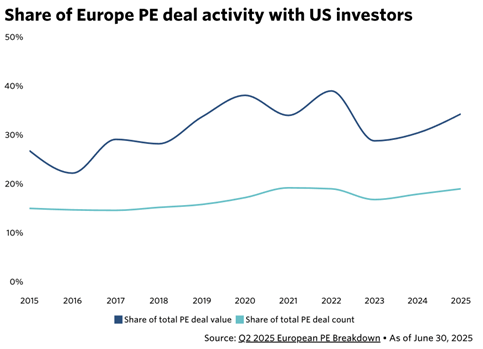

According to Pitchbook data, US investors participated in 19% of all European PE deals in the first half of 2025 – up from 17.9% in 2024 – contributing over a third of overall deal value. Their growing share of the pie is particularly evident at the upper end of the market, highlighting renewed interest in large-scale cross-border deals. Eight of the 10 largest European PE transactions in Q2 involved at least one US sponsor[3].

For European GPs, this presents a significant opportunity. But securing commitments takes more than just showing up. The fundraising environment is resilient but selective so GPs must clearly articulate what sets them apart, demonstrating differentiated access to the market, telling a compelling and credible story, and making every LP interaction count.

Here are five things European private equity managers should keep in mind to stand out when looking to secure capital from across the pond:

- Sharpen and communicate your edge

Competition for capital among European GPs is fierce. To stand out, GPs need to articulate their edge clearly – whether it’s a sector or geographic focus, deep operating expertise, or consistent sourcing performance. In a crowded market, your USP must be unmistakable, and repeated clearly and consistently through presentation decks, meetings, websites, the media and data rooms. - Tell the right story, the right way

LPs want to understand not just what you invest in, but how and why. In other words, they want conviction, clarity and context. This means articulating your thesis and team credentials, and doing that in a way that resonates with a transatlantic audience. Why this market? Why now? What makes you uniquely qualified to execute? How are you adding value? - Use LP face time wisely

Private equity remains a relationship-driven industry, and face-to-face meetings are crucial. LP surveys continually point towards the importance of face‑to‑face interactions in influencing manager selection decisions. Industry events offer a window for GPs to make lasting impressions, especially with investors flying in from overseas. But time is tight and attention spans are short. So come prepared to speak to your impact, co-investment opportunities, pipeline and performance. And make sure you follow- up with

substance to keep the dialogue going. - Show deal-sourcing prowess

With more than half of GPs struggling to find quality deals (particularly undervalued or high-growth opportunities)[4], a GP’s deal‑sourcing capabilities can go a long way. LPs want to know you can access what others can’t. That means showcasing proprietary sourcing channels, local relationships and co-investment discipline as key differentiators. - Be ready on ESG and disclosure

The ESG conversation is shifting, especially for transatlantic capital flows. Politicised anti-ESG rhetoric in the US has prompted a sharper focus on value creation. This means generic ESG messaging is no longer cutting it. Any narrative around sustainability must come with more rigour around its role as both a value creation lever and risk management tool. To earn trust and build credibility GPs must be ready with comprehensive frameworks, tangible KPIs, independently verified data and leadership accountability. European GPs have an opportunity to double down and cement their leadership in the sustainability space. But this is only possible if they have the data to back up their messaging.

For European GPs with a compelling story, and the clarity to tell it, the next wave of LP capital isn’t just curious. It’s ready to commit.

With thanks to Gregory for their contribution to this article.

[1] https://media.privateequityinternational.com/uploads/2025/07/h1-2025-fundraising-report-pei.pdf

[2] https://www.bain.com/insights/private-equity-midyear-report-2025/

[3] https://pitchbook.com/news/articles/the-bargain-hunters-are-back-us-investors-boost-their-european-pe-participation

[4] https://www.msci.com/research-and-insights/paper/the-2025-general-partner-survey