2017 a record year- and a remarkable decade for fixed income

2017 was a landmark year for global fund flows. The inexorable march of passive continued, but there were also shining spots of opportunity for active managers. At FundForum this year we’ll share what our data and insights show about the opportunities which have been seized by asset manager leaders across the active and passive spectrum. However, no discussion of 2017 could be complete without talking about the performance of fixed income.

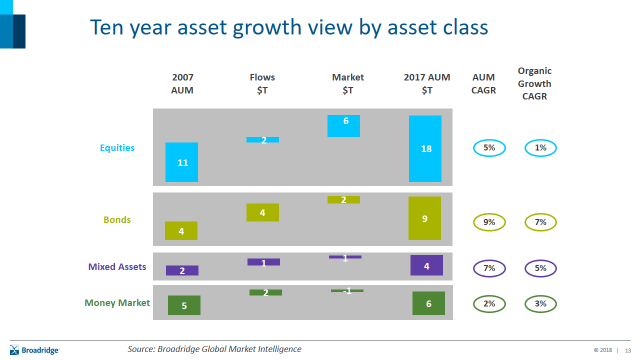

Fixed income has had an impressive 10 years, demonstrating the fastest asset growth of the broad asset classes, driven mostly by inflows as demonstrated by the average annual inflow or organic growth of 7% per year over the decade. A supportive US monetary policy beginning before the crisis, followed by an exceptional one since, have acted as substantial tail winds to asset values. In addition multiple long term structural trends have boosted investor appetite for the asset class - retirees looking for income, pension plans looking to match liabilities and new capital adequacy regulations focused on risk reduction. The end result has been $4 trillion of fixed income net flows available to asset managers over the last 10 years, double the equity experience.

The 10 year growth story - by asset class

The hunt for yield – go flexible, go global

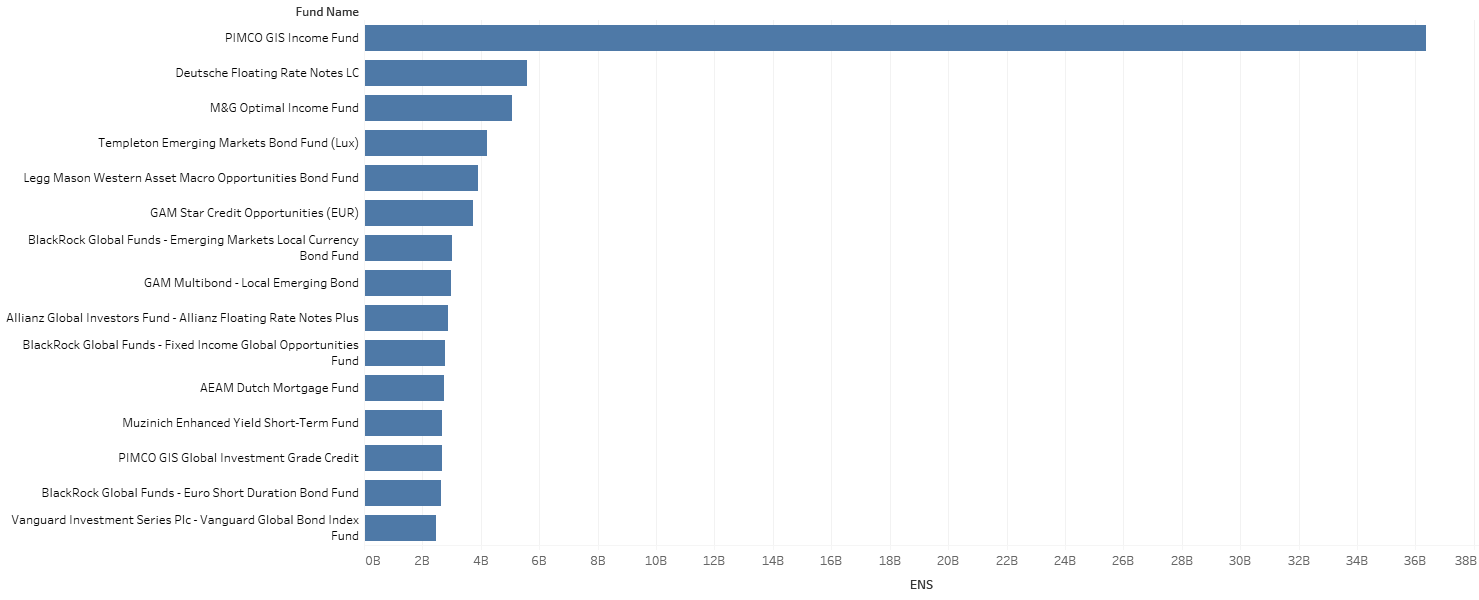

The global hunt for yield has profoundly impacted the investment portfolios of retail and institutional investors alike. Public fixed income instruments held to maturity are not sufficient to achieve investors’ yield goals. One of the features of the new landscape has been a shift into more ‘allocation focused’ fixed income portfolios with a new set of popular products emerging– flexible fixed income, multi-sector, unconstrained, multi-asset credit, to name but a few. A matrix graphic showing the variability of credit sector performance over time has become a mainstay of any fixed income sales presentation, and a key justification of this allocation approach. PIMCO has executed a master class in this type of flexible strategy in the form of its GIS Income fund. The active fixed income strategy is focused on generating income and preserving capital across a broad opportunity set, and has dominated industry net flow rankings. In an era where passive typically steals the headlines, this is a strong counterpunch for active. It is also not alone, with M&G Optimal Income and Legg Mason Western Asset Macro Opportunities also gaining significantly during 2017.

Emerging markets have also been a key theme and essential tool in the ‘hunt for yield’ toolkit. The EM debt landscape has changed significantly over the last 10 years, moving beyond the traditional hard currency space and evolving into a diverse asset class with many sub sectors and varied return drivers. One of the biggest changes to the dynamics of the market has been the rising domestic appetite for local currency bonds, reducing the volatility of this asset class, whilst increased local issuance has boosted the supply and so liquidity available. Rising EM corporate issuance prompted the launch of dedicated EM corporate bond strategies, and the ongoing development of the ‘blended’ EM space – strategies which invest in both hard and local currency, a space which has seen strong support from investors in 2017. Franklin Templeton, BlackRock, GAM, Amundi and Ashmore have all benefited from a fantastic year for EMD. However as more firms launch EM strategies, either as standalones or part of a multi-sector offering, this is a space that will continue to be highly competitive.

The next phase emerges - Rate rise protection

As monetary policy enters a new era, we see a consensus from investors settling around a slow rising of the short end of the yield curve, but a split view on the risks of inflation. Investors will look to balance new opportunities for yield at the same time as protecting asset values against rising rates. In 2017 we have seen these new needs materialize through increasing allocations to short duration and floating rate strategies. German giants Deutsche and Allianz Global Investors have both been beneficiaries of this theme, with strong flows into both of their flagship floating rate strategies – Deutsche’s fund is number two behind PIMCO in the graphic above. Muzinich Enhanced Yield Short term fund and BlackRock’s Euro Short Duration Bond fund are also notable, both coming in the top 15 fixed income strategies in 2017, as investors look for opportunities at in short duration.

What next?

The next 10 years may present more challenges to fixed income investors but the structural drivers will continue to channel flows as demands for regular income will only get stronger. Global macroeconomics may be the ultimate governor of the shape of the fixed income industry, but asset managers have shown themselves to be innovative in the face of whatever can be thrown at them. New approaches (e.g. factor) and vehicles (e.g. ETFs) will further equip investors to cope with changing conditions and present opportunities to asset managers.