A disciplined approach to international ex-U.S. equities

At Boston Partners, we embrace an approach developed in the 1980s for U.S. large-cap equities. Over the years, we have successfully adapted it across a wide range of market capitalizations, and we began applying it internationally in 2004. This broadened application reflects our belief that the time-tested approach used in the U.S. market applies equally well to a global universe of stocks.

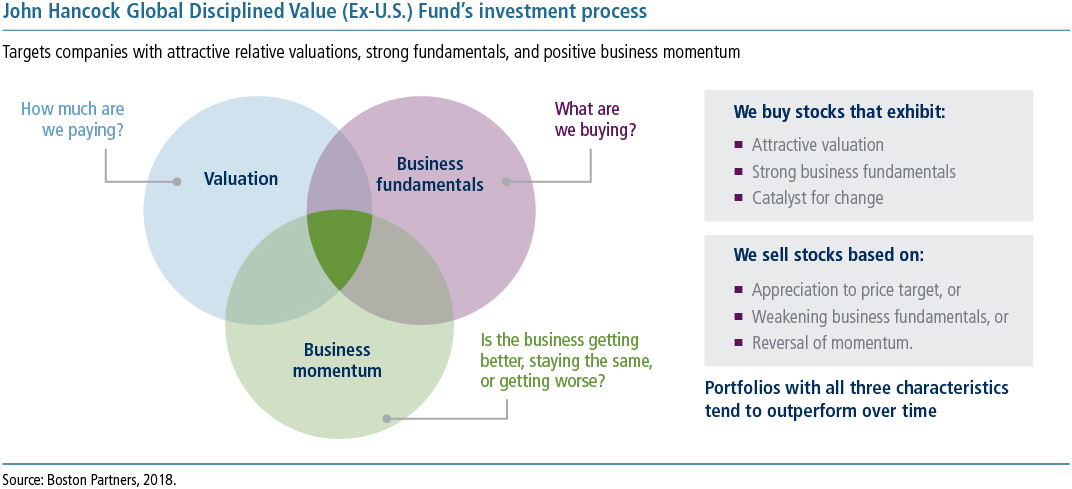

Critical elements of stock selection

This belief is rooted in our conviction that, irrespective of where a company is headquartered, stock performance is driven by the same set of characteristics that make up the three critical elements of our stock selection: attractive valuations, strong business fundamentals, and a positive catalyst for change. Stocks selected for our equity portfolios must exhibit each of the following attributes:

- Low valuation, meaning that they must be cheaply or reasonably priced relative to the market

- Positive business momentum, or the ability to grow earnings

- Good business fundamentals with strong cash flow

This approach works, in our view, because in our experience low-valuation stocks have been shown to outperform higher-valuation stocks over time.1 Meanwhile, companies with strong fundamentals, such as high returns on invested capital, tend to outperform those with poor fundamentals. Stocks with positive business momentum resulting from improving trends or rising earnings generally outperform those with negative momentum.

Fundamental analysis is key

While macroeconomic factors such as falling currencies or monetary policy affect all markets, top-down approaches that incorporate such factors cannot identify the best long-term opportunities, in our view. We favor a bottom-up approach based on a repeatable process applied to each stock, without specific regard to industry sectors, currencies, geographic regions, or countries.

Small- and mid-cap flexibility

One distinct feature of our approach relative to many ex-U.S. equity funds is our flexibility to invest across the market capitalization spectrum, from small to mid to large caps. This creates a broader opportunity set than those available to peers focused primarily on large caps. Our approach to identifying bottom-up equity opportunities can result in the fund meaningfully varying its market cap exposure relative to its benchmark, the MSCI EAFE Index, which is designed to capture large- and mid-cap representation across ex-U.S. developed markets, but not small caps. In our view, small- and mid-cap ex-U.S. stocks make up a uniquely overlooked universe of opportunities where skilled investment managers can truly add value.

Identifying market dislocations

As a result of our unique process, we often do not follow the herd instincts of the broader market, which tends to react to news events and tries to predict earnings with near-perfect precision. Inevitably, something goes wrong, the broad market overreacts, and many companies’ share prices fall disproportionately to the issues that their businesses face. We believe that stocks exhibiting such dislocations between a company’s valuation and its business fundamentals offer the best potential to limit downside risk in falling markets while keeping pace in rising markets, and to generate long-term growth of capital.

Boston Partners will be at FundForum International in Berlin, 11-13 June. Find out more about the world's premier wealth management event >>

1 Boston Partners, 2018

The opinions expressed are those of Boston Partners as of May 2018 and are subject to change. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index. John Hancock Funds, LLC, John Hancock Advisers, LLC, and their affiliates, employees, and clients may hold or trade the securities mentioned in this commentary. Past performance does not guarantee future results.

Diversification does not guarantee a profit or eliminate the risk of a loss.

Global investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Hedging and other strategic transactions may increase volatility and result in losses if not successful. Please see the funds’ prospectuses for additional risks.

John Hancock Worldwide Investors, PLC (company) has been authorized in Ireland as a UCITS fund pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulation 2011, as amended. Certain funds of the company have also been authorized for retail sale in Austria, Germany, Italy, Spain, Switzerland, and the United Kingdom.

Shares of John Hancock Worldwide Investors, PLC are only available for certain non-U.S. persons in select transactions outside the United States or, in limited circumstances, otherwise in transactions that are exempt from the registration requirements of the U.S. Securities Act of 1933, as amended, and such other laws that may be applicable. Fund shares may only be sold in accordance with applicable law.

This material does not constitute or contain an offer, solicitation, recommendation, or investment advice with respect to the purchase of any security in any jurisdiction. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment. This and other important information is contained in the prospectus and other disclosure documents. Read these documents before investing. To obtain a prospectus for any John Hancock UCITS fund, visit us at jhworldwideinvestors.com. Prospective investors should also consult their professional advisors as to the suitability of any investment in light of their particular circumstances and applicable citizenship, residence, or domicile.

© 2018 John Hancock Funds, LLC and affiliated companies. All rights reserved. Member FINRA. 601 Congress Street Boston, MA 02210-2805 +1 800-225-6020 jhworldwideinvestors.com

OF451296