A 2014 study[1] on America’s massive Corn Belt showed the crop is becoming increasingly vulnerable to the effects of global warming. Scientists predicted a troubling reduction of yields, possibly up to 30 percent over the next 50 years, if the plant is unable to adapt to dryer and hotter conditions. In the same way that the acceleration of climate change threatens to render crops that have flourished for thousands of years unfit for their environment, the transformation hitting the investment industry is endangering incumbents’ traditional growth models.

Our industry is in the midst of profound change. Regulators and investors are increasing their scrutiny of asset managers and demanding more transparency. Many active fund managers have struggled with their performance and how to navigate the rise of passive strategies. Meanwhile, some pension funds have begun to lower their assumed rates of return, even as they face strong pressure to deliver secure retirement outcomes for their members.

New research from State Street[2] reveals that two-thirds of industry respondents believe that growth is more challenging to achieve in the current market environment. Yet optimism is surprisingly high, with 75 percent expressing confidence they will achieve their growth objectives over the next five years, driven largely by a belief that strong macroeconomic conditions will translate into growth for their businesses. This optimism may be misplaced, as disruptive technology, market shifts and complex regulations are creating a new set of growth conditions, favouring the firms who can re-engineer themselves to flourish.

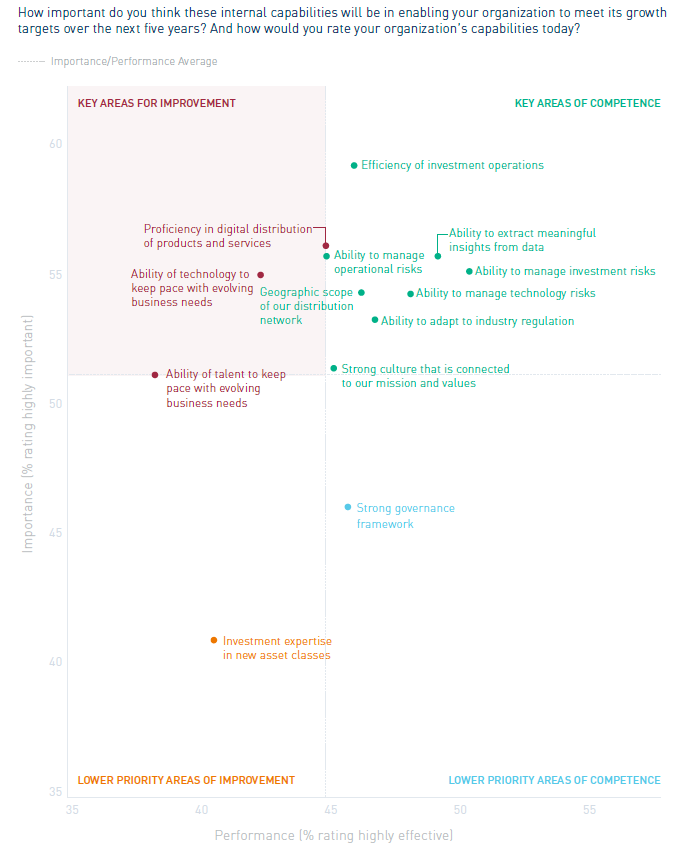

Our Growth Gap Matrix identifies the competencies that are crucial for future growth, yet are relative weaknesses for investment institutions today:

- Ability of technology to keep pace with business needs;

- Adequacy of talent to meet evolving business model;

- Proficiency in digital distribution.

Growth Gap Matrix

Today, asset managers and asset owners can no longer rely on economic growth alone to help drive strong results. Financial institutions must build a new platform for growth that will allow them to:

- Compete at scale

- Align technology with ambition

- Cultivate asset intelligence

Compete at scale

Mounting compliance requirements and demand for customized, diversified investment solutions will require managers and investors to adopt a new approach to scale. Asset managers believe a high level of industry consolidation will persist over the next five years: 76 percent say the rise of passive management will drive more active managers to consolidate, and three-quarters say increasing regulation will make it harder for smaller managers to survive on their own.

The need to achieve economies of scale spans both investment and operations. Our research shows strong interest in co-investment strategies to access more attractive opportunities, as well as appetite to outsource operational areas that aren’t “mission critical,” which can free institutions to more effectively pursue their growth agenda.

Align technology with ambition

Only 43 percent of the industry says it is adapting technology quickly enough to support business growth needs. Institutions must integrate often disparate systems and drive automation across the back, middle and front office. But they must also build a platform that is flexible enough to accommodate future growth and harness new technologies. For asset managers, the provision of user-friendly mobile access to investments, as well as automated advisory services, will be important differentiators to enable future growth.

Cultivate asset intelligence

As the investment industry becomes increasingly digital and investors seek to construct diverse portfolios, institutions need the power of deeper data insight across every facet of the investment cycle to optimize investment performance, risk management and operational efficiency. Machine learning and deep data algorithms will play a critical role in enabling a real-time, sophisticated analysis of risk. But a new asset intelligence-led model can only succeed if it is backed by the right talent and an organizational culture that embraces new strategies and perspectives.

Fortunately, our industry has a long track record of resilience and reinvention. Our research shows that across the industry, institutions recognize their existing models may fall short. But at the same time, we see plans underway to transition to a new model. With the right tools and talent in place, incumbents can thrive in the new climate for growth.

To discover how the industry is progressing toward a new growth model, read our new report.

[1] David B. Lobell et al., “Greater Sensitivity to Drought Accompanies Maize Yield Increase in the US Midwest,” Science, May 2, 2014.

[2] State Street, A New Climate for Growth – Cultivating Asset Intelligence to Thrive, June 2017. This research is based on a State Street survey of 507 senior executives at investment organizations, insurance companies and official institutions, conducted by Longitude Research on behalf of State Street during March and April of 2017. The respondents were drawn from 19 countries in Americas, Europe and Asia Pacific (including official institutions – e.g. sovereign wealth funds and central banks, pension and retirement funds, insurance companies, foundations, charities, endowments and asset management firms).

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street’s express written consent.

State Street Corporation, One Lincoln Street, Boston, MA 02111-2900.

© 2017 State Street Corporation - All Rights Reserved

Exp. Date: 6/30/2018

CORP -3063