The sponsorless lending market seems to be growing – but should you go for sponsored lending or sponsorless lending? Which option gives investors better risk-adjusted returns, and how do you determine which strategy works best for you? We hear from Gabriella Kindert, Expert in Alternative Lending and Board Member at Mizuho Europe, as she analyses the current market trends and deciphers the differences between the two strategies.

Currently, about 80% of Private Debt transactions involve financial sponsors who, in addition to equity capital, are seen as instrumental in improving financial transparency and governance.

Nonetheless, the vast majority of debt financing required in our economy happen without these financial sponsors. Many family-owned companies are run professionally and may not be interested in selling their businesses. Entrepreneurs often do not want to dilute their equity value, but still require flexible funding solutions to support their growth expansion plan. These opportunities fuel the so-called “sponsorless” market in private lending.

In our panel discussion at SuperReturn Private Credit Europe 2019, we investigated how this sponsorless market has evolved from the investors’ perspective. Does it offer a better risk-adjusted return and investment proposition?

Here are the key takeaways:

1) The growth of the sponsorless market will continue

The European economy depends on family-owned businesses that do not want to dilute their business or change ownership. However, owners are becoming increasingly familiar with the concept of Alternative Lending / Private Debt, and the asset class became known and accepted in the last decade.

Due to the contraction of banks from the market, the funding gap for SMEs is still estimated to be EUR 2-3 trillion. This will be partially addressed by:

- digital solutions provided by new companies like Funding Circle

- more traditional Private Debt providers that in the higher EV segment can more efficiently service clients by traditional underwriting methods.

We have only seen the beginning phase of this market opportunity and a variety of financing solutions are emerging.

2) Sponsorless transactions have a 150-200 bps yield premium (“governance premium”)

Because each transaction is bespoke, it is an arduous task to find an objective assessment regarding the level of the premium on like-to-like basis. Further, specific features are linked to some regional elements and supply/demand factors change over time, such as the availability of traditional financing sources (banks) and other capital market conditions.

According to Cliffwater, in the US market, there is a 230 bps yield premium for holding debt of companies not controlled by private equity firms, which is referred to as the governance premium.

Sponsorless borrowers might be assessed as riskier because of management behavior, particularly under corporate distress. These deals may be more difficult to source. However, considering the more balanced relations and the consequent bargaining power between lenders and borrowers (less push and support from PE on terms), sponsorless transactions may have more lender-friendly terms and pricing.

3) The required skill set and key success factors are different

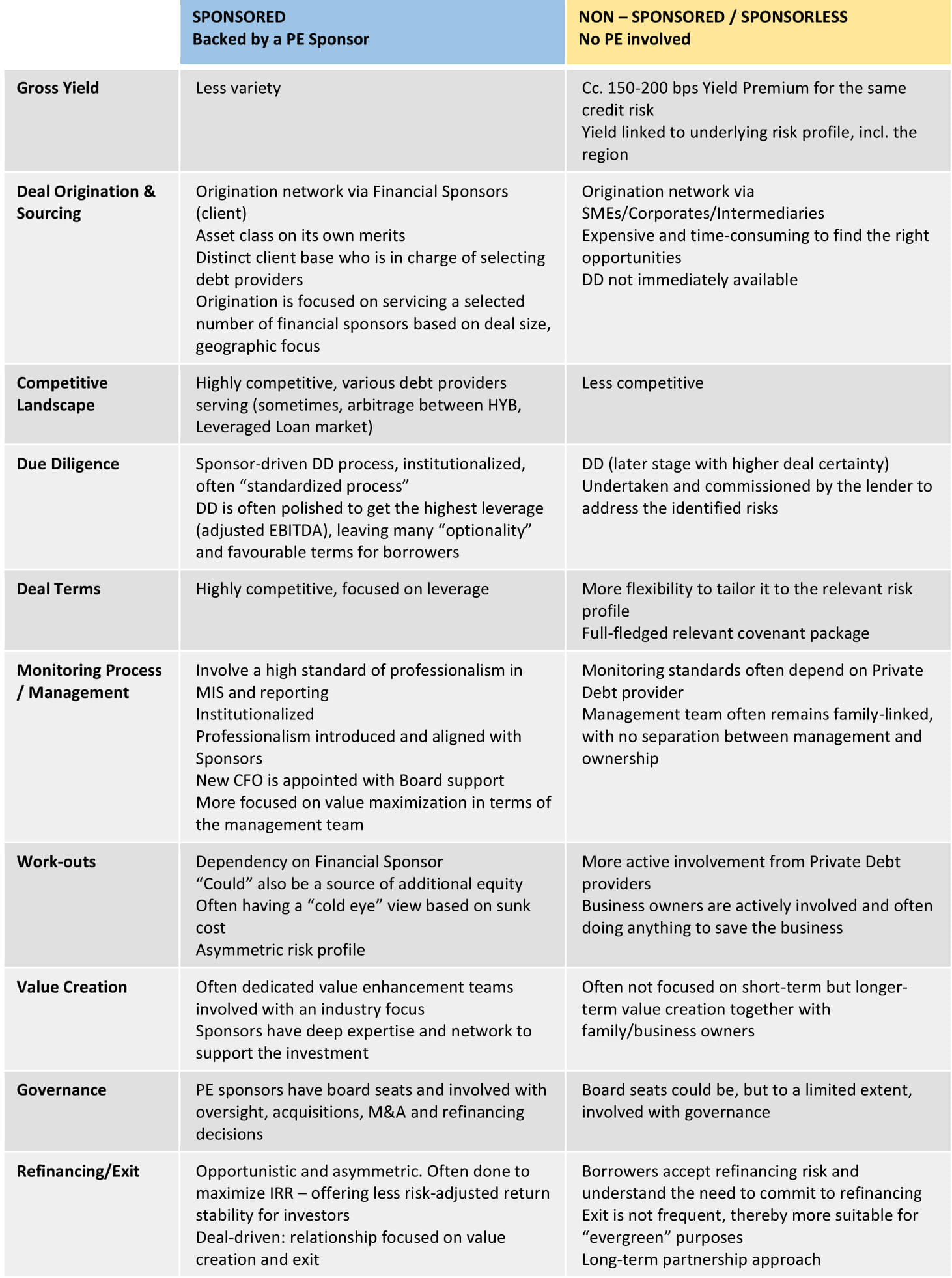

The drivers of the deal sourcing, structuring, monitoring, and exit process are different in these two segments.

Consequently, the key success factors also differ and in the case of Due Diligence process of GPs these factors need to be taken into account with different weight.

4) Sponsorless transactions require additional work from GPs.

Due to higher sourcing, network requirements and structuring complexity, GPs need to do more work. In the sponsor-driven world, business originations can be more focused on a selected group of clients who drive terms and select debt providers.

In a sponsorless market, GPs need to scan and review a larger market. Subject matter experts estimate that executing and monitoring a similar EV transaction, in the sponsorless universe requires 50-100% more working hours. This implies that for the same size of the portfolio (AUM), there is a higher personal and consequently, running costs. GPs seem to bear this extra cost because fees do not seem to be structurally higher for “sponsorless” strategies. (This could also be the reason why many GPs focus their strategies on financial sponsors.)

Consequently, the value from the portfolio and the additional risk-adjusted return seems to be captured by the investor.

So, is the sponsorless market a wise choice for investors?

- There seems to be a yield premium for sponsorless transactions.

- Based on the Probability of Default and Recovery estimates, expected loss seems to be favorable due to the better balance and bargaining power of lenders.

- Considering that the extra work and costs are mostly born by GPs, the investment proposition in terms of net return seems favorable for investors.

- Further, there are diversification opportunities as a larger investment universe can be addressed.

As you may have noticed, I bolded my “seeming” conclusions above because the truth is, opinions diverge regarding the actual and expected loss figures on sponsor-driven and sponsorless transactions. Some subject matter experts claim that the financial support from sponsors is far less profound and the memory of lenders fade quickly. Moreover, you will not be hard-pressed to find GPs/LPs who believe in one more than the other.

I say the verdict is in the numbers. As more and more data come in about the actual support and added value of financial sponsors and performance data on portfolios, we will know in a few years which is a better path. Time and solid data always trump opinions and besides he presence of financial sponsors many different considerations can make a difference.