Airports in a post-pandemic world

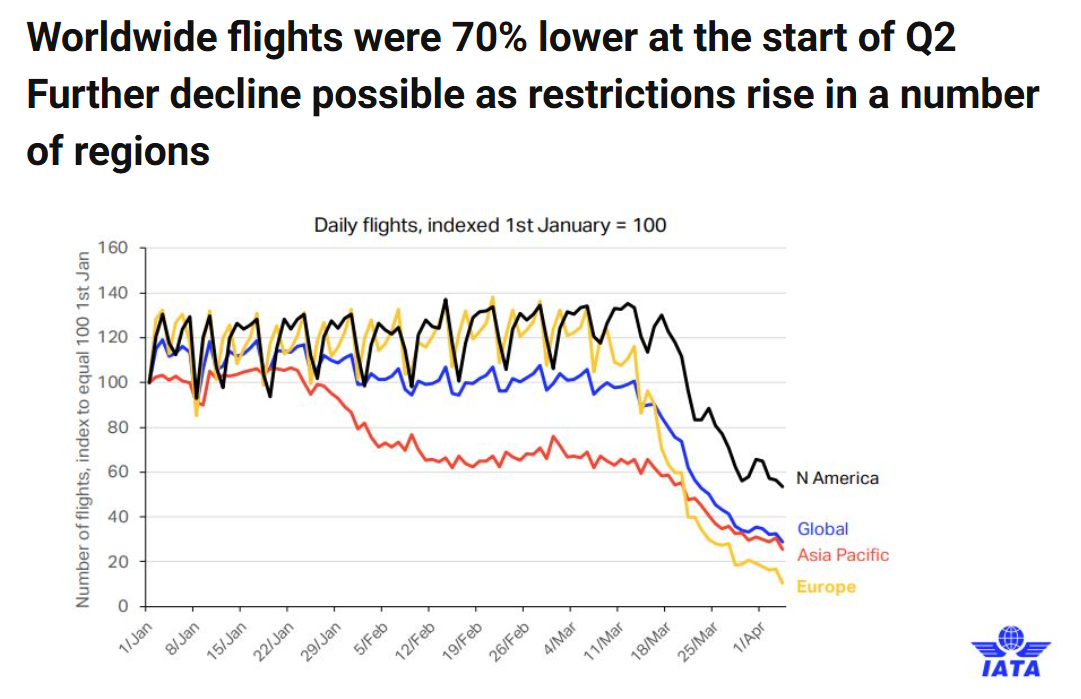

The world has been rocked and shaken by the impact of the global COVID-19 pandemic. The transportation sector has been one of the worst sectors impacted. Various numbers are being bandied about of the impact on air travel. IATA estimates over USD250 billion in lost revenues (-44% vs. 2019) in a scenario with severe travel restrictions lasting three months. IATA also projects the COVID-19 crisis will see airline passenger revenues drop by USD314 billion in 2020, a 55% decline compared to 2019.

As we plan to come out of lockdowns and travel restrictions, let’s try to assess the world after travel restrictions are relaxed and the downstream implications on airports. COVID-19 is expected to have behavioural impact on passengers. It is expected that norms like social distancing, business travel advisory restrictions, avoiding discretionary travel in the form of tourism and visiting friends and relatives will continue well beyond lifting of travel restrictions. Precautionary regulatory directives on air travel processes are expected to be put in place leading to more elaborate and time-consuming processing of passengers at airports. Certain efficiencies of work-from-home like video and audio meetings and remote working will bring about long-term changes in business behaviours and bring down the frequency of business travel.

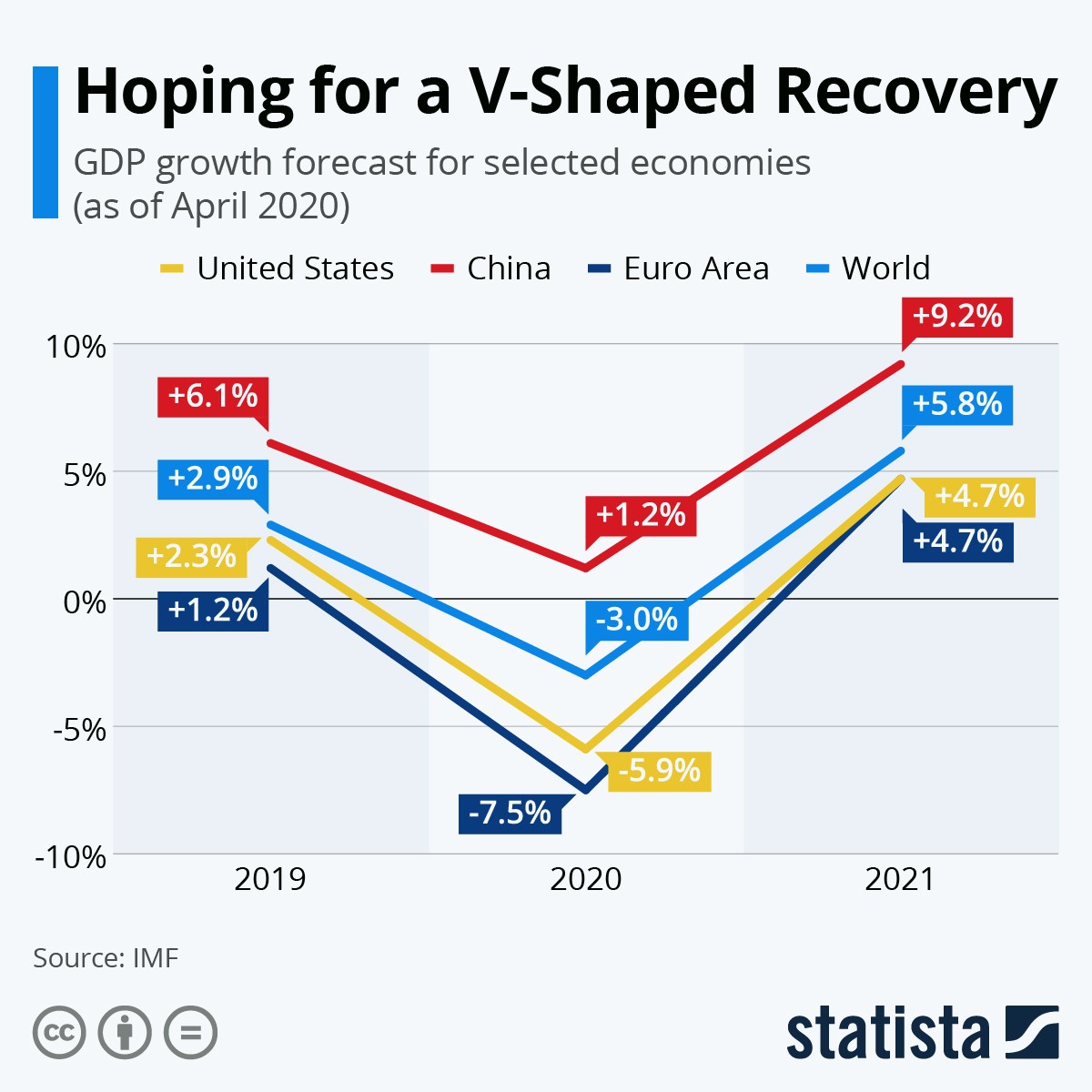

One thing is clear – this crisis has not led to destruction of physical infrastructure akin to a war. It has however created dents in human psychology to the extent that it will take a long time for people to do a simple thing like shake hands. A vaccine will accelerate the fall of these mental barriers and that may be a year away. The length of recession following the pandemic is debatable dependent on a V-shaped, U-shaped or even slower recovery.

Let’s focus on airports and understand certain key impacts

Airports need to be ready for at least a couple of years of negative growth in air travel. This may be further compounded by consolidation in the airline industry with some bankruptcies and the resultant fall in supply of airline seats. This mismatch in supply and demand of airline seats may, in the short and medium term, increase airline ticket prices and, in turn, affect traffic further. On the plus side, in my opinion, rail travel may take a harder hit. The reason is passengers may not want to risk a long rail journey in close confines of a travel tube. In this respect a much shorter air trip for a necessary travel would be preferable, of course given affordability. This is expected to in turn shift a chunk of marginal rail travellers to air travel.

Greater regulatory precautionary restrictions are expected to be put in place aimed at social distancing at airports. This in turn is likely to cause slower passenger processing and rising costs and stretching of airport infrastructure. A fall in passenger numbers can be a mitigating factor.

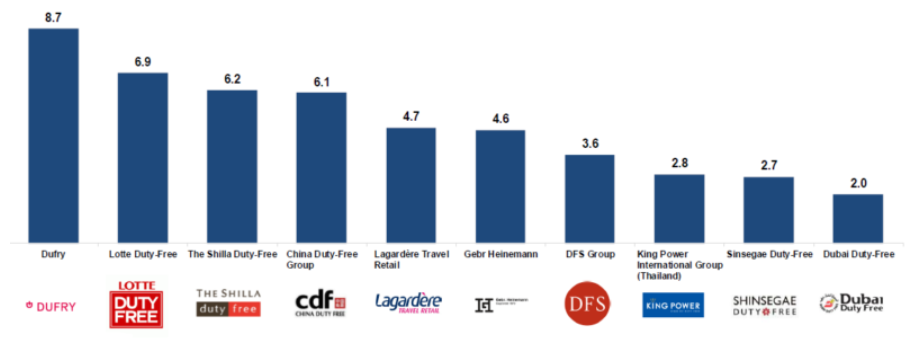

With lower passengers, airport non-aero revenues will take a hit. Concessionaires which pay minimum guaranteed amounts would seek waivers or reductions, thus impacting the downside protection such structures offer. Airports may be constrained to offer concessions since the alternate of termination may be sub-optimal since the new incumbent may offer well discounted terms apart from the dislocation and time element of changing concessionaires.

What measures can airports take in the emerging scenario?

If airports act decisively, they can emerge from this crisis fitter and stronger. A cost optimisation exercise is imperative. My view is that using technology, innovation, manpower planning, and process improvement, airport operating costs can be brought down by 15-20%. Airports would need to be aggressive in looking at their costs. This can benefit even ROI based regulated airports like Delhi and Mumbai where costs are a pass through but there is a revenue leakage on account of the revenue share on regulated aeronautical revenues. This crisis entails a critical look at business processes and cost reductions can be permanent and long term, the benefits of which flowing through in the path ahead, fast-forwarding 18-24 months down the road when air travel is expected to be normalised.

The non-aeronautical revenue mix would need to be looked at critically. Advertising revenue would be hit as it is usually the first to get impacted in a downtrend. Food and beverage (F&B) revenue may fall. In F&B, passengers may have greater confidence to shop for pre-packaged food and food that they can take across the counter. F&B revenue may also be impacted since passengers may prefer to carry food from home while travelling. Retail revenue should emerge unscathed or maybe rise since dwell time is likely to go up given regulatory precautions in processing would make passengers arrive earlier to airports. On the non-aeronautical side, airports would need to engage actively in re-negotiating with concessionaires, re-optimising space for various categories, and possibly look at some level of redesign of terminal space. I expect air cargo business to do better as businesses realign their logistics and online shopping goes up significantly.

---

Top Global Duty Free & Travel Retail (prior to COVID Crisis) | Source: Moodie Davitt

Airports will need to look at their growth plans critically. This crisis is expected to pull back growth plans by a couple of years. Those airports that are in planning stages can shelve their plans for some time. Airports that are well into construction would need to look at the designs and plans afresh to see if some cost saving and/or deferment can be undertaken on capex commitments.

On the liability side the challenges will be multi-fold for airports. Revenue share deferments, liquidity enhancing debt and debt in other forms would stretch the liability side and this compounded with lower revenues and EBITDA will create financial stress. Ideally fresh equity will need to be infused. This can be done from existing shareholders if they are deep pocketed. Alternatively, raising equity from new private investors would be in order to reduce financial stress. The problem here is that valuations have taken a deep hit due to this crisis. While this may not be the best time to raise equity, it may be unavoidable in differing doses for various airports.

In conclusion, there is light at the end of the tunnel for airports – though currently this light appears as if looking through a funnel with a very narrow end. Airports as a sector have been severely impacted no doubt, but the intensity of impact will vary airport-to-airport given size, passenger profile, cost structure, revenue profile, liability side of balance sheet, etc. Airports will need to look at their business models critically to ensure they come out fitter, healthier, and much more resilient.

---

This article was originally published by Airport IR as COVID-HQ: OPINION – Airports Getting Ready for a Post-pandemic World