Arthur Budge, President & CEO at Five States Energy Capital, discusses how oil and gas went from boom to bust and how value investors can make low-risk income based investments to take advantage of the opportunities by investing in producing oil and natural gas properties.

My favorite Yogi Berra quote is: "It's déjà vu all over again". This is such an apropos description of the oil and gas industry.

The oil and natural gas industry is very cyclical. Supply and demand are price inelastic, and small changes in supply or demand have a material impact on wellhead prices. This cyclicality is due to high operating leverage. During periods of expansion, there is a tendency to use more debt, increasing risk and volatility. This results in a recurring pattern of boom and bust.

Today, too much oil production has resulted in lower oil prices, resulting in a financial wash-out. The US is once again the world’s largest oil producer, providing the increased supplies that caused oil and gas prices to fall. Capital investment in new development (outside of shale) is slowing around the world. Consensus is that the US will remain the world’s marginal oil producer for the next decade or longer - it currently produces as much oil as the world economy demands, but only at high cost.

Solar, wind and other renewables will not have a major impact on world oil or natural gas demand for at least a decade or longer. Neither will electric cars. The most impactful change is the shift from coal to natural gas as the primary fuel used to generate electricity (natural gas now exceeds coal and will continue to take market share from coal). For the next twenty years, world demand for oil and natural gas will continue to increase, depleting the lowest cost shale formations which will result in rising oil prices.

Future oil and gas prices

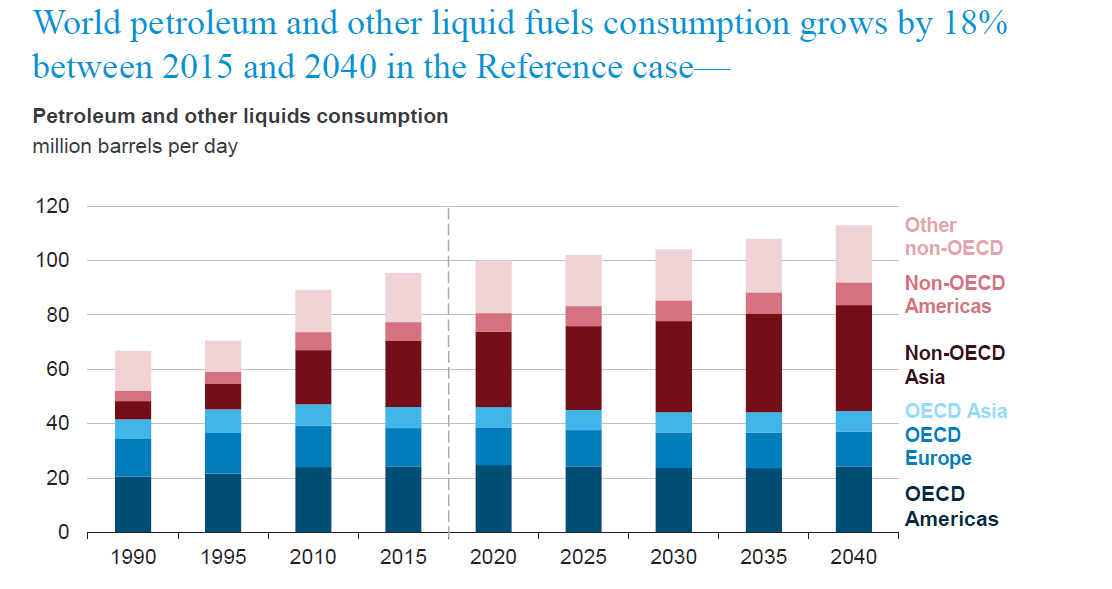

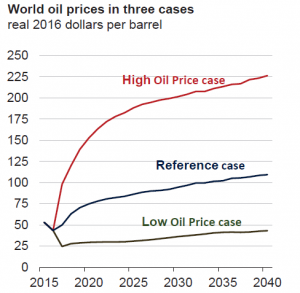

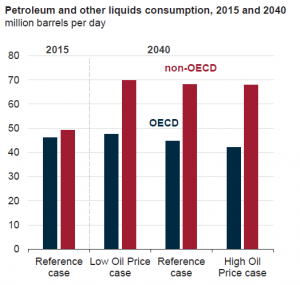

Oil prices are a function of world-wide supply and demand. Despite increased US production, if world demand grows faster than world supply the price of oil will increase. Almost all major forecasts predict increased demand for oil over the next decade.

Future prices for natural gas are less clear. Natural gas is the most logical fuel to transition the world away from coal as the primary energy commodity. It provides the most environmental benefit per dollar invested. However, US reserves are so plentiful it may take a long time for the price of natural gas to increase materially.

Source: Energy Information Administration (EIA) International Energy Outlook 2017, page 35

Source: Energy Information Administration (EIA) International Energy Outlook 2017, page 35

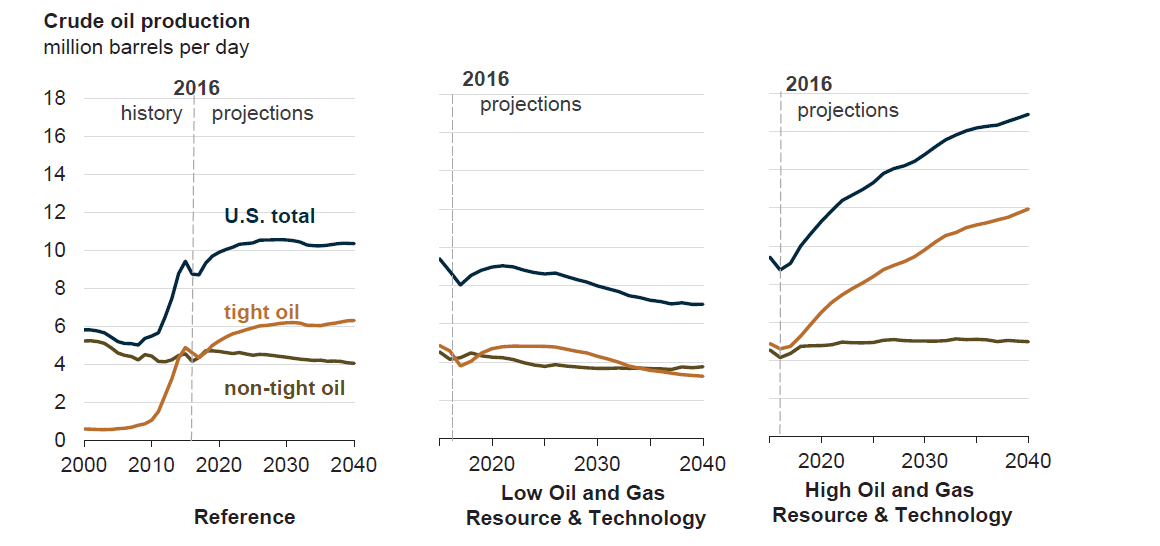

The development of shale resources resulted in a renaissance in US oil and natural gas development. US shale deposits account for more than 80% of total world shale oil reserves. By comparison, the EIA estimates total world conventional proven oil reserves to be 1.7 trillion barrels, and unconventional reserves to be 5 trillion barrels. The US now has over half of the proven world oil reserves, and much of these reserves are only economically viable at prices over $60 per barrel.

Increased supply from shale has resulted in lower world oil prices, but the EIA projects shale oil production in the US will peak in the next decade. Unlike oil, the unconventional natural gas supply is expected to last for decades without any impact on the ability to develop new supplies.

Source: Energy Information Administration (EIA) Annual Energy Outlook 2017, page 43

Source: Energy Information Administration (EIA) Annual Energy Outlook 2017, page 43

So according to the EIA, we have plenty of oil and natural gas. The key questions from an investor standpoint are “at what price?” and “for how long?”.

Maintaining the supply of unconventional crude oil requires higher prices. A widely accepted estimate is that crude oil needs to be above $60 to sustain current production. As the best shale oil reserves are depleted, the sustainable wellhead price per barrel must increase to support the development of lesser quality reserves.

Value investing

Value investing is defined as investing in assets at a market price below their intrinsic value, where intrinsic value is the estimate of an asset’s worth. Importantly, intrinsic value differs from market price in that it represents the calculated present value of the underlying income stream.

Market price is the price at which an asset is trading at any given time. If oil and natural gas properties can be purchased for their intrinsic value, an investor can earn the implied rate of return as current income. The investor does not have to sell the asset to make a profit.

Most of the last decade, the market price of producing properties has been higher than the intrinsic value. Recently this trend has reversed.

The intrinsic value of a property is calculated using traditional fundamental analysis. Engineering forecasts of the future production is prepared. Forecasts of production volume on mature, proved developed fields tend to be very accurate in a portfolio context. Wellhead price forecasts and expenses are used to calculate the forecast of present value of projected future income. A standard reference discount rate is +/-10% before G&A.

A buyer may adjust the discount rate depending on subjective assessment of risk and quality. The likelihood of more income from future development not included in the projected income may also be a factor in using a lower discount rate. If the market price of a property is at or below the present value, a value investor will buy. Most of the last decade, the market price of producing properties has been higher than the intrinsic value. Recently this trend has reversed. The best time to buy often does not feel right. Intrinsic value often equals or exceeds market price following a decline in the overall sector, when investors are hurting from overpaying when the market price was higher than intrinsic value.

Private equity investors using value strategies have been able to compete in part by capturing the Liquidity Premium inherent in illiquid assets. They could then arbitrage the difference between the private and public market valuations on exit, by buying in the private market and selling in the public market. Examples of the Liquidity Premium are easiest to see in real estate and oil and gas. Real Estate Investment Trusts (REITs) and energy Master Limited Partnerships (MLPs) have traded at 1.5 to 2.5 the private market value of the underlying assets. This liquidity premium can be captured through new investments in oil and gas properties.

Value investing in the oil patch

The market price of producing oil and natural gas properties is a function of three factors:

- Expected future price of oil and natural gas and expenses

- Discount rate on which the present value of properties is calculated

- Sentiment, manifest in availability of capital and supply of producing properties for sale

Future prices are currently much lower than they were forecast to be a few years ago. This has resulted in a decline in the value of proved producing properties of two-thirds to seventy-five percent. A property that would have sold for $1 million or more in 2014 has a present value today of $250,000 - $350,000, and can be purchased to generate first year free cash flow of over 10%.

Discount rates currently used by the market when calculating the present value of properties are “reverting to the mean”. When properties could be financed with debt at 4% to 8% interest, competitors were using discount rates of 8% or lower. Now that “cheap leverage” is no longer available, discount rates are reverting to the long-term range of 8% to 15%.

During the boom, oil companies could get all the funding they wanted for almost any project. Many projects that were funded are not profitable at current wellhead prices. Most new acquisitions made toward the end of the boom will never achieve payback of the investment. Many oil companies are now in a debt or liquidity squeeze. Debt levels that three years ago looked conservative have proven to be excessive. Capital investments in oil and gas are now more disciplined, providing a greatly improved environment for deploying new capital. This is providing both an increased supply of assets available for purchase and an improved environment for companies who are making new oil and natural gas investments.

So what can we conclude?

2018 is feeling a lot like the 1990s:

- Producing properties can be purchased on attractive valuations at today’s wellhead prices.

- Intermediate-term expectations are for higher oil prices. But the market price of producing properties today does not reflect those increases.

- Capital rationing is creating the largest supply of mature properties in over ten years.

This sets up a great fundamental investing opportunity:

- Market is aligning with intrinsic value.

- Current yields on producing properties are attractive compared to stocks, bonds or real estate. Yields exceed rates currently available from junk bonds less risk.

This provides an ideal value investing opportunity. New investments will provide an attractive yield to cover the “time value” of owning properties while an investor has a “free option” on the upside potential in oil prices. The timing of the inevitable increase in prices is unimportant as an attractive yield is earned while waiting for the price increase.

The key to success is accumulating good quality, long-lived production at or below intrinsic value and managing and administering those assets efficiently. This was the basic strategy for successful value investing after the 1980s oil bust, and has set up for similar opportunities again. It really is like déjà vu all over again (and again).