Chongjun Zhu, Product and Marketing Analyst and Ziwen Huang, Research Analyst, InvesTAO discuss why investors should access China now.

The post COVID-19 macro trends have highlighted China’s various investment opportunities. China has long been a market for Alpha generation. Its outperforming potential has been strengthened since the start of the pandemic.

As a China fund specialist, InvesTAO focuses on advising asset owners to invest in unique outperforming funds in China. One key point is evident from history or society evolution cycle perspective: investors should consider China as an “alternative” ASSET CLASS and reallocate now, as China has become the generator of post-pandemic Alpha and on its way of the long rising trend of social cycle.

The capital market is going to play a pitoval role in the world’s economic recovery. Where should investors look for growth? According to the IMF’s World Economic Outlook, April 2020, China and India will be the only major economies that maintain a positive GDP growth in 2020, as shown in Figure 1.

Furthermore, an allocation to China should be prioritised for two additional reasons: 1) China’s Alpha potential is promising; 2) There is easier access now for foreign institutional investors.

*Past performance is not indicative of future results.

Alpha potentials in China – Resilient domestic demand, featuring consumer goods and healthcare

According to Man Numeric, foreign allocations in China are underexposed by roughly US$ 5.5 trillion, which may be an unprecedented pool of Alpha generation. The underrepresentation of China in major portfolios will receive more attention by the investors who are considering a promising option of diversification.

One major reason China markets remain promising during tumultuous times is its resilience: there is a combination of organic growth and confidence from its market participants. China’s strong domestic demand has been a sustainable driver in recent years for China’s A-share growth, and it has leviated market confidence data including PMI within a span of months, indicating a fast rebound (Figure 2).

The post COVID-19 macro trends have highlighted China’s various investment opportunities.

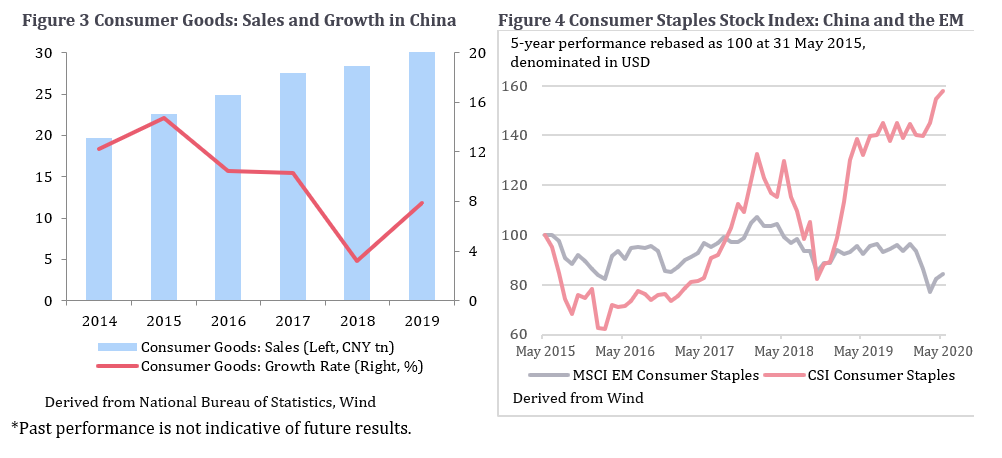

Sectors like consumer goods are considered to be significant outperformance sources. The demand has never been stronger. As shown in Figure 3, in 2019, sales of consumer goods in China boasted an 8% of YoY growth, which is a healthy rate compared to the 6.1% of GDP growth.

The ongoing lockdown and continuous social distancing measures mean that the consumers cannot yet spend towards service-led sectors. Therefore, the “new normal” consumption pattern will further benefit Consumer Staples.

As seen in Figure 4, China’s Consumer Staples index outperforms the EM Consumer Staples index by an extremely wide margin, even after factoring in existing geopolitical tensions.

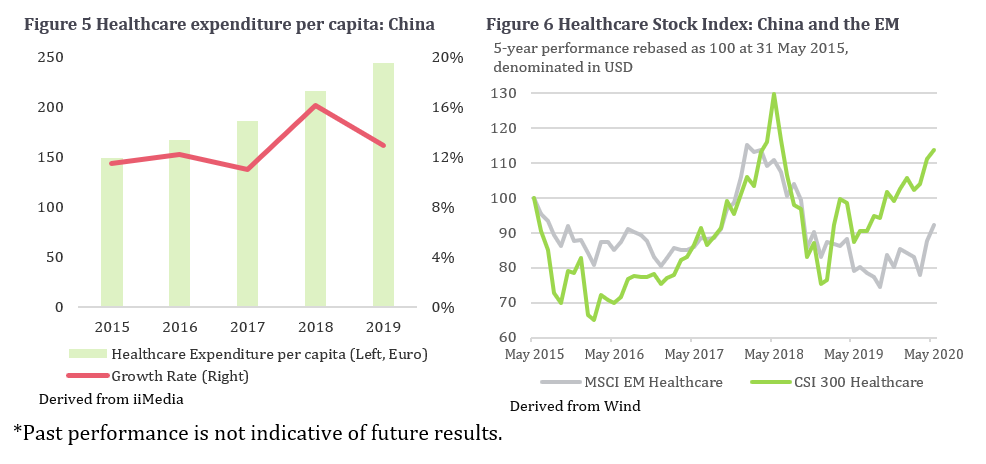

In addition to Consumer Staples, Healthcare is another sector where strong organic growth has been observed. It is not surpring that after Q1 2020, healthcare and pharmaceutical stocks will secure a solid spot in the global equity markets. In the last five years, China has seen a 10% YoY growth per capita in healthcare expenditure (Figure 5). From the supply side, the innovation in healthcare in China is also remarkable.

According to Frost & Sullivan and Statista, the R&D spending of the pharmaceutical industry in China has doubled since 2014, and it is expected to reach US$ 49.3 billion in 2023, which will account for 23% of the total spending worldwide. As such, the Healthcare sector is expected to be a major generator of Alpha investment in China A-share and among the Emerging Markets (Figure 6).

*Past performance is not indicative of future results.

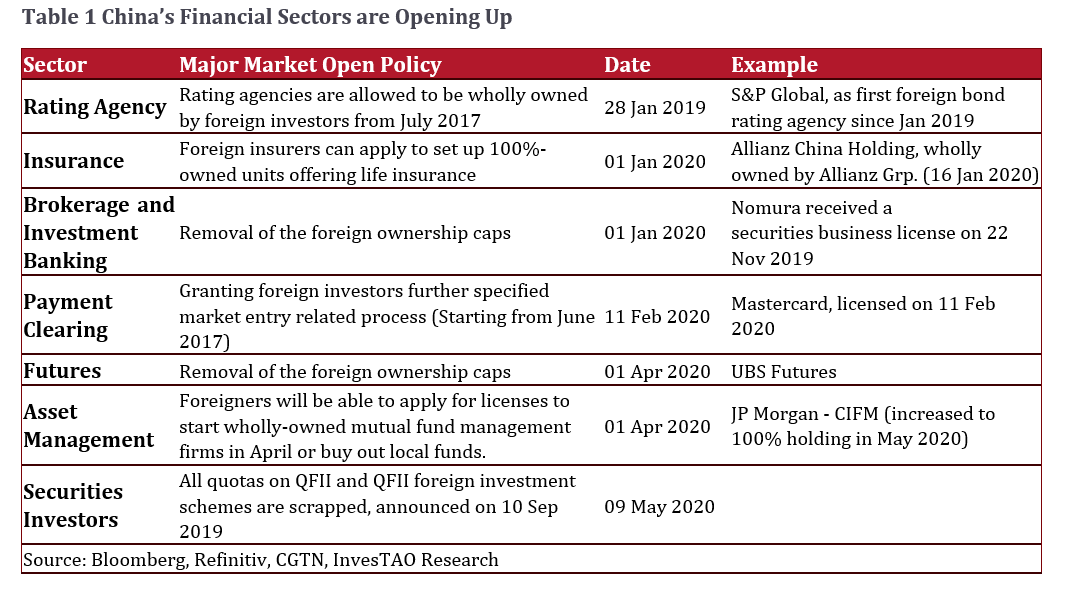

In addition to China’s resilience and market potentials, the Chinese authority is committed to further liberalise its capital market and advance its integration with the world market. Scrapping QFII/RQFII quota last year was only the beginning. There has been robust policy moves from top level Chinese leadership in order to encourage wider access to the Chinese capital market.

Market access for foreign institutional investors

China’s main policy initiatives in the last two years are aimed for capital market liberalisation (see Table 1). While China does take “baby steps”, signals are indicating that China is actively seeking further integration with the world market. Having an easier access will further reduce the coast associated with investing in China, which making Alpha-generation more desirable.

The current world seems to be full of chaos. Nevertheless, we ought to be reminded that order is born within such turmoil. Despite the threats of US-China decoupling, the political disruption of Hong Kong, and the possible second wave of COVID-19 ravaging the world once again, individuals and society always find a way to work for our collective betterment. Allocating to China will aid towards that betterment.

Shelley Yang, CEO of InvesTAO will be speaking on investing in Asia at IM|Power Online.