Asset manager priorities are converging

Institutional asset managers worldwide are balancing operational complexity and efficiency, data management, and risk and resiliency with the need to generate value and achieve growth for their clients. These were the findings of BNY Mellon’s recent study “Asset Management: Transformation is Already Here.” It asked more than 200 forward-thinking leaders to take a holistic view of the seismic challenges impacting the asset management industry and specifically, how these challenges were impacting every aspect of their business, from front- to back-office.

A parallel BNY Mellon study, “From Alternative to Mainstream,” surveyed 100 institutional investors and 100 alternative asset managers and found notable convergence in priorities. In addition to shifting investor needs, alternative asset managers face structural changes within their organisations alongside increased competition and changing economics. As a result, they are deploying digital and data analysis technologies to increase efficiency, overcome regulatory hurdles, promote product innovation and improve reporting.

Institutional asset manager priorities

Asset managers envision a future in which technology platforms, transparency, and data continue to fundamentally alter what’s possible. The need for robust data management and analytics is also bringing new complexities to the fore, such as the challenges of aggregating and managing data across fragmented systems, and the obstacles of unstructured data sources, reliability, completeness, and freshness of data.

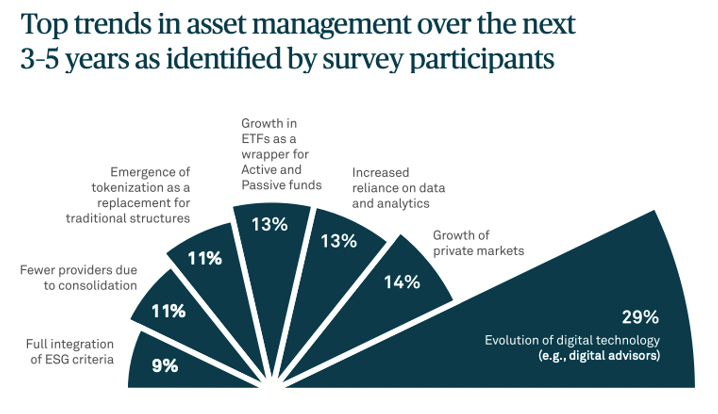

Among traditional asset managers in our research, two trends rose to the top of their agenda: The evolution of digital technology, and the growth in ETFs as a wrapper for active and passive funds.

Source: Asset Management: Transformation is already here

Source: Asset Management: Transformation is already here

Regarding technology, the key to success is to find providers who have invested in their technology and infrastructure and are committed to supporting long-term initiatives.

Source: Asset Management: Transformation is already here

Regarding distribution, the increased adoption of new technologies is shaking up the way asset managers bring products to market. Two broader industry trends propelling fundamental change in distribution are:

- Investors shifting towards lower-fee products (such as passive ETFs) and alternatives

- New product launches that mean asset managers face much greater competition for shelf space with intermediaries

While passive ETFs have reshaped the industry, asset managers in our survey stated that several active strategies would become more relevant. Two-thirds of asset managers expect to increase their offerings in data-intensive automated quant and smart beta strategies. Active management strategies (61%) and active ETFs (49%) are also on the rise as investors seek options to help them meet specific objectives.

Furthermore, large majorities of respondents in our research expect direct-to-consumer distribution (80%) and new market entrants (76%) to increase over the next three years. Distribution and digital priorities are connected, with 83% of respondents seeking to deploy digital capabilities for product distribution, and 66% doing the same for data analysis and insights.

Alternative Asset Manager Priorities

In alternatives, greater digitisation is critical for managers to achieve their objectives for operational efficiency, data management and serving rising market participation of “digitally native” investors.

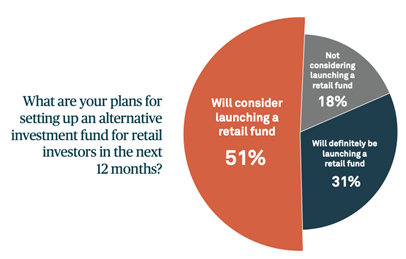

Therefore, many alternative managers are preparing for a coming retail revolution. Nearly one-third of managers in our survey say they will definitely launch an alternative investment fund aimed at the retail market, with even more saying they will consider doing so.

Source: From alternative to mainstream

But to attract retail capital, alternative asset managers will need to put significant effort into designing the right products with liquidity appropriate for the retail space, as well as building effective distribution channels. Many will be quite unfamiliar with these areas.

Across these forces, deeper structural changes to the industry and shifting investor expectations are prompting alternative asset managers to scale up, reduce costs and innovate in order to stay ahead in an increasingly competitive market. They see increased product innovation as another significant structural game-changer.

For alternative managers, the more that institutional investors and retail investors engage, the more growth opportunities there may be. It comes down to a choice: follow this evolution, nudging ever closer to the world of mainstream asset management, or, instead, specialise further.

Convergence and outsourcing

In “Asset Management: Transformation is Already Here,” the increase in alternatives stands out—72% of respondents expect to increase their offerings across hedge funds, private equity, private debt, infrastructure and real estate vehicles. But new assets, values and priorities bring data and technology questions to the forefront for both traditional and alternative managers.

To offer compelling products in these areas, all asset managers need the ability to analyse effectively, identify opportunities, make investment decisions, monitor portfolios and report to investors. In addition, alternatives require specialist expertise and have historically needed separate technology solutions.

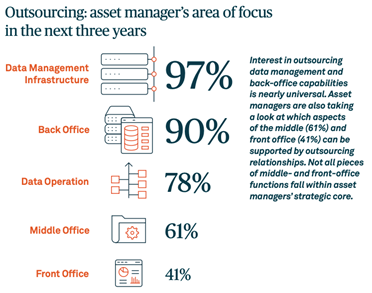

At the same time, they are only adding to the complexity of asset management operations as their priorities converge. As they branch out into more complex products, look to scale up and, in some instances, reduce costs, managers increasingly see outsourcing as a way of removing some of the pain points associated with setup and ongoing operations.

BNY Mellon are gold sponsors of IMpower Incorporating FundForum 2022. Find out more about the 2022 event and agenda here >>