Asset managers 'must do more on climate change'

How can client assets be used for good? Can investments be used for the better of mankind? And our asset managers making the most of this by acting on climate change directly? They must do more - that is clear. That's according to Sacha Sadan, director of corporate governance at Legal & General Investment Management (LGIM).

Asset management can be an arcane subject, but the basics are simple. Most of our work at LGIM involves trying to give financial peace of mind to our millions of customers before and during their retirement.

To be effective, we must take a truly long-term view when thinking about what could affect clients’ savings through periods spanning decades. Consider climate change as an example. Left unchecked, it would have a devastating effect on society, companies, and consequently our clients’ assets. So protecting the planet and protecting savings can and must go hand in hand.

In fact, let us turn the question around: ask not what the climate can do for your pension, but what your pension can do for the climate.

Pensions, votes and backing shareholders: putting the impact in impact investing?

Many people don’t realise that one of the most powerful ways that they can have an impact on the world is through their pension. The trillions invested through pensions in the world’s largest companies give people the right to demand high standards and sustainable business models. As asset managers and stewards of those pensions, we have a duty to help drive this change.

For some, the solution is simple – just stop investing in fossil fuels. But fossil fuels will continue to exist with or without investments from pension funds, so that won’t solve the climate issue.

Instead, we should remain invested and use our shareholder rights to push for change. A starting point is to cast votes in favour of greater transparency around businesses’ climate plans.

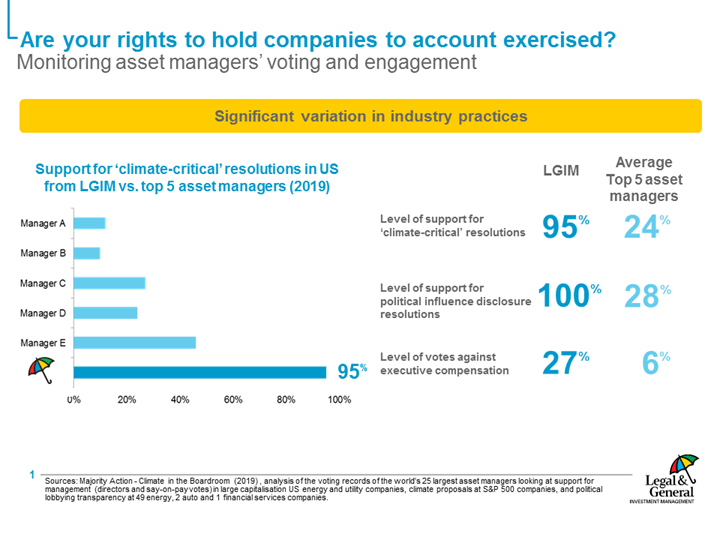

Almost every asset manager now espouses the importance of investing responsibly and reflecting environmental, social, and governance considerations into ESG-branded funds, but independent research makes plain that many are not putting this rhetoric into practice.

At LGIM, we feel we can speak out on this topic because we do speak out with our votes. In keeping with our longer-term record, this year alone we have continued to consistently back ‘climate-critical’ shareholder resolutions.

Unfortunately, there is significant variation in industry practice. While new research published last week found many investors are too ‘cosy’ with companies on the climate crisis, it simultaneously praised LGIM as one of the ‘top five’ best performers in terms of its voting record on climate issues.

Where there is less variation is in the industry’s tendency to agree that investors selling out of high-carbon sectors will not solve the climate challenge.

While there remain buyers and users of fossil fuels, the mere act of divesting from companies owning those hydrocarbons will not reduce the impact on the climate from those fossil fuels being burnt. Nor does this necessarily mean climate-related risks have been reduced, if – as often happens in practice – divestment results in overexposure to seemingly low-carbon industries such as financials; i.e. to the lenders and insurers of the very same fossil-fuel assets.

We agree that engagement is preferable to divestment, but believe that forceful engagement is needed. As the new UK Stewardship Code recognises, “asset owners and asset managers play an important role as guardians of market integrity and in working to minimise systemic risks” such as climate change.

It is therefore incumbent on asset owners to raise their expectations; on asset managers to put a professed commitment to ESG principles into action; and on key intermediaries such as investment consultants, ratings agencies and proxy voting advisers to accelerate the process.

With the new code and similar initiatives around the world pushing investors for timely disclosure of their full voting record, alongside rationales for contentious votes (such as abstentions or votes against shareholder proposals), we expect to see more progress.

Here's the resolutions

There are already some positive signs. Over the summer, the Harvard Business Review noted that the proportion of total shareholder resolutions focused on environmental and social issues had grown from around 33% between 2006 and 2010 to over 50% by 2017.

Morningstar has reported that during the 2019 proxy voting season, which ended in June, investors had their say on 177 shareholder resolutions addressing environmental and social concerns. The average shareholder support for these resolutions was 29%, up from 25% last year, and 14 resolutions won a majority of voted shares.

As investors become more engaged, it is also important not to take a narrow view of companies, but to consider as well the impact of wider issues like deforestation in supply chains, or of the emissions associated with companies’ products.

The impact on government policy is also important, which is why LGIM is also a consistent supporter of resolutions calling on companies to review and suspend membership from any trade associations whose lobbying activities are inconsistent with the Paris Agreement.

With the emergence of the largest-ever group of investors calling on governments to step up their climate ambitions – a group LGIM has joined – it is essential that corporate lobbying is aligned with this goal.

Investors who are sceptical about such engagement should remember that these more muscular attempts to raise ESG standards via resolutions are not a zero-sum game; they benefit the entire market. By working together as asset managers, we can influence boards and improve corporate conduct.

E - and SG

Importantly, this isn’t and shouldn’t just be about the environment. The focus on environmental policies is understandable given the climate emergency, but we at LGIM are equally committed to social and governance factors.

We champion diversity through our engagement activities, for example. In 2018, we voted against more than 100 board chairs in the UK over the lack of diversity in their companies. We also regularly promote good governance practices through our votes, on issues such as board independence, auditor rotation, or the alignment of pension contributions between executives and the workforce.

Crucially, when we express our commitment to higher ESG standards through our entire voting weight – we vote as LGIM on every stock across our entire equity book, not fund by fund – it sends a powerful message.

Our clients and the market would benefit even more if the industry took a more consistent approach, encouraging investee companies to improve their practices and turning the direction of travel towards a sustainable future. Let us work together to make this happen.