Carbon transition: An investment imperative

The push for climate solutions is likely to prove a powerful force in the coming years.

As markets digest high inflation, interest rate hikes, recurring COVID-19 outbreaks and war in Ukraine, among other forces, it’s possible to overlook long-term, structural investment themes otherwise hiding in plain sight. One such theme we focus on is the global push for sustainable energy and overarching carbon transition.

No mere fad, the urgency to achieve a global transition to a more sustainable, carbon-neutral future is largely rooted in structural change:

The global population has grown to nearly 8 billion people today from roughly 2 billion just 100 years ago, reflecting about 1.4% annual population growth.1

Global energy consumption has increased more dramatically, to roughly 180,000 terawatt-hours annually, versus just 18,000 some 100 years ago, reflecting a tenfold increase or roughly 4.5% compound annual growth in the production and consumption of energy.2

Finally, dangerous planetary impacts have accelerated with the use of carbon-rich fossil fuels, helping to trigger a 1.5° Fahrenheit increase in the Earth’s surface temperature over the same 100-year period.3

Policy change helps drive opportunity

Against this backdrop, and thanks in part to policy commitments from countries representing more than 50% of global GDP, the theme of carbon transition infrastructure has come to the fore.4 Importantly, we do not view this carbon transition narrative as simply the investment trend du jour but, rather, as a decades-long, structural, fundamental theme unfolding at literally a planetary scale.

Over the next 30 years, roughly $50 trillion of investment capital is expected to address opportunities presented by decarbonisation efforts, with investments and innovations targeting both the structural transformation of enabling technology and global infrastructure.5

Electrification leads the charge

Electrification is a central component of the sustainable infrastructure mega-theme and includes an estimated $14 trillion in power grid investment through 2050.6 Globally, we will need a modernised, “future-proofed” electricity grid to accommodate additional renewable resources and vehicle electrification capabilities already on the decarbonisation roadmap.

With respect to an advanced, electrified transportation fleet in the U.S., the Edison Electric Institute recently increased its estimate for electronic vehicles on the road by 2030 from 18.7 million to 22 million.7 This 17.6% increase suggests an accelerated buildout of charging infrastructure to support a rapidly growing number of electric vehicles. Currently, only about 10,000 fast-charging ports are available across the U.S., a quantity that will need to increase more than one hundredfold given today’s more than one million gas pumps across 145,000 gas stations.8

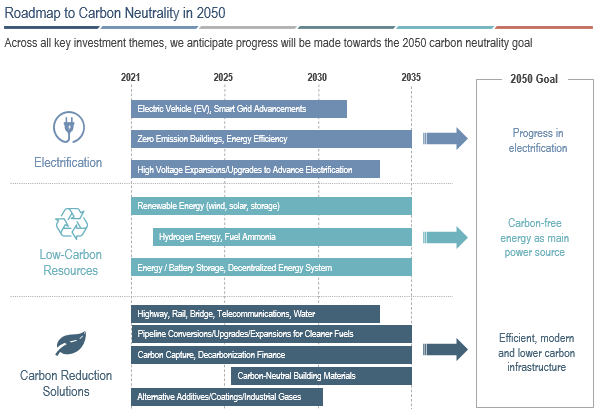

Carbon transition infrastructure sub-themes

In framing the investment opportunities, we focus on three sub-themes we believe represent the fundamental elements of the carbon transition infrastructure landscape: electrification, low-carbon resources and carbon reduction solutions.

Focused on progress in electrification, these solutions help replace technologies that use high carbon emitting fuels with those that use low-carbon resources as an energy source. Examples span smart grid and electric vehicles charging solutions to zero emission buildings and high voltage expansions across electricity transmission and distribution infrastructure.

Working toward carbon-free energy as a main power source, low-carbon resources include energy companies focused on reducing CO2 emissions through renewable energy such as solar, wind, geothermal, green hydrogen and their related storage and transport.

Finally, carbon reduction solutions encompass products and services that facilitate the carbon reduction goals of infrastructure owners. These include pipeline conversions by engineering and construction service providers, carbon capture technologies that help recycle hazardous materials to the environment, carbon-neutral building materials, and alternative additives or industrial gases that mitigate carbon by-production, to name a few.

Source: “Green Growth Strategy Through Achieving Carbon Neutrality” (Ministry of Economy, Trade and Industry: December 2020), “Strategic Roadmap for Hydrogen and Fuel Cells” (Ministry of Economy, Trade and Industry: March 2019) and Neuberger Berman.

Source: “Green Growth Strategy Through Achieving Carbon Neutrality” (Ministry of Economy, Trade and Industry: December 2020), “Strategic Roadmap for Hydrogen and Fuel Cells” (Ministry of Economy, Trade and Industry: March 2019) and Neuberger Berman.Impact of geopolitical events

Long before the COVID-19 pandemic, war in Ukraine, current energy shock, inflationary uptick and central bank response, the global push began for a decarbonised, sustainable energy future.

The road to decarbonisation may also provide important geopolitical de-risking benefits to investors as greener energy sources (e.g., sun, wind, hydrogen) are more geographically independent than the traditional sources of energy (e.g., oil, gas, coal) at the root of many current geopolitical challenges.

The utility of utilities

Often overlooked, we believe select utilities are favourably exposed to the multidecade decarbonisation mega-trend as they can help lead our structural transition by deploying renewable energy resources. The defensive characteristics of many utilities have the potential to provide a welcome, calmer port in a market volatility storm, while also offering earnings visibility given the historically steady, long-term nature of electrification and unfolding clean energy growth opportunities.

In conclusion

The mix of factors across policy change, investment opportunities, and the geopolitical environment continues to increase investor attention on carbon transition infrastructure investment, both in recent months and over the intermediate to long term.

References

- Source: The World Bank, Statista.

- Source: Our World in Data, “Energy Production and Consumption.”

- Source: NASA, Goddard Institute for Space Studies

- Source: UN, “Net-Zero Emissions Must Be Met by 2050 or COVID-19 Impact on Global Economies Will Pale Beside Climate Crisis,” November 2020

- Source: Energy Transitions Commission, “Making Missions Possible: Delivering a Net Zero Economy,” September 2020.

- Source: BloombergNEF, S&P Global.

- Source: Edison Electric Institute

- Assumes 8 gas pumps per gas station. Source: API, “Service Station FAQs”

This material is provided for informational purposes only, is general in nature and is not directed to any category of investors and should not be regarded as individualized, a recommendation, investment advice or a suggestion to engage in or refrain from any investment-related course of action. Neuberger Berman is not providing this material in a fiduciary capacity and has a financial interest in the sale of its product and services. Investment decisions and the appropriateness of this material should be made based on an investor’s individual objectives and circumstances and in consultation with his or her advisors. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness, or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. There is no assurance that any events, outlook, and expectations will be achieved, and actual results may be significantly different than that shown here. Historical trends do not imply, forecast, or guarantee future results. Information is based on current views and market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Third party economic or market estimates discussed herein may or may not be realized and no opinion or representation is being given regarding such estimates. Neuberger Berman products and services may not be available in all jurisdictions or to all client types. Investing entails risks, including possible loss of principal.

Carbon Transition Infrastructure companies may be more volatile than more established companies. If government policies and incentives for reducing greenhouse gas emissions are reduced or eliminated, the demand for the services provided by Carbon Transition Infrastructure companies may be negatively impacted. To the extent the Fund invests more heavily in particular sectors, its performance will be especially sensitive to developments that significantly affect those sectors. Individual sectors may be more volatile, and may perform differently, than the broader market.

The “Neuberger Berman” name and logo are registered service marks of Neuberger Berman Group LLC ©2022 Neuberger Berman Group LLC. All Rights Reserved.