Climate change risk across the EU banking system – Prometeia survey results revealed

As a result of the increasing attention from supervisory authorities (EBA, ECB) and public opinion towards climate change, in Q3 2020 Prometeia conducted a survey aimed to deepen how EU banks are currently facing and planning to manage the near future risks that are arising from climate change.

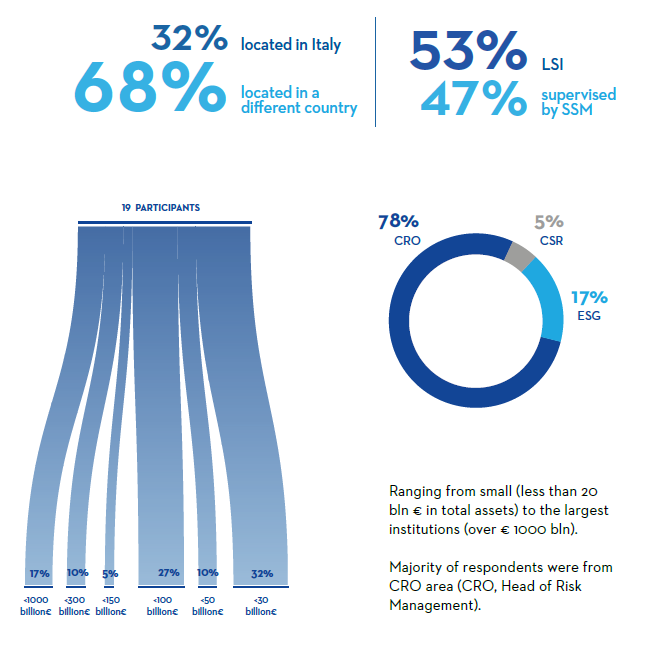

The exercise was carried out on a panel of banks mainly located in the European Union, ranging from less significant to global significant lenders.

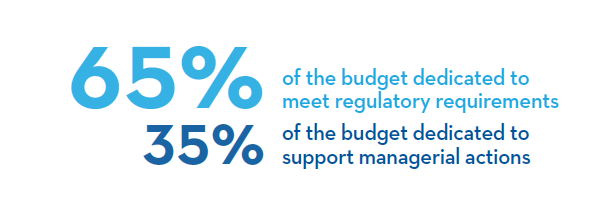

Interestingly enough, the survey shows that the European banking industry proves to be only partially ready: the level of awareness of the impact these new risks is now widespread, but a few institutions have actually taken initiatives to address them. The most of the lot is still in a ‘pilot’ phase: 59% of the banks respond that the climate change budget in a 3-5 year horizon is between less than € 1 million, 65% of which is allocated in order to meet future regulatory requirements. The other 35% will be dedicated to develop new climate-change-integrated business, credit and climate risk proprietary models.

Most of the budget related to climate change risk investments will be dedicated to embed climate change risk in business processes, and related credit/operational risk models.

In-house scenario & climate risk models will be interested by investments. A small part of the budget will be also allocated to improve business aspects such as data & IT infrastructure and customer relationship management, with the aim of pursuing the wealth management best practice.

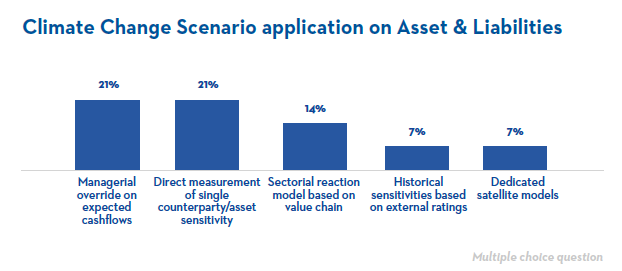

A few banks state they apply the climate change risk scenarios directly to the fair values of assets and liabilities. The most common internal methodologies used by those banks which apply the scenarios directly, in order to measure the scenario impact on fair values are managerial override on expected cashflows and the direct measurement of single counterparty and asset sensitivity.

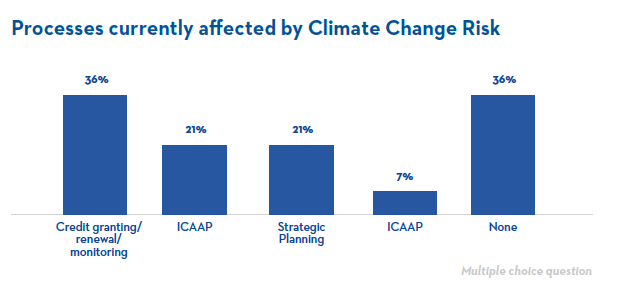

Currently, banks focus mainly on the credit process. Only 21% of the banks is including climate change considerations in the ICAAP process, while no bank has selected the following processes: pricing, provisioning, regulatory capital calculation and remuneration policy. So, climate change related issues are not currently taken into account in these processes. Furthermore, 36% of the sample surveyed do not consider climate change risk in any of the internal business processes.

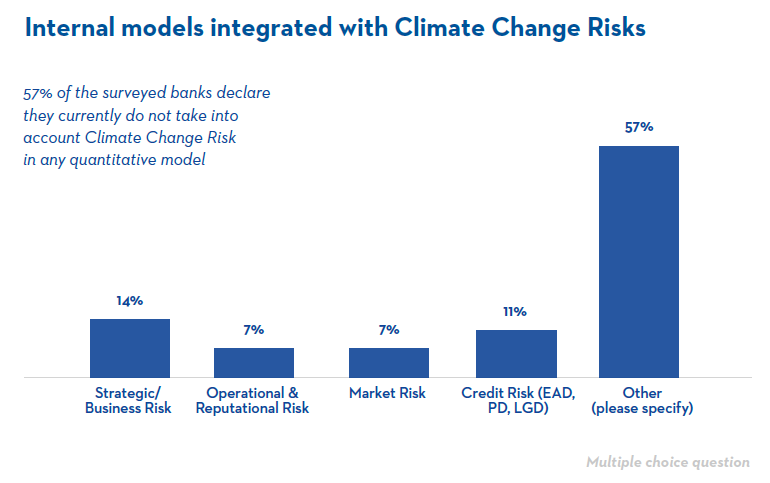

Only few banks are engaging themselves in the integration of climate change risk in their risk management models - indeed 57% of the sample specify that they have not yet developed any quantitative model in order to integrate new risks arising from climate change. Among the banks that are currently integrating the new risk, the main trend is to prioritise the development of a new integrated model for strategic/business risk. Few of the pooled claim to integrate also credit, market and operational risk models. No bank takes into account the impact of these new risks in their liquidity and IRRBB models.

From all this we can state that the banking Industry is aware of the arising problem deriving from the climate change, but a radical change in the management culture is needed, before related regulation takes place, in order to have banks effectively ready to face all the possible effects of climate change.