CTFN merger arbitrage data

Equity prices of companies involved in mergers or prospective mergers move in distinctly volatile patterns relative to comparable equities in the same sector. Many catalysts emerging from the newsflow around an M&A deal influence these unique price movements.

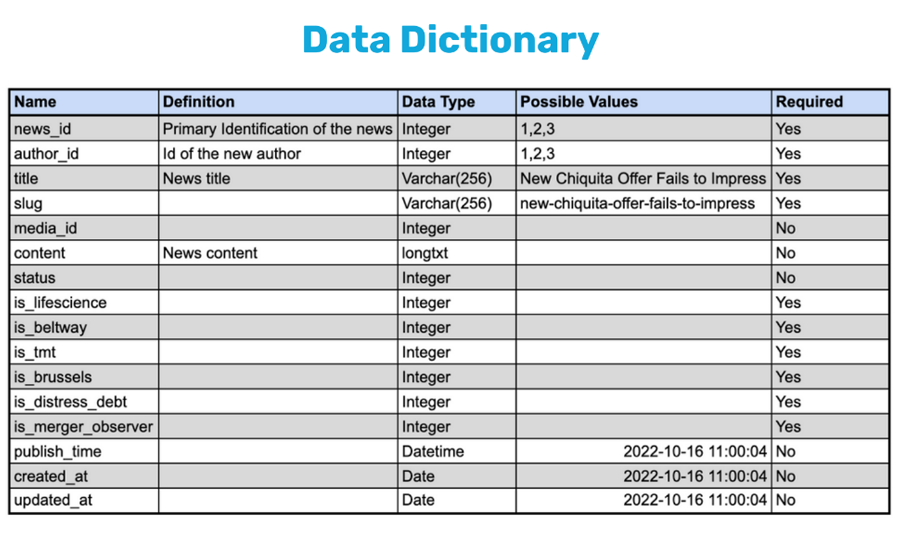

Data has been collected for CTFN-reported M&A news events, along with the companies involved in the event. An analysis was conducted to compare average volatilities for the companies involved in these news events. Historical data was acquired from EOD Historical at a minute-by-minute frequency, as well as end-of-day data, to contextualize the equity volatility at the time the CTFN news broke.

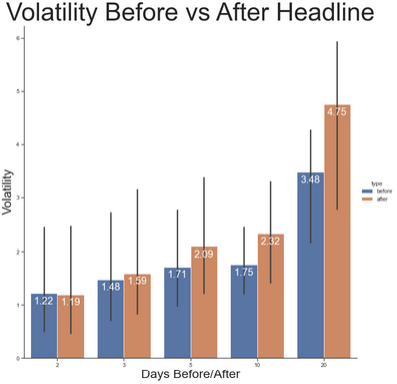

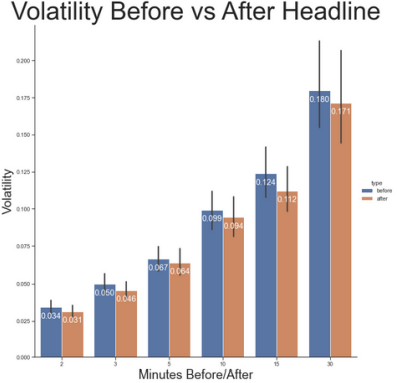

This analysis demonstrates the extent to which CTFN content historically impacts the equity prices of companies involved in M&A both during the prospective merger period, and after the announcement of a definitive agreement while the deal is pending consummation. As shown below, CTFN stories about key deal hurdles and related events impacting the spread underlie the increase in volatility post-publication.

Data compilation

- Data for News Events

- EOD Historical Price Data: by Daily Price and Minute Price

- Events and tickers excluded from original dataset: for Daily Analysis and Minute Analysis

- Jupyter Notebook used for data collection, cleaning, and analysis

Analysis

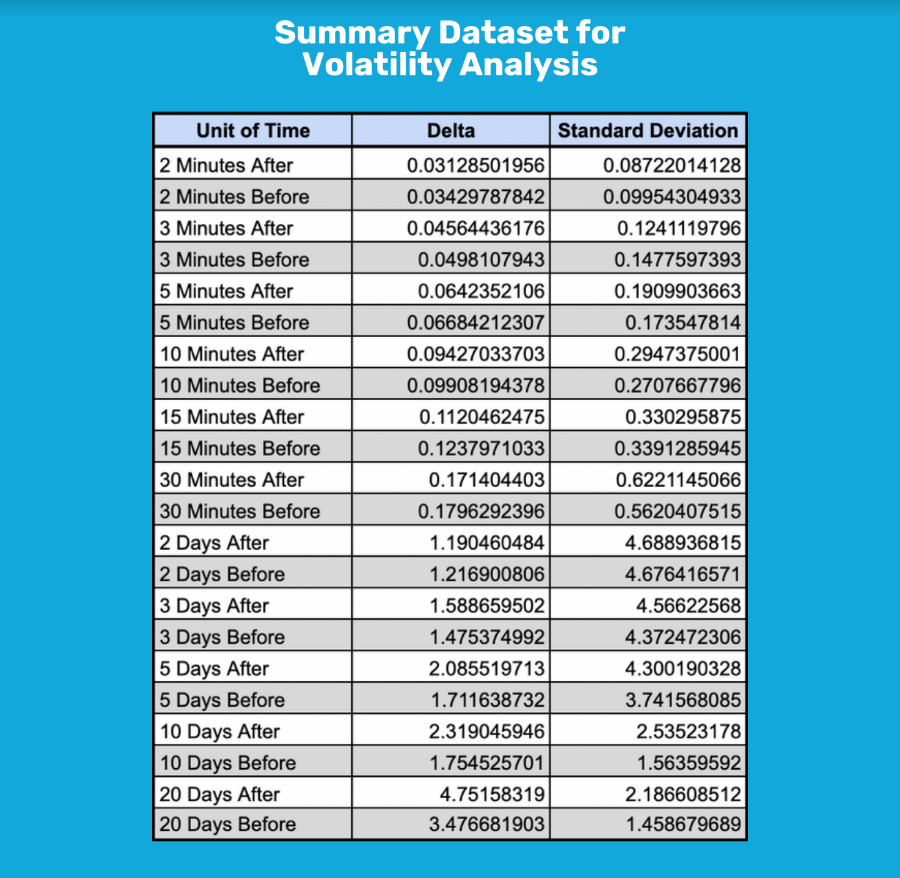

The data illustrate how CTFN's stories impact volatility in the names covered. In a majority of cases, in the minutes following a story's publication, CTFN's impact generates a temporary pause in the volatility of the underlying tickers, suggesting qualitative managers cancel orders upon publication of a new story to reevaluate their views. The data show that over the course of days, the mentioned names exhibit an increase in volatility that persists for more than ten trading sessions.

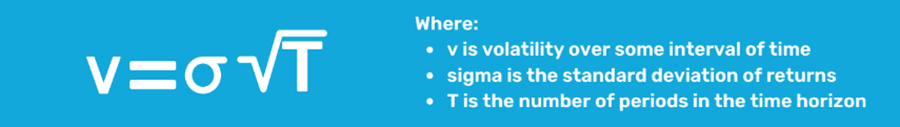

Volatility Calculation

Volatility was calculated according to a standard definition taken from Investopedia:

Daily Analysis

Data was analyzed from 4,156 news events that CTFN reported, ranging from January 27th, 2014 - July 28th, 2022. This included 735 unique companies. Volatility was calculated using time windows of 2, 3, 5, 10, and 20 days, comparing the volatility before the event to the volatility after. Results show that volatility rises in the weeks following a M&A event that CTFN reports.

Minute Analysis

Data was analyzed from 2,911 news events ranging from January 27th, 2014 - July 28th, 2022. This included 529 unique companies. Volatility was calculated using time windows of 2, 3, 5, 10, 15, 30, and 20 minutes, comparing the volatility before the event to the volatility after. Results show that in the minutes following a M&A event, volatility decreases.

Background & Research

Equities of companies involved in a merger or prospective mergers tend to exhibit patterns of volatility that are distinct from comparable companies in the same industry or index.

When a company is reported to be in merger discussions as the target, the stock price tends to gap upwards to a prospective deal price and to remain at these elevated levels until a merger is announced or until market participants are convinced that no deal will be forthcoming.

Once a deal has been announced, the target’s stock tends to trade in a tight relationship with the contracted consideration, which could be a cash price, securities, or a combination. The price of the target at that point tends to reflect the market’s perception of the probability of receiving the consideration and the likely timing.

Observed volatility patterns for target stock typically see a sharp move on initial news of a prospective deal or definitive deal, followed by a lessening of volatility as the stock price accretes towards the consideration.

Newsflow around the various hurdles to deal completion sets up events where volatility in relation to the newly compressed, post-merger announcement volatility might expand. Examples of this would include the emergence of shareholder opposition to an announced deal, or perceived regulatory risk such as opposition from antitrust authorities.

With respect to the acquiring company’s stock price, this will often move together with perceptions of whether the deal is accretive to earnings per share and capable of completion or, conversely, whether it is potentially dilutive. In addition, if there is a stock component in the consideration, arbitrageurs will need to borrow and short this stock, which can also elicit downside pressure on the price.

In any case, market participants who seek to profit from these moves typically look for a “spread” to develop between the target company’s stock price and the consideration offered. Accordingly, these players buy or sell based on their ever-changing views of the probability of close and the timing of close (where “close” equates to when the spread would thereby collapse, and the arbitrageur would receive the consideration).

News stories from CTFN have been shown to impact stock prices of firms involved in M&A both during the prospective merger period, and especially after the announcement of a definitive agreement, while the deal is pending consummation. Specific news on key deal hurdles and relevant events to the spread underlie this increase in volatility post-publication.

To download the complete dataset, please click here.

About CTFN

CTFN is a market-leading news and data resource for investors and professionals who are serious about following merger-related developments and understanding events that could influence industrial dynamics — including changes in regulatory enforcement across North America, Europe, and the UK. Our proprietary platform provides financial news, data, and resources for investors, legal and corporate professionals, regulators, and academics seeking granular knowledge around corporate mergers and notable events, potential impacts from changes in regulatory agencies, and insight into the political environment surrounding these situations.

To learn more about CTFN, please schedule a complimentary platform overview. Contact CTFN here.

Join our digital week, RiskFuse, in December, and learn more!