Risk management is an exciting industry to be a part of. Currently undergoing transformative changes, there are several challenges that risk managers are facing, but that is one of the reasons why the FutureRiskMinds at RiskMinds International chose this industry as their career path. As the new year kicks off, RiskMinds365 wants to look forward to get to know the risk managers of the future, what they think of the industry’s transformation, and what they see as the biggest challenges right now.

At a time when industries compete against each other for the millennial and generation Z workforce, risk management has the unique selling point of offering risk managers the opportunity to make an impact.

“Risk management is fundamental to the success of the banking industry”, a FutureRiskMind shared with us in our survey. “You can actively contribute to the success of the organisation and make a difference to outcomes.”

Another response read: “In its essence, banking is the activity of correctly measuring risk and implementing policies to optimise returns given the associated risk. Therefore, risk management is at the very centre of a bank's strategy.”

Thanks to their expertise in Economics, Finance & Accounting, Mathematics, Business, and Computer Science & IT, the FutureRiskMinds cohorts are in an advantageous position to tackle the challenges ahead of risk management.

Artificial intelligence and machine learning in banking

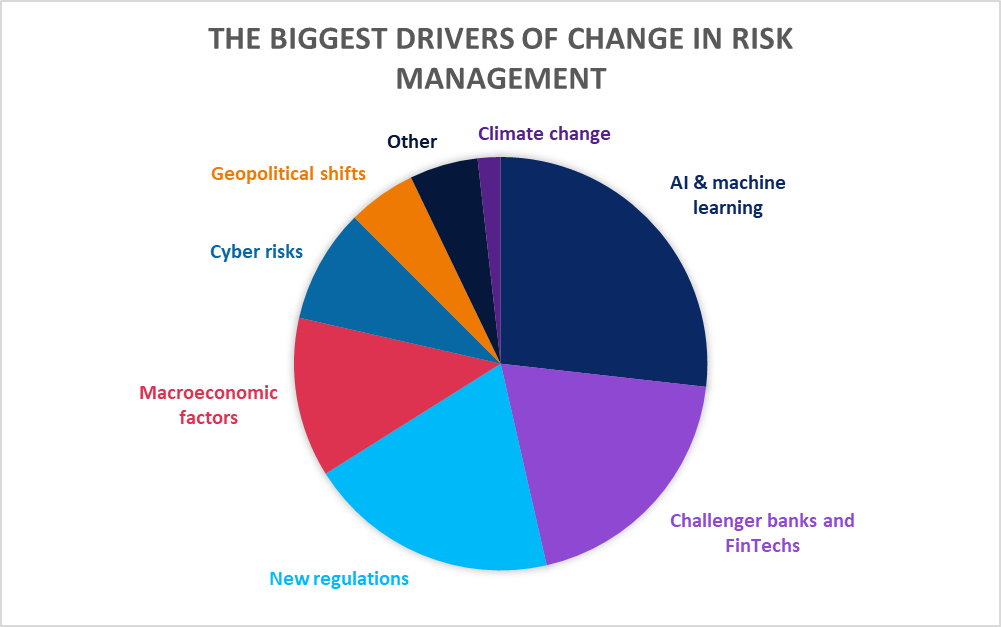

Over a quarter of the FutureRiskMinds group believe that Artificial Intelligence (AI) and Machine Learning (ML) will be one of the key change-makers in the industry. AI and ML already have a big impact on the banking industry. For example, JP Morgan Chase & Co’s LOXM is an AI programme that executes client orders rapidly and at the best possible price.

One respondent wrote: “Technology, automation and innovation are becoming more and more central in the industry and embracing AI and ML is no longer simply about having an advantage towards the competitor, it is about survival. Banks can leverage a huge amount of data and systems which are a fundamental step towards high quality predictive and behavioural models for the benefit of clients, stakeholders and senior management.”

The implementation of AI is high on the agenda of many industries, however, the social implications of AI can be costly.

Noreena Hertz said at RiskMinds International: “I don’t buy that we are moving into a future where humans and machines will work happily hand in hand. Millions will be displaced, and not just in blue collar jobs. 45% of Reuters articles are now written by computers, 40% of their output is now read by computers.”

Furthermore, many professionals in the finance sector reported that the use of AI is not as advanced as the sector might like it to be.

“There’s this huge revolution of AI in finance – everyone is so excited about it – but the truth is that very few firms are successfully employing AI in finance”, Christina Qi, Hedge Fund Partner at Domeyard LLC told us.

57% of FutureRiskMinds also think that the risk management industry is not embracing change and innovation at the right pace, and 21% of them believe that future risk managers will spend most of their time getting to grips with AI and ML.

Challenger banks, FinTechs, & new regulations

Approximately a fifth of FutureRiskMinds chose challenger banks & FinTechs as one of the big drivers of change in the industry, and 90% of them see them as friends rather than foes.

Monzo Bank’s former Chief Risk Officer Ruth Doubleday told us in an interview that challenger banks may have a technological advantage over incumbent banks, the latter of which inherited old IT systems that “have been put together in a patchwork framework through mergers and acquisitions over the years and these IT systems don’t always talk to each other”.

Regulatory schemes like the Basel Committee’s BCBS 239 is pushing to change this. But according to the European Central Bank’s Report on the Thematic Review on effective risk data aggregation and risk reporting, “the implementation status of the BCBS 239 principles within the sample of significant institutions is unsatisfactory”. This will likely be a challenge for all financial institutions throughout 2019 and beyond.

Macroeconomic factors and geopolitical shifts

Combined, approximately 18% of FutureRiskMinds believe that macroeconomic factors and geopolitical shifts will drive change in the risk management industry. When looking at the big geopolitical risks of the current era (Brexit, Italy, President Trump, and Putin), we see polarising party politics.

According to Hertz, the rise of populism across Europe is at “odds with so much of what we value: reason, science, enlightenment, and facts. Nativist values are an anathema to those of us who see ourselves as global citizens”.

Indrani De, Managing Director of Macro & Country Risk at TIAA, told us at RiskMinds international 2018 that the globalisation of trade and financial markets had been the hallmark of the last two decades.

“The problem,” said De, “is that once populism takes hold there is a high likelihood of anti-globalisation and anti-growth policies.”

Cyber risk and cyber risk management

“For consumers, the issue of trust is becoming ever more important”, Lana Abdullayeva, Open Banking & PSD2 Director at Lloyds Banking Group, wrote. “Being able to trust service providers with data throughout the customer journey is becoming a vital part of the customer experience.”

Therefore, cyber risk is an integral part of enterprise risk management. But practicing correct cyber hygiene and integrating cyber security into internal policymaking remain challenges for the banking sector.

“In reality, it’s one of the most difficult risks to manage because it is so detailed”, Ebbe Negenman, Chief Risk Officer at Aegon Bank, said at RiskMinds International. “When I have looked at the incidents we have encountered in the last few years, some of them have been really small but with a large reputational aspect. That is really difficult to grab into a model or report. Yes, you should manage this risk within ERM, but how to do that is still being worked on.”

The future risk manager

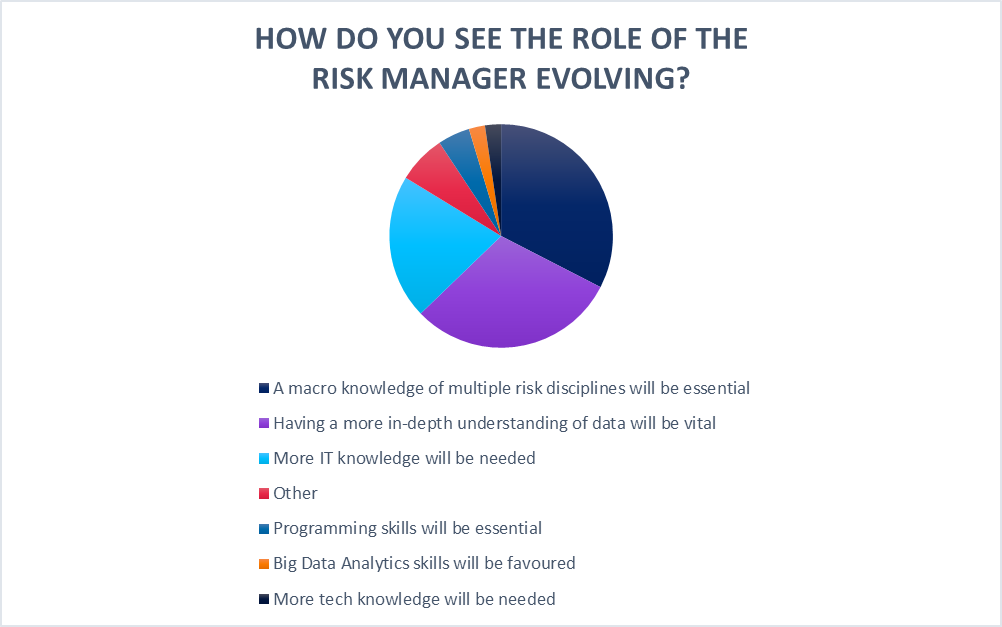

The FutureRiskMinds survey clearly indicates the importance of a business’ technological development, highlighting the understanding of data, IT knowledge, and programming, big data analytics, and general tech skills as desirable traits of the future risk manager.

A FutureRiskMind summarised:

“The regulatory environment in combination with the pace with which innovation, technological advancements and related new risks (e.g. cyber risks) are evolving make it challenging to stay abreast of the change.

“Not only will the current developments fundamentally change the risk profile and the way in which those risks are managed. But also, it will become increasingly challenging to proactively shape the future of risk management, to constantly improve the way we work, make use of the benefits of disruptive technologies and thereby help the business increase value and agility.

“However, the ability to think and act differently will be a key success factor not only for the business but for every area within an organization. In particular, the risk function can benefit from applying and adopting new technologies such as big data and artificial intelligence, to better monitor and control risks as well as to increase efficiency and to create value.

“The challenge is to establish an environment and spare time for stimulating innovation and quickly acquire the necessary skills in order to exploit the opportunities these new technologies can bring.”