Do bonds still provide the necessary hedge in portfolios?

Do bonds still provide the necessary hedge in portfolios? Michael Arone CFA, Chief Investment Strategist, US SPDR Business gives his verdict and perspective on this timely discussion.

Bonds: Necessary edge?

The simple answer is yes. Unfortunately, in today’s complex investing environment there aren’t many simple answers. In 2018, the traditional benchmark for core bond exposure, the Bloomberg Barclays US Aggregate Bond Index (Agg) narrowly escaped a negative return. And because it’s still likely the Federal Reserve (Fed) will raise rates at least once this year, investors’ expectations for future bond returns have dimmed.

The problem is basic bond math: As bond yields rise, bond prices fall. If a bond’s coupon can cover the duration-induced price decline, then it’s not necessarily a loss-generating event from a total return perspective. But that’s not the current case for traditional bond exposures like the Agg.

Poor returns for both stocks and bonds in 2018 have many investors questioning the benefits of traditional diversified portfolios. As investors have become less certain about bonds’ role, it is important to note that the Agg has posted a negative total return just three times in the last 40 years.

However, in each of these negative years for bonds, stocks were positive, offering at least some hope for the standard 60% equity/40% bonds allocation.[1]

In contrast, last year’s subpar performance from the Agg occurred with global stocks in a funk. More than 70% of MSCI ACWI stocks were trading below their 200-day moving average at the end of 2018. And nearly 60% of global stocks declined at least 20% from their 52-week high, putting them in a bear market.[2]

It is highly unusual for both stocks and bonds to suffer simultaneously. In reality, it’s been almost three decades since both asset classes posted negative returns in the same year. This challenging environment threatens the total return of a traditional 60/40 investment portfolio.

"Ongoing geopolitical tensions, slowing global growth and an extended bull market in US equities mean this challenging environment will likely persist in 2019."

In fact, last year that traditional 60/40 portfolio experienced its worst calendar year return since the global financial crisis struck roughly a decade ago.[3] However, when stocks plummeted more than 40% during the financial crisis, at least bonds rose to provide the expected ballast to portfolios. Not in 2018.

So, it’s no wonder — in this low return, low yield environment — that investors are rethinking the role of bonds in traditional diversified portfolios.

So, how did we get here?

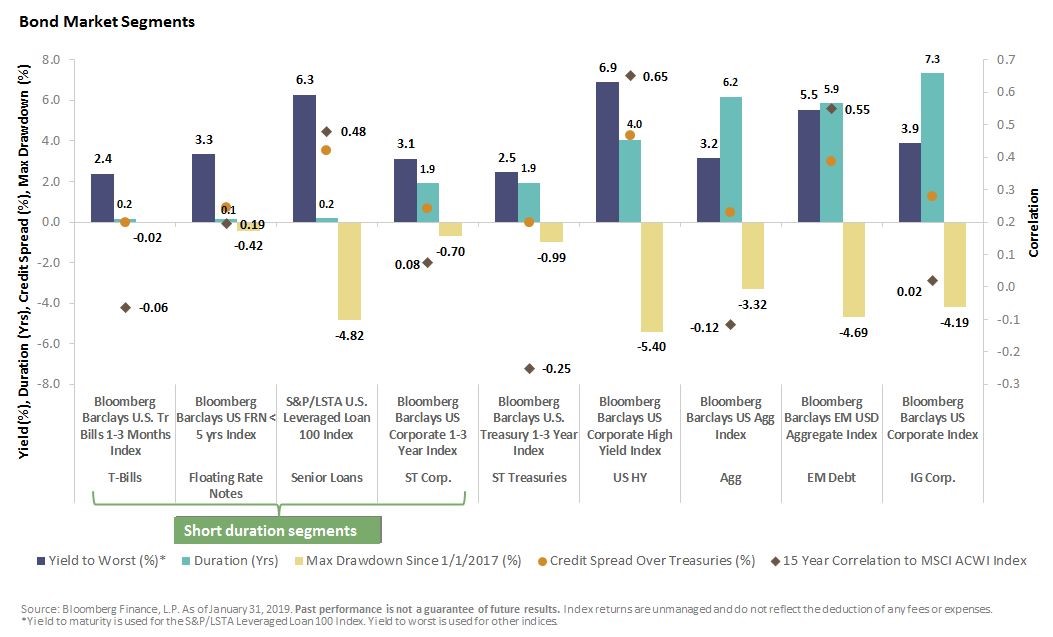

Rising rates have altered the relative attractiveness of various bond sectors to hedge equity risk. For example, with its asymmetric yield and interest rate risk profile, the traditional Agg is no longer the ideal hedge.

As yields fell but duration became extended due to ultra-accommodative monetary policies, the cushion afforded by the coupon on these bonds no longer outweighed the effects of duration-induced price declines. This resulted in sharper, more severe drawdowns that accelerated as rates rose.

In addition, the Fed’s seven rate hikes in the last two years have increased the yields of shorter duration bonds, creating more opportunities to generate income without taking on sizeable interest rate or credit risks.

"Unfortunately, in today’s complex investing environment there aren’t many simple answers."

We’ve seen strong absolute and risk-adjusted performance since early 2017, with the Fed’s hikes creating an improved return stream and risk profile for shorter duration bonds compared to the Agg.

Am I right? Am I wrong? Selecting bond sectors is the key

Whether constructing a portfolio to generate income or manage risk, investments on the short end have become more attractive, especially considering that many have a duration of less than 2 years compared to the Agg’s duration of north of 6 years.

For example, investment grade floating rates notes carry a duration figure of less than 3 months.

To mitigate equity risk, consider focusing on bond sectors’ correlation to equities, yield per unit of duration, and drawdown performance since the Fed began to hike rates at the end of 2015.

Considering credit spread can also help you guard against adding just low-beta equity risk through credit instruments. Finally, investment grade ultra-short and short-duration bonds may be a better risk mitigation tool than equities; in addition to providing some income, they have limited drawdowns, attractive yield per unit of duration, low credit risk and low correlation to equities.

Same as it ever was: Bonds still an important hedge

Hindsight is 20/20, but an equal-weighted allocation to investment grade floating rate notes, Treasury bills and 1-3 year corporates alongside a position in the Agg would have improved a 60/40 portfolio’s return by roughly 30% last year.[1] The total portfolio return would still have been negative, but the bond sleeve’s positive return would have buffered the drawdown in equities.

Ongoing geopolitical tensions, slowing global growth and an extended bull market in US equities mean this challenging environment will likely persist in 2019.

To balance equity risk, investors should consider shortening duration and focusing on higher quality sectors of the fixed income market. As investors pursue those strategies, we’ve seen significant inflows into exchange traded funds (ETFs). In fact, bond ETFs took in more than $15 billion in January.[2]

This pushed bond inflows over the last three months to the highest level ever as investors sought the defensive properties of bonds, underscoring their important role in hedging equity volatility.

The views expressed in this material are the views of Michael Arone through the period ended February 7, 2019 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward looking statements.

Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

[1]FactSet, as of 12/31/2018.

[2] Bloomberg Finance L.P., as of January 31, 2019.

[3]Bloomberg Finance L.P., as of 12/31/2018.

[4]Bloomberg Finance L.P., as of 12/31/2018.

[5]Bloomberg Finance L.P., as of 12/31/2018.