Embedding ESG into the bank’s management approach: Extension of the balance sheet approach to a value creation ESG desk

Many banks have ESG on top of their agenda. Some voices even state: Sustainability is the new capital. This statement is encouraging for the fight against the global warming. But what does sustainability actually mean in banking practice? In contrast to capital management, the steering mechanisms for sustainability are clearly underdeveloped, even not existing. This article provides a pragmatic starting point for such mechanisms.

The challenge for a steering mechanism is the fundamental difference between capital and sustainability. There is no common definition of sustainability.

If we assume that sustainability is ESG then we realise that ESG is multi-dimensional 'E', 'S' and 'G'. Each of these dimensions is multidimensional in its own.

Water, pollution, biodiversity, carbon footprint are examples of dimensions of 'E'.

The challenge is increased by the fact that there is no common obvious numeraire. This situation opens the room for flexibility but also the tendency to define multiple ESG KPIs.

KPI to KMI

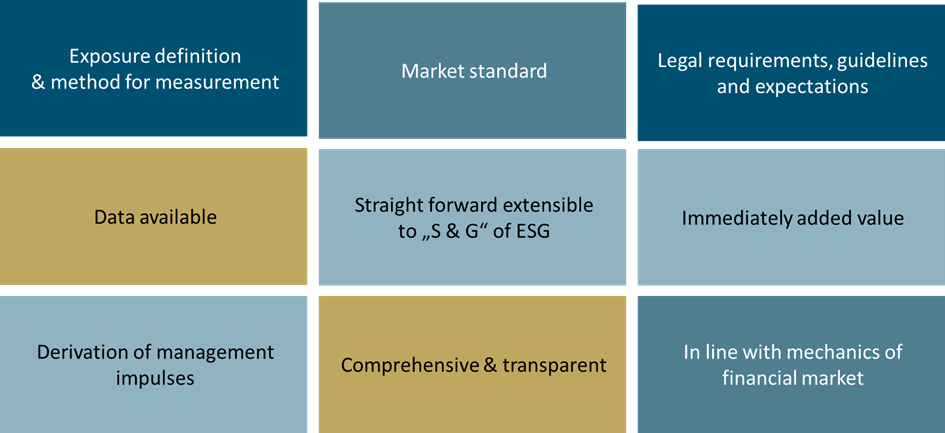

The drawback of too many KPIs is the fact that a certain subset is not actively managed but regarded as soft and just reported. In the context of ESG, we need to define Key Managed Indicators (KMI). A KMI should have number of characteristics, in the context of ESG it is important that a KMI could be constructed in the same way for each dimension of ESG. The following figure shows some of the essential characteristics a KMI should fulfill:

Figure 1: Illustration of characteristics of an ESG KMI

The existing sustainability banking regulation does not offer many KMIs which are fulfilling these criteria. However, the 'Green Asset Ratio' (GAR) does – though it can be argued about the comprehensiveness if we define the EU-Taxonomy as the underlying approach. Data for the EU-Taxonomy[1] maybe a challenge, but no additional data is required over and above this is the GAR is sent into the centre stage.

The beauty of the GAR is that the bank’s management can set its ambition comparable to a capital ratio by defining a GAR target.

How to manage ESG?

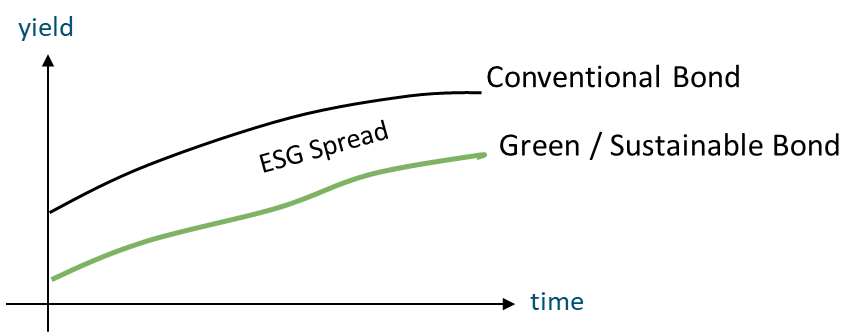

If a bank has defined its GAR target, the question is how to create a steering mechanism which is in line with the mechanisms of the financial markets. Here, the silver bullet is to request the bank’s treasury to manage the GAR. By extending the fund transfer pricing (FTP) by an ESG component, the bank’s treasury has all the tools to steer. It must be acknowledged that this steering mechanism is only reinforceable if there is a sustainability spread.

There are several papers proving the existence of a positive sustainability spread, e.g., Kapraun & Scheins (2019), '(In-)Credibly Green: Which Bonds Trade at a Green Bond Premium?' or Generali Investments (2021), 'Green & Sustainable bonds: a label is not enough'.

Figure 2: Illustration of a sustainability spread.

Who takes the risk? From risk taking to revenue generation

The steering mechanism indicated on the previous page can be embedded straight into an existing FTP mechanism. The latter is implemented at almost any advanced banks.

While the above illustrated concept allows to manage a regulatory measure, at least one fundamental question is not addressed: 'Who actually takes the ESG risk' or is this risk socialised within a bank and taken on top line? At least for climate risk within the real-estate loan portfolio a modified concept from trading can be applied to improve transparency and focus.

The introduction of a climate risk scenario into CECL / IFRS 9 ECL calculations allows to quantify the impact onto the collateral (real-estate). This quantified climate risk is the insurance premium which is transferred internally to the newly established ESG Desk within the bank.

This ESG Desk provides insurance cover to the front office against climate risks. Thus, all climate risk is centralised at the ESG Desk. The ESG Desk can either buy insurances at an insurer or mitigate the risks by working with the real estate owner on making it more resilient against climate risks and thereby reduce the loss provision. Consequently, the desk exhibits not only an ESG advisory function but also offers the ability to actively generate new business for the bank.

Ultimately, this ESG Desk is incentivised to reduce the climate risk exposure measured in clear PnL relevant items or in terms of expenses for insurances, while also generating new revenue.

[1] Another Taxonomy could be applied as well. Thus, the approach is not limited to EU regulated or headquartered banks.