Escalating GTN reductions puts pressure on sales

Pharmaceutical manufacturers have a sales funnel, depicted above, that is being clogged by escalating gross-to-net (GTN) reductions.

Components of the GTN Sales Funnel are as follows:

- Gross Sales at a drug’s Wholesaler Acquisition Cost (WAC). Note that gross sales are for prescriptions filled representing prescriptions written less reductions attributable to payer restrictions, patient abandonment due to high out-of-pocket costs, and patient discontinuation. According to IQVIA, prescriptions filled as a percent of total written were 34% in 2019 for new launch products in the first year on market.

- Rebates to pharmacy benefit managers, managed care organizations and government entities. The rebate percentage is impacted by the drug’s price, product profile, clinical alternatives, and formulary position.

- Chargebacks for sales to customers that purchase and dispense drugs to patients. Entities such as the VA, DOD, & Kaiser negotiate a customer contract price (with the pharmaceutical manufacturer) below WAC. Accordingly, the wholesaler will invoice (chargeback) the pharmaceutical manufacturer for the difference between the amount received from the contracted customer (contract price) and the amount originally paid to the pharmaceutical manufacturer (WAC) for the drug.

- Medicare Part D Coverage Gap Branded pharma companies are required to pay a government rebate of 70% when the patient enters the Medicare Part D Coverage Gap (“donut hole”) by incurring retail drug costs exceeding $4,130.

- Copay cards buydown is based on the pharmaceutical company subsidy reducing patients’ out-of-pocket cost. Accrual rates are developed by estimating the commercial redemption rate and average patient out-of-pocket cost reduction.

- Returns for expired product are generally accepted six months before to twelve months after expiry. Accrual rates are difficult to estimate due to the time lag between the date of sale and product return.

- Cash discounts are typically 2% of wholesaler purchases based on WAC.

- Wholesaler fees are based on WAC and range from 1% to 12% depending on the size of the pharmaceutical manufacturer.

Estimating GTN accrual rates

GTN adjustments are recorded when product is sold based on estimated accrual rates.

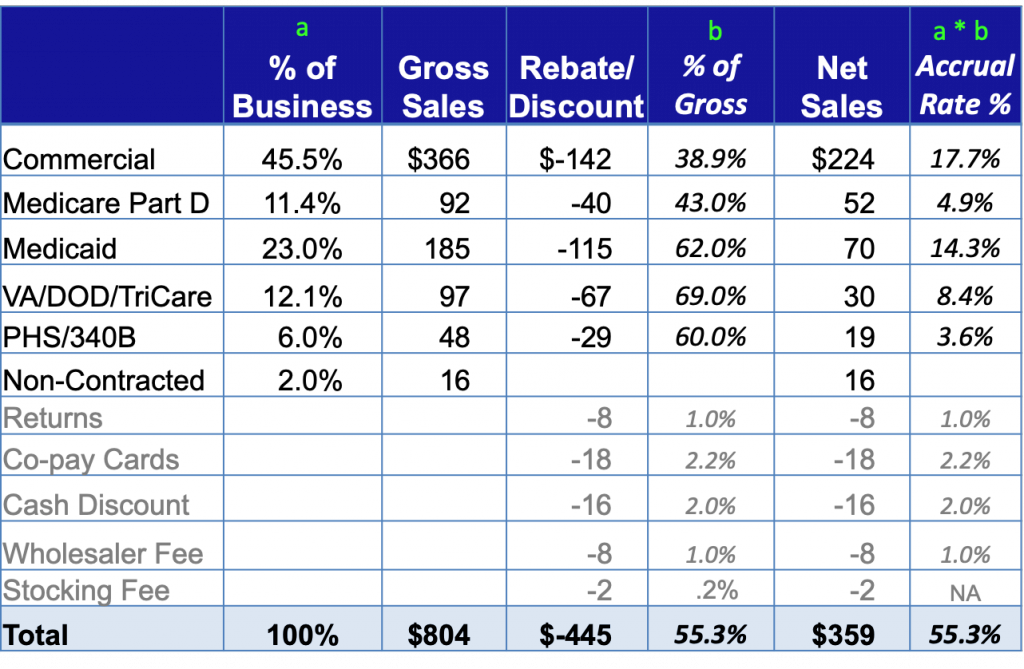

Accrual rates are developed by preparing a projected channel summary as shown in the illustration below:

Estimating payer mix (percent of business) and rebate/discount rates is challenging. Many factors influence the demand and rebate rate by payer including price, formulary position, promotional activities, market access dynamics, product profile and the competitive environment. Judgement and cross-functional collaboration are required to develop sound accrual estimates supported with salient documentation. More accurate accrual estimates minimize significant true-up adjustments and unexpected surprises.

Clogged pipes are reducing the flow thru the GTN Sales Funnel

The amount flowing thru the GTN sales funnel continues to decline. Total GTN reductions doubled from $83 billion in 2013 to $166 billion in 2018. Rebates plus other GTN reductions in 2020 for Sanofi, Janssen, and Lilly surpassed 50% of gross. Drug classes such as diabetes and respiratory have GTN reductions of over 70% of gross sales leaving less than 30% to cover cost of sales, royalties, SG&A and R&D.

Primary reasons for the rapid growth in GTN reductions are as follows:

- Escalating rebates for preferred or exclusive formulary access

- Price protection contracts

- Growth in Medicare Donut Hole

- Medicaid best price plus CPI penalty rebates

- Increase in pharma copay buydowns to offset escalating patient out-of-pocket costs

- Growth in 340B drug pricing government program

- Duplicate discounts for 340B and Medicaid

Pharmaceutical companies must develop innovative differentiated drugs addressing unmet medical needs to be less vulnerable to escalating rebates and ensure formulary access. There continues to be a rapid increase in specialty drugs where average rebates and discounts approximate 25% which is significantly below the average of 54% for traditional brands.

Advanced data insightful analytics coupled with cross-functional collaboration are encouraged to explore options to optimize the amount flowing thru the GTN sales funnel.

Visit GTNPharma.com to read other blogs and learn about our workshops & webinars.