Estimation of Flood Risk on a residential mortgage portfolio [1}

Floods are a key challenge in the Physical Risk domain, especially in Italy. In a recent paper we aimed at measuring, with a scenario-based approach, the impact of flood risk on mortgages secured by residential properties. Eventually, the risk driver has been reflected on LGDs and PDs parameters to measure the impacts on the expected losses of the portfolio.

We executed the flood risk measurement in the long-term over three different climate scenarios, representing different global reactions to climate change.

The methodology adopted can be broken down along three axes:

- Identification of exposure: properties’ geographical location, especially in terms of proximity to waterways.

- Hazard measurement, consisting of the flood phenomenon forecast, expressed in terms of flood depth. The forecast is calculated starting from the application of the IAM macroclimatic model which estimates, among other output variables, temperatures, wind and precipitation. The 2022-2050 forecast horizon is based on three distinct NGFS scenarios:• Orderly Transition,

• Disorderly Transition

• and Hot-House World, which were also used for the recent ECB-sponsored Climate Risk Stress Test in 2022. - Vulnerability of individual exposures, derived from the characteristics of interior and exterior quality, etc.

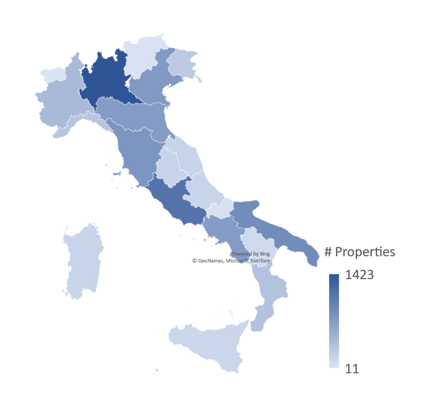

The sample was made of 10,000 properties for 1.59 billion euro worth of Exposure at Default, distributed geographically according to the distribution of the Italian population.

Operatively, the identification of exposure started from the association of each property to its geographic coordinates (geolocation). Then, in order to improve the model-based measurement, each asset has been enriched with specific geo-morphological features (such as distance to rivers).

Hazard measurement starts from a top-down econometric model (IAM) which integrates both climatic and economic modules, modeling the feedback loops between economic activity, Greenhouse Gas (GHG) emissions, climate variables such as temperatures and precipitations, and transition policies. The long-term projections of these variables are aligned with the ones coming from the reference scenario – in this case, the 2021 release of the NGFS scenarios.

However, since the climate variables projected by the IAM are estimated on a nation-wide basis, further specification of the model is needed to properly account for local climatic conditions, that are very heterogenous on the Italian territory. We were able to solve this issue through a statistical downscaling procedure, which allowed to estimate a precipitation and flood depth levels for each geographic cell in scope.

The vulnerability assessment measures the damage to properties by using hazard-dedicated damage functions, transferring the intensity of the climate event (in this case, the flood depth) to a replacement value, that is the cost of repairing the damage in percentage of the value of the property (also known as mean damage ratio). The issue of heterogeneity repeats itself here, since available damage functions are usually estimated at the country level: further data about local conditions of the housing markets in terms of price, quality and height of the buildings have been taken into account, in order to better estimate the devaluation occurring after the flood event to each property in scope.

The risk profile of each property has been characterized across five return periods [2] : 10-year, 50-year, 100-years, 200-year and 500-year. This led to calculate the Average Annual Loss (AAL), that is the equivalent, in catastrophe risk terms, of the expected loss. The aggregate results of this calculation are broadly consistent with previous research about the vulnerability of Italian property market to flood risk.

With the AAL, all the items needed for the calculation of the Loss Given Default (LGD) shock for each property are in place. The impact of the flood risk on the Probability of Default (PD), however, is not readily computable by means of established models. This has been addressed by using a correlation formula[3], derived from the Vasicek portfolio model, which allows to estimate a shock to the PD proportional to the shock of the LGD.

The main results are:

• The main part of the portfolio (84% of properties) is subject to a negligible flood risk, with subsequent null effects on risk parameters.

• Even if we consider the remaining 16% of the portfolio having some level of vulnerability to flood risk, the impact is highly unequal. The bottom third of those exposures would see their expected loss rise between 1% and 6% on a 30-year timeframe, while the middle third increase would be from 15% to 31% on the same period. For the worst third, however, the increase in risk would be huge, since the expected loss would increase up to 3-5 times compared to the initial level in the entire time horizon.

• The comparison between the 3 scenarios shows results that are consistent with the NGFS / ECB narrative: in the long run, the risk of extreme climate events increases substantially more in the Hot-House World with respect to the scenarios where climate transition is, sooner or later, properly addressed; this reflects into a portfolio-wide risk premium that is 33% higher than in the Orderly Transition scenario in the long run.

The presented methodology opens the way to a bunch of possible research and implementation streams: there is room for refining the calculation of the property depreciation and LGD shocks, estimate a proper PD model for flood risk, and to integrate this kind of models into risk management, stress testing and planning processes.

References:

[1] Summary of methodology and results of the research on Flood Risk conducted jointly by the Risk Management function of Intesa Sanpaolo and Prometeia, published in August 2022 for AIFIRM, the Italian Risk Managers Association.

[1] As a reminder: a “50-year return period event” is an event whose magnitude is matched or exceeded, on average, once every 50 years (with a 2% probability).

[1] J. Frye, M. Jacobs Jr., Credit loss and systematic loss given default, The Journal of Credit Risk Vol 8, 1-32, Spring 2012.

About the authors:

Luca Bartolucci, Principal & Deputy Head Climate Change & ESG Risks competence line, Prometeia

Andrea Lugli, Specialist Climate Change & ESG Risks competence line, Prometeia

Maurizio Pierigè, Senior Partner & Head Climate Change & ESG Risks competence line, Prometeia

Prometeia is a partner of RiskMinds International 2022. Read more and explore their sessions here.