Figuring Out Factors: Strategies for Implementation

How can you implement factors in equity portfolios? Mark Carver, Executive Director & Global Head of Factor Index Products, MSCI moderated a panel discussion on this topic at Inside ETFs 2019. Hear Mark summarize the panel discussion below.

At the Inside ETFs conference, I moderated a panel discussing best practices for implementing factors in equity portfolios. On the surface, this may seem as simple as transferring your investment beliefs to actionable trades inside a model portfolio using factors.

But effective implementation may require consideration of a number of issues, including: the level of factor exposure in the existing portfolio; evaluating active risk through the lens of the passive and active parts of the portfolio; and whether the ongoing factor exposures can be managed in a static or dynamic fashion.

Determining current factor exposures

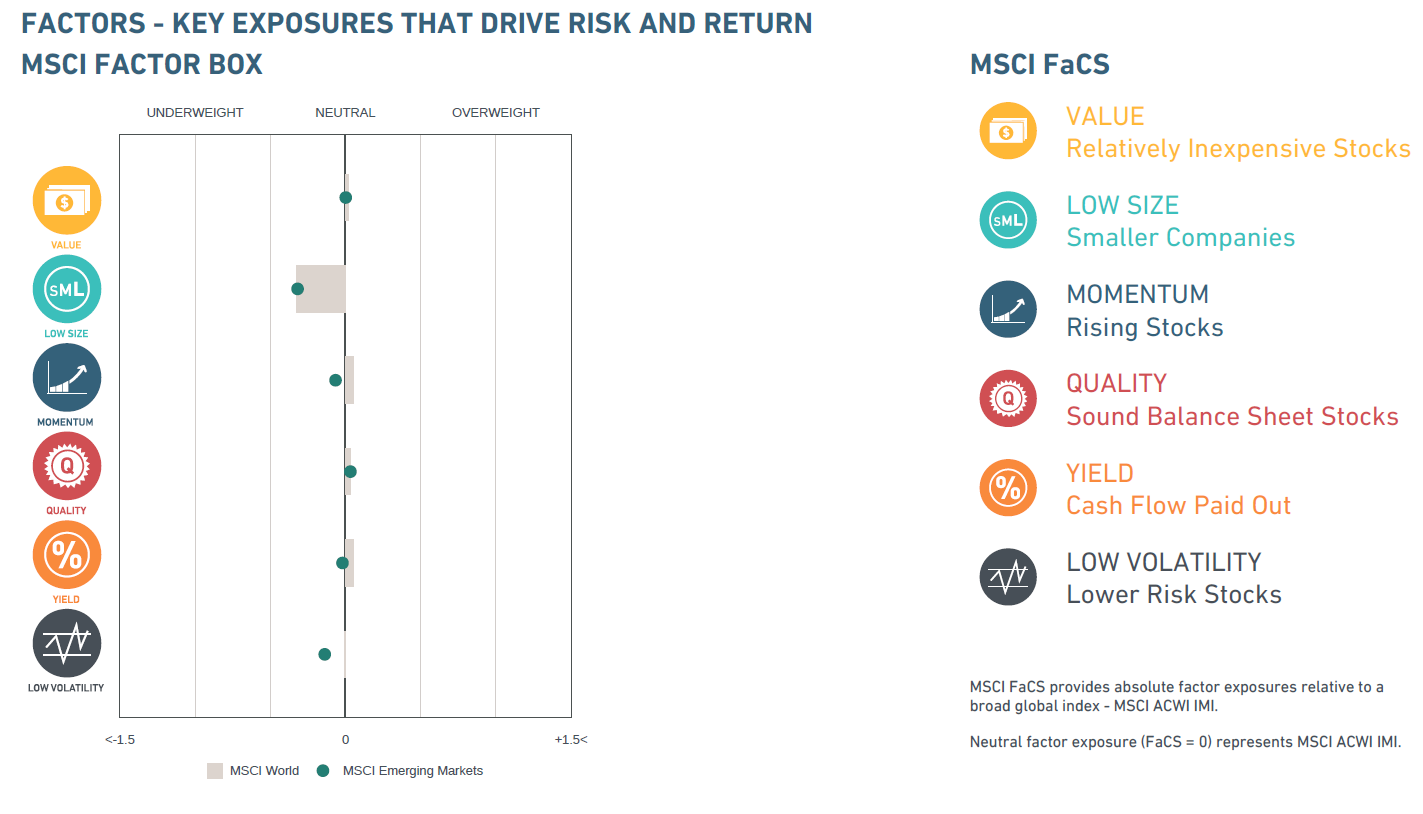

We often hear clients argue that factors have no influence on their portfolios. But this would only be true if that investor owned the total investable equity opportunity set, represented here by the MSCI ACWI IMI. If you own any other portfolio, then, by definition, you’re a factor investor, and you can employ a framework to uncover your factor exposure.

Consider, for instance, a portfolio allocated only to a developed-market index, such as one replicating the MSCI World Index. This portfolio, examined through MSCI FaCS, a factor classification standard developed by MSCI[1] shows modest factor tilts (notably a bias to large-cap stocks).

MSCI FaCS allows investors to determine their starting factor exposures, monitor changes through time based on their holdings and decide whether these exposures continue to match their allocation objectives. When you use this lens, you may be surprised by previously unknown factor tilts in your existing portfolio but knowing where you are allows you to align your portfolio to your beliefs.

Factor exposures for the MSCI World Index

Evaluating active risk

The next decision our clients typically face is determining the level of active risk from factor allocations through the prism of the active and passive portions of their portfolio. My colleagues Anil Rao and Raman Subramanian wrote a piece titled “Bridging the Gap: Adding Factors to Passive and Active Allocations,”[1] which addresses this challenge.

They introduce a risk-budgeting framework in which investors’ decisions about which portion of their portfolio they should use to fund factor allocations rest on how much active risk (or tracking error) they are willing to assume across their equity portfolio.

Advisors have often allocated to minimum-volatility strategies, which seek to reduce total risk. However, the trade-off has often been an increase in the level of active risk. For example, the MSCI World Minimum Volatility Index provided lower 3-year standard deviation than the MSCI World Index (8.83% vs. 10.60%), yet relatively high historical active risk (6.57% vs. that of another factor index such as the MSCI World Value Weighted Index 3.13% for instance).[2]

Given this framework, some investors focused on lower active risk have funded factor allocations from the active portions of their portfolios, while those willing to accept higher active risk may have chosen to fund from the passive part.

This may be true regardless of whether these investors selected factor-index-linked products, such as ETFs or active factor-based products managed by quantitative asset managers.

Employing a static or dynamic approach

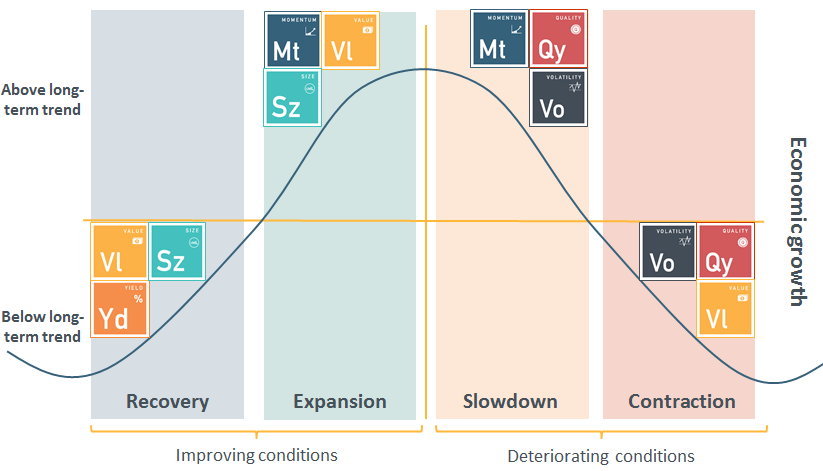

The last consideration is whether or not to employ factor rotation, in which factors’ weights are dynamically adjusted based on macro-based signals, such as leading economic indicators to measure the economic cycle, relative valuation of factors or value spreads and market sentiment (i.e., risk on/risk off). This is a controversial idea in the investment community, with strong opinions on both sides of the timing debate.

However, the desire among investors to adjust portfolio weights based on the health of the market and changing investment fundamentals persists. Clients consistently ask about employing dynamic weights to their factor allocations.

The graph below overlays factors along the economic cycle, measuring economic conditions in the near term versus the longer-term running average. As you can see, historically, factors have exhibited a level of cyclicality to the macro environment. However, the debate over whether the cyclicality is predictable ex-ante or only observable ex-post rages on.

Factors through the macro cycle

Like many questions, the answer to “How do I implement factors within my equity allocation?” is not as simple as it seems and is worthy of deeper discussion.

A full treatment of adapting factor weights is beyond the scope of this blog post, but my colleagues Hitendra Varsani and Vipul Jain recently published an excellent paper on the topic titled “Adaptive Multi-Factor Allocation,”[1] which is available at MSCI.com.

[1]Rao, A., R.A. Subramanian and D. Melas.(2017). “Bridging the Gap: Adding Factors to Passive and Active Allocations.” MSCI Research Insight.

[2]MSCI World Minimum Volatility Index standard deviation and active risk from January 1988 to January 2019. MSCI World Value Weighted Index standard deviation and active risk from January 1994 to January 2019.

[3] Varsani, H. and V. Jain. (2018). “Adaptive Multi-Factor Allocation.” MSCI Research Insight.