Four principles that can assist risk managers to prepare for future risks

The world is going through a massive paradigm shift, with changes and new risks emerging everywhere. The landscape is changing profoundly and there is a great risk that disproportionate focus on Covid-19 may blind risk managers to the significant build-up of risk in other areas, none of which can be resolved with a vaccine. Jaco Grobler, independent risk management and strategy expert, gives us an overview of the trends we’re seeing globally emerge, and shares his methods to prepare for future risks by following four key principles: the principle of polarity, rhythm, cause and effect, and synchronicity.

Risk managers are traditionally very capable in dealing with a crisis as it unfolds. However, identifying risk events well in advance remains a big challenge for most risk managers, in particular when the landscape changes so rapidly – as we are experiencing currently. The majority of risk management tools rely heavily on historical data to provide a proxy for estimating future risk events. There is no guarantee that future risk events will be a repeat of historical events, therefore creating significant “rear view mirror” risk.

This article aims to provide insight into four fundamental principles that I have been using throughout my career to assist me in understanding how risks develop and what the potential outcome could be.

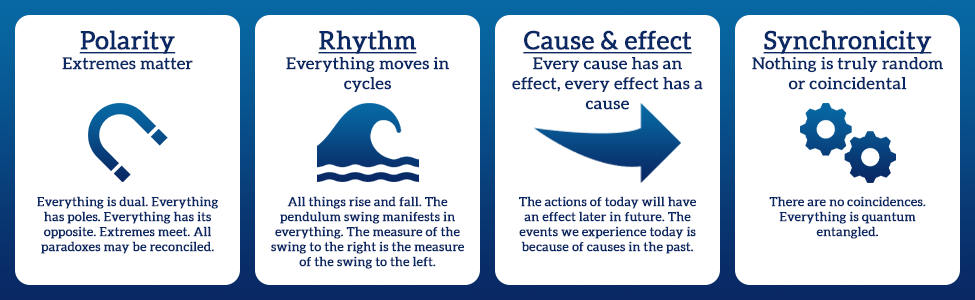

There are four primordial principles that are very relevant to risk management. Understanding and applying these four principles will provide risk managers with a lot of insight to prepare for future risk events. These four principles are:

Principle of polarity

The principle of polarity explains that there are two poles in everything and that opposites are really only two extremes of the same thing. An obvious example being hot and cold — both being temperature, varying only in degree. For example, there is no clear crossover moment when hot stops being hot, and starts being cold and vice versa, with no absolutes on either end. What matters is that there is always different perspectives. As an example, one person may see the stock market as hugely inflated whereas another will see it as offering a lot of value.

It’s important that risk managers develop the ability to take a step back and evaluate the polarities that exist and determine how significant these extremes are. We are probably observing more severe extremes than ever in history, and extreme polarities always adjust at some point. Gaining in-depth insight will allow you to understand the possible size of the adjustment that could occur.

Polarisation of society

As politics become more populist and corrupt, political instability extremes will further increase. Trying to keep populism under water is like trying to keep the beach ball under water, the lower you push it down the higher it will pop out. Increasing censorship and draconian measures (cause & effect) will likely further increase these extremes.

Economic extremes

There are numerous economic extremes at all-time record levels. For debt levels, in particular sovereign debt, an adjustment must occur at some point (principle of rhythm). The larger this extreme grows, the more severe the adjustment will be.

Meanwhile, interest rates are at a historic 300-year lows, in many cases negative. This extreme threatens the fundamentals of how currency works. If lenders are not rewarded for their risk the system may implode. Combined with record debt levels, any upwards adjustment in interest rates will result in a significant economic shock.

Asset bubbles

Valuations are increasingly disconnected from economic reality. Many assets do not reflect the damage from Covid-19 lockdown, leading to poor economic health. Quantitative easing further amplifies this extreme. Some valuations also have increasingly larger intangible components and are not in line with profitability. There is an assumption that profitability will return to pre-pandemic levels, but this may not be the case.

Social economics

Existing social tensions are further strained by the rise in unemployment rates and the destruction of small businesses. Inequality extremes are at their highest levels in decades. The danger lies in the combination of other social and economic extremes: cyclical highs and current radical policy actions (principle of cause & effect and principle of synchronicity).

Governments are under pressure for social support, but social grant funding is not sustainable. Like any drug addition, the patient does need to quit at some point, either through rehabilitation or death. Political instability makes an orderly rehabilitation unlikely.

Unfunded liabilities

Many pension funds are largely under water. This represents one of the largest “unaccounted” forms of funding gaps in history.

Also, social spending is at increasing risk of defaulting in the future. Sovereigns do not only default on their debt issuance, but they very frequently default on social commitments. This combined with many other extremes (principle of synchronicity) has the potential to create significant systemic social risk.

Principle of rhythm

Between the opposite poles of the principle of polarity is the pendulum swing of the principle of rhythm. This principle embodies the wisdom that everything exists in a measured motion, from here to there, moving in and out, swinging backward and forward, the rise and fall of the tides, ebbing and flowing and never truly sitting still. Never stopping, always changing. Most of what we measure in the world of risk management moves in cycles, it is important to understand where we are in the cycle.

As per the principle of extremes, debt levels are at an all time high. The majority of economic growth is supported by increases in debt which is a bad form of growth. What we observe is a super cycle that has gone way past its long-term peak trend. The pendulum has swung extremely far and an adjustment is overdue.

The interest rate cycle is way below a long-term cyclical level, lower than anything we have seen in history. Some may argue it’s a new normal, but in line with the principle of rhythm, we ought to expect a major adjustment. The adjustment could coincide with massive inflation or even the demise of the fiat currency systems at some point.

Fiat currencies are approaching the end of a cycle (almost zero return, excessive money printing, perpetual roll over, etc.) whereas new digital currencies are at the start of a new cycle.

In the geopolitical power arena, the descent of US is contrasted by the ascent of China.

Climate risk brings about the end of many cycles (fossil fuel driven economies) and the start of new cycles (renewable energy, electric cars, etc). The demise of old systems always brings about the creation of new systems, its critical to understand where we are in these cycles and how to deal with them proactively. Inaction in this area will have negative consequences in the future, e.g. an increased number of natural disaster events (cause & effect).

All pandemics in history have resulted in significant pre-existing imbalances being triggered with catastrophic effect. We have not yet fully seen that happen with the current pandemic due to significant stimulus interventions. These interventions however simply amplified the imbalances and there is no vaccine to prevent what may be inevitable adjustments (cycles always adjust).

Principle of cause & effect

This principle embodies the fact that there is a cause for every effect and an effect for every cause. Meaning, that nothing merely ‘happens’ for no reason. This principle is very important to understand how future risks will materialise. Following the global financial crisis of 2007/2008, the policy actions (cause) of loose monetary policy, low taxes, and high fiscal spending created asset bubbles (effect), a significant debt problem and large unfunded liabilities today. Whilst we still need to observe the manifestation effect of these imbalances, we also need to understand that unprecedented actions currently being taken will have a significant effect in future.

Unprecedented monetary actions (near zero interest rates and excessive money printing) will have significant implications going forward. We are observing the biggest monetary policy experiment in history without a clear understanding of future implications. Those who argue it’s a new normal with acceptable risk (based on current statistical information) may not understand the ketchup bottle effect, where you shake the ketchup bottle a few times and nothing comes out, only to find that suddenly it all comes out at once. Excessive money printing in the 1930’s was followed by a massive inflation and currency crises a few years later.

Advances in quantum computing will likely render existing encryption useless within the next 1-2 decades. Cyber risk will be an ever-increasing challenge as physical networks are being replaced with digital networks that are prone to many single points of failure risk. At the same time, privacy becomes a massive challenge with data monetisation. The customer is becoming the product, resulting in a massive conflict of interest.

We are also observing radical technological inventions that challenges the relevance of the workforce. For example, the digital economy needs entirely different skills. Furthermore, it may exacerbate the already existing issues of unemployment.

The massive displacement of the workforce resulting from Covid-19 lockdowns will also have a lasting effect and has changed the way we work. A new limitless working trend is emerging (anywhere, anyone, anytime) and employers will need to rethink their value propositions and how to maintain wellness and an identity with those who are not located at corporate offices any longer.

The invention of crypto currencies will have a significant impact on the banking and payment ecosystem. Banks will likely be most affected due to loss of transactional revenue and loss of deposit float. Should a certain number of savers change from fiat currencies to alternative crypto currencies, banks may have great difficulty maintaining their current funding model.

Excessive government spending (fiscal deficits) will without doubt result in additional taxes in future – there is no such a thing as government funded expenses; it is all taxpayer funded – or default on obligations (debt, social spending, or inflation).

Principle of synchronicity

The principle of synchronicity refers to events that appear to be coincidences with no obvious causal relationship, yet they seem to be meaningfully related in some way.

Applying the principle of synchronicity is much more difficult than the previous three principles. It is more akin to gut feel risk management combined with the observation of what initially appears as random risk events or trends that start to align. The way I have dealt with this in my career is to be on the look out for what I like to refer to as “pings” from different unrelated sources that start to form a trend of something new emerging. As an example, in 2018, I observed a number of “pings” popping up on pandemic risk, including an official warning from the World Health Organisation on the increasing risk of a pandemic happening. These “pings” combined with the fact that we have not had a significant pandemic for a very long time (cyclical trend) and climate change increasing the probability (cause and effect) suggested that there was a synchronicity developing.

Synchronicities are much more difficult to convey to management as it is often difficult to support with statistical facts and can be easily dismissed. They are however very important tools for forward looking risk management.

Today, I am paying close attention to:

The change in the consciousness of humanity

Combined with socio-political trends, it seems that we will never revert back to the old ways. Such significant change is normally characterised with periods of chaos and the fall of empires. The chaos always has a pattern and it’s important to be able to step back and observe the pattern.

From analogue to digital and quantum systems

Although we are adopting technologies quite rapidly, the management structures and thinking remains largely out-dated. Old paradigm systems will fail and, in its place, create the opportunity for new paradigm thinking to evolve that is built on the principles of quantum systems.

The decline of capitalism

There are many signs that suggest the model of capitalism, as we know it, is reaching its end of life and a new system is starting to emerge. It’s important to observe the developments and synchronicities because it relates to payment technologies, currencies (including crypto), debt mechanisms, etc.

Conclusion

Everything is interconnected and in flux. Applying these four principles will allow risk managers to gain greater insight to understand forward looking risks better. It is easy to get depressed by the magnitude and severity of risks described above. However, there is no need to panic, there are always solutions for all risk problems and those who are well prepared will always have an advantage during the next crisis.

About the author

Jaco is an independent risk management and strategy expert, who provides strategic advisory services. He has 25 years risk management experience, and is the former Chief Risk Officer (CRO) for FirstRand Group, Africa’s largest financial services group by market cap.

| Email: | jaco@newparadigmfinance.com |

| WhatsApp: | +27 83 452 4220 |

| Website: | www.newparadigmfinance.com |

| LinkedIn: | https://www.linkedin.com/in/jaco-grobler-271415/ |

| Facebook: | https://www.facebook.com/newparadigmfinance |

| Twitter: | @financeparadigm |