FRTB: A sheep in wolf’s clothing or a catalyst for a risk IT architecture transformation?

The Fundamental Review of Trading Book (FRTB) capital rules have prompted many discussions and are a cause of much concern for banks with any significant trading book. Industry experts have forecast dire consequences for banks if and when the rules come into effect in terms of both increased capital requirements and the efforts required to comply with the regulations. Celent, for example, estimated that the total implementation will cost a tier one bank between $60 million and $150 million over the next three years.

The Fundamental Review of Trading Book (FRTB) capital rules have prompted many discussions and are a cause of much concern for banks with any significant trading book. Industry experts have forecast dire consequences for banks if and when the rules come into effect in terms of both increased capital requirements and the efforts required to comply with the regulations. Celent, for example, estimated that the total implementation will cost a tier one bank between $60 million and $150 million over the next three years.

The volatility and uncertainty on the FRTB timeline and the delay in finalizing the rules make FRTB a regulation non-grata. The enormous complexity of FRTB, in particular of the Internal Model Approach (IMA), makes FRTB an exceptional challenge for global tier one banks. According to a survey of d-fine and FIS in November 2017, only 12 percent of the respondents will use FRTB for internal management and 58 percent stated the decision is still open.

But is FRTB really the wolf to be feared? Or is it a sheep in wolf’s clothing? The view on FRTB changes if we look at the bigger picture.

Market risk – overengineered?

FRTB will undoubtedly help banks calculate risk more accurately. Risk management overall also should improve under the new standards.

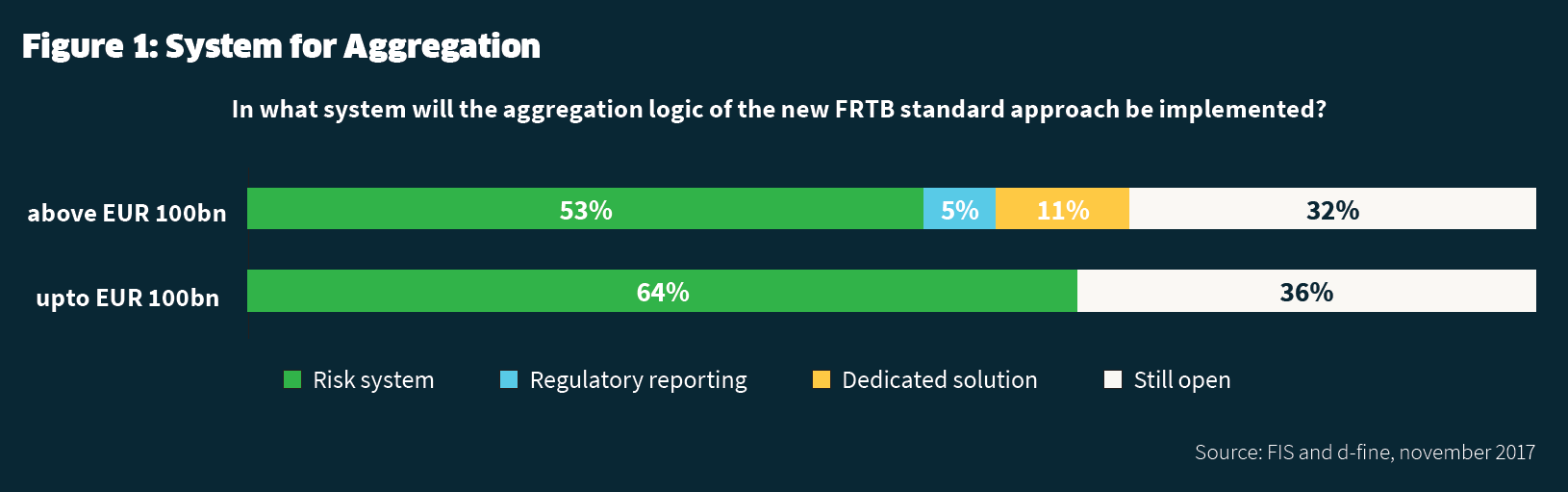

The new Standardized Approach (SA) may be more complex than some initial versions of the IMA under the current regulatory regime. Even if the crucial input parameters like position sensitivities are straightforward to derive (which they aren’t), the aggregation step with all its details is turning out to be a true challenge. Aggregation and dynamic flexible disaggregation are essential to understanding the risks and ultimately to benefiting from the regulation. The complexity of aggregation and disaggregation is a challenge on its own. An increasing number of banks are becoming aware of this, and large banks in particular are responding with a dedicated solution for the aggregation requirement.

To IMA or not to IMA?

IMA has gained significant complexity beyond the Basel 2.5 proposals with multiple expected shortfall calculations, non-modellable risk factors (NMRFs) and the P&L Attribution (PLA) test.

External factors are contributing to the complexity: For example, the move to replace LIBOR will require massive re-papering of contracts and create a step change in the risk factors used, possibly creating non-modelability and making the bank more likely to fail the PLA test. In addition, Brexit, MiFID II and global trade tensions are making markets more unpredictable and volatile, while banking regulations such as SR 11-7 and model risk management are putting modelling under greater scrutiny.

In many jurisdictions, a bank can decide for itself if it applies for an IMA or not, i.e., the regulator does not request this bank to have an IMA. So, the additional complexity often leads banks to focus more keenly on the business case – that the reward of a capital reduction that pays for the additional investment to obtain and maintain IMA approval.

While the largest banks will likely remain with IMA and the smaller banks will use SA, the picture is not so clear for the firms in between. Because FRTB is such a change from the current model, medium-sized banks must decide whether the work required to apply and maintain IMA will swamp the lower capital amounts.

Moreover, since approval is at the desk level, the decision must be made for each desk individually. However, when making this decision, banks must simultaneously consider the capital output floor, which is applied to each bank’s total market, credit and operational risk capital as a percentage of the capital calculated using the standardized approaches.

If a bank has an advanced model for credit risk, it may already be constrained by the capital floor, so any additional capital savings generated by a market risk IMA model will have no effect on the total capital requirement. So, in the new regulatory regime, decisions on internal market risk models aren’t independent of credit, counterparty risk and operational risk models and outputs.

A subtler consequence of the flooring is its ongoing impact. Even if market risk is constant, changing credit risk impacts market risk capital contributions. This interconnection of risk types underlines the fact that FRTB needs to be looked at in a broader context.

The FIS™ Readiness Report 2018 confirms that sell-side firms that have modernized their operating model to focus on digital innovation, advanced automation and emerging technologies are better placed in terms of risk as well. Seventy percent of the top performing firms – the sell-side Readiness Leaders – say they are well equipped to support their growth plans from a market/credit risk perspective, compared to only 30 percent of the rest of the sell-side industry.

Three more points of uncertainty

The rules have been clarified somewhat by the consultative document released in March 2018. However, there are still significant industry concerns around how the PLA test will work on hedged portfolios, for example, and whether the NMRF proposal will be viable in the current format (as the NMRF capital alone is a multiple of the expected shortfall for many banks).

In terms of timelines, while regional regulators have confirmed some delays, there is still significant risk that political and industry pressures will lead to further postponements or even alter the regulations in regional implementations.

Lastly, the technological landscape is changing constantly. With the rise of open-source software, componentization, cloud and machine learning, a bank’s architecture must be able to embrace the latest capabilities, for surely its competitors will be. Technology is also the only way to adhere to the underlying theme of FRTB: to improve timeliness and accuracy of risk management. So, the picture is changing – it is now becoming a risk architecture redesign one.

The bigger picture

While the detailed implementation of the rules may still be unclear, there is no reason not to take the rules seriously. According to a recent survey from d-fine and FIS, only 22 percent of banks above a balance sheet of 100 billion euros have not started either projects or a detailed analysis phase. What we see is banks taking the rules seriously, but not in all cases literally.

FRTB has three clear principles: transparency, understanding of your risk factors and consistency of pricing. In addition, banks will want to achieve operational efficiency, return on equity and lower costs – all embedded in a BCBS 239-compliant approach.

As illustrated by the capital flooring example above, both decision-makers and risk experts need to understand the intersection of risk regulations and the potential synergies for their bank on an enterprise level, not in silos. These regulations include:

- BCBS 368: Interest rate risk in the banking book

- EBA/GL/2015/08: Guidelines on the management of interest rate risk arising from non-trading activities

- BCBS 317: Margin requirements for non-centrally cleared derivatives

- ECB: Internal Capital Adequacy Assessment Process (“ICAAP“)

- BCBS 424: Section – Minimum capital requirements for CVA risk

In addition, the non-methodology parts of FRTB highlight the need to restructure trading desks and introduce new workflows and processes between treasury and trading.

These are significant strategic investments of time and money that target fundamental changes in banks’ risk and pricing infrastructures. In return, senior management will have a better grip on their bank and can make better, more sustainable and profitable business decisions; while risk professionals will have a flexible risk infrastructure that can deal with the next crisis as it emerges.

With the increased focus on capital, front-office stakeholders and traders are now much more focused on pre-deal assessment and ongoing monitoring of capital impacts of trades and strategies. Traders will be looking for near real-time updates on the impact of deals and clues to how capital can be optimized. In the new IMA paradigm – which is not intuitive and not always in line with the front office’s perceived reality – an extensive and seamless pre-deal advisory assessment is essential.

Despite these challenges, for the most part banks see the general spirit of the regulations as positive. They are starting to take it as a once-in-a-generation opportunity to rebuild their overall risk architecture for the future. While there is some evidence of banks being cautious on investments, in the majority of cases we see them pro-actively making “no regrets” decisions that will give them the agility to respond as the rules and business decisions crystalize.

Thinking beyond FRTB – The leveraged componentized approach

Although the regulation’s focus on the front office could be taken to imply that banks should focus on re-using a front-office system for risk, banks should be wary of monolithic single-stop solutions. That approach creates significant project risk in terms of delivering that solution and significant vendor risk in the case of a vendor-supplied solution.

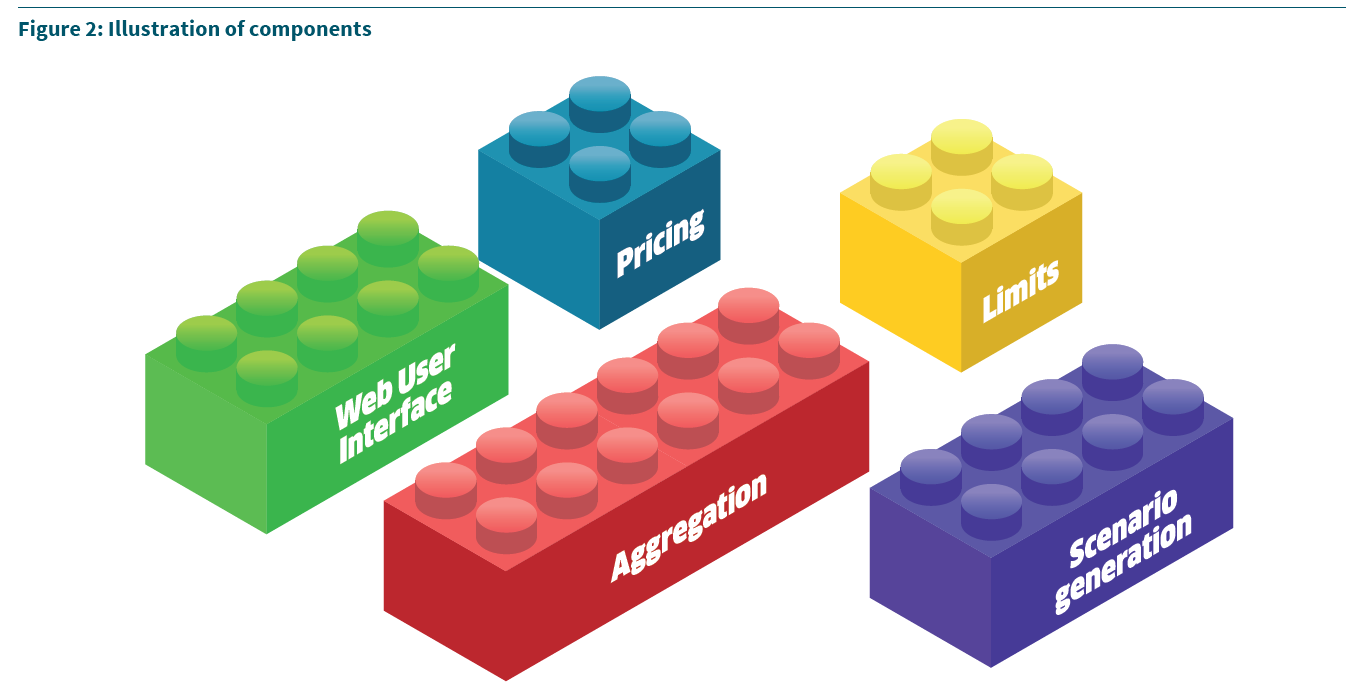

Increasingly, banks are choosing flexible, scalable and configurable technology components that will serve the bank for the next generation of risk requirements, not just for the immediate requirements around trading book market risk.

Because a component is a small and dedicated element of a value chain, not the entire value chain, banks can select a component for each purpose, whether that means a standard software component or an in-house build.

Secondly, once a component is in production, it can be swiftly and cost-efficiently enriched, modified, deployed or upgraded – independent of the rest of the architecture. This approach not only saves time and money, it allows the bank to flexibly (re)configure as needed, based on the latest requirements. This is crucial in circumstances such as FRTB where some parts of the regulation – as highlighted above – are still changing.

Consider this approach in light of FRTB, where the components outline a standard view of the generic functions:

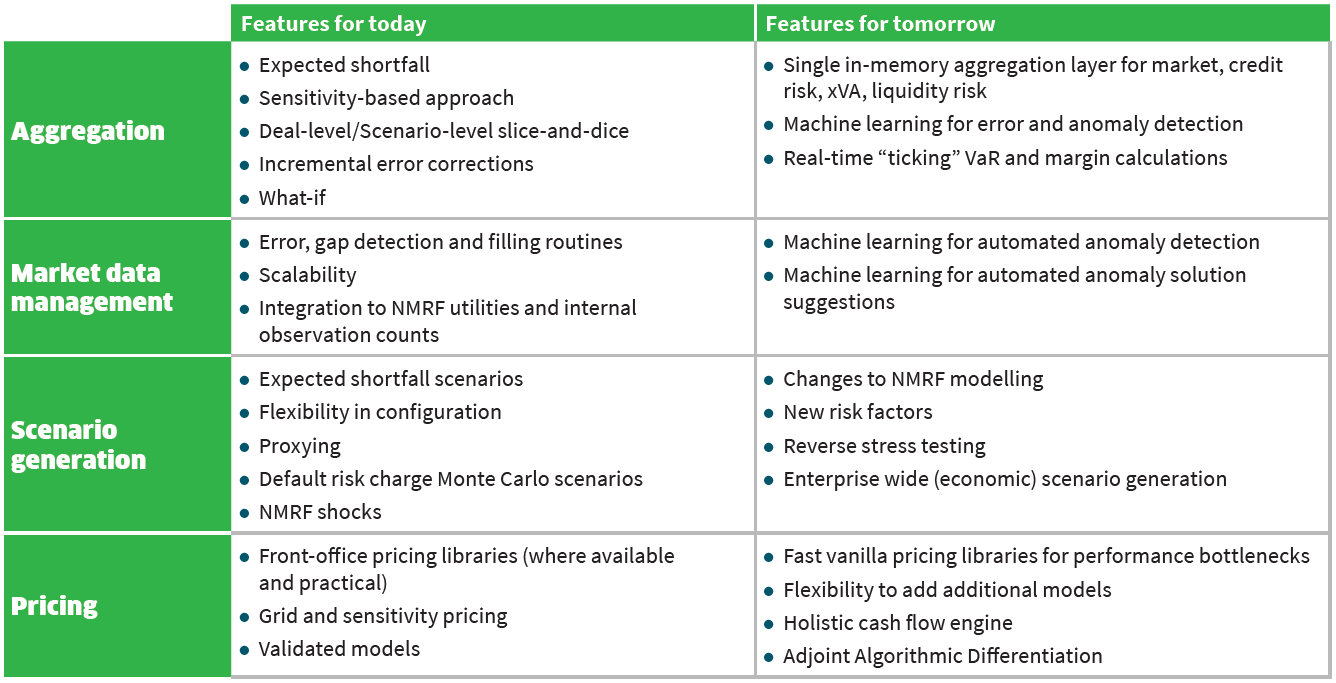

So, what are the core component capabilities today and in the future beyond FRTB?

The component that aligns most closely with FRTB is the aggregation one. Features to look for include cross-risk capability – many banks are looking for a single aggregation layer that can handle all risk types – and machine learning. Banks are looking to make more of their data, and with the pressure that FRTB will put on resources, it is vital that banks are optimizing any human processes they can by using the latest data science tools.

Data and integration

One of the challenges in component architecture is making sure the components can talk to each other efficiently. For this reason, banks should look for components that use common data formats or conventions, such as FPML, or have adapters or interfaces to other common components.

Further, interfaces should be intelligent, with the ability to catch errors, look for duplicate or missing entries, and alert operational users quickly and efficiently. Certainly, REST APIs are a must. Dashboards and workflows to identify issues and report impacts should save time and increase efficiency even further.

Cross-cutting technology and disruption considerations

Looking beyond the components, banks should also consider some IT trends that cut across all functions.

Cloud

Do I need elastic scalability and flexibility of cloud? How is data security managed? And then – are the components cloud-ready? Cloud has turned a corner – not least because there now seems to be widespread regulatory acceptance. Across financial services, the sell side has been the slowest to move toward cloud technologies, but the FIS Readiness Report reveals that they are embracing them now – even for mission-critical activities. One-third of the sell-side firms surveyed are moving at least one mission-critical activity to the cloud, and the sell-side Readiness Leaders are even more enthusiastic; two-thirds of them are doing this, with 67 percent of the Leaders moving risk management applications to the cloud.

Utilities and services

Going even further than the cloud, banks should ask if some of these activities could be outsourced to a service provider or industry utility. With the onset of more regulations, utilities have started to gain traction. The first of the new wave of utilities have been launched with services for margin and NMRF observation counting. With increasing cost pressures and clearly defined component requirements, it is likely these models will continue to grow.

Machine learning and artificial intelligence (AI)

Machine learning and AI are key technologies going forward – and they are already a reality. The FIS Readiness Report discovered that 64 percent of sell-side Readiness Leaders are piloting machine learning or AI initiatives versus 19 percent of the rest of the sell side. Crucially, 47 percent of those projects are in risk management.

A catalyst for modernization

Regardless of when FRTB comes into force now and with which rules, it will have an impact beyond the original intentions. Most banks with a significant trading book are taking the opportunity to re-imagine and re-implement much of their risk architecture. It’s about efficiency; aligning risk, finance and the front office; and control across a broad spectrum of systems and contributing trades, transactions and events within the broader bank across its legal and geographic landscape.

FTRB has become a catalyst for modernization. It shows a clear path toward a holistic and efficient risk architecture that can continuously support the front-office business, finance and risk management. The future is not an architecture that reports on the sources of risks but one that spans market, counterparty and even liquidity risk – on an enterprise level.

Having such an architecture based on modern IT architectural principles and with the latest technology deployed will prepare banks for not just the unexpected turns of FRTB but the next financial stress or crisis.