Geopolitical risk in 2025: From fragmentation to financial fallout

The global economy faces unprecedented pressures as the world order moves from a period of relative calm in recent decades to one of increasing tension and instability. Pakistan and India are the latest example, ushering in the first drone war between nuclear-armed nations.

Consequently, geopolitics has become a Gordian Knot for financial institutions to untangle. CROs increasingly face a multi-dimensional challenge, complicated further by AI-generated misinformation, cyber threats and the fragility of global supply chains. Any attempt to overcome this challenge will require banks to adopt holistic and agile risk management approaches, integrating geopolitical risk into overall business strategy and enhancing operational resilience.

Geopolitical shocks and tensions can directly affect banks’ financial position through an increase in credit, market, operational, liquidity and funding risks. For example, geopolitical risk and fragmentation caused by tariffs, sanctions or even outright war, could lead to the rapid deterioration of asset quality as trust among nations erodes.

Furthermore, the rising number of cyber-attacks can increase banks’ operational and reputational risks and negatively affect profitability. Indeed, the results of the EBA’s Risk Assessment Questionnaire show that the share of EU/EEA banks that faced successful cyber-attacks has nearly tripled since 2022.

Velocity of risk

Geopolitical risk is no longer just a slow-moving macro trend; it now evolves with startling speed. The pace at which a single event can propagate and magnify the risk dimension can quickly expose financial institutions still reliant on legacy risk technologies.

One of the clearest examples in 2025 has been the erratic nature of U.S. trade policy, where abrupt tariff announcements – such as the so-called “Tariff Tuesday” targeting Canada, China, and Mexico – have blindsided markets and disrupted cross-border financial flows. This unpredictability has chilled investor sentiment and complicated forward planning for corporates, with direct implications for banks' credit exposures, liquidity risk, and capital allocation.

For CROs, it is not merely the breadth of geopolitical risk that is challenging, but its velocity—the rapid onset of policy shocks, sanctions, and retaliatory moves that leave little time to recalibrate. This accelerating pace demands a step-change in how risk is monitored and managed, moving from backward-looking assessments to dynamic early warning systems, real-time scenario planning, and faster decision loops.

Credit risk, market risk, liquidity risk, counterparty risk…all come into sharp focus when economic growth prospects hit a speed bump.

In the latest Risk Management Association research report, published last November in collaboration with Oliver Wyman, it was noted by CROs that in response to the speed of risk, their respective institutions are implementing new early warning indicators and risk limits, enhanced scenario analysis, crisis management and incident response plans.

To strengthen their early warning capabilities, financial institutions are adopting horizon scanning tools and news aggregators. Tools like these are helping risk teams to continuously monitor global political developments and regulatory changes in real time and go some way to maintaining a front-foot stance.

Dynamic stress testing

CROs recognise they must transform stress testing and scenario planning from routine exercises into dynamic, forward-looking pillars of resilience to effectively address the escalating threat of geopolitical risks.

This means developing rigorous, high-impact scenarios that go beyond historical precedents to anticipate the full spectrum of potential geopolitical shocks – such as sudden sanctions or regional conflicts – and their cascading effects on liquidity, operations and reputation.

CROs should leverage advanced analytics and real-time intelligence to map vulnerabilities, stress-test critical exposures, and uncover hidden interdependencies across the institution and its partners. By embedding these insights into strategic decision-making and crisis planning, CROs can ensure their organisations are not only compliant, but also agile and prepared to withstand and adapt to the unpredictable realities of a volatile world.

Using modern, integrated ERM frameworks can also help CROs mitigate risks across their organisations. This includes embedding risk mitigation strategies such as supply chain diversification and regulatory compliance into business processes.

Plan for resilience

Cyberattacks and geopolitical risk are two important areas for CROs to address to build resilience, given their potential to wreak havoc on financial markets. Both were most frequently cited in a recent Bank of England survey.

In a January 2025 speech given by Carolyn Watkins, an external member of the Financial Policy Committee at the Bank of England, she pointed out that “a plan beats no plan”, a term used by former US Treasury Secretary Timothy Geithner in the wake of the GFC.

In her view, financial institutions can mitigate geopolitical risk by focusing on three aspects:

- Resilience: building financial and operational resilience in line with the elevated geopolitical risk environment;

- Diagnosis: focus on those scenarios that expose the most important vulnerabilities in the financial system, and

- Preparedness: from testing recovery and resolution plans to war-gaming cyber events.

Non-bank financial risks are growing increasingly important and are a key aspect of how FIs think about enhancing the strength of their risk modelling. Private credit, or shadow banking, has surged in recent years, reaching $1.5 trillion at the start of 2024. According to Morgan Stanley, the asset class is estimated to reach $2.8 trillion by 2028.

To better prepare for severe financial shocks caused by geopolitical tensions, the Bank of England rolled out SWES – System-wide Exploratory Scenario – In conjunction with more than 50 FIs. As Watkins explained, this drew on vulnerability mapping to identify the most important threats to core UK markets and estimated where collective actions might amplify or reduce the impacts.

One of the key lessons was that resilience of repo, money market funds and corporate bond markets was critical to ongoing functioning, and therefore worth monitoring.

Three transmission channels

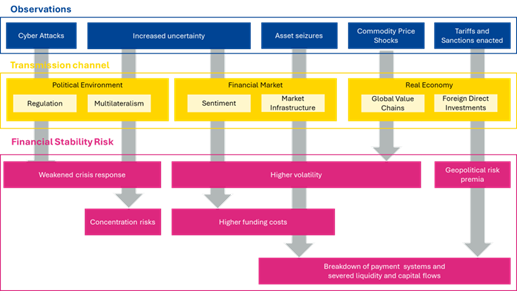

The European Banking Authority has proposed a simplified framework to better understand the interrelated nature of geopolitical risks and their impact on financial stability.

Real-world risks such as cyber attacks, asset seizures and tariffs are most likely to be magnified through three transmission channels:

- the political environment,

- financial markets and

- the real-economy; see below in Figure 1.

Figure 1: Observations, transmission channels and financial stability risk from geopolitical tensions

According to the EBA, the intensity and scope of the impact depends on the transmission channels. For example, the introduction of tariffs and sanctions creates frictions in the flow of capital and liquidity, fuelling a disintermediation of markets, for which investors demand higher returns to cover the added risks.

Tariffs have been a dominant driver of financial volatility in 2025, with huge swings in bond and equity markets caused by ongoing policy uncertainty. President Trump's tariff policies led to a sharp sell-off in U.S. Treasuries following “Liberation Day”. Yields on the 10-year Treasury soared to 4.592% in April, the highest since February while the 30-year Treasuries spiked to 4.9% after Federal Reserve Chairman Jerome Powell raised concerns about the inflationary and economic growth risks of the White House’s tariffs.

Moreover, the US dollar has fallen nearly 10% since January, with investors expecting further depreciation.

This decline is attributed to mixed tariff announcements and concerns over a potential "dollar confidence crisis.”

The scale of these movements in FX and bond markets cause asset repricing which impact banks’ balance sheets and profit margins.

Geopolitical risk: A top 3 priority over the next 12 months

CROs are under no illusions as to the severity of rising geopolitical tensions and their impact on global financial stability. According to a new EY risk management survey, 70% of CROs believe changes in geopolitical conditions will impact their organisations. They view it as the third most important priority for their organisations (36%) over the next 12 months, compared to last year when it was only the 12th highest priority risk for both CROs and boards. Even more revealing is the fact that 91% of CROs in EY’s survey rated geopolitical conditions as a top-five risk for the next three years. This could influence how banks think about global client exposure across asset classes and require even more stringent risk protections pertaining to lending activities, cross-border transactions, FX exposures etc.

CROs are acting on multiple fronts to prepare for potential downturns. Nearly two-thirds (62%) are reducing the risk appetite or curtailing lending to certain high-risk industries and geographies, while more than half (56%) are tightening lending standards; this is happening as non-bank financial risks increase due to the continued expansion of private credit.

Technology advances led by generative AI can provide some comfort to risk leaders as they look for ways to build operational resilience and enhance their scenario modelling.

Adopting more cutting edge technology solutions into their organisations should help keep CROs and their organisations on the front foot in respect to handling what they view as the top two most important emergent risks over the next three years: cybersecurity threats and availability and integrity of data.

In an era where geopolitical turbulence and systemic uncertainty are the new constants, the mandate for CROs is clear: build resilience not only for what is known, but for what remains unknowable.