As Dan Quayle, 44th Vice President of the United States and Chairman of Cerberus, noted in his fireside chat on the first main day of the conference at SuperReturn Berlin, China was one to watch.

That might seem to be stating the obvious, but the China/US relationship would define the next decade, he felt. Quayle referenced a recent national security report that indicated global competition between US, Russia and China was a far greater risk today than terrorism.

A sobering thought indeed, but there was a glimmer of hope. Trump likes Xi Jinping, according to the ex-Vice President, and Trump “is all about personal relationships”. Fears of a major trade war may yet be unfounded.

China’s prospects

Given China’s importance, it was useful to dive into where China stood today in terms of its economy. Michael Pettis, the highly respected Professor of Finance at Guanghua School of Management at Peking University, was at SuperReturn to give us an overview.

Michael Pettis shares his thoughts on the Chinese macroeconomic reforms in an exclusive interview at SuperReturn International. Click here for the full interview.

China had a great imbalance in its economy which, despite Beijing promising to solve it since 2007, was even worse today, began Pettis. “What we see in China is a huge imbalance of distribution of income. Household income as share of GDP in China is probably the lowest ever recorded, whereas local governments and businesses earn too much. China also has the highest savings rate in the world,” he explained.

The Chinese economy needed to re-balance away from investment and towards consumer demand and household consumption. If it didn’t, a painful adjustment might be on its way.

China’s growth model

There was no doubt that the Chinese growth model – which Pettis argued had plenty of historical precedence – had worked in the previous three decades.

“China has been incredibly successful at accumulating savings and directing those savings into investments,” stated Pettis. This was a good growth model when a country is severely under invested, and where it’s relatively easy to identify where investments are needed, as was the case with China. “This model was what the doctor ordered for China,” he said.

The issue was that every country that has run this model has run into the same problem – they max out on investments and their debt increases. Part of the current problem, argued the professor, is that vested interests prevent reforms. “What was really interesting was when the term “vested interest” started to appear in the Chinese press,” he said. “It’s now a common phrase, but this was no coincidence.”

China has sought to overcome this through a drive to centralise power, leaving Xi Jinping in a position to be able to implement the necessary reforms. These ultimately consist of reducing leverage by assigning debt servicing costs to the elite and local governments; and increasing consumption by increasing household income.

But how could this be accomplished?

“If you want Chinese household consumption to go up, the only way to do it is to transfer wealth from local governments and state-owned companies back to Chinese households,” he said. Whilst this was no mean feat politically, it was what we now had to watch out for, he concluded.

Global Flashpoints

Globally, the were other worries weighing on the minds of politicians. This time of a more geopolitical nature. Quayle listed North Korea as the obvious number one flashpoint.

“There are three things that could happen,” he said. “A continuation of sanctions; a military option – which few believe is viable; or the inevitable, which is that North Korea becomes nuclear.

“The question is, what do they want those weapons for? They might claim that it is for self-defense, but they could equally use them to demand Seoul. Then the question becomes, will the US risk Seattle for Seoul? I don’t know the answer to that.”

The Middle East continued to be highly problematic, particularly the Kurdish question in Turkey and the alignment of Iran with Russia. Europe, on the other hand, was relatively stable. “My gut tells me it’s going to be a very soft Brexit or they will have some sort of another vote.

National referendums are based on emotion, not on logic, not on facts.

“One takeaway from Brexit is that national referendums are not necessarily a good thing. National referendums are based on emotion, not on logic, not on facts. I hope that’s the one takeaway not only in Britain, but elsewhere. They are not a good thing for good governance.”

Within the US, all eyes were on the midterms, and where Trump’s popularity would stand. “If you look back four to five decades, if popularity is below 50% the average loss in the House is 36 seats. It only takes 24 to flip it.”

Of the Mueller investigation, Quayle conceded that, while there had been indictments, it was looking like there was no Russian collusion. That only left obstruction of justice, where an underlying crime had to be proved. He concluded on a hopeful note, however. “If you look at the world in 2017, the humanity – we are living longer, living better, and in most places, we are living freer.”

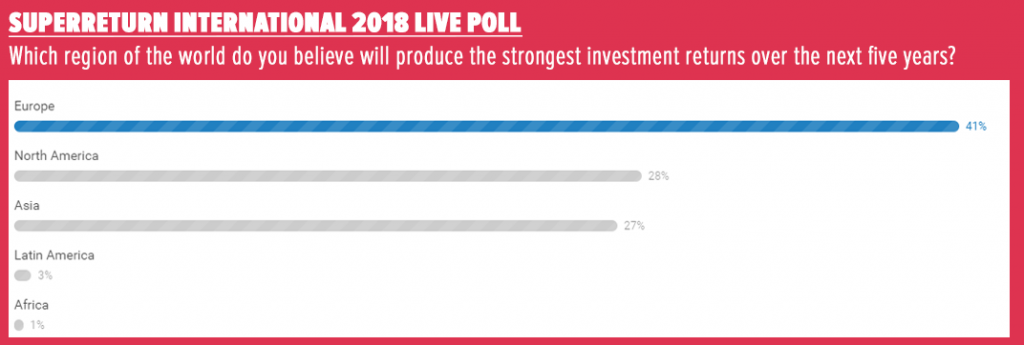

Live at SuperReturn International 2018, we asked the audience: Which region of the world do you believe will produce the strongest investment returns over the next five years?